Understanding ING Group's 2024 Annual Report (Form 20-F)

Table of Contents

Key Highlights from ING Group's 2024 20-F Filing

Analyzing ING Group's overall financial performance in 2024 requires a careful review of the 20-F filing's financial statements. Here are some key takeaways:

-

Revenue: [Insert actual revenue figure from the 2024 20-F filing]. This represents [insert percentage change compared to the previous year] compared to 2023, indicating [insert interpretation: growth, stagnation, or decline]. Analyzing ING Group revenue across different segments allows for a more granular understanding of performance drivers.

-

Net Income: [Insert actual net income figure from the 2024 20-F filing]. This reflects a [insert percentage change compared to the previous year] change compared to the previous year's performance. Understanding the factors contributing to this change is vital for profitability analysis.

-

Profitability: Key profitability metrics, such as Return on Equity (ROE) and Return on Assets (ROA), should be examined from the 20-F. [Insert actual figures and analysis from the 20-F]. These figures illuminate the efficiency of ING Group's operations and its ability to generate profits from its assets.

Analysis of ING's Revenue Streams and Geographic Performance (20-F)

ING Group's revenue streams are diverse, spanning across various business segments and geographic regions. Understanding the performance of each area is crucial for a complete picture:

-

Retail Banking: [Insert data and analysis from the 20-F on retail banking performance, including key metrics and growth trends]. This segment's performance is heavily influenced by [mention relevant factors like interest rates, consumer spending, etc.].

-

Wholesale Banking: [Insert data and analysis from the 20-F on wholesale banking performance, including key metrics and growth trends]. This segment's performance is particularly sensitive to [mention relevant factors like global economic conditions, regulatory changes, etc.].

-

Investment Management: [Insert data and analysis from the 20-F on investment management performance, including key metrics and growth trends]. This area is subject to market volatility and investor sentiment, making consistent performance challenging.

-

Geographic Diversification: ING Group operates across numerous countries. The 20-F will detail the performance in each key market. [Analyze regional performance highlighting strong and weak areas based on data from the 20-F. Mention specific countries and their contributions to ING Group's overall revenue]. This geographic diversification plays a critical role in mitigating risk and accessing growth opportunities.

Risk Factors and Future Outlook: Insights from the 20-F

The 20-F filing transparently outlines the risk factors that could impact ING Group's future performance:

-

Economic Downturn: [Explain how an economic downturn could affect ING Group based on insights from the 20-F, including the potential impact on loan defaults, reduced investment activity, etc.]. ING Group's risk management strategies in this area are crucial for evaluating its resilience.

-

Geopolitical Instability: [Explain how geopolitical risks, such as international conflicts or trade wars, could influence ING Group's operations based on the 20-F. Consider mentioning the impact on specific regions or business segments].

-

Regulatory Changes: [Explain the potential impact of regulatory changes on ING Group's operations. The 20-F should detail the company’s compliance efforts and potential financial or operational implications of new regulations].

-

Future Outlook: [Summarize ING Group’s management’s outlook and future projections as presented in the 20-F. Include any significant changes in strategy or business plans].

Understanding ING Group's Capital Structure and Financial Position (20-F)

Analyzing ING Group's capital structure and financial position from the 20-F data offers insights into its long-term sustainability:

-

Capital Adequacy: [Explain ING Group's capital ratios and their compliance with regulatory requirements based on data from the 20-F. Discuss the implications for its financial stability].

-

Liquidity Ratio: [Analyze ING Group’s liquidity ratios as presented in the 20-F. Discuss their implications for the company's ability to meet its short-term obligations].

-

Debt-to-Equity Ratio: [Analyze ING Group’s debt-to-equity ratio as reported in the 20-F. Discuss the company's leverage and its impact on its financial risk profile]. This ratio indicates the proportion of debt financing compared to equity financing.

-

Financial Stability: [Offer an overall assessment of ING Group’s financial stability based on the analyzed metrics. Consider discussing any concerns or positive trends identified in the 20-F].

Conclusion: Key Takeaways and Next Steps for Understanding ING Group's 2024 20-F Filing

This analysis of ING Group's 2024 20-F filing reveals a complex financial picture, highlighting both strengths and potential risks. Key aspects include [mention 2-3 of the most important conclusions, e.g., revenue growth in specific segments, challenges related to geopolitical instability, strong capital adequacy]. Understanding these aspects is crucial for investors and stakeholders.

To gain a truly comprehensive understanding of ING Group’s performance and financial position, we strongly encourage you to download and thoroughly review the full ING Group 2024 20-F filing. Further research into specific segments, geographic regions, or risk factors detailed within the report can provide even deeper insights. Staying informed about ING Group's financial performance through careful analysis of the ING Group 2024 Annual Report (Form 20-F) is essential for making informed decisions.

