Understanding High Stock Market Valuations: A BofA Analysis

Table of Contents

BofA's Perspective on Current Market Valuations

BofA's assessment of current stock market valuations often fluctuates, depending on the specific report and the prevailing economic conditions. While a precise, universally applicable statement is impossible, their analysts frequently utilize a range of metrics to gauge market health. Generally, BofA's reports often highlight concerns regarding elevated valuations in specific sectors, while acknowledging the influence of factors like low interest rates and strong corporate earnings in supporting overall market levels. For the most up-to-date perspective, it's essential to refer to their latest publications.

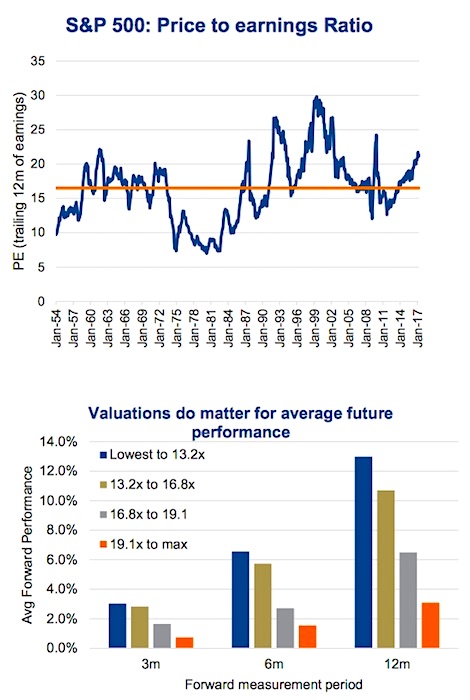

- Key metrics BofA uses to assess valuations: BofA employs a variety of valuation metrics, including the Price-to-Earnings ratio (P/E), the cyclically adjusted price-to-earnings ratio (Shiller PE), and various sector-specific ratios. These metrics provide different perspectives on valuation, considering historical performance and projected earnings.

- BofA's predictions for future market performance: BofA's predictions vary depending on the economic outlook and their analysts' interpretation of the data. Their reports often present a range of scenarios, reflecting the uncertainty inherent in market forecasting. It's crucial to note that these predictions are not guarantees.

- Sectors identified as overvalued or undervalued by BofA: BofA's research frequently identifies specific sectors as potentially overvalued or undervalued. This analysis typically involves a deeper dive into individual company performance, industry trends, and anticipated future growth. Past examples include highlighting concerns about specific technology sectors while identifying opportunities in value-oriented sectors.

- Link to relevant BofA research reports: [Insert links to relevant BofA research reports here. Update these links regularly to ensure accuracy].

Factors Contributing to High Stock Market Valuations

Several macroeconomic factors contribute to the perception of high stock market valuations. Understanding these factors is crucial for navigating the market effectively.

- Low interest rates and their impact on stock prices: Low interest rates make borrowing cheaper for companies and investors, fueling investment and pushing up stock prices. This often leads to higher valuations as investors seek higher returns in the stock market when bond yields are low.

- Quantitative easing and its effect on market liquidity: Quantitative easing (QE) programs increase the money supply, making more capital available for investment and driving up asset prices, including stocks. This added liquidity can inflate valuations.

- Strong corporate earnings growth (or lack thereof): Sustained strong corporate earnings growth can justify higher stock prices and valuations. Conversely, a slowdown or decline in earnings can lead to downward pressure on valuations.

- Investor sentiment and speculation: Positive investor sentiment and speculative trading can lead to a surge in demand for stocks, driving prices higher even if underlying fundamentals don't fully support the increase. This can contribute to bubbles.

- Technological innovation and its influence on valuations: Rapid technological advancements can create significant growth opportunities, leading to high valuations for companies in innovative sectors. The potential for disruption also impacts valuations, sometimes creating very high multiples for high-growth companies.

Risks Associated with High Valuations

Investing in a highly valued market presents significant risks. Understanding these risks is essential for risk management.

- Increased risk of market correction or crash: High valuations make the market more vulnerable to sharp corrections or even crashes. A negative catalyst, such as rising interest rates or unexpected economic downturn, could trigger a significant market decline.

- Potential for lower future returns: Stocks purchased at high valuations tend to offer lower future returns compared to stocks purchased at lower valuations. This is because the potential for price appreciation is inherently limited when valuations are already high.

- Vulnerability to interest rate hikes: Rising interest rates increase borrowing costs, potentially slowing down economic growth and reducing corporate earnings, leading to lower stock prices. High-valuation stocks are particularly sensitive to interest rate hikes.

- Impact of geopolitical events on valuations: Geopolitical instability, such as wars or trade disputes, can significantly impact market sentiment and valuations, often leading to increased volatility.

