Understanding The Net Asset Value (NAV) Of Amundi MSCI World II UCITS ETF USD Hedged Dist

Table of Contents

What is NAV and How is it Calculated for Amundi MSCI World II UCITS ETF USD Hedged Dist?

The Net Asset Value (NAV) represents the total value of an ETF's underlying assets per share. For the Amundi MSCI World II UCITS ETF USD Hedged Dist, understanding the NAV calculation requires considering its unique structure. The NAV is calculated daily, typically at the close of market hours.

The key components of the NAV calculation are:

- Market Value of Underlying Assets: This is the total market value of all the stocks held within the ETF, reflecting the current market prices of each holding. The Amundi MSCI World II ETF tracks the MSCI World Index, so this component represents the aggregated value of a diverse portfolio of global equities.

- Impact of Currency Hedging: The "USD Hedged" designation is vital here. This means the ETF employs strategies to mitigate the risk associated with fluctuations in exchange rates between the underlying assets' currencies (likely a mix of various global currencies) and the US dollar. This hedging strategy influences the NAV, buffering it against significant currency swings. The specific hedging techniques employed will affect how the NAV reacts to currency fluctuations.

- Expenses and Fees: The ETF's operating expenses, including management fees and other administrative costs, are deducted from the total asset value to arrive at the net asset value. This expense ratio is an important factor affecting the overall return.

- Illustrative Example: Imagine the ETF holds $100 million in assets. After accounting for a $1 million expense, and after the effect of the currency hedging strategy, the NAV might be calculated as $99 million. If there are 10 million shares outstanding, the NAV per share would be $9.90.

It's crucial to distinguish between NAV and the market price. While they should be very close, the market price can fluctuate throughout the trading day, influenced by supply and demand. The NAV represents the true underlying value of the ETF's assets.

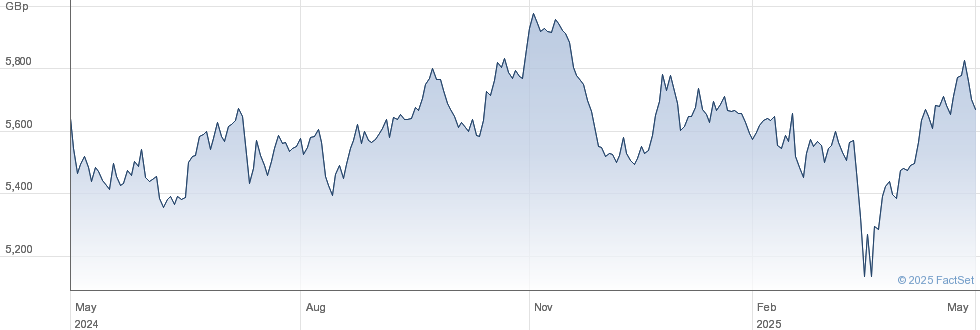

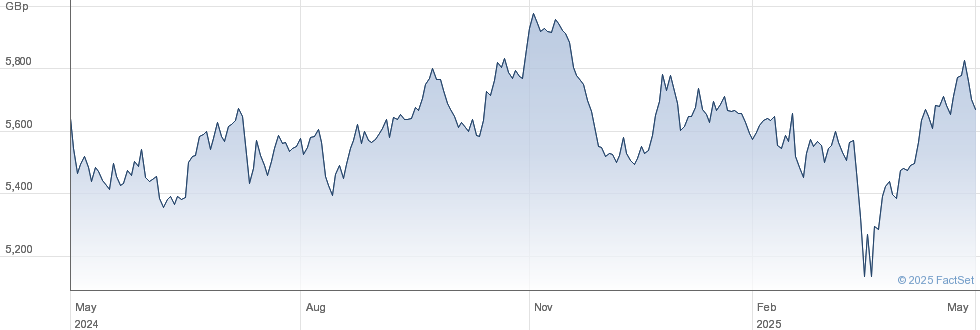

Factors Affecting the NAV of Amundi MSCI World II UCITS ETF USD Hedged Dist

Several factors can significantly impact the NAV of the Amundi MSCI World II UCITS ETF USD Hedged Dist:

- Market Fluctuations: The primary driver of NAV changes is the performance of the underlying stocks within the MSCI World Index. Positive market movements generally lead to an increase in the NAV, while negative movements decrease it. This reflects the inherent market risk associated with global equity investments.

- Currency Exchange Rates: Even with the USD hedging, residual currency fluctuations can still subtly affect the NAV. The effectiveness of the hedging strategy is a critical factor to consider. Changes in the exchange rates between the base currencies of the underlying assets and the US dollar will have an impact, although this impact will be reduced compared to an unhedged ETF.

- Dividends and Corporate Actions: Dividends paid by the companies held in the ETF will increase the cash component of the fund’s assets, generally leading to a slight increase in the NAV. Corporate actions, such as stock splits or mergers, can also affect the NAV.

