Understanding Indian Crypto Exchange Compliance: A Practical Overview

Table of Contents

The Evolving Regulatory Landscape of Crypto in India

The regulatory landscape for cryptocurrencies in India has been in constant flux. Initially, there was significant uncertainty and concern surrounding cryptocurrencies, with the Reserve Bank of India (RBI) even issuing a circular in 2018 that effectively banned banks from dealing with cryptocurrency entities. However, this ban was overturned by the Supreme Court of India in 2020, a landmark decision that breathed new life into the Indian crypto market.

Despite this positive development, a comprehensive and unified law governing cryptocurrencies remains elusive. Ongoing debates within the government continue to shape the future of crypto regulation in India. The government is currently exploring various options, including potential frameworks that could range from outright prohibition to a more permissive approach with robust regulation. The role of self-regulatory organizations (SROs) is also being considered as a way to foster responsible growth within the industry.

- Initial uncertainty and concerns surrounding cryptocurrencies: The early years saw a lack of clarity on the legal status of crypto.

- Supreme Court's 2020 decision overturning RBI's ban: This decision marked a turning point, allowing crypto exchanges to operate legally.

- Current discussions on potential regulatory frameworks: The government is actively considering various regulatory models for the crypto space.

- The role of self-regulatory organizations (SROs): Industry bodies are expected to play a vital role in establishing best practices and ensuring compliance.

Key Compliance Areas for Indian Crypto Exchanges

Several key areas demand strict adherence to ensure Indian crypto exchange compliance. Failure to meet these standards can result in significant penalties and damage to reputation.

KYC/AML Compliance

Know Your Customer (KYC) and Anti-Money Laundering (AML) compliance are paramount for preventing financial crimes and maintaining a transparent operating environment. Indian crypto exchanges must implement robust KYC/AML procedures to verify the identities of their users and monitor transactions for suspicious activity. This includes meticulous record-keeping and the ability to promptly report any suspicious activity to the relevant authorities.

- Aadhaar verification and other identity checks: Utilizing Aadhaar, India's biometric identification system, is often a crucial component of KYC verification.

- Transaction monitoring and suspicious activity reporting (SAR): Exchanges must have systems in place to detect and report potentially illicit transactions.

- Penalties for non-compliance: Failure to comply with KYC/AML regulations can lead to hefty fines and even legal repercussions.