- The possibility of asset bubbles: High valuations can be a sign of an asset bubble, which is a rapid increase in asset prices driven by speculation rather than fundamentals. Bubbles are inherently unsustainable and prone to dramatic collapses.

Strategies for Navigating High Stock Market Valuations

Based on BofA's analyses and general market wisdom, several strategies can help investors navigate a market with high valuations.

- Diversification strategies to mitigate risk: Diversifying investments across different asset classes (stocks, bonds, real estate, etc.) and sectors can reduce the overall portfolio's risk.

- Focus on value investing or growth investing: The optimal approach depends on BofA's current recommendations and your individual risk tolerance. Value investing focuses on undervalued companies, while growth investing targets companies with high growth potential.

- Consideration of alternative investments: Alternative investments, such as private equity or commodities, can offer diversification benefits and potentially better returns in a high-valuation stock market.

- Importance of a long-term investment horizon: A long-term investment horizon allows investors to ride out market fluctuations and benefit from long-term growth. Short-term market timing is generally discouraged.

- Regular portfolio rebalancing: Regularly rebalancing the portfolio to maintain the desired asset allocation can help manage risk and take advantage of market opportunities.

The Role of Sector-Specific Analysis

It's crucial to avoid viewing the market as a monolith. Sector-specific analysis is essential for identifying opportunities and mitigating risks.

- Sectors identified by BofA as particularly overvalued or undervalued: BofA's research often provides detailed sector-specific analysis, highlighting areas of potential overvaluation or undervaluation. This analysis is critical for making informed investment decisions.

- Sector-specific risks and opportunities: Different sectors face unique risks and opportunities. Understanding these sector-specific dynamics is essential for developing a well-informed investment strategy.

Conclusion

Understanding high stock market valuations is a complex undertaking, requiring a thorough analysis of macroeconomic factors, individual company performance, and investor sentiment. BofA's research provides valuable insights into these dynamics, highlighting both the potential risks and opportunities. Factors such as low interest rates, quantitative easing, and strong (or weak) corporate earnings significantly influence valuations. However, these high valuations also come with inherent risks, including the potential for market corrections, lower future returns, and vulnerability to interest rate hikes. By diversifying investments, focusing on value or growth strategies depending on BofA's guidance and the market environment, considering alternative investments, maintaining a long-term perspective, and regularly rebalancing your portfolio, you can navigate this challenging environment effectively.

Understanding high stock market valuations is crucial for making informed investment decisions. Continue your research using reliable sources like BofA's reports and consider consulting a financial advisor to develop a personalized investment strategy that addresses your risk tolerance and financial goals in the context of these high stock market valuations.

Featured Posts

-

Begrenset Effekt Av Adhd Medisin Pa Skoleprestasjoner Fhi

Apr 29, 2025

Begrenset Effekt Av Adhd Medisin Pa Skoleprestasjoner Fhi

Apr 29, 2025 -

Ohio Doctors Parole Hearing A Sons Struggle 36 Years After Murder

Apr 29, 2025

Ohio Doctors Parole Hearing A Sons Struggle 36 Years After Murder

Apr 29, 2025 -

Past Tragedy Weighs Heavy As Louisville Residents Shelter In Place

Apr 29, 2025

Past Tragedy Weighs Heavy As Louisville Residents Shelter In Place

Apr 29, 2025 -

April 27 2025 Nyt Spelling Bee Complete Solutions And Pangram

Apr 29, 2025

April 27 2025 Nyt Spelling Bee Complete Solutions And Pangram

Apr 29, 2025 -

Capital Summertime Ball 2025 Your Ticket Acquisition Strategy

Apr 29, 2025

Capital Summertime Ball 2025 Your Ticket Acquisition Strategy

Apr 29, 2025

Latest Posts

-

Strands Nyt Game 403 Answers Thursday April 10th

May 09, 2025

Strands Nyt Game 403 Answers Thursday April 10th

May 09, 2025 -

Strands Nyt Answers Saturday April 12 2024 Game 405

May 09, 2025

Strands Nyt Answers Saturday April 12 2024 Game 405

May 09, 2025 -

Nyt Spelling Bee April 4 2025 Pangram Clues And Answers

May 09, 2025

Nyt Spelling Bee April 4 2025 Pangram Clues And Answers

May 09, 2025 -

Nyt Strands Hints And Answers Thursday April 10 Game 403

May 09, 2025

Nyt Strands Hints And Answers Thursday April 10 Game 403

May 09, 2025 -

Nyt Strands Hints And Answers Saturday April 12 Game 405

May 09, 2025

Nyt Strands Hints And Answers Saturday April 12 Game 405

May 09, 2025