UK Inflation Slows, Pound Strengthens As BOE Rate Cut Bets Diminish

Table of Contents

Falling UK Inflation: A Deeper Dive

The recent slowdown in UK inflation provides a much-needed respite for consumers and businesses alike. Let's examine the details.

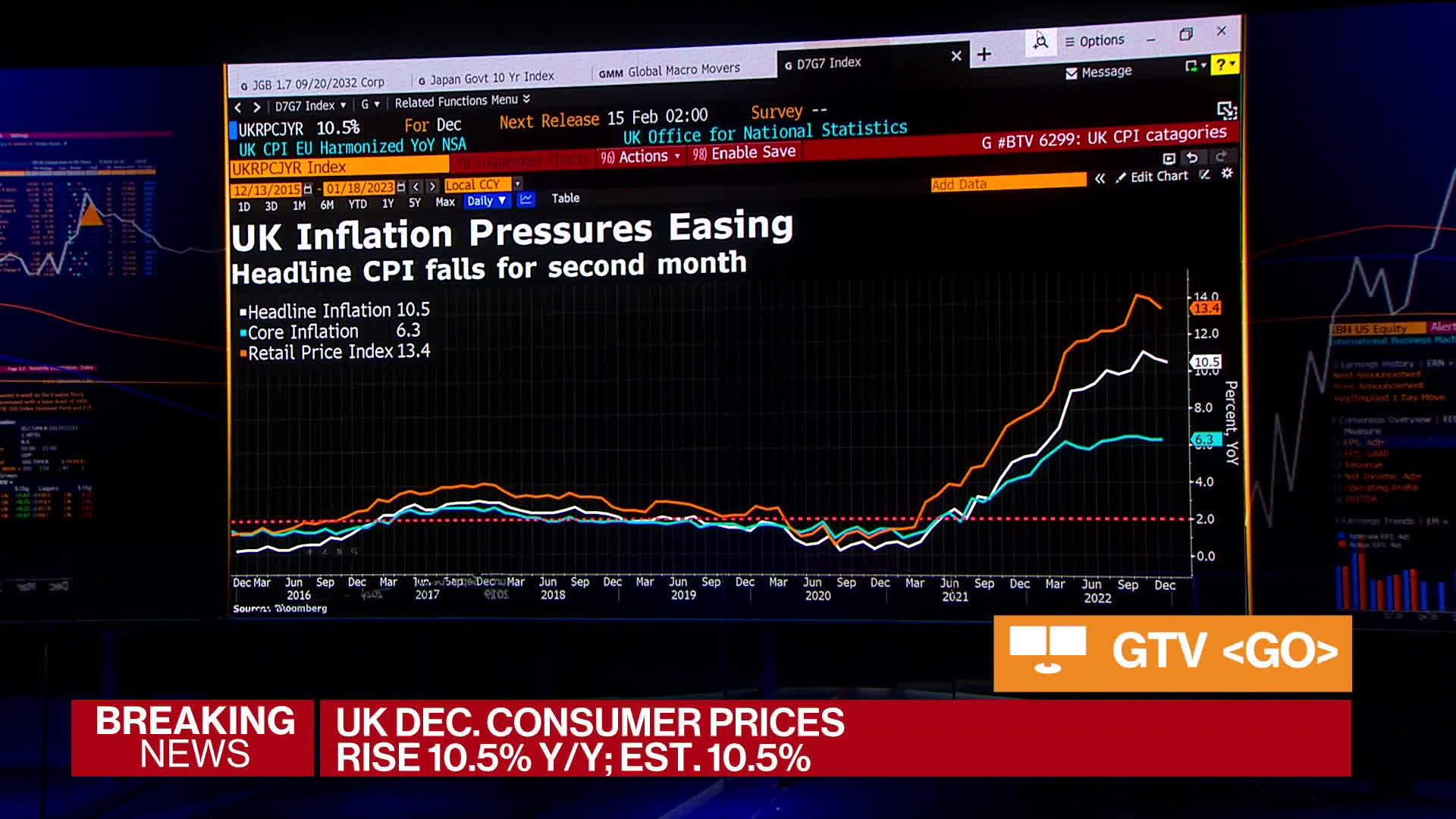

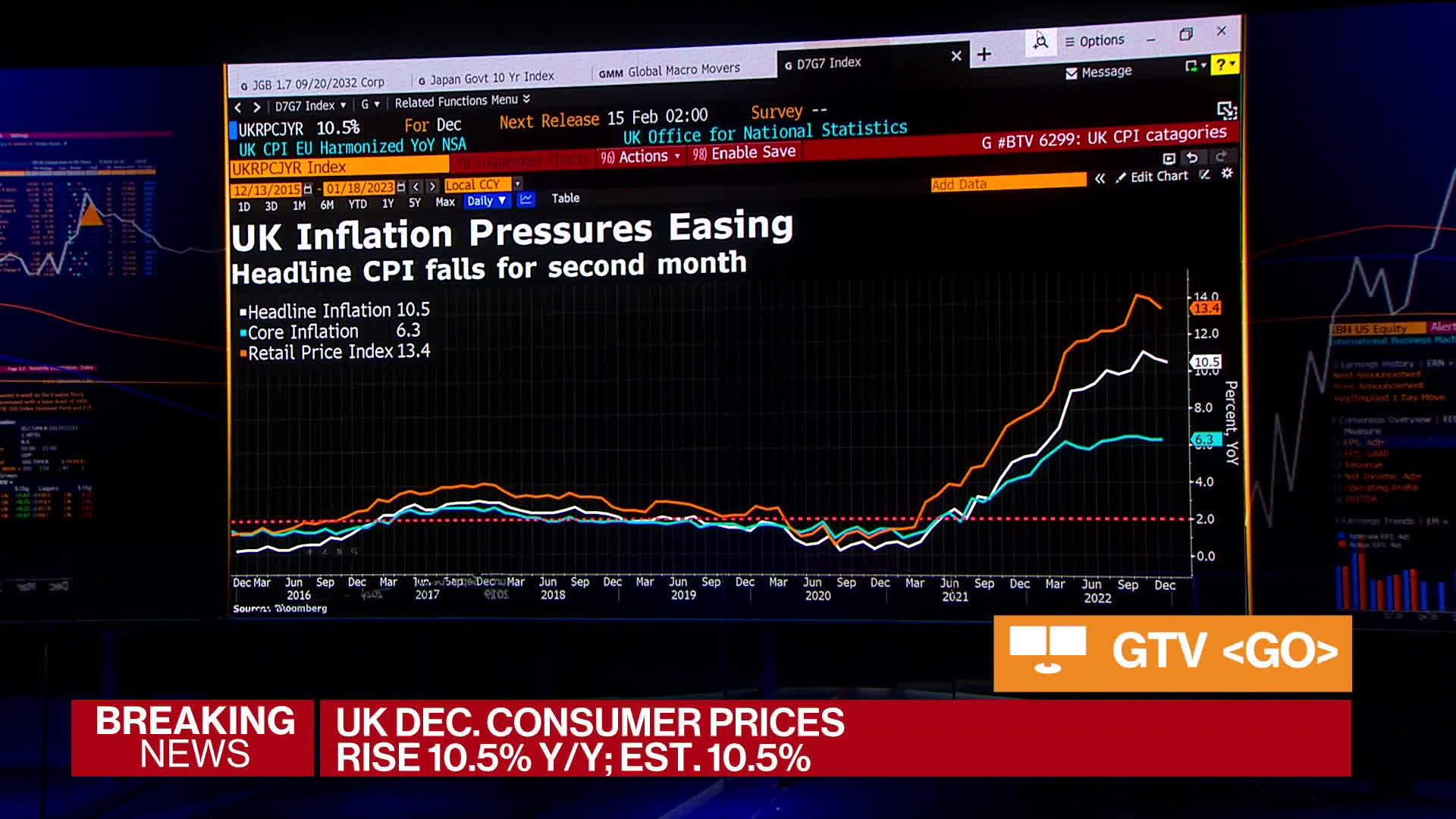

CPI Data and its Significance

The latest Consumer Price Index (CPI) figures reveal a welcome decrease in the UK inflation rate. While the precise numbers will vary depending on the reporting period, a noticeable percentage drop compared to previous months and the previous year is a positive indicator. For instance, if the CPI was previously at 10%, a drop to 8% represents substantial progress, though still high by historical standards.

- Specific Numbers: (Insert the most recent CPI data here – e.g., "The September 2024 CPI figure shows a decrease to X%, down from Y% in August.")

- Areas of Faster/Slower Decline: Inflation may be falling faster in some sectors (e.g., energy) and slower in others (e.g., food). This variance needs careful analysis to understand the overall trend.

- Impact on Household Budgets: Even a small reduction in the inflation rate UK can significantly impact household budgets, offering some relief to those struggling with the cost of living crisis UK. This translates to increased disposable income and improved purchasing power for many households.

Underlying Inflationary Pressures