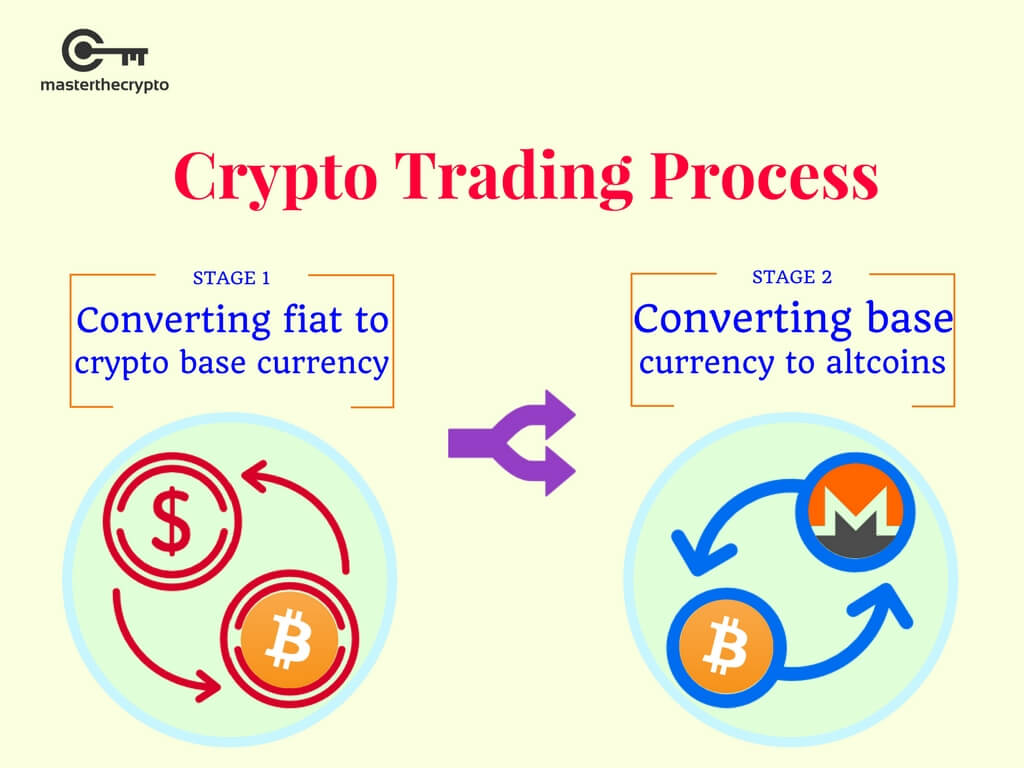

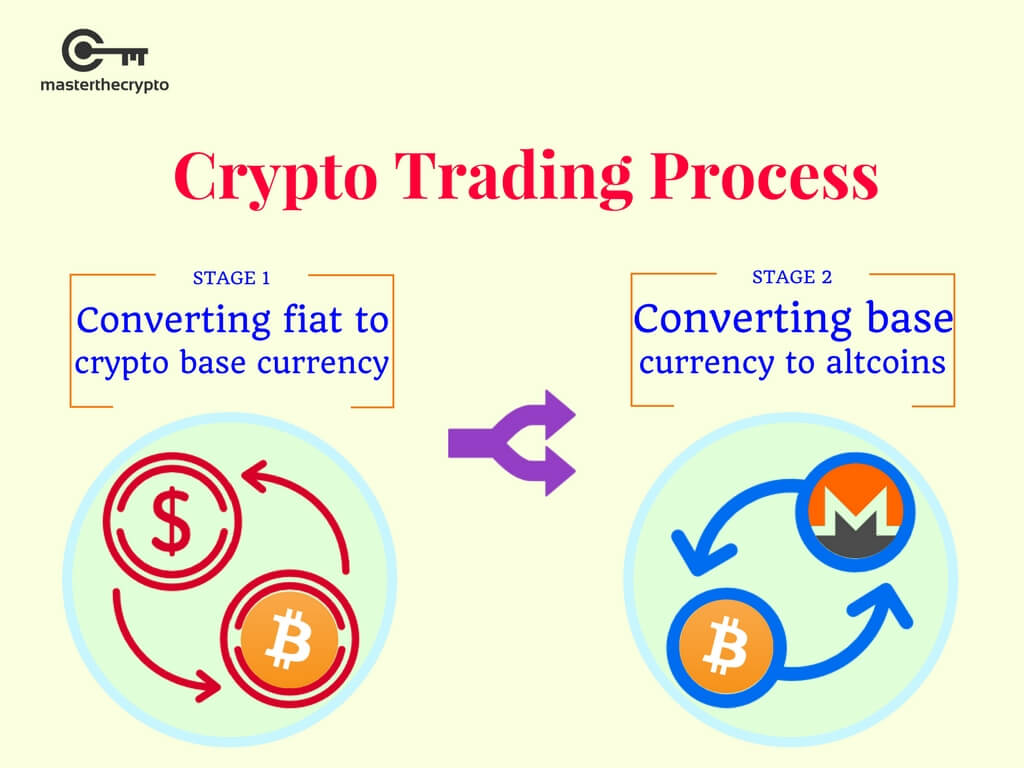

Taxation of Cryptocurrency Transactions

Understanding the tax implications of cryptocurrency transactions is crucial for both exchanges and users. Currently, profits from cryptocurrency trading are considered taxable income in India. This means that exchanges are responsible for collecting and remitting taxes on behalf of their users, and users must accurately declare and pay taxes on their profits.

- Income tax on capital gains: Profits from crypto trading are subject to income tax, with rates varying depending on the individual's income bracket.

- GST implications: The Goods and Services Tax (GST) may also apply to certain cryptocurrency transactions, depending on the specific nature of the transaction.

- Tax reporting requirements: Exchanges and users are required to maintain accurate records and file tax returns accordingly.

Data Security and User Protection

Protecting user data and funds is a top priority for any reputable crypto exchange. Robust security measures, including data encryption, secure storage practices, and comprehensive cybersecurity protocols, are essential for maintaining user trust and complying with data protection regulations. Implementing robust dispute resolution mechanisms is also vital to address user complaints and ensure fairness.

- Cybersecurity best practices: Implementing multi-factor authentication, regular security audits, and penetration testing are crucial security measures.

- Data encryption and storage: Protecting user data through encryption and secure storage methods is vital for compliance.

