Understanding Principal Financial Group (PFG): 13 Analyst Opinions Deconstructed

Table of Contents

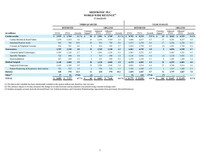

Analyst Ratings Summary: A Snapshot of PFG's Current Outlook

To gain a quick understanding of the current market sentiment towards Principal Financial Group (PFG), let's examine the consensus among 13 analysts. This snapshot provides a valuable starting point for our deeper dive into individual opinions and their underlying rationale. The distribution of ratings reveals a general outlook on PFG's stock performance.

- Number of Buy ratings: 5

- Number of Hold ratings: 6

- Number of Sell ratings: 2

- Average Target Price: $78.50

- Highest Target Price: $95.00

- Lowest Target Price: $62.00

The range between the highest and lowest target prices for Principal Financial Group (PFG) stock highlights the significant variation in analyst expectations. This emphasizes the importance of considering multiple perspectives before making any investment decisions. The relatively high number of "Hold" ratings suggests a degree of caution and uncertainty surrounding PFG's future performance.

Key Factors Driving Analyst Opinions on Principal Financial Group (PFG)

Analyst opinions on Principal Financial Group (PFG) are shaped by a complex interplay of macroeconomic factors and the company's specific performance and strategic direction. Let's examine the key drivers influencing these diverse perspectives:

-

Interest Rate Sensitivity: PFG's business model is sensitive to interest rate fluctuations. Rising interest rates can positively impact investment returns, while falling rates can have the opposite effect. Analysts carefully consider the prevailing interest rate environment and its likely impact on PFG's profitability.

-

Impact of Inflation on PFG's business: Inflationary pressures affect both PFG's operating costs and the value of its investments. Analysts analyze how effectively PFG is managing these inflationary pressures and whether its pricing strategies can offset rising costs.

-

Recent Earnings Reports Summary: Recent earnings reports are a key factor influencing analyst sentiment. Strong revenue growth, increased profitability, and positive forward guidance tend to generate more bullish ratings. Conversely, disappointing results often lead to more bearish opinions.

-

Key Strategic Initiatives: PFG's strategic initiatives, such as mergers, acquisitions, and new product launches, are closely scrutinized by analysts. Successful execution of these initiatives can boost future growth prospects and increase investor confidence in Principal Financial Group (PFG).

Strengths and Weaknesses Highlighted by Analysts Regarding PFG

Analyzing the strengths and weaknesses identified by analysts provides a balanced perspective on Principal Financial Group (PFG). This allows investors to gauge the overall risk-reward profile associated with investing in the company.

-

Top 3 Strengths identified by analysts:

- Strong balance sheet and financial stability.

- Consistent dividend payouts, attractive to income-seeking investors.

- Established market position and brand recognition.

-

Top 3 Weaknesses identified by analysts:

- Exposure to market volatility and economic downturns.

- Potential regulatory changes that could impact profitability.

- Intense competition within the financial services industry.

Examples from analyst reports often highlight the nuanced nature of these strengths and weaknesses. For example, while a strong balance sheet is a significant positive, analysts might also point out that it may not entirely protect PFG from the broader economic headwinds.

Valuation and Investment Implications: What Analysts Suggest about PFG Stock

Understanding the valuation metrics used by analysts is crucial for assessing whether Principal Financial Group (PFG) stock is currently undervalued or overvalued.

- Average P/E Ratio: 15.5

- Average Price-to-Book Ratio: 1.2

- Potential Upside/Downside based on target prices: Based on the average target price of $78.50 and the current market price, the potential upside could be significant, while the downside is limited. However, this is highly dependent on the accuracy of the analysts' predictions.

- Risk assessment based on analyst opinions: The mix of buy, hold, and sell recommendations indicates a moderate level of risk, suggesting the need for careful consideration before investing.

The variation in valuation multiples used by different analysts often reflects their differing assumptions about PFG's future growth prospects and the overall economic environment.

Conclusion: Making Informed Decisions about Principal Financial Group (PFG)

The analysis of 13 analyst opinions on Principal Financial Group (PFG) reveals a range of perspectives, from cautiously optimistic to moderately bearish. While a consensus exists on PFG's strengths—such as its financial stability and dividend payments—there are also concerns about its exposure to market risks and regulatory changes. Remember, conducting thorough research and understanding diverse perspectives is crucial before making any investment decisions related to Principal Financial Group (PFG). Consider your own risk tolerance and financial goals before investing. Share your thoughts and analysis of Principal Financial Group (PFG) in the comments below – let's discuss!

