Understanding Berkshire Hathaway's Apple Strategy After Buffett's Departure

Table of Contents

Analyzing Buffett's Apple Investment Philosophy

Buffett's rationale for Apple wasn't just about the high stock price; it was about a fundamental understanding of long-term value. He recognized Apple's exceptional brand strength, its loyal consumer base, and the recurring revenue generated through its ecosystem of products and services. This wasn't a speculative bet; it was an investment in a company that he perceived as possessing durable competitive advantages.

- Long-Term Value: Buffett's investment philosophy prioritizes companies with strong intrinsic value and the potential for consistent growth over the long term. Apple fit this criteria perfectly.

- Brand Strength & Consumer Loyalty: Apple’s strong brand recognition and fiercely loyal customer base ensured sustained demand for its products, a key factor in Buffett's investment decision.

- Recurring Revenue Model: The subscription services Apple offers, like iCloud and Apple Music, generated predictable and recurring revenue streams, adding to the investment's appeal.

Berkshire Hathaway's Apple holdings have grown significantly over the years, transforming Apple into a cornerstone of its portfolio. This substantial investment reflects Buffett's confidence in Apple’s business model and its future prospects. The size of this holding speaks volumes about the integration of Apple's business model within Berkshire Hathaway's overall portfolio strategy. This was a departure from some of Berkshire Hathaway’s more traditional investments, highlighting a shift towards technology and consumer-facing businesses.

Berkshire Hathaway's Succession Plan and its Impact on Apple Holdings

The succession plan at Berkshire Hathaway, with Greg Abel and Ajit Jain as potential successors, is crucial in understanding the future of its Apple holdings. While both are highly respected within the company, their individual investment styles might differ from Buffett's. This difference could lead to subtle or even significant changes in Berkshire Hathaway's investment strategy, including its approach to the Apple investment.

- Greg Abel's Approach: Abel's background in Berkshire Hathaway Energy suggests a focus on operational efficiency and long-term value creation, potentially aligning with Buffett's philosophy regarding Apple.

- Ajit Jain's Approach: Jain's expertise in insurance underwriting might bring a more risk-averse approach to investment decisions, which could influence the handling of the Apple stake.

- Potential for Change: While a complete divestment from Apple seems unlikely in the near future, adjustments to the investment strategy are possible, including shifting the allocation within the overall portfolio.

The crucial aspect here isn't necessarily a complete overhaul of the Apple strategy but rather a subtle evolution shaped by the distinct perspectives and approaches of the new leadership.

Market Predictions and Future of Berkshire Hathaway's Apple Stake

The future of Berkshire Hathaway's Apple stake is inherently linked to market conditions and Apple's future performance. Several factors influence the outlook, including global economic trends, technological advancements, and competitive pressures.

- Apple Stock Price Prediction: Analyst predictions for Apple's stock price vary widely, reflecting the uncertainties inherent in the market. However, most agree on Apple's continued strength in the long term.

- Market Analysis: Macroeconomic factors, such as inflation and interest rates, can significantly impact investment decisions. A volatile market might influence Berkshire Hathaway's willingness to hold such a large position in a single stock.

- Risks and Opportunities: Maintaining a large stake in Apple presents both risks and opportunities. Risks include potential declines in Apple's stock price, while opportunities exist if Apple continues to innovate and grow.

The ongoing macroeconomic environment and the constant evolution of the technology landscape will be key determinants of Berkshire Hathaway's continued investment in Apple.

Alternative Investment Strategies for Berkshire Hathaway

Berkshire Hathaway's vast resources allow it to explore alternative investment avenues. Diversification, a key principle in investment management, could lead to a reallocation of assets away from Apple, although not necessarily a complete sell-off.

- Berkshire Hathaway Diversification: To mitigate risk, Berkshire Hathaway might diversify its portfolio further by investing in other promising sectors, including renewable energy, healthcare technology, and artificial intelligence.

- Emerging Technologies: Investments in emerging technologies could provide substantial returns, but also carry higher risks. This could be a balancing factor against the more established Apple investment.

- Portfolio Management: The balance between established investments (like Apple) and newer, higher-risk ventures will define Berkshire Hathaway's future portfolio strategy.

The evolution of Berkshire Hathaway’s investment strategy will involve a delicate balancing act between maintaining its existing strengths and embracing new opportunities.

Conclusion: The Future of Berkshire Hathaway's Apple Strategy – A Call to Action

The future of Berkshire Hathaway's Apple strategy post-Buffett remains uncertain, yet filled with intriguing possibilities. While a dramatic shift is unlikely in the immediate future, subtle changes in investment approach are expected under new leadership. The interplay between market conditions, succession planning, and alternative investment opportunities will shape the evolution of this iconic partnership. The core tenets of long-term value investment and a focus on strong businesses will likely remain central, but the precise application of these principles may change. Stay updated on the developments related to Berkshire Hathaway's Apple strategy and continue your research on Berkshire Hathaway investment choices. Understanding this evolving relationship is critical for anyone interested in long-term investment strategies and the future of both Berkshire Hathaway and Apple.

