Understanding Stock Market Valuations: BofA's Advice For Investors

Table of Contents

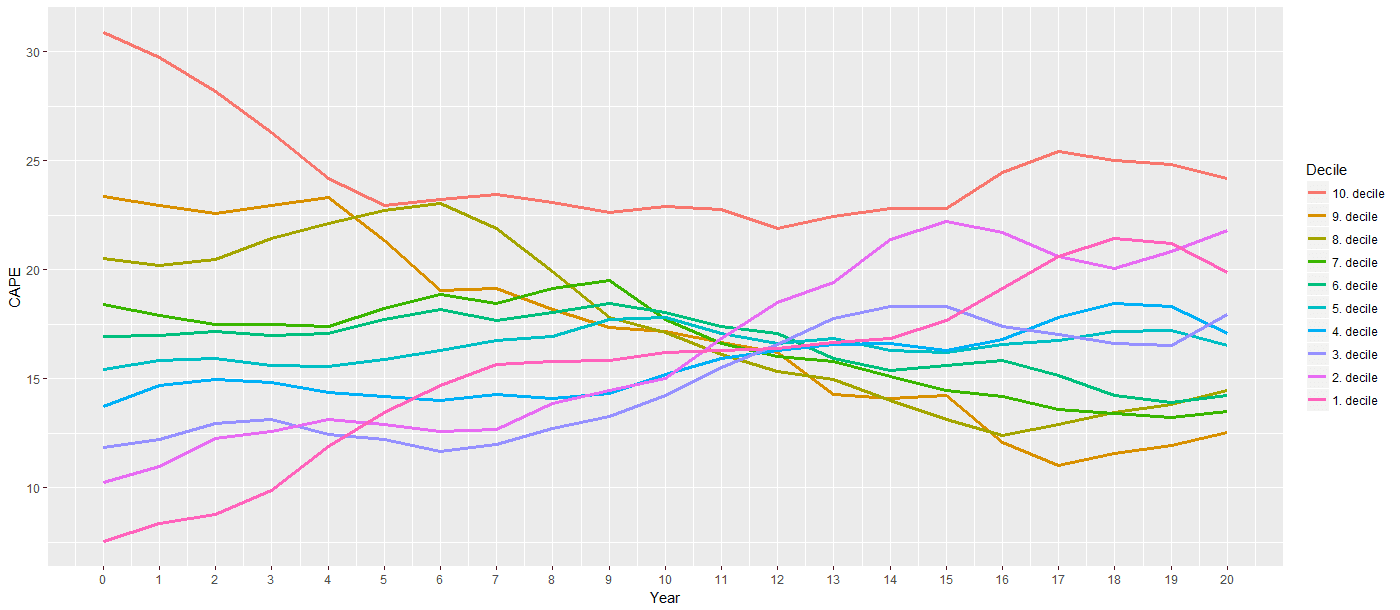

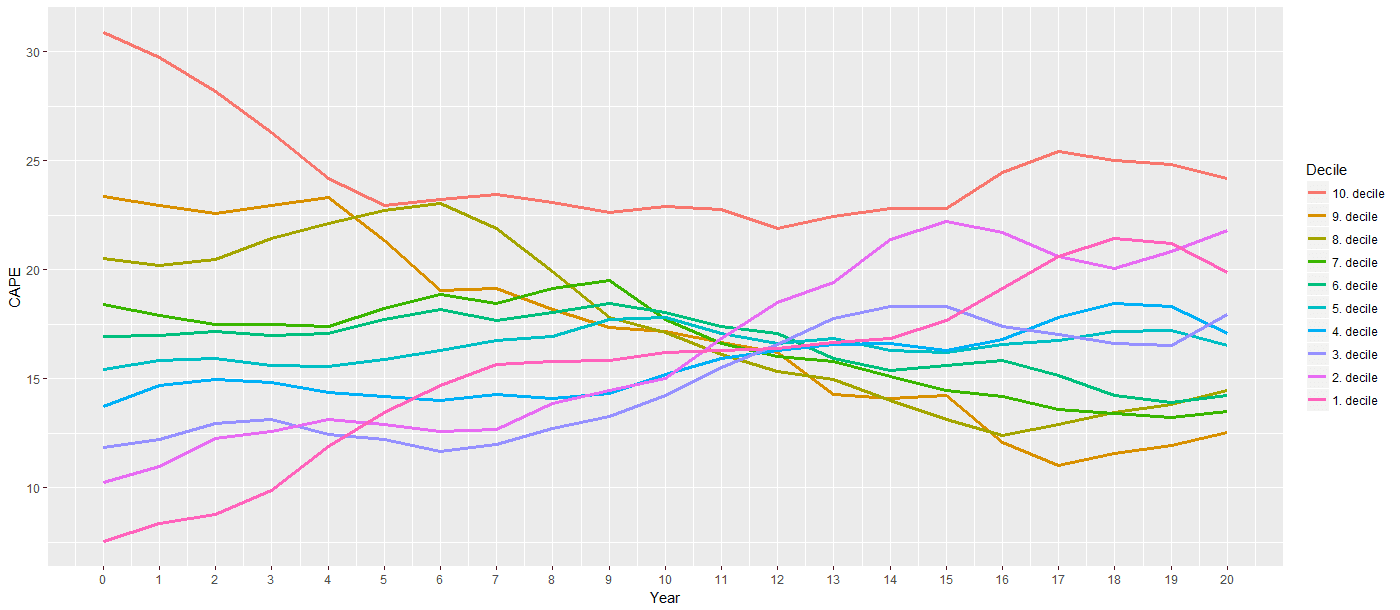

Key Valuation Metrics

Understanding how to evaluate the worth of a company is fundamental to successful investing. Several key metrics help investors assess stock market valuations. Let's explore some of the most important ones.

Price-to-Earnings Ratio (P/E)

The Price-to-Earnings ratio, or P/E ratio, is a widely used metric to compare a company's stock price to its earnings per share (EPS).

-

Definition and Calculation: The P/E ratio is calculated by dividing the market value per share by the earnings per share (P/E = Market Price per Share / Earnings per Share). For example, if a company's stock price is $50 and its EPS is $5, its P/E ratio is 10.

-

Interpreting P/E Ratios: A high P/E ratio suggests that investors are willing to pay a premium for each dollar of earnings, often indicating high growth expectations or strong investor confidence. Conversely, a low P/E ratio might signal that a stock is undervalued or that the market has lower expectations for future earnings. However, it's vital to compare P/E ratios within the same industry, as different sectors have different norms. A high P/E ratio in a high-growth tech sector might be considered normal, while the same ratio in a mature utility company could be a warning sign.

-

Limitations of P/E Ratio: The P/E ratio has limitations. It can be misleading when a company has negative earnings, making the ratio undefined. Furthermore, accounting practices can influence earnings, potentially distorting the P/E ratio. One should also consider the quality of earnings, not just the quantity.

Price-to-Book Ratio (P/B)

The Price-to-Book ratio (P/B) compares a company's market capitalization to its book value of equity. The book value represents the net asset value of a company as shown on its balance sheet.

-

Definition and Calculation: The P/B ratio is calculated by dividing the market price per share by the book value per share (P/B = Market Price per Share / Book Value per Share).

-

Interpreting P/B Ratios: A high P/B ratio suggests that the market values the company's assets at a premium to their book value, potentially reflecting intangible assets like brand recognition or strong future growth potential. A low P/B ratio might suggest undervaluation or potential issues with the company's assets. Again, industry comparisons are crucial.

-

Limitations of P/B Ratio: The P/B ratio is less useful for companies with significant intangible assets, as book value might not accurately reflect the true value of the business. Furthermore, accounting methods can affect the book value, impacting the ratio's reliability.

