Understanding The Current CoreWeave Stock Situation

Table of Contents

CoreWeave's Business Model and Competitive Landscape

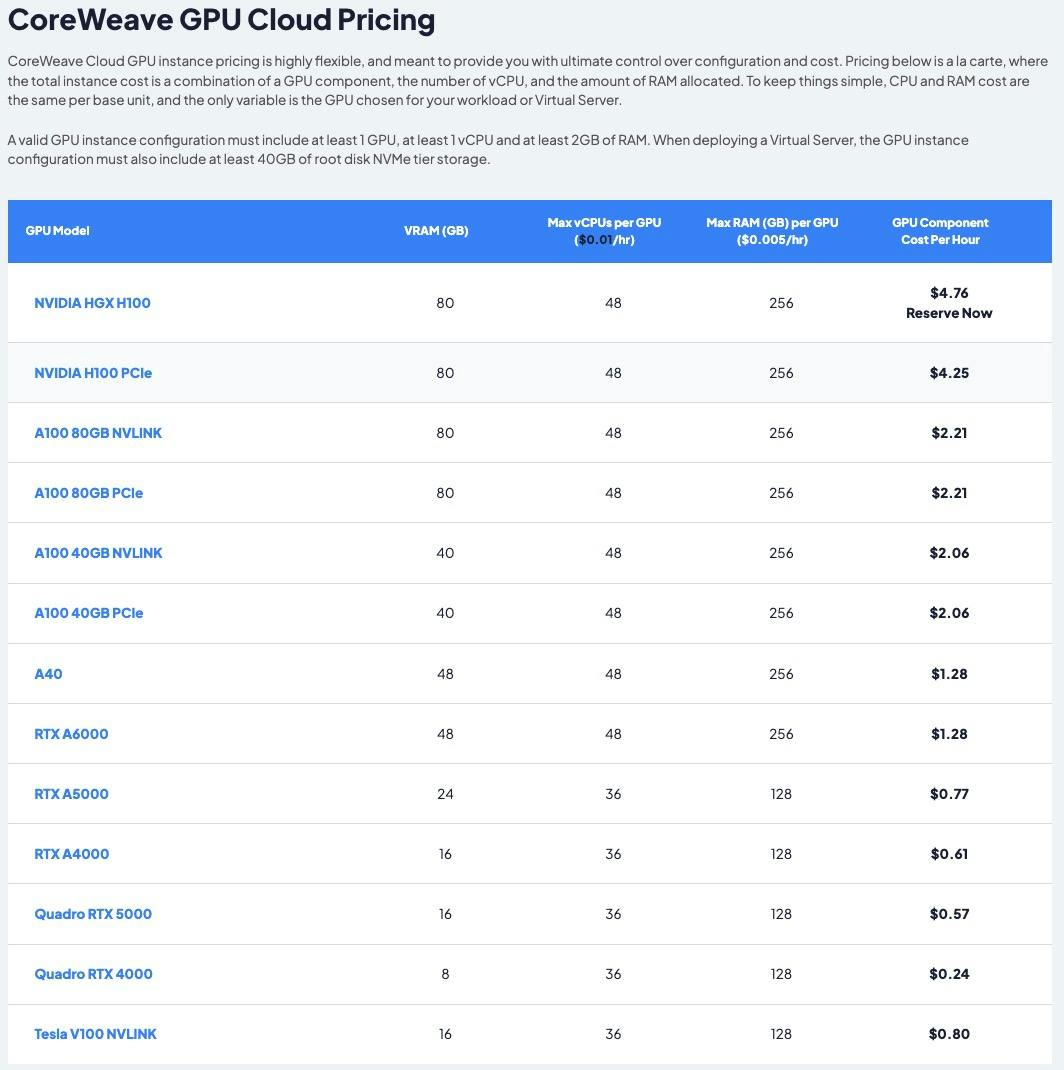

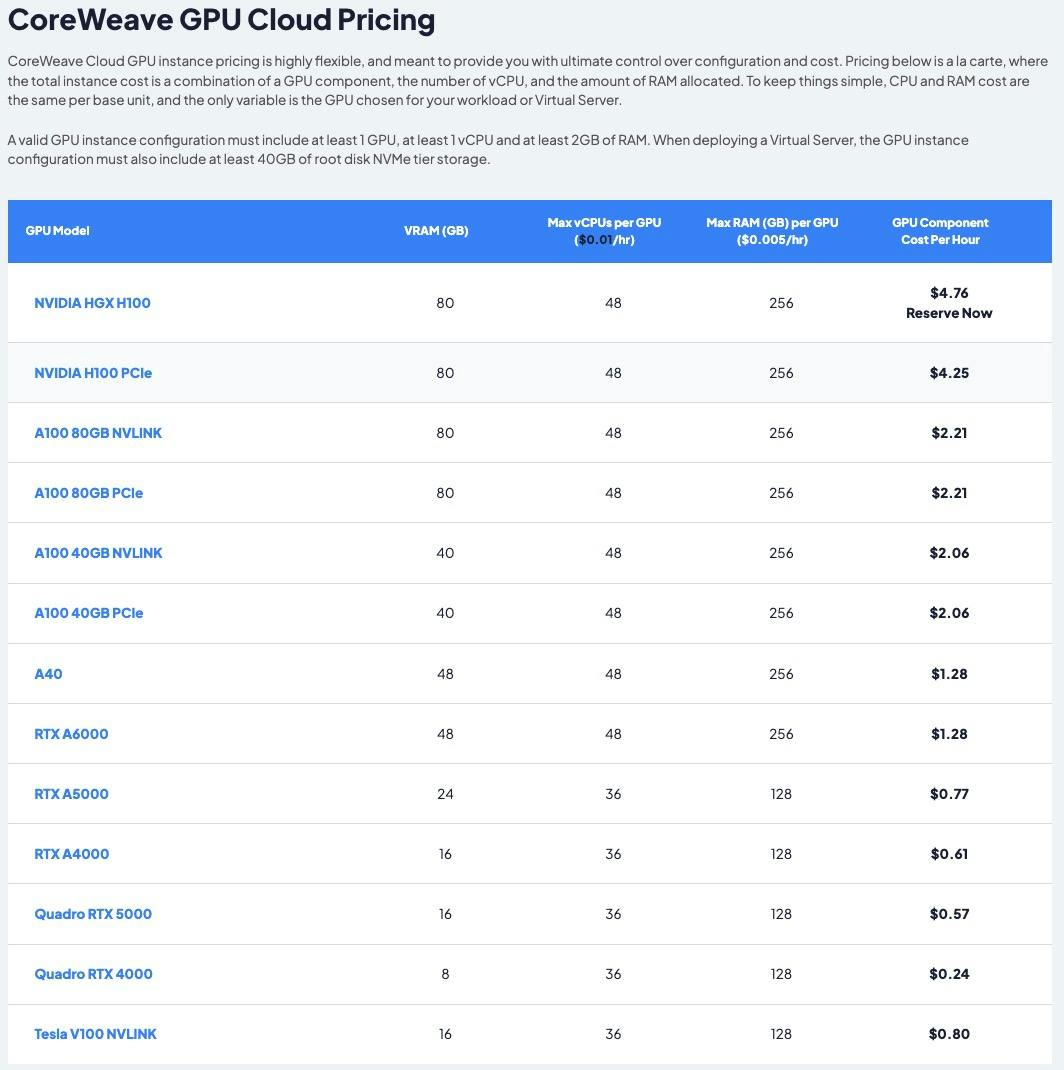

CoreWeave distinguishes itself in the crowded cloud computing market with its specialization in high-performance computing (HPC) and its strong focus on the burgeoning AI infrastructure market. Its unique selling proposition (USP) lies in providing scalable, cost-effective GPU cloud computing solutions, primarily targeting AI and machine learning workloads. This niche focus provides a competitive advantage.

- Competitive Advantages: CoreWeave leverages its expertise in GPU infrastructure, offering superior performance and scalability compared to general-purpose cloud providers. Its focus on specific market segments allows for tailored solutions and stronger client relationships.

- Competitive Disadvantages: Being a relatively newer player, CoreWeave possesses a smaller market share compared to giants like AWS, Google Cloud, and Azure. Its dependence on a niche market also presents some risk.

- Market Share and Growth Potential: While precise market share figures are difficult to obtain for a privately held company, CoreWeave’s rapid growth and strategic partnerships suggest a significant upward trajectory in the AI cloud computing sector. The explosive growth of AI presents a vast opportunity.

CoreWeave competitors include established players like AWS, Google Cloud, and Azure, each offering their own strengths in cloud computing. However, CoreWeave's specialized approach positions it for success in the rapidly expanding AI cloud computing market.

