Understanding The Amundi MSCI World II UCITS ETF USD Hedged Dist Net Asset Value

Table of Contents

What is Net Asset Value (NAV) and How Does it Apply to This ETF?

Net Asset Value (NAV) represents the net value of an ETF's assets minus its liabilities, per share. For the Amundi MSCI World II UCITS ETF USD Hedged Dist, the NAV calculation considers the total market value of all the underlying securities within the ETF's portfolio. This portfolio, designed to track the MSCI World Index, is comprised of a diverse range of global equities.

The "USD Hedged" aspect is crucial. This means the ETF employs currency hedging strategies to minimize the impact of fluctuations between the USD and other currencies on the NAV. Without hedging, changes in exchange rates could significantly affect the value of assets held in other currencies. The "Dist" indicates that the ETF distributes dividends to its shareholders, impacting the NAV. When dividends are paid out, the NAV decreases accordingly, reflecting the distribution of assets to shareholders.

Keywords: Net Asset Value Calculation, Currency Hedging, USD Hedged ETF, Dividend Distribution, NAV Impact.

Bullet Points:

- Assets: The NAV calculation includes the market value of all stocks within the MSCI World Index replication.

- Liabilities: Liabilities include management fees, administrative expenses, and other operational costs.

- Currency Fluctuations: The USD-hedged strategy aims to reduce the volatility stemming from currency exchange rate movements, compared to an unhedged version.

- Dividend Frequency: The Amundi MSCI World II UCITS ETF USD Hedged Dist distributes dividends periodically; this frequency is outlined in the ETF's prospectus.

Factors Affecting the Amundi MSCI World II UCITS ETF USD Hedged Dist NAV

Several factors influence the NAV of the Amundi MSCI World II UCITS ETF USD Hedged Dist. Understanding these elements allows for a more informed assessment of your investment.

- MSCI World Index Performance: The primary driver is the performance of the underlying MSCI World Index. Positive performance in the global equities market generally leads to a higher NAV, while negative performance results in a lower NAV.

- Currency Exchange Rates: Even with hedging, residual currency fluctuations can still slightly affect the NAV. Significant shifts in exchange rates could create minor deviations despite the hedging strategy.

- Expense Ratio: The ETF's expense ratio, representing the annual cost of managing the fund, gradually reduces the NAV over time. This is a continuous, albeit usually small, deduction.

- Investor Demand: High investor demand can push the market price of the ETF above its NAV (a premium), while low demand can lead to the market price trading below the NAV (a discount).

Keywords: MSCI World Index, Exchange Rates, Expense Ratio, Investor Demand, NAV Fluctuations.

Bullet Points:

- MSCI World Index Impact: A 1% increase in the MSCI World Index generally translates to approximately a 1% increase in the ETF's NAV.

- Exchange Rate Influence: While hedging mitigates risk, unforeseen major currency shifts can still subtly impact the NAV.

- Expense Ratio Effect: The expense ratio continuously reduces the NAV over time; it's crucial to factor this into long-term projections.

- Supply and Demand: High buying pressure increases the market price, and conversely, high selling pressure decreases it.

Where to Find the Amundi MSCI World II UCITS ETF USD Hedged Dist NAV

The daily NAV for the Amundi MSCI World II UCITS ETF USD Hedged Dist is readily accessible from several sources:

- Amundi Website: The official Amundi website provides the most up-to-date NAV information. Look for the ETF's specific page within their investment product listings.

- Brokerage Platforms: Most reputable brokerage platforms (e.g., Interactive Brokers, Fidelity, Schwab) display the real-time or end-of-day NAV for ETFs held in your account.

- Financial News Websites: Major financial news websites frequently publish ETF NAV data. However, always verify the source’s reliability.

It's important to note that the NAV you see at the end of the trading day represents the most accurate reflection of the ETF's value for that day. Real-time NAV data may fluctuate slightly throughout the trading session.

Keywords: Amundi Website, Brokerage Platforms, Financial News, Daily NAV, Real-time NAV.

Bullet Points:

- Amundi Website: (Insert link to the relevant Amundi page if available). Check their fund factsheets and pricing sections.

- Brokerage Platforms: Consult the help section or customer support of your brokerage platform to learn how to find ETF NAVs.

- Financial News Sources: Reputable sources like Bloomberg, Yahoo Finance, or Google Finance may provide this data, but double-check data accuracy.

Conclusion: Mastering the Amundi MSCI World II UCITS ETF USD Hedged Dist NAV

Understanding the Net Asset Value of the Amundi MSCI World II UCITS ETF USD Hedged Dist is essential for making informed investment decisions. This NAV is affected by the performance of the underlying MSCI World Index, currency fluctuations (despite hedging), expense ratios, and investor demand. Regularly monitoring the NAV allows you to track your investment’s performance and to compare it to the market price. By utilizing readily available resources like the Amundi website and your brokerage platform, you can gain a clearer picture of your investment's value and make adjustments to your investment strategy as needed. Learn more about the Amundi MSCI World II UCITS ETF USD Hedged Dist and its NAV by conducting further research on the Amundi website or consulting with a qualified financial advisor. Keywords: Amundi MSCI World II UCITS ETF NAV, Investment Performance, Informed Investment Decisions, ETF Investment Strategy.

