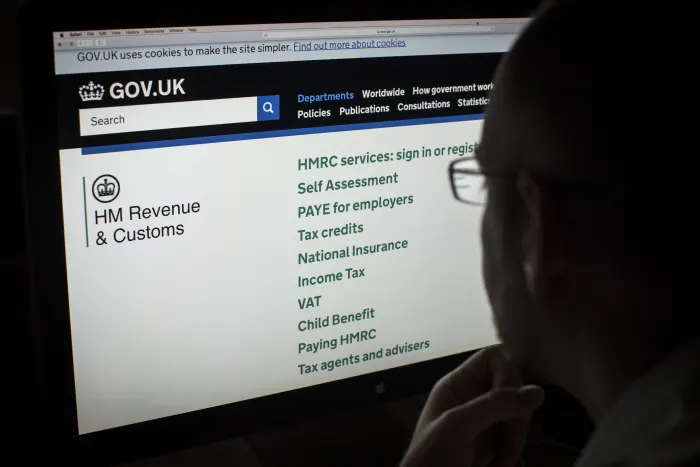

UK Taxpayers Affected By HMRC Website Outage

Table of Contents

Extent of the HMRC Website Outage

The HMRC website outage, lasting from [Start Date and Time] to [End Date and Time], caused widespread disruption to essential online tax services. The outage affected a significant portion of the UK, impacting both individuals and businesses relying on HMRC's digital platforms. The complete shutdown of the online portal prevented millions of taxpayers from accessing key services.

- Complete shutdown of online portal: Taxpayers were unable to access any online services, creating a significant bottleneck.

- Phone lines overwhelmed: The increased demand on HMRC's phone lines led to lengthy wait times and difficulty contacting customer service for assistance.

- Impact on self-assessment deadline approaching: The outage occurred just before the self-assessment deadline, causing significant stress for individuals and businesses needing to file their returns.

- Potential for late filing penalties: The inability to file taxes on time due to the outage raised concerns about potential penalties and interest charges for affected taxpayers. The disruption also affected access to PAYE services, tax credit updates, and other crucial functionalities.

Impact on UK Taxpayers

The HMRC website outage had far-reaching consequences for UK taxpayers, causing significant inconvenience and potential financial hardship. Many individuals and businesses struggled to meet deadlines, leading to increased stress and uncertainty.

- Missed tax deadlines and potential penalties: The inability to access online services resulted in missed deadlines, potentially leading to substantial penalties and interest charges for late filing.

- Delayed refunds and financial hardship: Taxpayers expecting refunds faced delays, causing potential financial strain.

- Increased workload and stress for taxpayers: The outage forced many to spend extra time trying to resolve their tax issues, causing increased stress and frustration.

- Negative impact on business operations: For self-employed individuals and businesses, the disruption impacted their ability to manage their finances effectively, potentially hindering operations. Many reported being unable to access vital information needed for business accounting and planning.

HMRC's Response to the Outage

HMRC released an official statement acknowledging the outage and apologizing for the inconvenience caused to taxpayers. They reported working diligently to restore services and addressed the issues impacting the website's functionality.

- Official statement released by HMRC: The statement acknowledged the problem and outlined the steps being taken to resolve it.

- Measures taken to restore service: HMRC detailed the technical measures implemented to restore full functionality to its online services.

- Communication channels used to update taxpayers: Information updates were communicated through various channels such as social media, press releases, and their official website.

- Extension to filing deadlines (if any): HMRC announced an extension to the self-assessment deadline to alleviate the burden on affected taxpayers. (Note: Replace "(if any)" with specifics if an extension was granted).

Preventing Future HMRC Website Outages

Preventing future HMRC website outages requires a multi-pronged approach encompassing technological improvements and enhanced communication strategies.

- Investing in robust IT infrastructure: Upgrading servers and implementing more resilient systems is vital to prevent future disruptions.

- Regular system testing and maintenance: Regular testing and maintenance can identify and address potential vulnerabilities before they lead to widespread outages.

- Improved communication strategies: Clear and timely communication with taxpayers during outages is essential to mitigate anxiety and uncertainty.

- Enhanced disaster recovery plans: A comprehensive disaster recovery plan can ensure business continuity and minimise the impact of unexpected disruptions.

Taxpayers can also prepare by keeping important documents offline, planning ahead for deadlines, and seeking assistance early should they encounter difficulties accessing online services.

Conclusion: Understanding the Implications of the HMRC Website Outage and Preparing for the Future

The HMRC website outage underscored the critical need for reliable online tax services and the potential consequences of system failures. The disruption caused significant inconvenience, potential financial penalties, and widespread stress for countless UK taxpayers. HMRC must invest in robust infrastructure and improved communication to prevent future occurrences. Staying informed about any further updates regarding the HMRC website outage and potential impacts on your tax obligations is crucial. Regularly check the official HMRC website for the latest information and guidance.

Featured Posts

-

Isabelle Nogueira Anuncia Maiara E Maraisa Para Festival Da Cunha Manaus

May 20, 2025

Isabelle Nogueira Anuncia Maiara E Maraisa Para Festival Da Cunha Manaus

May 20, 2025 -

Politique Camerounaise Macron Troisieme Mandat Et Le Debat Sur L Avenir

May 20, 2025

Politique Camerounaise Macron Troisieme Mandat Et Le Debat Sur L Avenir

May 20, 2025 -

Services Juridiques Professionnels Atkinsrealis Droit Inc

May 20, 2025

Services Juridiques Professionnels Atkinsrealis Droit Inc

May 20, 2025 -

Eurovision Song Contest 2025 The Official Artist List

May 20, 2025

Eurovision Song Contest 2025 The Official Artist List

May 20, 2025 -

Find The Answers Nyt Mini Crossword March 31

May 20, 2025

Find The Answers Nyt Mini Crossword March 31

May 20, 2025

Latest Posts

-

Potvrdeno Jennifer Lawrence Dobila Drugo Dijete

May 20, 2025

Potvrdeno Jennifer Lawrence Dobila Drugo Dijete

May 20, 2025 -

Izvor Blizak Jennifer Lawrence Otkriva Detalje O Drugom Djetetu

May 20, 2025

Izvor Blizak Jennifer Lawrence Otkriva Detalje O Drugom Djetetu

May 20, 2025 -

Jennifer Lawrence I Njezino Drugo Dijete Sve Sto Znamo

May 20, 2025

Jennifer Lawrence I Njezino Drugo Dijete Sve Sto Znamo

May 20, 2025 -

Novi Clan Obitelji Lawrence Potvrda O Drugom Djetetu

May 20, 2025

Novi Clan Obitelji Lawrence Potvrda O Drugom Djetetu

May 20, 2025 -

Je Li Jennifer Lawrence Rodila Drugo Dijete

May 20, 2025

Je Li Jennifer Lawrence Rodila Drugo Dijete

May 20, 2025