Understanding Finance Loans: A Comprehensive Guide To Interest, EMIs, And Tenure

Table of Contents

Understanding Interest Rates

What are Interest Rates?

Interest rates represent the cost of borrowing money. Lenders charge interest as compensation for lending you their funds. Think of it as the price you pay for using someone else's money. Interest rates can be either fixed or variable. A fixed interest rate remains constant throughout the loan tenure, providing predictable monthly payments. A variable interest rate, on the other hand, fluctuates based on market conditions, potentially leading to changes in your monthly EMIs.

- Definition of interest: The fee charged by a lender for the use of their money.

- Interest Calculation: Simple interest is calculated only on the principal amount, while compound interest is calculated on both the principal and accumulated interest, resulting in faster growth of the debt.

- Factors Affecting Interest Rates: Several factors influence interest rates, including your credit score (a higher score often translates to a lower rate), prevailing market conditions (economic growth or recession), the type of loan (home loans typically have lower rates than personal loans), and the loan amount.

Impact of Interest Rates on Loan Cost

Higher interest rates directly translate to higher total loan repayments. Even a small difference in the interest rate can significantly impact the total amount you pay over the life of the loan.

- Total Interest Paid Calculation: The total interest paid is the difference between the total amount repaid and the initial loan amount.

- Comparing Loan Options: Always compare the Annual Percentage Rate (APR) of different loan offers. The APR includes all fees and charges associated with the loan, giving you a clearer picture of the true cost.

- Importance of Comparing APR: The APR provides a standardized measure for comparing loans from different lenders, enabling you to choose the most cost-effective option.

Deciphering EMIs (Equated Monthly Installments)

What are EMIs?

An EMI is a fixed monthly payment made towards a loan. It covers both the principal amount (the original loan amount) and the interest accrued. A simplified formula for calculating EMI is:

EMI = [P x R x (1+R)^N] / [(1+R)^N-1]

Where:

-

P = Principal Loan Amount

-

R = Monthly Interest Rate (Annual interest rate/12)

-

N = Loan Tenure in Months

-

Breakdown of EMI Components: Each EMI payment comprises a portion towards the principal and a portion towards the interest. Initially, a larger part goes towards interest, and gradually, the proportion shifts towards the principal as the loan tenure progresses.

-

Factors Affecting EMI: The EMI amount is influenced by three primary factors: the loan amount (higher amount means higher EMI), the interest rate (higher rate means higher EMI), and the loan tenure (longer tenure means lower EMI).

Choosing the Right EMI

Selecting the right EMI is crucial for managing your monthly budget effectively. A lower EMI offers greater affordability in the short term, but it could lead to paying significantly more interest over the loan's lifetime due to a longer tenure.

- Factors to Consider: When choosing an EMI, consider your monthly income, other financial commitments, and your risk tolerance.

- Budgeting for EMIs: Ensure that your chosen EMI comfortably fits within your monthly budget, leaving enough room for other expenses.

- Advantages of Lower EMIs/Longer Tenures: Lower EMIs provide immediate relief on monthly cash flow, but bear in mind that you will pay more interest overall. Conversely, higher EMIs and shorter tenures lead to lower overall interest payments but demand a larger monthly commitment. Prepayment options allow you to pay off the loan faster, reducing the total interest paid.

The Significance of Loan Tenure

What is Loan Tenure?

Loan tenure refers to the duration of the loan, typically expressed in months or years. It significantly impacts the total interest paid. A longer tenure results in lower monthly EMIs but higher overall interest payments, while a shorter tenure means higher EMIs but lower total interest.

- Definition of Tenure: The length of time you have to repay the loan.

- Relationship Between Tenure and EMI Amount: They have an inverse relationship: longer tenure, lower EMI; shorter tenure, higher EMI.

- Impact of Longer/Shorter Tenures on Total Cost: Longer tenures result in higher total interest payments, while shorter tenures reduce total interest paid but increase the monthly burden.

Choosing the Right Loan Tenure

Balancing affordability with the total interest paid is key when choosing a loan tenure. Carefully weigh the pros and cons of longer and shorter tenures to make an informed decision.