Featured Posts

-

James Wiltshires 10 Years At The Border Mail Reflections On A Career

May 23, 2025

James Wiltshires 10 Years At The Border Mail Reflections On A Career

May 23, 2025 -

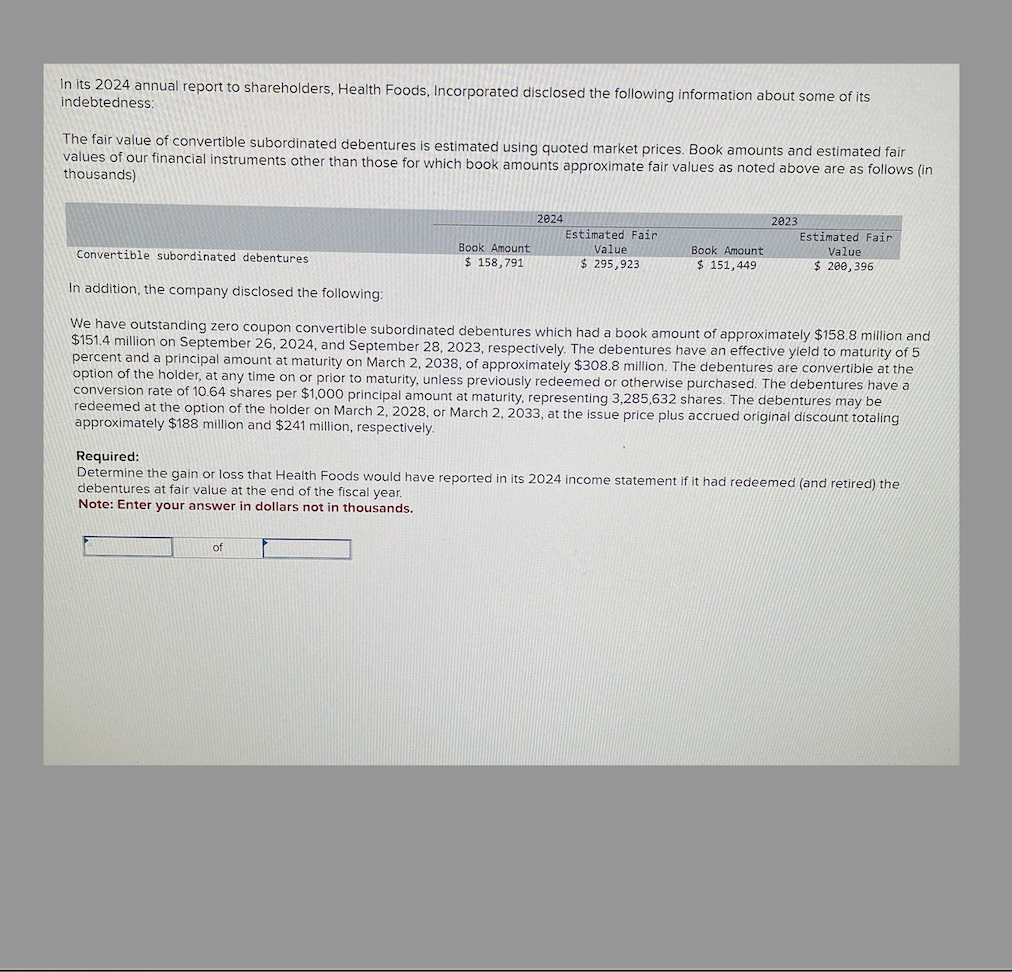

Wolf Activity And Its Impact On The North State A Barton Perspective

May 23, 2025

Wolf Activity And Its Impact On The North State A Barton Perspective

May 23, 2025 -

Grand Ole Oprys Historic London Concert Royal Albert Hall Broadcast

May 23, 2025

Grand Ole Oprys Historic London Concert Royal Albert Hall Broadcast

May 23, 2025 -

Vybz Kartel Tour A Dream Fulfilled For Nuffy

May 23, 2025

Vybz Kartel Tour A Dream Fulfilled For Nuffy

May 23, 2025 -

Big Rig Rock Report 3 12 And Rock 101 A Comprehensive Overview

May 23, 2025

Big Rig Rock Report 3 12 And Rock 101 A Comprehensive Overview

May 23, 2025

Latest Posts

-

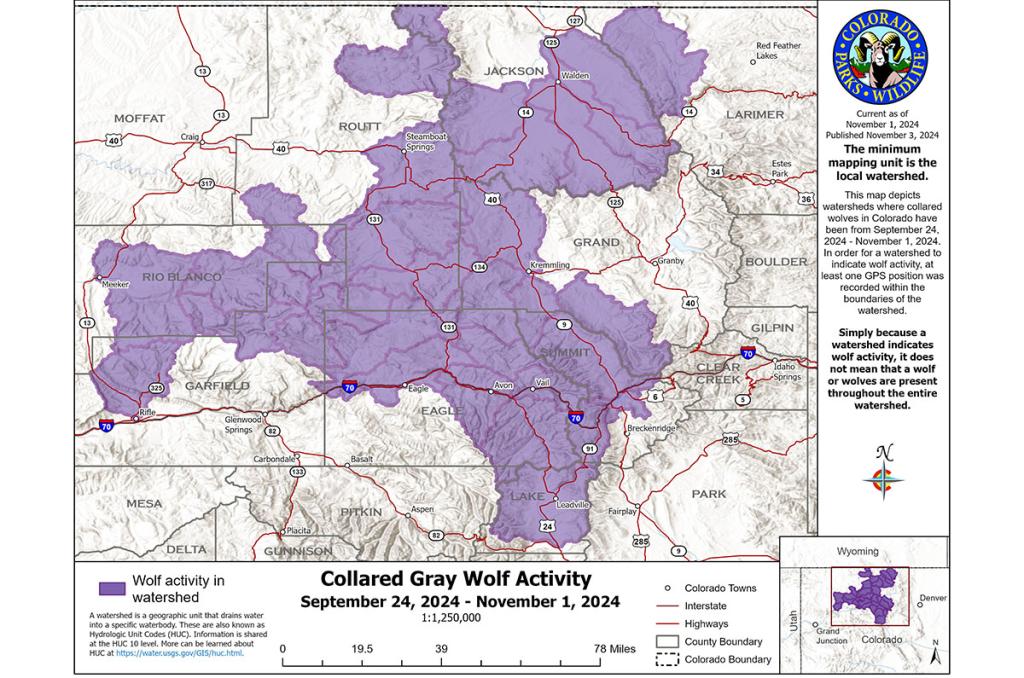

