Understanding CoreWeave (CRWV)'s Recent Stock Market Performance

Table of Contents

CoreWeave's Business Model and Competitive Landscape

CoreWeave distinguishes itself in the competitive GPU cloud computing market through its unique approach. Unlike its competitors, CoreWeave focuses heavily on sustainability and energy efficiency, a crucial factor in the increasingly environmentally conscious tech industry. This commitment to sustainability is a key differentiator, attracting environmentally conscious clients and investors. Keywords: CoreWeave business model, cloud computing competitors, GPU cloud, competitive advantage, market share.

- Sustainable Infrastructure: CoreWeave prioritizes utilizing renewable energy sources for its data centers, reducing its carbon footprint and attracting clients with ESG (Environmental, Social, and Governance) investment strategies.

- Strategic Partnerships: The company has forged strategic alliances with major hardware providers and software developers, further strengthening its position in the market and broadening its service offerings. These partnerships ensure access to cutting-edge technologies and provide a wider range of solutions for its clients.

- Target Market and Customer Base: CoreWeave primarily targets businesses and research institutions with intensive computing needs, particularly in the fields of artificial intelligence (AI), machine learning (ML), and high-performance computing (HPC). Their customer base includes a diverse range of companies, from startups to large enterprises.

- Competitive Pricing and Service Offerings: CoreWeave strategically prices its services to compete effectively against established players like AWS, Google Cloud, and Azure, while highlighting its unique advantages such as superior performance and sustainability.

Factors Influencing CRWV Stock Price Volatility

The volatility of CRWV's stock price is influenced by a complex interplay of factors. Understanding these factors is crucial for any investor considering adding CRWV to their portfolio. Keywords: CRWV stock price, volatility, market sentiment, investor confidence, economic factors, tech stock performance, risk assessment.

- Macroeconomic Factors: Broad economic conditions, including inflation rates and interest rate hikes, significantly impact investor sentiment towards technology stocks, including CRWV. Economic uncertainty often leads to decreased investor confidence and increased volatility.

- News and Announcements: Positive news, such as new partnerships, increased revenue, or successful product launches, can drive up the stock price. Conversely, negative news or unexpected setbacks can lead to sharp declines.

- Short-Selling and Institutional Investor Activity: The actions of short sellers and large institutional investors can heavily influence CRWV's stock price. Significant short-selling can put downward pressure on the stock price, while large institutional buys can create upward momentum.

- Overall Tech Sector Performance: The performance of the broader technology sector inevitably affects CRWV's stock price. If the overall tech market is performing well, CRWV is likely to benefit, and vice versa.

Analyzing CoreWeave's Financial Performance and Growth Prospects

Analyzing CoreWeave's financial performance is key to understanding its growth potential. While still a relatively young company, CoreWeave's financial reports reveal key insights into its trajectory. Keywords: CRWV financials, revenue growth, profitability, financial projections, future growth, market opportunity, AI growth.

- Revenue Streams and Diversification: CoreWeave's revenue streams are currently focused on GPU-accelerated cloud computing services. Diversification into related areas could help mitigate risk and enhance future growth.

- Profit Margins and Operating Expenses: Analyzing profit margins and operating expenses helps assess the company's efficiency and profitability. Improved efficiency and cost management are crucial for sustainable growth.

- Long-Term Growth Projections and Market Opportunity: The market for AI and GPU-accelerated computing is expected to experience significant growth in the coming years. CoreWeave is well-positioned to capitalize on this growth, given its focus on these areas.

- Impact of AI Adoption: The increasing adoption of AI across various industries presents a significant opportunity for CoreWeave. The company's ability to provide robust and scalable GPU computing resources is directly related to the success and growth of the AI industry.

Investment Considerations and Risk Assessment for CRWV

Investing in CRWV, like any stock, involves inherent risks and rewards. Thorough due diligence is crucial before making any investment decisions. Keywords: CRWV investment, risk factors, due diligence, investment strategy, potential returns, stock valuation.

- Potential Risks: Risks associated with investing in CRWV include competition from established players, macroeconomic factors, technological disruptions, and the inherent volatility of the tech sector.

- Investment Strategies: Different investment strategies, such as long-term buy-and-hold or short-term trading, can be employed depending on individual risk tolerance and investment goals.

- Potential Returns and Risks: While the potential returns from investing in CRWV can be substantial, given the growth potential of the GPU-accelerated cloud computing market, investors must carefully weigh these potential gains against the associated risks.

- Importance of Research and Professional Advice: Before investing in CRWV or any stock, it is crucial to conduct thorough research and, if necessary, seek advice from a qualified financial advisor.

