Understanding CoreWeave's (CRWV) Wednesday Stock Price Rise

Table of Contents

Potential Catalysts Behind the CRWV Stock Price Increase

Several factors could have contributed to the impressive rise in CoreWeave's (CRWV) stock price on Wednesday. Let's examine the most likely contributors:

Positive Earnings Report/Guidance

A positive earnings report or upbeat guidance from CoreWeave (CRWV) is often a primary driver of stock price increases. Were there any positive financial announcements on or shortly before Wednesday that could explain the surge? We should look for indicators such as:

- Revenue Growth: A significant percentage increase in year-over-year or quarter-over-quarter revenue would be a strong positive signal. Any specific numbers released should be examined closely.

- Customer Acquisition: An increase in the number of new customers, particularly large enterprise clients, signifies strong market demand and future growth potential for CRWV. The type of new customers acquired is also crucial – are they in high-growth sectors like AI?

- Profitability Improvements: Improved margins, reduced operating expenses, or increased profitability would all contribute positively to investor sentiment. Specific data points on these metrics are key.

For example, if CoreWeave (CRWV) reported exceeding expectations for Q2 revenue growth by 15% and added several major clients in the AI sector, this would likely fuel a positive market reaction.

Market Sentiment and Industry Trends

The overall market sentiment towards cloud computing and AI stocks plays a significant role. Wednesday's market conditions may have been particularly favorable for CoreWeave (CRWV). Factors to consider include:

- Positive AI Industry News: Positive news or breakthroughs in the artificial intelligence sector could boost investor confidence in AI infrastructure providers like CoreWeave (CRWV).

- Broad Market Trends: A generally positive day in the broader technology sector could lift all boats, including CRWV.

- Competitor Performance: Positive news or strong performance from competitors in the cloud computing space might indirectly benefit CRWV by strengthening investor confidence in the entire sector.

Analyst Ratings and Price Target Adjustments

Changes in analyst ratings or price target adjustments by reputable investment banks can have a significant impact on a stock's price. Look for evidence of:

- Upgrades: Were there any upgrades in analyst ratings from "hold" or "sell" to "buy" or "outperform"? This would send a strong positive signal to the market.

- Increased Price Targets: An upward revision of price targets by analysts suggests a more optimistic outlook for CoreWeave (CRWV)'s future performance.

- Positive Analyst Comments: Any positive comments from analysts highlighting CoreWeave's (CRWV) competitive advantages, growth potential, or strong financial performance would further bolster the stock price.

Analyzing the Impact of AI and Cloud Computing on CRWV's Value

CoreWeave's (CRWV) success is intrinsically linked to the booming AI and cloud computing markets. Let's examine this connection:

CoreWeave's AI Infrastructure Focus

CoreWeave (CRWV) is uniquely positioned to benefit from the explosive growth of artificial intelligence. Their focus on providing specialized infrastructure for AI applications is a significant competitive advantage.

- Growing AI Demand: The insatiable demand for high-performance computing resources to train and deploy AI models creates significant opportunities for CRWV.

- Strategic Partnerships: Any strategic partnerships or investments in the AI space, for example collaborations with leading AI companies, contribute to the company's growth trajectory.

- Technological Leadership: CRWV's innovative technology and ability to offer cutting-edge solutions are crucial aspects of their competitive standing.

Competitive Advantages in the Cloud Computing Market

CoreWeave (CRWV) operates within a competitive landscape, but their unique value proposition sets them apart:

- Unique Selling Propositions: What specific features or services differentiate CoreWeave (CRWV) from giants like AWS, Google Cloud, and Azure?

- Technological Innovation: Are they pioneers in any specific cloud computing technologies?

- Market Share and Growth: What is their current market share, and what is their projected growth within the cloud computing market segment?

Risk Factors and Considerations for Future CRWV Performance

While the Wednesday stock price surge is encouraging, it's essential to acknowledge potential risks:

Market Volatility and Economic Uncertainty

Investing in the stock market always carries inherent risks. External economic factors can significantly impact even the strongest companies.

- Economic Downturn: A recession or economic slowdown could reduce demand for cloud computing services and negatively affect CoreWeave's (CRWV) growth.

- Market Corrections: The technology sector is known for its volatility; sudden market corrections can significantly impact stock prices.

Competition and Technological Disruption

The cloud computing and AI markets are highly competitive. New technologies or innovative competitors could disrupt CoreWeave (CRWV)'s business.

- New Entrants: The emergence of new players with disruptive technologies poses a threat to established companies.

- Technological Advancements: Rapid technological changes could render CoreWeave's (CRWV) current offerings obsolete.

Dependence on Specific Customers or Industries

CoreWeave (CRWV)'s financial health could be impacted by over-reliance on specific customers or industries.

- Customer Concentration: High concentration of revenue from a limited number of clients exposes CRWV to significant risk if those clients reduce their spending.

- Industry-Specific Risks: Dependence on a specific industry that experiences a downturn could negatively impact CoreWeave's (CRWV) performance.

Conclusion: Understanding CoreWeave's (CRWV) Stock Price Movement and Future Outlook

CoreWeave's (CRWV) Wednesday stock price increase was likely driven by a combination of positive financial news, favorable market sentiment, and positive analyst assessments. However, investors should always consider both the potential upside and downside risks before investing in any stock. Understanding the interplay between CoreWeave's (CRWV) focus on AI infrastructure, its competitive position in the cloud computing market, and the broader economic climate is crucial for making informed investment decisions. Continue your due diligence on CoreWeave (CRWV) to fully understand its potential and associated risks before investing.