- Dispute resolution mechanisms for users: Clear and effective processes for handling user complaints and disputes are essential.

Advertising and Marketing Regulations

The advertisement and marketing of cryptocurrencies in India are subject to various guidelines and restrictions. Exchanges must ensure that their marketing materials are accurate, transparent, and do not make misleading or exaggerated claims. This includes responsible influencer marketing practices and clear disclosures about the risks associated with cryptocurrency investments.

- Misleading advertising and promotional claims: Avoid making unrealistic promises or guarantees about cryptocurrency returns.

- Disclosure requirements: Clearly disclose the risks involved in cryptocurrency investments.

- Regulatory scrutiny on influencer marketing: Any collaborations with influencers must comply with advertising standards.

Best Practices for Indian Crypto Exchange Compliance

Maintaining Indian crypto exchange compliance requires a proactive approach. This includes staying informed about the constantly evolving regulatory landscape, implementing robust internal controls, and seeking expert guidance when needed.

- Regular audits and internal compliance reviews: Conduct periodic audits to identify and address potential compliance gaps.

- Staying updated on regulatory developments: Keep abreast of any changes in regulations and update your practices accordingly.

- Implementing strong governance frameworks: Establish clear policies and procedures to ensure compliance across the organization.

- Seeking legal counsel: Consult with legal and compliance experts to ensure your practices align with all relevant regulations.

Conclusion

Understanding Indian crypto exchange compliance is crucial for the continued growth and stability of the cryptocurrency market in India. By adhering to KYC/AML regulations, complying with tax laws, implementing robust security measures, and adopting responsible marketing practices, Indian crypto exchanges can contribute to a safe and transparent ecosystem. Staying informed about the evolving regulatory landscape and seeking expert advice are key to maintaining Indian crypto exchange compliance and building a trustworthy reputation. Proactive compliance is not just a legal obligation, but also a key factor in fostering user confidence and driving sustainable growth within the Indian cryptocurrency space. Ensure you are fully compliant with all aspects of Indian Crypto Exchange Compliance to protect your business and your users.

Featured Posts

-

Akkor Davasi Burak Mavis In Aihm Yolculugu Ve Karma Evlilik

May 15, 2025

Akkor Davasi Burak Mavis In Aihm Yolculugu Ve Karma Evlilik

May 15, 2025 -

Improved Monsoon Outlook Positive Implications For Indias Agricultural Growth And Consumption

May 15, 2025

Improved Monsoon Outlook Positive Implications For Indias Agricultural Growth And Consumption

May 15, 2025 -

Snelle Actie Npo Na Zorgen Over Frederieke Leeflang

May 15, 2025

Snelle Actie Npo Na Zorgen Over Frederieke Leeflang

May 15, 2025 -

Filming Euphoria Season 3 Jacob Elordis Perspective On The Powerful Experience

May 15, 2025

Filming Euphoria Season 3 Jacob Elordis Perspective On The Powerful Experience

May 15, 2025 -

Kiprskiy Vopros Obsuzhdenie Vyvoda Turetskikh Voysk

May 15, 2025

Kiprskiy Vopros Obsuzhdenie Vyvoda Turetskikh Voysk

May 15, 2025

Latest Posts

-

Analyse De Actie Tegen Npo Baas Frederieke Leeflang En De Gevolgen

May 15, 2025

Analyse De Actie Tegen Npo Baas Frederieke Leeflang En De Gevolgen

May 15, 2025 -

Is Dit Het Begin Van Het Einde Actie Tegen Npo Directeur Frederieke Leeflang

May 15, 2025

Is Dit Het Begin Van Het Einde Actie Tegen Npo Directeur Frederieke Leeflang

May 15, 2025 -

Verdere Escalatie Verwacht Actie Tegen Frederieke Leeflang En De Npo

May 15, 2025

Verdere Escalatie Verwacht Actie Tegen Frederieke Leeflang En De Npo

May 15, 2025 -

Reacties Op De Dreigende Actie Tegen Npo Baas Frederieke Leeflang

May 15, 2025

Reacties Op De Dreigende Actie Tegen Npo Baas Frederieke Leeflang

May 15, 2025 -

Nieuwe Ontwikkelingen In De Actie Tegen Npo Directeur Frederieke Leeflang

May 15, 2025

Nieuwe Ontwikkelingen In De Actie Tegen Npo Directeur Frederieke Leeflang

May 15, 2025