Understanding CoreWeave's (CRWV) Significant Stock Jump Last Week

Table of Contents

CoreWeave's Business Model and Growth Potential

CoreWeave's remarkable success is rooted in its innovative business model and strategic positioning within the rapidly expanding cloud computing and AI landscapes.

Focus on AI and GPU Computing

CoreWeave specializes in providing cloud computing infrastructure powered by high-performance GPUs (Graphics Processing Units). This focus perfectly aligns with the exploding demand driven by artificial intelligence, machine learning, and other computationally intensive applications.

- The Importance of GPU Computing for AI: GPUs excel at parallel processing, making them ideal for the complex calculations required by AI algorithms. This allows AI models to train significantly faster and more efficiently than with traditional CPUs.

- CoreWeave's Competitive Advantage: CoreWeave differentiates itself through its massive scale, providing clients with unparalleled access to GPU resources. This scalability ensures clients can quickly ramp up or down their computing needs, optimizing costs and responsiveness.

- Strategic Partnerships: CoreWeave actively cultivates partnerships with leading AI companies, further solidifying its position in the market and ensuring access to cutting-edge technologies and a strong pipeline of clients. These partnerships provide a strong foundation for future growth and expansion.

Scalability and Infrastructure

CoreWeave's ability to rapidly scale its infrastructure is a crucial factor in its success. The volatile nature of the cloud computing market necessitates a provider that can adapt quickly to fluctuating demand.

- Massive Infrastructure Capacity: CoreWeave boasts a substantial and rapidly expanding infrastructure, comprising thousands of high-performance GPUs. This allows them to handle even the most demanding workloads.

- Strategic Investments: The company continually invests in expanding its data center capacity, ensuring it can meet the growing needs of its clients and maintain a competitive edge. Recent announcements regarding infrastructure expansions underscore this commitment to growth.

- Strategic Partnerships for Infrastructure: CoreWeave also collaborates with key infrastructure providers, optimizing performance, cost-efficiency, and reliability.

Strong Customer Acquisition

CoreWeave has successfully attracted high-profile clients across various industries, demonstrating the value proposition of its services and solidifying its market position.

- High-Profile Clients: While specific client names might be confidential, CoreWeave's case studies showcase collaborations with major players in the AI and machine learning sectors.

- Brand Credibility and Market Share: These partnerships significantly contribute to CoreWeave's brand credibility and accelerate its market share growth. The trust placed in CoreWeave by these industry leaders speaks volumes about its capabilities.

Market Factors Influencing CRWV's Stock Price

Several market factors contributed to the recent surge in CoreWeave's stock price.

Increased Investor Interest in AI

The overall market is experiencing a surge in investor interest in AI-related companies. This broader trend significantly impacts CoreWeave's valuation.

- Broad Market Trends: The AI boom is fueling significant investments in the sector, attracting venture capital, private equity, and public market investors.

- Market Reports and Analyses: Several reputable market research firms have published bullish reports on the future of AI and the growth potential of companies like CoreWeave.

Positive Analyst Ratings and Predictions

Positive analyst ratings and optimistic predictions further contributed to the stock's rise.

- Analyst Upgrades and Positive Sentiment: Leading financial analysts have issued positive ratings and price targets for CRWV, reflecting confidence in the company's future performance.

- Key Analyst Arguments: These positive assessments often highlight CoreWeave's strong growth trajectory, strategic partnerships, and the immense potential of the AI market.

Overall Market Sentiment

The overall market environment also played a role. Improved investor confidence and positive trends in technology stocks generally contributed to the CRWV stock jump.

- Positive Market Environment: A generally positive market sentiment, particularly within the technology sector, often lifts even well-performing individual stocks.

Potential Risks and Challenges for CoreWeave

Despite the positive outlook, CoreWeave faces potential risks and challenges.

Competition in the Cloud Computing Market

The cloud computing market is intensely competitive, with established giants and emerging players vying for market share.

- Key Competitors: CoreWeave competes with major players in the cloud computing sector, each with its own strengths and weaknesses. Maintaining a competitive edge requires continuous innovation and strategic execution.

Dependence on GPU Technology

CoreWeave's business model relies heavily on GPU technology. Changes in market dynamics or the emergence of alternative technologies could pose a risk.

- Technological Disruptions: While GPUs currently dominate AI computing, advancements in other technologies could potentially challenge this dominance in the future.

