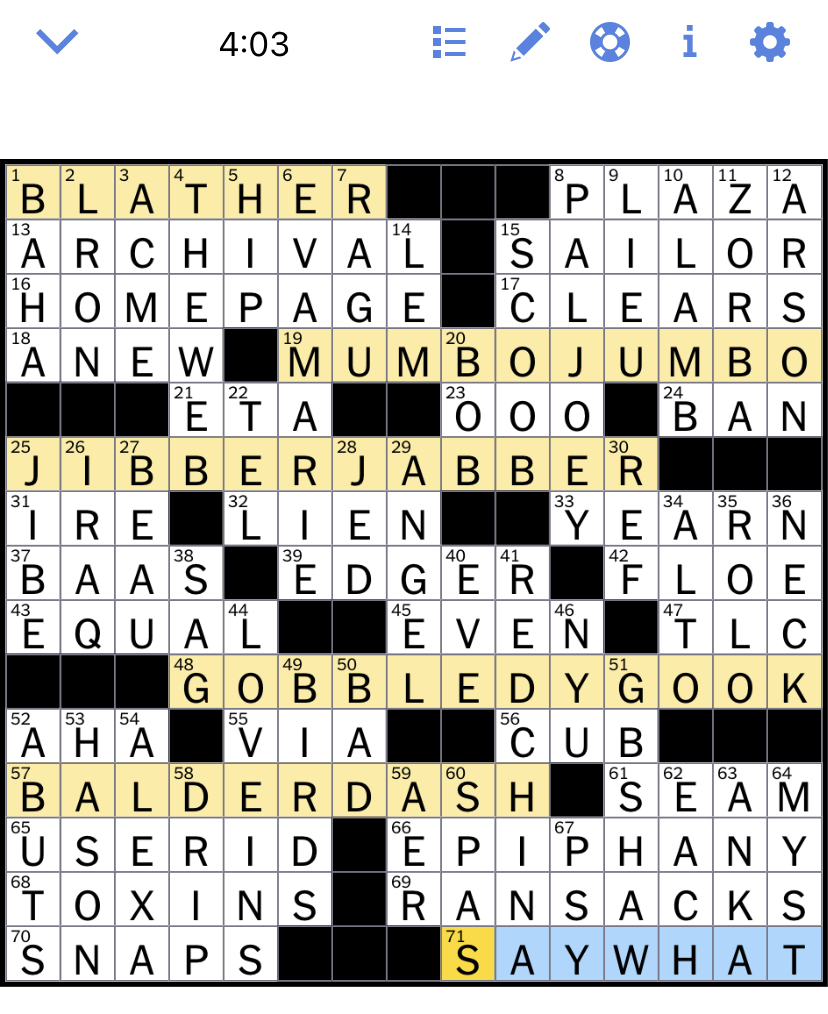

Understanding The Amundi MSCI World Catholic Principles UCITS ETF Acc Net Asset Value

Table of Contents

What is Net Asset Value (NAV) and How Does it Apply to this ETF?

Net Asset Value (NAV) represents the value of an ETF's underlying assets per share. In simple terms, it's the total value of all the securities held within the ETF, minus any liabilities, divided by the number of outstanding shares. For the Amundi MSCI World Catholic Principles UCITS ETF Acc, the NAV calculation involves several steps:

- Determining the value of underlying assets: This involves calculating the market value of each company's stock within the ETF's portfolio. The ETF invests in a diversified range of global equities selected according to specific Catholic social principles, aiming to exclude companies involved in activities deemed ethically objectionable.

- Currency conversion: As the ETF invests globally, the values of assets in different currencies need to be converted to a base currency (likely Euros, given it's a UCITS ETF). Fluctuations in exchange rates will directly impact the NAV.

- Deducting expenses: The ETF's management fees and other expenses are subtracted from the total asset value before calculating the NAV per share.