Recent Financial Performance and Key Metrics

Unfortunately, detailed public financial reports for CoreWeave are limited due to its private status. However, available information points to strong revenue growth fueled by increasing demand for its specialized GPU cloud services. Key performance indicators (KPIs) to watch, once publicly available, will include:

- CoreWeave Revenue: Expect substantial year-over-year revenue growth driven by the increasing adoption of AI and machine learning.

- CoreWeave Earnings: Profitability will be a key metric to monitor, demonstrating the efficiency of its operations and its ability to scale profitably.

- CoreWeave Customer Acquisition Cost (CAC): A low CAC signifies effective marketing and sales strategies.

- CoreWeave Churn Rate: A low churn rate demonstrates strong customer retention and satisfaction.

- CoreWeave Average Revenue Per User (ARPU): High ARPU indicates that CoreWeave effectively serves high-value clients with high-demand applications.

Analyzing these metrics, when publicly released, will be vital for understanding CoreWeave's financial health and its long-term prospects. The CoreWeave stock valuation will largely depend on these figures.

Factors Influencing CoreWeave Stock Price

Several factors influence the CoreWeave stock price (once publicly traded), ranging from macroeconomic trends to company-specific events.

- Macroeconomic Factors:

- Interest Rates: Rising interest rates can negatively impact investor sentiment and potentially lower valuations.

- Inflation: High inflation can increase operating costs and reduce profitability.

- Recessionary Fears: Economic uncertainty can lead to decreased investment in technology, impacting demand for cloud services.

- Industry-Specific Factors:

- Competition: Increased competition from established cloud providers could pressure CoreWeave's pricing and market share.

- Technological Advancements: Rapid technological changes demand continuous innovation and adaptation, which will influence CoreWeave's stock.

- Regulatory Changes: New data privacy regulations or government policies could affect CoreWeave's operations and profitability.

- Company-Specific Factors:

- Management Changes: Key personnel changes could impact the company's strategic direction and execution.

- New Product Launches: Successful new product introductions can drive revenue growth and boost investor confidence.

- Strategic Partnerships: Alliances with major technology companies could enhance CoreWeave's market reach and capabilities. CoreWeave stock price prediction models need to account for these factors.

Analyst Ratings and Future Outlook

Currently, there are no widely available analyst ratings for CoreWeave stock as it is privately held. However, once it goes public, analysts will provide forecasts and ratings. The future outlook for CoreWeave will depend heavily on its ability to maintain its growth trajectory, secure large enterprise clients, and successfully navigate the competitive cloud computing landscape. A CoreWeave stock forecast will require careful consideration of the risks and opportunities discussed above. The CoreWeave investment outlook is positive for many given its focus on the high-growth AI market, but this also presents inherent risks.

Conclusion: Investing in CoreWeave Stock – A Final Assessment

Understanding the current CoreWeave stock situation requires considering its unique business model, the competitive landscape, its (future) financial performance, and the various macroeconomic and industry-specific factors that can influence its price. While the company's focus on the rapidly expanding AI infrastructure market presents significant opportunities, it also faces competition from established giants. Conducting thorough research and consulting with a financial advisor are crucial before making any investment decisions related to CoreWeave stock. Stay informed about the evolving CoreWeave stock situation to make well-informed investment choices.