Financial Sustainability

Maintaining profitability and sustainable growth is crucial for CoreWeave's long-term success.

- Financial Metrics: Investors should carefully analyze CoreWeave's financial statements, paying attention to key metrics like revenue growth, profitability, and cash flow.

Conclusion

CoreWeave's (CRWV) significant stock price increase last week reflects its strong position in the rapidly growing AI-driven cloud computing market, positive market sentiment, and promising growth prospects. However, the intense competition and dependence on specific technologies present potential challenges. The company's ability to navigate these challenges will be crucial for its continued success.

While the recent jump in CoreWeave (CRWV) stock presents exciting opportunities, understanding the underlying factors is crucial for informed investment decisions. Continue researching CoreWeave's performance and market trends to make well-informed choices regarding your CoreWeave (CRWV) investments. Stay tuned for further analysis and updates on the evolving landscape of the cloud computing and AI sectors.

Featured Posts

-

Conquete Parisienne Stephane La Voix Romande Qui Fait Vibrer La Capitale

May 22, 2025

Conquete Parisienne Stephane La Voix Romande Qui Fait Vibrer La Capitale

May 22, 2025 -

Du An Ha Tang Trong Diem Dong Luc Phat Trien Giao Thong Tp Hcm Binh Duong

May 22, 2025

Du An Ha Tang Trong Diem Dong Luc Phat Trien Giao Thong Tp Hcm Binh Duong

May 22, 2025 -

Dak Lak Phu Yen Chay Bo Hon 200km Hon 200 Nguoi Tham Gia

May 22, 2025

Dak Lak Phu Yen Chay Bo Hon 200km Hon 200 Nguoi Tham Gia

May 22, 2025 -

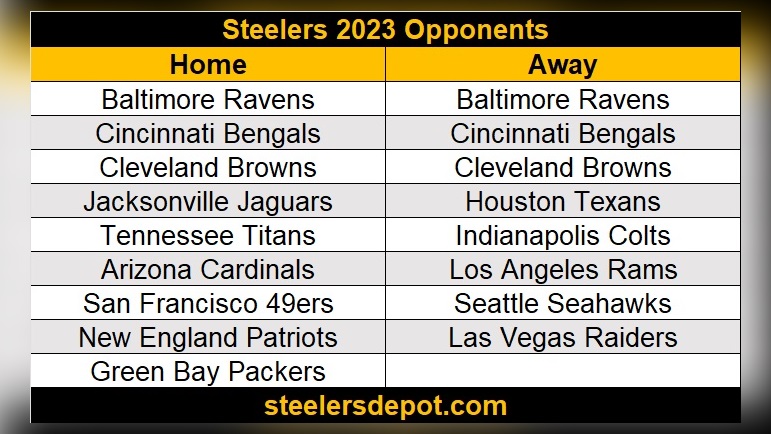

Steelers Schedule Release Key Takeaways And Analysis

May 22, 2025

Steelers Schedule Release Key Takeaways And Analysis

May 22, 2025 -

Music World Mourns Dropout Kings Lose Vocalist Adam Ramey

May 22, 2025

Music World Mourns Dropout Kings Lose Vocalist Adam Ramey

May 22, 2025

Latest Posts

-

Netflix May 2025 Whats New To Stream

May 22, 2025

Netflix May 2025 Whats New To Stream

May 22, 2025 -

Netflix New Releases May 2025

May 22, 2025

Netflix New Releases May 2025

May 22, 2025 -

S Sh A Ta Konfiskatsiya Rosiyskikh Aktiviv Pozitsiya Senatoriv Vklyuchayuchi Grema

May 22, 2025

S Sh A Ta Konfiskatsiya Rosiyskikh Aktiviv Pozitsiya Senatoriv Vklyuchayuchi Grema

May 22, 2025 -

Reaktsiya Na Zaklik Grema Chi Vidnovit S Sh A Viyskovu Dopomogu Ukrayini

May 22, 2025

Reaktsiya Na Zaklik Grema Chi Vidnovit S Sh A Viyskovu Dopomogu Ukrayini

May 22, 2025 -

Viyskova Dopomoga Ukrayini Zayava Senatora Grema Ta Yiyi Naslidki

May 22, 2025

Viyskova Dopomoga Ukrayini Zayava Senatora Grema Ta Yiyi Naslidki

May 22, 2025