Price-to-Sales Ratio (P/S)

The Price-to-Sales ratio (P/S) is particularly useful for evaluating companies with no earnings or negative earnings. It compares a company's market capitalization to its revenue.

-

Definition and Calculation: The P/S ratio is calculated by dividing the market capitalization by the company's total revenue (P/S = Market Cap / Revenue). This can also be calculated on a per-share basis using the market price per share and revenue per share.

-

Interpreting P/S Ratios: A high P/S ratio might indicate high growth expectations, but it could also suggest overvaluation if the company's revenue growth doesn't justify the premium. A low P/S ratio could signal undervaluation or concerns about future revenue growth.

-

Limitations of P/S Ratio: While useful, the P/S ratio doesn't consider profitability. A company with high sales but low profitability will have a lower P/S ratio, but this doesn't necessarily make it a good investment.

BofA's Investment Strategy and Stock Market Valuation

BofA's approach to stock market valuations is multifaceted, incorporating various factors beyond simple ratios.

Sector-Specific Valuations

BofA acknowledges that different sectors operate under different dynamics. Their valuation analysis considers these differences.

-

Industry Benchmarks: Direct comparisons within the same industry are key. A technology company's P/E ratio is interpreted differently from that of a utility company.

-

Growth Expectations: High-growth sectors typically command higher valuation multiples than mature, slow-growth sectors. BofA's analysis carefully considers projected growth rates for each sector.

Macroeconomic Factors

BofA's valuation models incorporate macroeconomic factors that significantly influence stock prices.

-

Impact of Interest Rates: Rising interest rates typically increase borrowing costs for companies and reduce investor appetite for riskier assets, potentially lowering valuations.

-

Inflationary Pressures: High inflation erodes purchasing power and can impact earnings, ultimately affecting valuation multiples. BofA analysts assess the inflationary environment and its effect on different sectors.

Risk Assessment and Valuation

BofA doesn't just look at financial statements; they consider risks.

-

Risk Premiums: Higher risk translates to higher required returns. BofA factors in risk premiums when evaluating valuation multiples, adjusting for the inherent risk of different investments.

-

Scenario Analysis: BofA employs scenario analysis to model how different events (e.g., geopolitical instability, regulatory changes) could affect valuations. This provides a more robust picture than a single-point estimate.

Conclusion

Understanding stock market valuations is paramount for successful investing. By utilizing key metrics like the P/E, P/B, and P/S ratios, and considering BofA's holistic approach – encompassing sector-specific analysis, macroeconomic factors, and risk assessment – investors can make more informed decisions. Remember to always conduct thorough due diligence and consider your own risk tolerance. Mastering stock market valuations is an ongoing learning process; continue refining your understanding to effectively manage your investments. Learn more about improving your understanding of stock market valuations today!

Featured Posts

-

Is The Stock Market Rally A Trap Investors Face Uncertain Future

Apr 22, 2025

Is The Stock Market Rally A Trap Investors Face Uncertain Future

Apr 22, 2025 -

Alterya Joins Chainalysis Boosting Blockchain Security With Ai

Apr 22, 2025

Alterya Joins Chainalysis Boosting Blockchain Security With Ai

Apr 22, 2025 -

Google Faces Doj In Court Renewed Battle Over Search Monopoly

Apr 22, 2025

Google Faces Doj In Court Renewed Battle Over Search Monopoly

Apr 22, 2025 -

Technical Glitch Forces Blue Origin To Postpone Rocket Launch

Apr 22, 2025

Technical Glitch Forces Blue Origin To Postpone Rocket Launch

Apr 22, 2025 -

Cassidy Hutchinsons Memoir A Jan 6 Witness Speaks Out This Fall

Apr 22, 2025

Cassidy Hutchinsons Memoir A Jan 6 Witness Speaks Out This Fall

Apr 22, 2025