Featured Posts

-

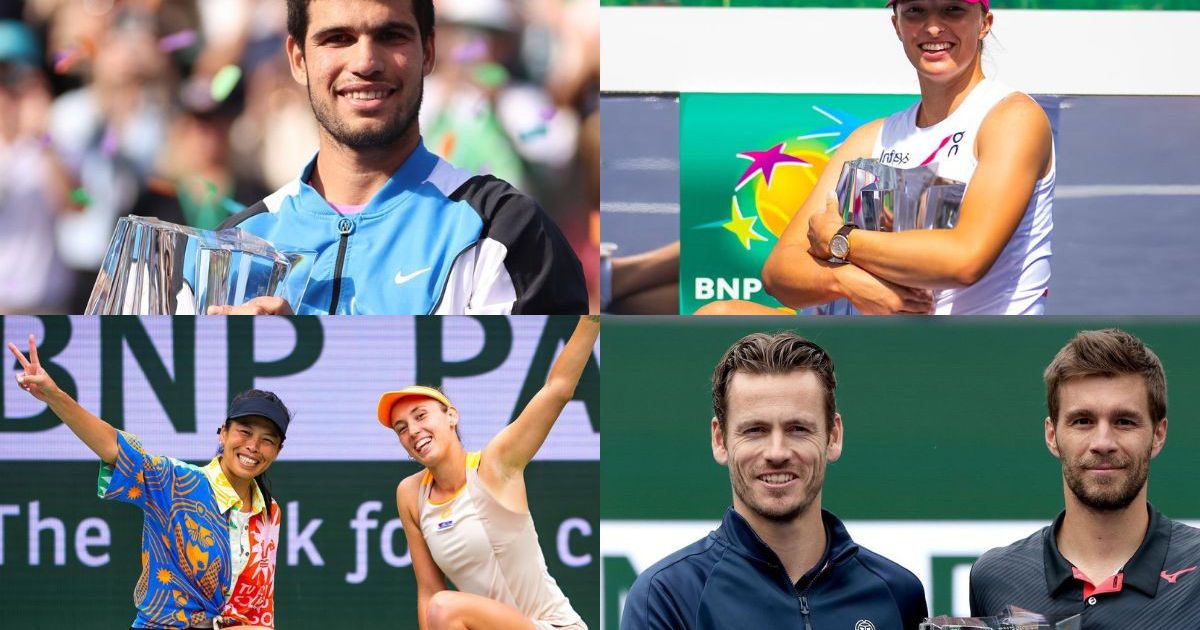

Kieu Nu 17 Tuoi Xu Bach Duong Lap Ky Tich Vo Dich Indian Wells

May 17, 2025

Kieu Nu 17 Tuoi Xu Bach Duong Lap Ky Tich Vo Dich Indian Wells

May 17, 2025 -

Jalen Brunson Injury Update Sunday Game Status Following Month Long Absence

May 17, 2025

Jalen Brunson Injury Update Sunday Game Status Following Month Long Absence

May 17, 2025 -

Valerio Therapeutics S A Postpones Publication Of 2024 Annual Financial Report

May 17, 2025

Valerio Therapeutics S A Postpones Publication Of 2024 Annual Financial Report

May 17, 2025 -

Preocupacion Por Prestamos Estudiantiles El Impacto De Una Segunda Presidencia Trump

May 17, 2025

Preocupacion Por Prestamos Estudiantiles El Impacto De Una Segunda Presidencia Trump

May 17, 2025 -

Novak Djokovic In Kortlardaki Zirve Yuekselisi

May 17, 2025

Novak Djokovic In Kortlardaki Zirve Yuekselisi

May 17, 2025

Latest Posts

-

Wnba Debut Paige Bueckers Gets A City Renamed In Her Honor

May 17, 2025

Wnba Debut Paige Bueckers Gets A City Renamed In Her Honor

May 17, 2025 -

City To Honor Paige Bueckers With One Day Name Change For Wnba Debut

May 17, 2025

City To Honor Paige Bueckers With One Day Name Change For Wnba Debut

May 17, 2025 -

Paige Bueckers A City Renamed For Her Wnba Debut

May 17, 2025

Paige Bueckers A City Renamed For Her Wnba Debut

May 17, 2025 -

Almeria Vs Eldense Resumen Y Goles La Liga Hyper Motion

May 17, 2025

Almeria Vs Eldense Resumen Y Goles La Liga Hyper Motion

May 17, 2025 -

La Liga Hyper Motion Sigue El Almeria Eldense En Vivo

May 17, 2025

La Liga Hyper Motion Sigue El Almeria Eldense En Vivo

May 17, 2025