The NAV differs from the market price of the ETF. The market price is the price at which the ETF is currently trading on the exchange, which can fluctuate throughout the day based on supply and demand. The NAV, however, is typically calculated at the end of each trading day and provides a more fundamental measure of the ETF's intrinsic value. Keywords: Net Asset Value, ETF price, Amundi MSCI World Catholic Principles UCITS ETF NAV, market price, ETF valuation.

Factors Influencing the Amundi MSCI World Catholic Principles UCITS ETF Acc NAV

Several factors influence the daily NAV of the Amundi MSCI World Catholic Principles UCITS ETF Acc:

- Underlying assets performance: The primary driver of NAV fluctuations is the performance of the global equities held within the ETF. Positive performance in the underlying companies leads to an increase in the NAV, and vice-versa. This is significantly influenced by global market trends and the specific sectors within the portfolio.

- Currency fluctuations: Changes in exchange rates between the currencies of the underlying assets and the ETF's base currency directly affect the NAV. A strengthening of the base currency against the currencies of the underlying assets would reduce the NAV, and vice-versa.

- ETF management fees and expenses: These ongoing costs are deducted from the total asset value, slightly reducing the NAV. A higher expense ratio will lead to a slightly lower NAV, all else being equal.

- Market conditions and investor sentiment: Overall market conditions, such as economic growth, interest rates, and investor confidence, play a significant role in influencing the NAV. Increased risk aversion can lead to lower NAVs, while positive market sentiment can drive them higher. Keywords: NAV fluctuation, market volatility, currency risk, expense ratio, underlying assets performance.

Accessing and Understanding the Amundi MSCI World Catholic Principles UCITS ETF Acc NAV

Investors can access the daily NAV of the Amundi MSCI World Catholic Principles UCITS ETF Acc through several channels:

- Amundi Website: The official Amundi website is the most reliable source for the daily NAV. You'll typically find this information under the ETF's fact sheet or pricing section.

- Financial News Sources: Many financial news websites and data providers, such as Bloomberg or Refinitiv, also publish ETF NAV data.

When interpreting NAV data:

- Reporting Time: Note the time at which the NAV is reported. It's usually calculated at the close of the relevant market.

- Currency: Ensure that you understand the currency in which the NAV is expressed.

Regularly monitoring NAV changes is essential for tracking the ETF's performance and making informed investment decisions. Significant upward or downward trends should prompt a review of your investment strategy. Keywords: NAV data, Amundi website, real-time NAV, historical NAV, ETF data sources.

Investing in the Amundi MSCI World Catholic Principles UCITS ETF Acc: NAV and Investment Strategy

The NAV plays a critical role in investment decisions:

- Buy and Sell Decisions: While not the sole determinant, the NAV can help in assessing whether an ETF is trading at a discount or premium to its intrinsic value. Some investors may consider buying when the market price is below the NAV and selling when it's above.

- Assessing Investment Performance: Tracking the NAV over time allows investors to assess the performance of their investment. Comparing the change in NAV against the initial investment provides a measure of the return generated.

Different investment strategies can be employed:

- Dollar-cost averaging: This strategy involves investing a fixed amount of money at regular intervals, regardless of the NAV. This reduces the risk associated with market timing.

Using the NAV in conjunction with other investment metrics and a well-defined investment strategy is key for maximizing returns while adhering to ethical principles. Keywords: Investment strategy, buy and sell signals, dollar cost averaging, portfolio management, investment performance.

Conclusion: Making Informed Decisions with Amundi MSCI World Catholic Principles UCITS ETF Acc NAV

Understanding the Amundi MSCI World Catholic Principles UCITS ETF Acc Net Asset Value is fundamental for investors interested in ethical and responsible investing. By understanding how the NAV is calculated, the factors influencing it, and where to find the relevant data, investors can make more informed decisions regarding their investment strategy and portfolio management. Monitoring the NAV is crucial for assessing the performance of this specific ETF and for adapting your approach as needed. To learn more about the Amundi MSCI World Catholic Principles UCITS ETF Acc and its NAV, visit the Amundi website [link to Amundi website]. Understanding the Amundi MSCI World Catholic Principles UCITS ETF Acc Net Asset Value is crucial for investors seeking both financial returns and alignment with their values.