While the headline CPI figures are encouraging, it's crucial to examine the underlying inflationary pressures. Core inflation (excluding volatile items like food and energy) provides a clearer picture of persistent inflation. A sustained fall in core inflation suggests a more permanent easing of price pressures, while a persistent high core inflation rate indicates that the decline in headline inflation might be temporary.

- Analysis of Core Inflation Figures: (Insert the most recent core inflation data here, and compare it to previous periods). A decline in core inflation would suggest a stronger, more sustainable reduction in UK inflation.

- Contributing Factors: Factors contributing to both headline and core inflation should be analyzed, including supply chain issues, energy prices, wage growth, and government policies.

- Potential Future Trends: Analyzing these factors helps predict future trends and assess whether the current fall in UK CPI is a temporary blip or a more sustained trend. This will largely depend on global economic events, and the ongoing impact of the war in Ukraine.

Pound Sterling's Strengthening Position

The decline in UK inflation expectations has had a positive impact on the pound sterling.

Impact of Reduced BOE Rate Cut Expectations

The diminished anticipation of a BOE rate cut has boosted investor confidence and strengthened the pound against other major currencies. When the market expects lower interest rates, it generally leads to a weaker currency, as investors seek higher returns elsewhere. The opposite is true when expectations of rate cuts diminish.

- Pound/Dollar Exchange Rate Fluctuations: (Insert data illustrating GBP/USD exchange rate movements, highlighting the recent strengthening of the pound).

- Reasons for Increased Investor Confidence: The falling UK inflation rate signals a healthier economic outlook, increasing investor confidence and subsequently driving up demand for the pound.

Other Contributing Factors

Several other factors contribute to the pound's recent strength beyond reduced BOE rate cut expectations.

- Global Economic Conditions: Global economic events significantly influence the value of the pound. A stronger global economy, particularly in key trading partners, can support the pound's value.

- Brexit Developments: The ongoing impact of Brexit continues to influence investor sentiment and the pound's performance. Positive developments in trade negotiations or reduced uncertainty can strengthen the pound.

- UK Political Stability: Political stability within the UK is another key factor. A stable political environment generally boosts investor confidence and strengthens the currency.

Implications for the UK Economy

The recent economic shifts have broad implications for the UK's economic landscape.

Impact on Businesses and Consumers

Lower inflation and a stronger pound have significant consequences for businesses and consumers.

- Impact on Consumer Spending: Reduced inflation boosts consumer purchasing power, potentially leading to increased consumer spending and stimulating economic growth.