Airplane Safety Statistics Separating Fact From Fear

May 23, 2025

Airplane Safety Statistics Separating Fact From Fear

May 23, 2025 -

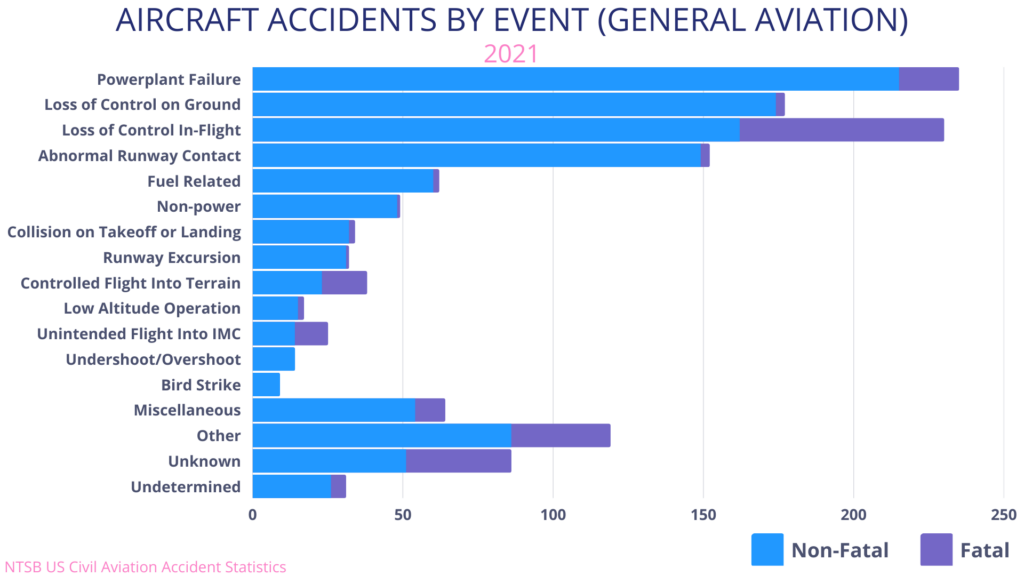

Close Calls And Crashes A Visual Analysis Of Airplane Safety Data

May 23, 2025

Close Calls And Crashes A Visual Analysis Of Airplane Safety Data

May 23, 2025 -

The White House Incident Exploring Alternative Approaches By President Ramaphosa

May 23, 2025

The White House Incident Exploring Alternative Approaches By President Ramaphosa

May 23, 2025 -

Airplane Safety Understanding The Statistics Behind Close Calls And Crashes

May 23, 2025

Airplane Safety Understanding The Statistics Behind Close Calls And Crashes

May 23, 2025 -

Could Cyril Ramaphosa Have Handled The White House Situation Differently A Critical Analysis

May 23, 2025

Could Cyril Ramaphosa Have Handled The White House Situation Differently A Critical Analysis

May 23, 2025