Featured Posts

-

Najvaecsie Nemecke Spolocnosti Prepustaju Tisice Pracovnych Miest V Ohrozeni

May 24, 2025

Najvaecsie Nemecke Spolocnosti Prepustaju Tisice Pracovnych Miest V Ohrozeni

May 24, 2025 -

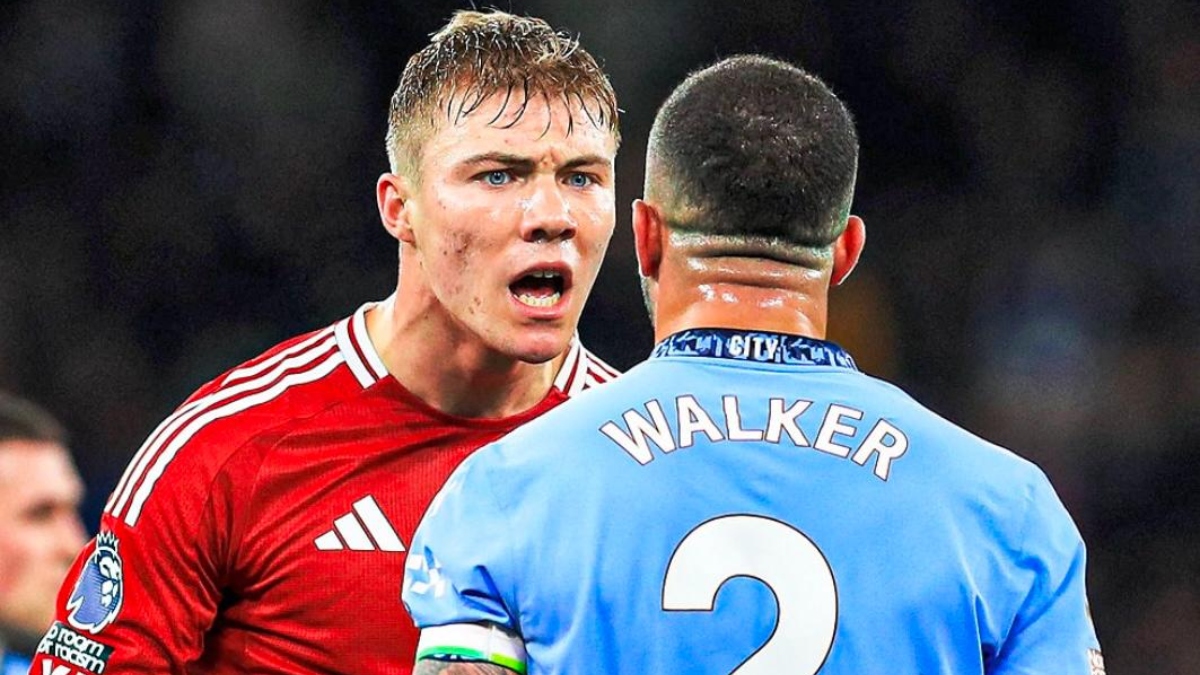

Kyle And Teddis Heated Confrontation Dog Walker Dispute

May 24, 2025

Kyle And Teddis Heated Confrontation Dog Walker Dispute

May 24, 2025 -

England Airpark And Alexandria International Airport Fly Local Explore Global With Ae Xplore

May 24, 2025

England Airpark And Alexandria International Airport Fly Local Explore Global With Ae Xplore

May 24, 2025 -

Escape To The Country Balancing Rural Life With Modern Comforts

May 24, 2025

Escape To The Country Balancing Rural Life With Modern Comforts

May 24, 2025 -

Alshrtt Alalmanyt Tdbt Mshjeyn Khlal Mdahmat Mfajyt

May 24, 2025

Alshrtt Alalmanyt Tdbt Mshjeyn Khlal Mdahmat Mfajyt

May 24, 2025

Latest Posts

-

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportations

May 24, 2025

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportations

May 24, 2025 -

Understanding Frank Sinatras Four Marriages Wives Love And Legacy

May 24, 2025

Understanding Frank Sinatras Four Marriages Wives Love And Legacy

May 24, 2025 -

The Four Women Who Married Frank Sinatra Their Stories And Impact

May 24, 2025

The Four Women Who Married Frank Sinatra Their Stories And Impact

May 24, 2025 -

Mia Farrow On Trump Deportations Of Venezuelan Gang Members Warrant Arrest

May 24, 2025

Mia Farrow On Trump Deportations Of Venezuelan Gang Members Warrant Arrest

May 24, 2025 -

Frank Sinatra And His Four Wives A Retrospective On His Marriages

May 24, 2025

Frank Sinatra And His Four Wives A Retrospective On His Marriages

May 24, 2025