Featured Posts

-

Landladys Explosive Outburst Employee Resignation Sparks Angry Tirade

May 22, 2025

Landladys Explosive Outburst Employee Resignation Sparks Angry Tirade

May 22, 2025 -

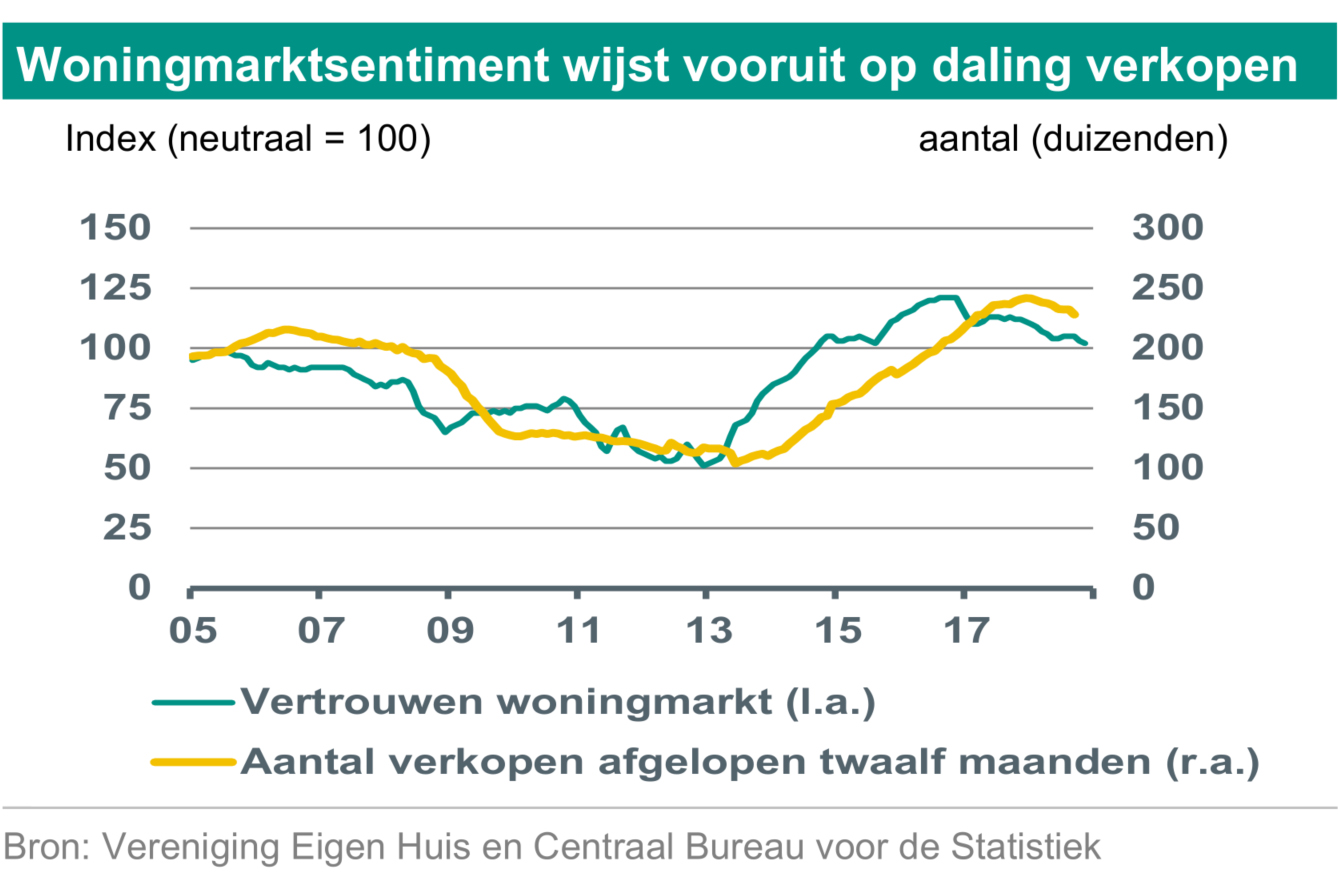

Huizenprijzen Nederland Abn Amro Versus Geen Stijl

May 22, 2025

Huizenprijzen Nederland Abn Amro Versus Geen Stijl

May 22, 2025 -

Ex Tory Councillors Wife Faces Delay In Racial Hatred Tweet Appeal

May 22, 2025

Ex Tory Councillors Wife Faces Delay In Racial Hatred Tweet Appeal

May 22, 2025 -

Abn Amro Sterke Stijging Occasionverkopen Door Groeiend Autobezit

May 22, 2025

Abn Amro Sterke Stijging Occasionverkopen Door Groeiend Autobezit

May 22, 2025 -

7 Duong Mo Ra Co Hoi Ket Noi Tp Hcm Long An Hieu Qua

May 22, 2025

7 Duong Mo Ra Co Hoi Ket Noi Tp Hcm Long An Hieu Qua

May 22, 2025

Latest Posts

-

Nyt Wordle March 26 Solution And Gameplay Analysis

May 22, 2025

Nyt Wordle March 26 Solution And Gameplay Analysis

May 22, 2025 -

March 26 Nyt Wordle How To Solve Todays Difficult Puzzle

May 22, 2025

March 26 Nyt Wordle How To Solve Todays Difficult Puzzle

May 22, 2025 -

Nyt Wordle Solution For March 26 Tips And Strategies

May 22, 2025

Nyt Wordle Solution For March 26 Tips And Strategies

May 22, 2025 -

Wordle March 8th 1358 Clues And Solution

May 22, 2025

Wordle March 8th 1358 Clues And Solution

May 22, 2025 -

Wordle 1358 Hints And Answer For March 8th

May 22, 2025

Wordle 1358 Hints And Answer For March 8th

May 22, 2025