Featured Posts

-

Nightcliff Shop Owners Death Teenager Charged Following Alleged Stabbing

May 24, 2025

Nightcliff Shop Owners Death Teenager Charged Following Alleged Stabbing

May 24, 2025 -

Finding The Answers Nyt Mini Crossword March 16 2025

May 24, 2025

Finding The Answers Nyt Mini Crossword March 16 2025

May 24, 2025 -

Inside Ferraris First Bengaluru Service Centre A Detailed Look

May 24, 2025

Inside Ferraris First Bengaluru Service Centre A Detailed Look

May 24, 2025 -

Bbc Radio 1 Big Weekend How To Increase Your Chances Of Getting Tickets

May 24, 2025

Bbc Radio 1 Big Weekend How To Increase Your Chances Of Getting Tickets

May 24, 2025 -

Glastonbury 2025 Announced Lineup Sparks Outrage Among Fans

May 24, 2025

Glastonbury 2025 Announced Lineup Sparks Outrage Among Fans

May 24, 2025

Latest Posts

-

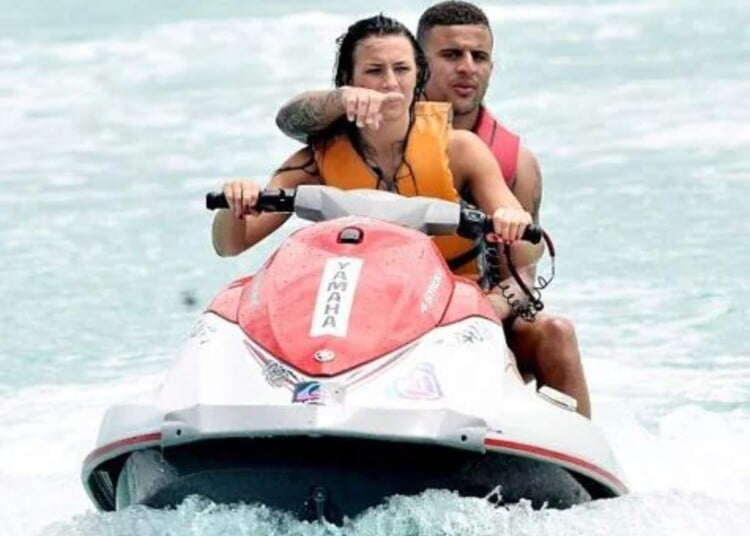

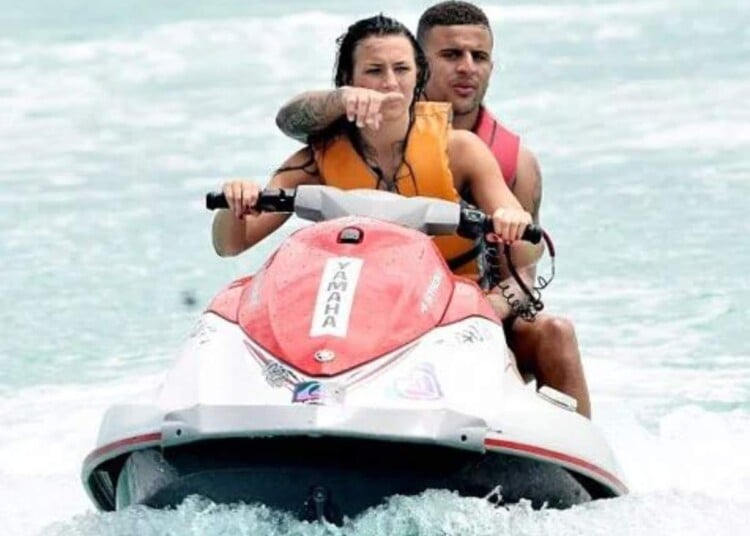