- Management Fees and Other Expenses: The expense ratio, which represents the annual management fee and other operational costs, directly impacts the NAV. Higher expense ratios can erode the NAV over time.

Understanding these factors is essential for accurately interpreting NAV movements and predicting potential future performance.

Where to Find the NAV of Amundi MSCI World II UCITS ETF USD Hedged Dist?

Reliable and up-to-date NAV data for the Amundi MSCI World II UCITS ETF USD Hedged Dist is readily available from several sources:

- Amundi Website: The official Amundi website is the most reliable source for official NAV information. Look for sections dedicated to ETF details or fund factsheets.

- Reputable Financial Data Providers: Major financial data providers like Bloomberg, Refinitiv, and Yahoo Finance typically provide real-time and historical NAV data for ETFs. These often require a subscription.

- Your Brokerage Account: Your brokerage platform will usually display the current NAV (or at least the closing NAV) of your holdings, including this ETF.

Interpreting NAV data is straightforward. It's usually presented as a price per share. Pay attention to the reporting date and time to ensure you are looking at the most current information.

Using NAV to Make Informed Investment Decisions with Amundi MSCI World II UCITS ETF USD Hedged Dist

The NAV plays a pivotal role in making informed investment decisions:

- Assessing ETF Performance: Tracking the NAV over time provides a clear indication of the ETF's performance, allowing you to assess returns and compare them against your investment goals.

- Identifying Buying/Selling Opportunities: Comparing the NAV to the market price can highlight potential discrepancies. If the market price trades at a discount to the NAV (a rare occurrence, but possible), it might present a buying opportunity. The opposite could indicate a potential selling opportunity. Note: Market timing is not guaranteed to be successful.

- Understanding Investment Strategy: By analyzing the NAV in conjunction with the ETF's stated investment strategy (tracking the MSCI World Index with USD hedging), you can gauge the fund manager's success in achieving its objectives.

- Using NAV with Other Indicators: NAV should not be considered in isolation. Combine it with other performance metrics such as the expense ratio, dividend yield, and historical performance data for a holistic assessment.

Conclusion: Mastering the Net Asset Value (NAV) of Your Amundi MSCI World II UCITS ETF USD Hedged Dist Investment

Understanding the NAV of the Amundi MSCI World II UCITS ETF USD Hedged Dist is vital for successful investing. By regularly monitoring the NAV, understanding its calculation, and considering the influencing factors, you can make more informed decisions about your investment strategy. Remember to consider the NAV alongside other relevant performance indicators. Gain a deeper understanding of your Amundi MSCI World II UCITS ETF USD Hedged Dist investment by regularly checking its NAV and utilizing this information to make well-informed decisions. Learn more about effective ETF investment strategies [link to relevant resources].

Featured Posts

-

Escape To The Countryside Top Locations For A Tranquil Life

May 24, 2025

Escape To The Countryside Top Locations For A Tranquil Life

May 24, 2025 -

Hawaii Keikis Memorial Day Lei Making Poster Contest Showcasing Artistic Talent

May 24, 2025

Hawaii Keikis Memorial Day Lei Making Poster Contest Showcasing Artistic Talent

May 24, 2025 -

Legendas F1 Motor Egyedi Porsche Koezuti Modell

May 24, 2025

Legendas F1 Motor Egyedi Porsche Koezuti Modell

May 24, 2025 -

Konchita Vurst Kak Se Promeni Sled Evroviziya

May 24, 2025

Konchita Vurst Kak Se Promeni Sled Evroviziya

May 24, 2025 -

Konchita Vurst Pobeditel Evrovideniya 2014 Gey S 13 Let Mechtaet Stat Devushkoy Bonda

May 24, 2025

Konchita Vurst Pobeditel Evrovideniya 2014 Gey S 13 Let Mechtaet Stat Devushkoy Bonda

May 24, 2025

Latest Posts

-

The Fallout Annie Kilners Public Statements After Kyle Walkers Night Out

May 24, 2025

The Fallout Annie Kilners Public Statements After Kyle Walkers Night Out

May 24, 2025 -

Annie Kilner Shows Off Huge Diamond Ring After Walker Sighting

May 24, 2025

Annie Kilner Shows Off Huge Diamond Ring After Walker Sighting

May 24, 2025 -

Kyle Walker And Annie Kilner The Story Behind The Poisoning Allegations

May 24, 2025

Kyle Walker And Annie Kilner The Story Behind The Poisoning Allegations

May 24, 2025 -

Annie Kilners Diamond Ring Confirmation Of Kyle Walker Romance

May 24, 2025

Annie Kilners Diamond Ring Confirmation Of Kyle Walker Romance

May 24, 2025 -

Annie Kilner Social Media Posts And The Kyle Walker Incident

May 24, 2025

Annie Kilner Social Media Posts And The Kyle Walker Incident

May 24, 2025