- Impact on Business Investment: A stronger pound can reduce import costs for businesses, potentially increasing their profitability and encouraging investment. Conversely, it can make exports more expensive.

- Impact on Economic Growth: The combined effect of increased consumer spending and business investment can contribute to stronger UK economic growth.

BOE's Policy Response

The Bank of England's response to the changing economic landscape will be crucial in shaping the UK's future economic trajectory.

- Potential Future Interest Rate Hikes/Cuts: The BOE might adjust interest rates based on its assessment of inflation, economic growth, and other economic indicators. If inflation continues to fall, further rate cuts might be less likely.

- BOE Monetary Policy: The BOE will continue to monitor the inflation rate UK and adjust its monetary policy accordingly, using tools like interest rate adjustments and quantitative easing.

- Quantitative Easing (QE): The use of QE (a policy of injecting money into the economy) may be less necessary if inflation continues to fall.

Conclusion

The recent slowdown in UK inflation and the subsequent strengthening of the pound suggest a potential turning point in the UK's economic outlook. The diminished expectations of a BOE rate cut signal growing confidence in the economy’s resilience. However, sustained monitoring of core inflation and global economic factors is crucial. Understanding these intricacies regarding UK inflation will help individuals, businesses, and investors make informed decisions. Stay informed on the latest developments surrounding UK inflation and its impact on the broader economy. Continue to monitor the UK CPI and other key economic indicators to stay ahead of the curve.

Featured Posts

-

Pokolenie Peremen Nashi Uspekhi I Vyzovy Buduschego

May 24, 2025

Pokolenie Peremen Nashi Uspekhi I Vyzovy Buduschego

May 24, 2025 -

Fedor Lavrov Lyudi Lyubyat Schekotat Nervy Razmyshleniya O Pavle I I Trillerakh

May 24, 2025

Fedor Lavrov Lyudi Lyubyat Schekotat Nervy Razmyshleniya O Pavle I I Trillerakh

May 24, 2025 -

The Demna Gvasalia Era At Gucci Expectations And Predictions

May 24, 2025

The Demna Gvasalia Era At Gucci Expectations And Predictions

May 24, 2025 -

Vozrast Geroev V Filme O Bednom Gusare Zamolvite Slovo

May 24, 2025

Vozrast Geroev V Filme O Bednom Gusare Zamolvite Slovo

May 24, 2025 -

Aubrey Wursts Strong Performance Propels Maryland Softball To Victory

May 24, 2025

Aubrey Wursts Strong Performance Propels Maryland Softball To Victory

May 24, 2025

Latest Posts

-

The Last Rodeo A Review Of The Affecting Bull Riding Film

May 24, 2025

The Last Rodeo A Review Of The Affecting Bull Riding Film

May 24, 2025 -

The Last Rodeo Movie Review Familiar Story Impactful Execution

May 24, 2025

The Last Rodeo Movie Review Familiar Story Impactful Execution

May 24, 2025 -

The Last Rodeo Review A Powerful Bull Riding Drama

May 24, 2025

The Last Rodeo Review A Powerful Bull Riding Drama

May 24, 2025 -

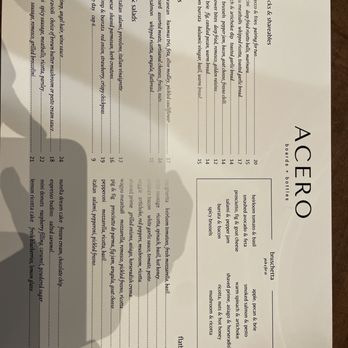

Celebrity Sighting Neal Mc Donough At Acero Boards And Bottles In Boise

May 24, 2025

Celebrity Sighting Neal Mc Donough At Acero Boards And Bottles In Boise

May 24, 2025 -

Behind The Scenes Neal Mc Donoughs Bull Riding Video Training

May 24, 2025

Behind The Scenes Neal Mc Donoughs Bull Riding Video Training

May 24, 2025