- Factors to Consider: Your financial situation, risk tolerance, and long-term financial goals should all influence your tenure choice.

- Calculating Total Interest Paid: Use online loan calculators to estimate the total interest payable for different tenures, assisting your decision-making process.

- Balancing Affordability with Long-Term Cost: Longer tenures offer short-term affordability but come at the cost of higher overall interest. Shorter tenures demand higher monthly payments but reduce the total interest paid.

Conclusion

Successfully navigating the world of finance loans requires a thorough understanding of interest rates, EMIs, and loan tenure. By carefully analyzing these three key elements, you can make informed decisions that align with your financial goals and budget. Remember to compare different loan options, factor in your financial capacity, and seek professional advice if needed. Mastering the intricacies of finance loans empowers you to make smart choices and secure the financing you need. Start exploring your options and find the best finance loan that suits your requirements today!

Featured Posts

-

Allqb Alhwlndy Yewd Layndhwfn Tfasyl Ttwyj Alfryq

May 28, 2025

Allqb Alhwlndy Yewd Layndhwfn Tfasyl Ttwyj Alfryq

May 28, 2025 -

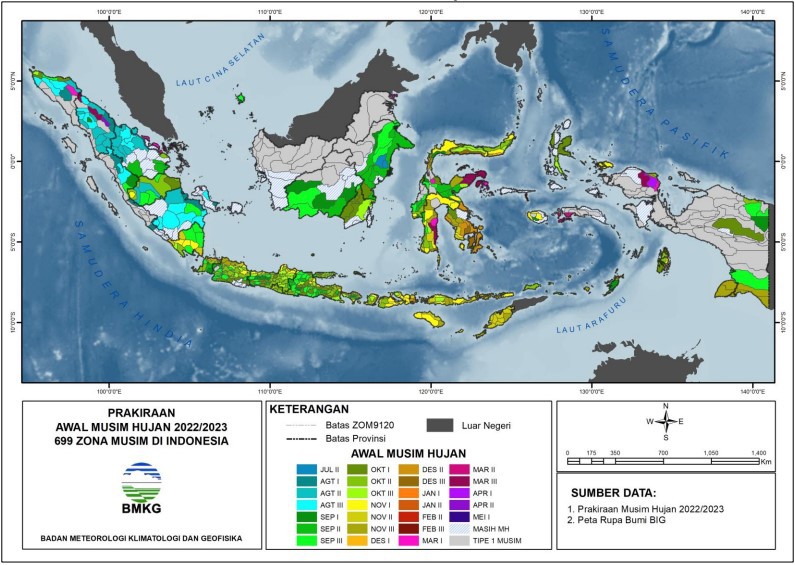

Jawa Barat Info Cuaca 23 April 2024 Hujan Di Bandung

May 28, 2025