Featured Posts

-

Porsche 911 S T In Riviera Blue Special Paint To Buy

May 24, 2025

Porsche 911 S T In Riviera Blue Special Paint To Buy

May 24, 2025 -

Evrovidenie 2013 2023 Chto Stalo S Pobeditelyami

May 24, 2025

Evrovidenie 2013 2023 Chto Stalo S Pobeditelyami

May 24, 2025 -

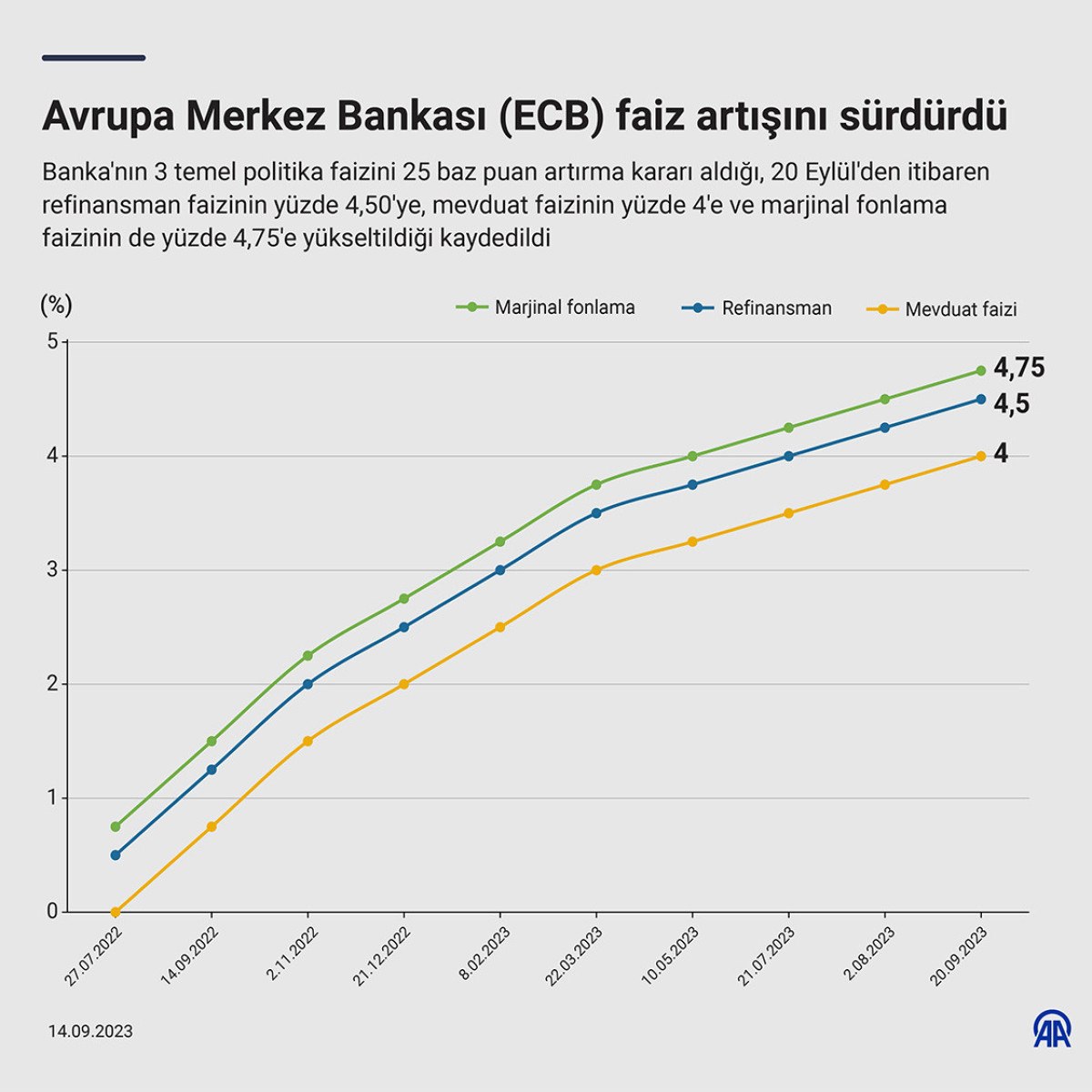

Avrupa Borsalari Ecb Faiz Kararindan Sonra Nasil Etkilendi

May 24, 2025

Avrupa Borsalari Ecb Faiz Kararindan Sonra Nasil Etkilendi

May 24, 2025 -

Planning Your Memorial Day Trip The Busiest Flight Days Of 2025

May 24, 2025

Planning Your Memorial Day Trip The Busiest Flight Days Of 2025

May 24, 2025 -

Glastonbury 2025 Lineup Confirmed Performers And How To Buy Tickets

May 24, 2025

Glastonbury 2025 Lineup Confirmed Performers And How To Buy Tickets

May 24, 2025

Latest Posts

-

Annie Kilner Social Media Posts And The Kyle Walker Incident

May 24, 2025

Annie Kilner Social Media Posts And The Kyle Walker Incident

May 24, 2025 -

Annie Kilners Posts Following Kyle Walkers Night Out Allegations Of Poisoning

May 24, 2025

Annie Kilners Posts Following Kyle Walkers Night Out Allegations Of Poisoning

May 24, 2025 -

Walker Peters To Leeds Transfer Speculation And Contact Confirmed

May 24, 2025

Walker Peters To Leeds Transfer Speculation And Contact Confirmed

May 24, 2025 -

Kyle Walkers Wife Annie Kilner Seen Out Following Husbands Night Out

May 24, 2025

Kyle Walkers Wife Annie Kilner Seen Out Following Husbands Night Out

May 24, 2025 -

Leeds Uniteds Pursuit Of Kyle Walker Peters Transfer Update

May 24, 2025

Leeds Uniteds Pursuit Of Kyle Walker Peters Transfer Update

May 24, 2025