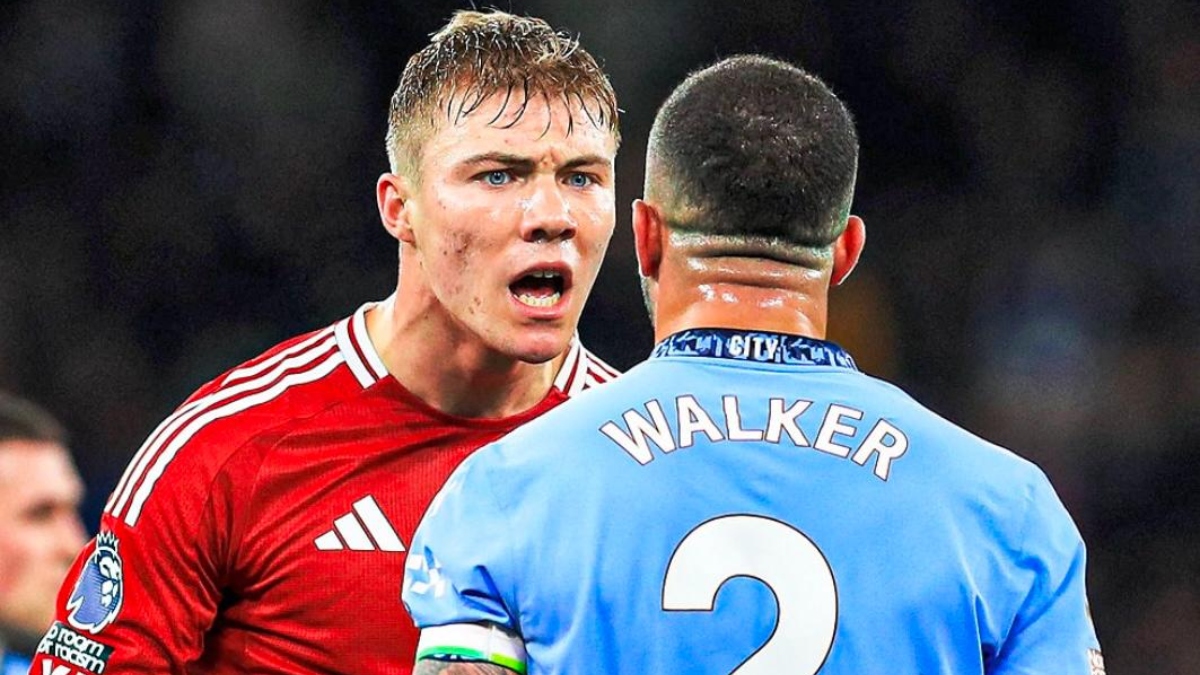

The Kyle Walker Annie Kilner Situation Explaining The Recent Events

May 24, 2025

The Kyle Walker Annie Kilner Situation Explaining The Recent Events

May 24, 2025 -

Dog Walker Drama Kyle And Teddis Fiery Exchange

May 24, 2025

Dog Walker Drama Kyle And Teddis Fiery Exchange

May 24, 2025 -

Recent Developments Annie Kilners Public Statements After The Kyle Walker Night Out

May 24, 2025

Recent Developments Annie Kilners Public Statements After The Kyle Walker Night Out

May 24, 2025 -

Kyle Walkers Recent Parties A Look At The Events Following Annie Kilners Return Home

May 24, 2025

Kyle Walkers Recent Parties A Look At The Events Following Annie Kilners Return Home

May 24, 2025 -

Kyle And Teddis Heated Confrontation Dog Walker Dispute

May 24, 2025

Kyle And Teddis Heated Confrontation Dog Walker Dispute

May 24, 2025