Conclusion

Understanding CoreWeave (CRWV)'s stock market performance requires a comprehensive analysis of its business model, competitive landscape, financial health, and growth prospects. While the company's focus on GPU-accelerated cloud computing and its commitment to sustainability are significant strengths, investors must also acknowledge the inherent risks associated with investing in a relatively young company within a volatile sector. The interplay between macroeconomic factors, market sentiment, and the company's own performance significantly influence CRWV's stock price.

Call to Action: Understanding CoreWeave (CRWV) and its stock market performance is an ongoing process. Continue your research into CoreWeave and the broader cloud computing market to make well-informed investment decisions. Stay updated on CRWV's financial reports and news to monitor its progress in the dynamic world of GPU-accelerated cloud computing. Remember to conduct thorough due diligence and, if necessary, consult with a financial professional before making any investment choices related to CRWV.

Featured Posts

-

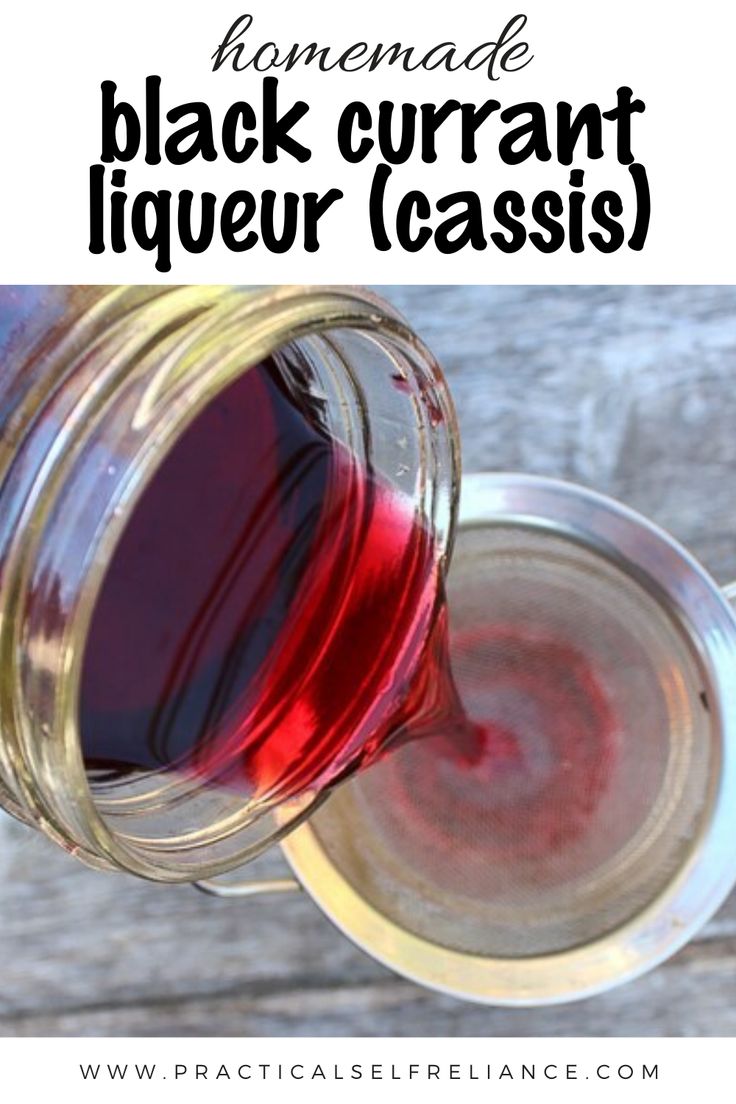

The Rich History Of Cassis Blackcurrant

May 22, 2025

The Rich History Of Cassis Blackcurrant

May 22, 2025 -

Decouverte A Velo De La Loire Du Vignoble Et De L Estuaire 5 Propositions

May 22, 2025

Decouverte A Velo De La Loire Du Vignoble Et De L Estuaire 5 Propositions

May 22, 2025 -

Remont Pivdennogo Mostu Oglyad Proektu Ta Yogo Finansuvannya

May 22, 2025

Remont Pivdennogo Mostu Oglyad Proektu Ta Yogo Finansuvannya

May 22, 2025 -

Aimscaps World Trading Tournament Wtt A Wild Ride

May 22, 2025

Aimscaps World Trading Tournament Wtt A Wild Ride

May 22, 2025 -

The Blake Lively Taylor Swift Dispute An Alleged Blackmail Scheme Involving Private Texts

May 22, 2025

The Blake Lively Taylor Swift Dispute An Alleged Blackmail Scheme Involving Private Texts