Jawa Barat Info Cuaca 23 April 2024 Hujan Di Bandung

May 28, 2025 -

Cast Announcement Dubbo Championship Wrestling Musical Readings

May 28, 2025

Cast Announcement Dubbo Championship Wrestling Musical Readings

May 28, 2025 -

25m Star Wants Liverpool Move But Man Utd Make Contact

May 28, 2025

25m Star Wants Liverpool Move But Man Utd Make Contact

May 28, 2025 -

How To Watch The 2025 American Music Awards Online For Free

May 28, 2025

How To Watch The 2025 American Music Awards Online For Free

May 28, 2025

Latest Posts

-

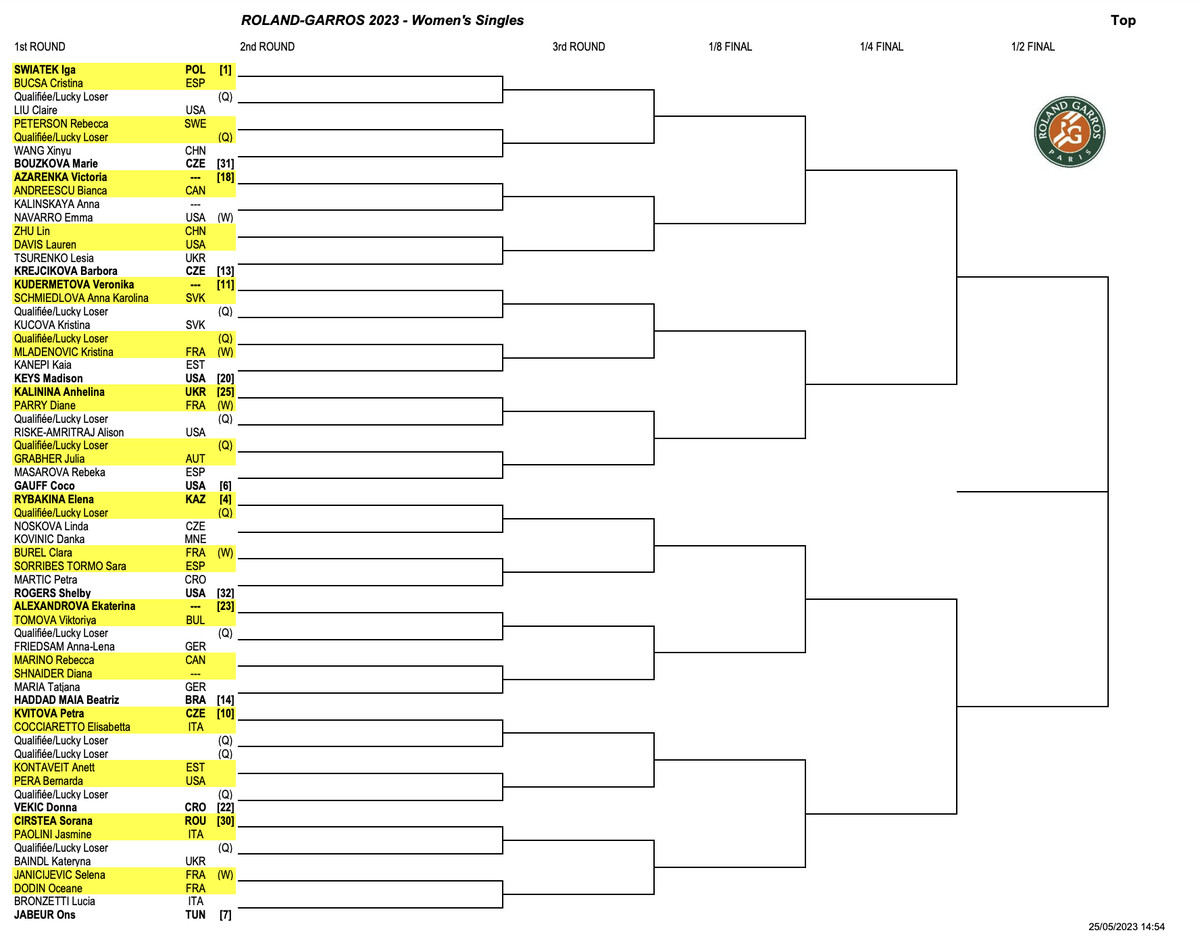

Djokovic And Sinners French Open Battle A Closer Look

May 30, 2025

Djokovic And Sinners French Open Battle A Closer Look

May 30, 2025 -

Knee Injury Sidelines Casper Ruud At Roland Garros Borges Secures Upset Win

May 30, 2025

Knee Injury Sidelines Casper Ruud At Roland Garros Borges Secures Upset Win

May 30, 2025 -

Sinner And Djokovic Rise To The French Open Challenge

May 30, 2025

Sinner And Djokovic Rise To The French Open Challenge

May 30, 2025 -

Ruuds Painful Knee Hinders Performance Leading To Defeat At Roland Garros

May 30, 2025

Ruuds Painful Knee Hinders Performance Leading To Defeat At Roland Garros

May 30, 2025 -

French Open Update Djokovics Strong Showing Gauff And Andreeva Advance

May 30, 2025

French Open Update Djokovics Strong Showing Gauff And Andreeva Advance

May 30, 2025