Featured Posts

-

Malaysias Najib Razak Implicated In French Submarine Bribery Scandal

May 22, 2025

Malaysias Najib Razak Implicated In French Submarine Bribery Scandal

May 22, 2025 -

7 Vi Tri Ket Noi Tp Hcm Long An Can Uu Tien Dau Tu

May 22, 2025

7 Vi Tri Ket Noi Tp Hcm Long An Can Uu Tien Dau Tu

May 22, 2025 -

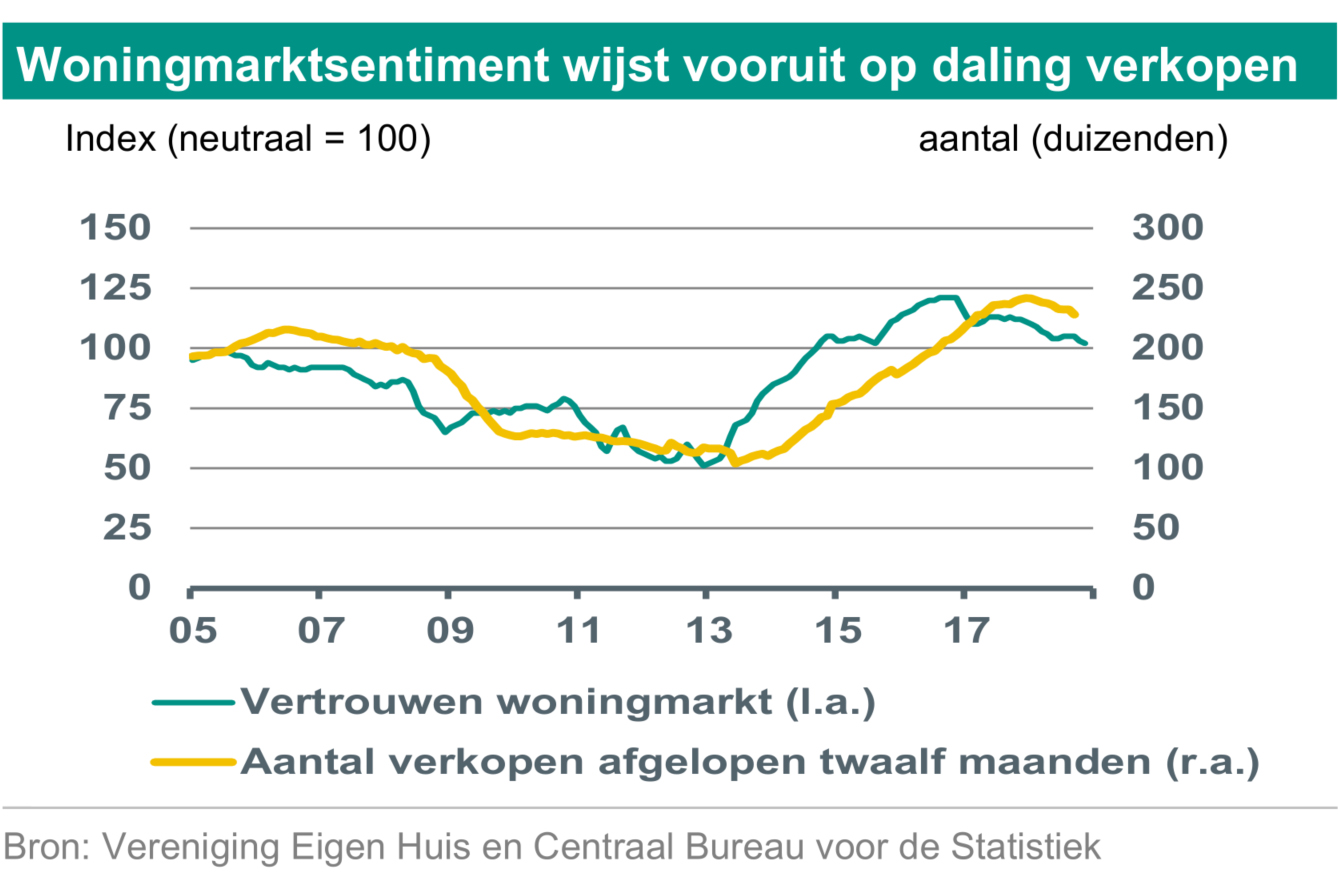

Huizenprijzen Nederland Abn Amro Versus Geen Stijl

May 22, 2025

Huizenprijzen Nederland Abn Amro Versus Geen Stijl

May 22, 2025 -

Steelers Intense Interest In Nfl Draft Quarterbacks

May 22, 2025

Steelers Intense Interest In Nfl Draft Quarterbacks

May 22, 2025 -

De Minimis Tariffs On Chinese Goods The G 7s Current Stance

May 22, 2025

De Minimis Tariffs On Chinese Goods The G 7s Current Stance

May 22, 2025

Latest Posts

-

Antony On His Near Transfer To Manchester Uniteds Rivals

May 23, 2025

Antony On His Near Transfer To Manchester Uniteds Rivals

May 23, 2025 -

Revealed Antonys Close Call With Manchester Uniteds Arch Rivals

May 23, 2025

Revealed Antonys Close Call With Manchester Uniteds Arch Rivals

May 23, 2025 -

Antony The Man United Transfer That Almost Wasnt

May 23, 2025

Antony The Man United Transfer That Almost Wasnt

May 23, 2025 -

Antonys Near Miss How He Almost Joined Manchester Uniteds Biggest Rivals

May 23, 2025

Antonys Near Miss How He Almost Joined Manchester Uniteds Biggest Rivals

May 23, 2025 -

Assessing The Success Of Manchester Uniteds Noussair Mazraoui Signing

May 23, 2025

Assessing The Success Of Manchester Uniteds Noussair Mazraoui Signing

May 23, 2025