May 22, 2025

Latest Posts

-

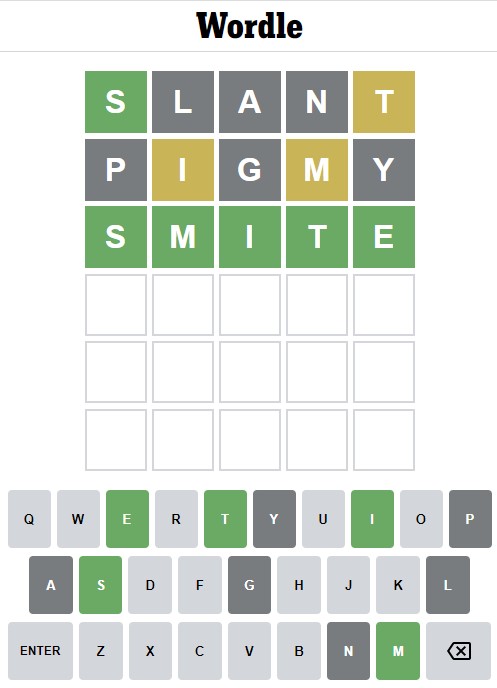

Wordle April 26 2025 Tips Clues And The Wordle Answer

May 22, 2025

Wordle April 26 2025 Tips Clues And The Wordle Answer

May 22, 2025 -

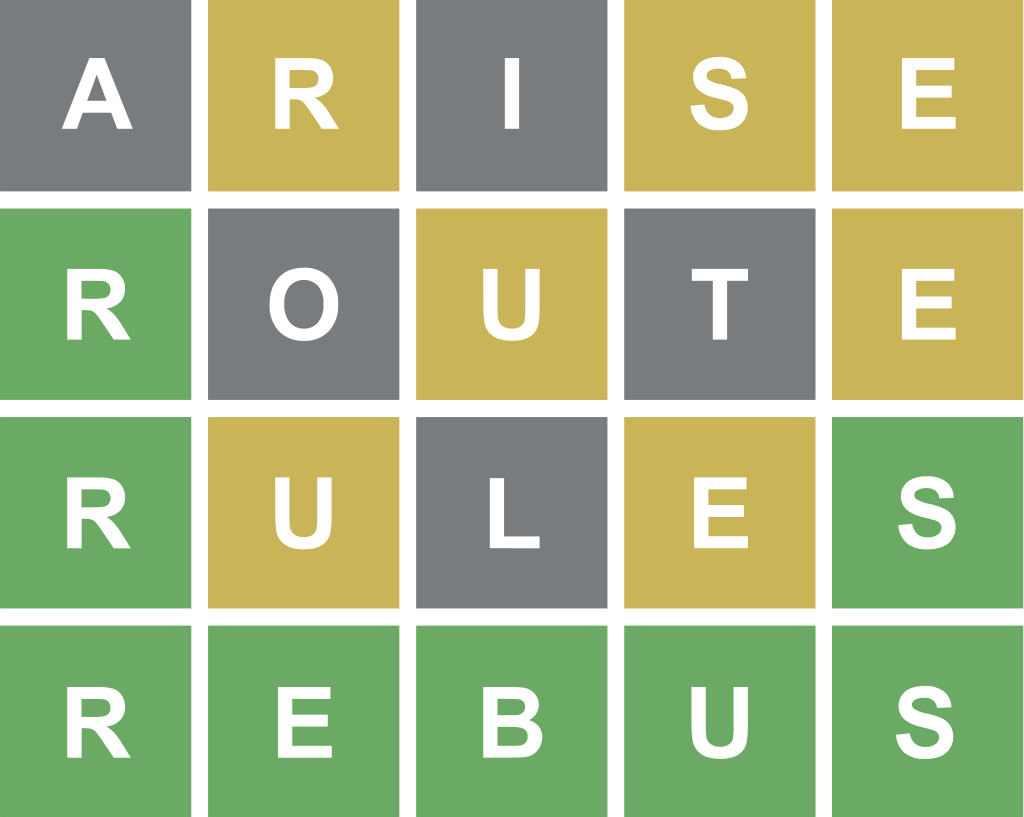

Wordle 370 March 20 Find The Answer With Our Hints And Clues

May 22, 2025

Wordle 370 March 20 Find The Answer With Our Hints And Clues

May 22, 2025 -

Wordle Hints And Answer March 20th 370

May 22, 2025

Wordle Hints And Answer March 20th 370

May 22, 2025 -

Solve Wordle 370 Clues And Solution For March 20th

May 22, 2025

Solve Wordle 370 Clues And Solution For March 20th

May 22, 2025 -

Wordle Today 370 March 20th Hints Clues And The Answer

May 22, 2025

Wordle Today 370 March 20th Hints Clues And The Answer

May 22, 2025