Understanding The Net Asset Value (NAV) Of The Amundi Dow Jones Industrial Average UCITS ETF

Table of Contents

What is the Net Asset Value (NAV) and How is it Calculated?

The Net Asset Value (NAV) represents the net value of an ETF's assets minus its liabilities, per share. For the Amundi Dow Jones Industrial Average UCITS ETF, this calculation reflects the collective value of its holdings, mirroring the performance of the Dow Jones Industrial Average.

The calculation involves several key components:

- Market Value of Underlying Assets: This is the primary driver of the NAV. It represents the total market value of all the shares of the 30 companies comprising the Dow Jones Industrial Average held by the ETF. Fluctuations in these individual stock prices directly impact the ETF's NAV.

- Impact of Currency Exchange Rates: Since the ETF might hold assets denominated in currencies other than your base currency, exchange rate variations can influence the NAV. If the ETF holds some non-USD assets and the USD strengthens against those currencies, the NAV in USD might decrease, even if the underlying assets maintain their value in their respective currencies.

- Deduction of ETF Expenses: The ETF's operating expenses, including management fees, are deducted from the total asset value before calculating the NAV per share. These expenses directly reduce the NAV.

- Accrued Income and Dividends: Any dividends received from the underlying companies are added to the total asset value before the NAV calculation. This increases the NAV, reflecting the income generated by the ETF's holdings.

Example: Let's assume the total value of the underlying assets is $100 million, expenses are $1 million, and accrued income is $500,000. If there are 10 million shares outstanding, the NAV would be ($100,000,000 + $500,000 - $1,000,000) / 10,000,000 = $9.95 per share.

The NAV is typically calculated daily, providing investors with an up-to-date view of the ETF's underlying value.

How Does the NAV Affect My Investment in the Amundi Dow Jones Industrial Average UCITS ETF?

The NAV is fundamental to understanding your investment performance. While the ETF's share price often closely tracks the NAV, there can be minor discrepancies.

- Relationship between NAV and ETF Share Price: Ideally, the ETF share price should closely mirror the NAV. However, market forces can cause temporary deviations.

- Fluctuations in NAV and Investor Returns: Increases in the NAV translate directly into gains for investors, while decreases represent losses. The NAV is the most accurate measure of your investment's underlying value.

- Premium and Discount to NAV: Sometimes, the ETF's market price trades at a slight premium or discount to its NAV. This is usually temporary and related to market supply and demand.

- Tracking Error and NAV: Tracking error (the difference between the ETF's performance and its benchmark index) can indirectly affect the NAV. A higher tracking error might suggest a less efficient replication of the index, impacting the NAV’s growth.

Where to Find the Amundi Dow Jones Industrial Average UCITS ETF NAV?

Access to the daily NAV is readily available through several channels:

- Amundi's Official Website: The fund manager, Amundi, typically publishes the daily NAV on its official website, often within the fund's fact sheet or dedicated ETF information pages.

- Financial News Websites and Data Providers: Major financial websites such as Bloomberg, Yahoo Finance, and Google Finance provide real-time or delayed NAV data for many ETFs, including the Amundi Dow Jones Industrial Average UCITS ETF.

- Your Brokerage Account Platform: Most brokerage platforms display the NAV of your holdings, including ETFs, directly in your account summary or portfolio view.

Ensure you understand the data presentation; the NAV is usually quoted per share. The NAV is typically published at the close of the market for the underlying assets.

Understanding the Impact of Dividends on NAV

Dividend payments from the underlying Dow Jones companies affect the NAV.

- Dividend Payments and NAV: When the ETF distributes dividends, the NAV decreases by the amount of the dividend per share paid out to investors. This is because the assets of the fund have been reduced.

- Ex-Dividend Date and its Impact: The ex-dividend date is when the stock starts trading without the dividend. The NAV reflects the dividend payout after the ex-dividend date.

- Reinvestment of Dividends: Many investors choose to reinvest their dividends, leading to the purchase of additional ETF shares. While this doesn't directly change the NAV per share, it increases your overall holdings.

Amundi Dow Jones Industrial Average UCITS ETF: A Deeper Dive

This ETF aims to track the performance of the Dow Jones Industrial Average, offering investors exposure to a basket of leading US blue-chip companies.

- Investment Strategy and Dow Jones Focus: The ETF's investment strategy is primarily passive, seeking to replicate the composition and weighting of the Dow Jones Industrial Average.

- Expense Ratio and NAV Impact: The ETF's expense ratio (the annual cost of managing the fund) indirectly impacts the NAV, as it reduces the overall return.

- Advantages and Risks: Advantages include diversification, liquidity, and relatively low costs. Potential risks include market volatility affecting the Dow Jones, and tracking error.

Conclusion: Mastering the Net Asset Value (NAV) of the Amundi Dow Jones Industrial Average UCITS ETF

Understanding the NAV of the Amundi Dow Jones Industrial Average UCITS ETF is crucial for effective investment management. Regularly monitoring the NAV, understanding its components, and recognizing the impact of dividends are key to making informed investment decisions. By utilizing the resources mentioned above and staying updated on market fluctuations, you can gain a comprehensive understanding of your investment's performance. Gain a deeper understanding of your investment in the Amundi Dow Jones Industrial Average UCITS ETF by regularly monitoring its Net Asset Value (NAV) and utilizing the resources mentioned above.

Featured Posts

-

Shop Owners Fatal Stabbing Teenager Rearrested After Initial Bail

May 24, 2025

Shop Owners Fatal Stabbing Teenager Rearrested After Initial Bail

May 24, 2025 -

Frankfurt Stock Market Closes Lower Dax Below 24 000 Points

May 24, 2025

Frankfurt Stock Market Closes Lower Dax Below 24 000 Points

May 24, 2025 -

Demna Gvasalias Influence Transforming The Gucci Brand

May 24, 2025

Demna Gvasalias Influence Transforming The Gucci Brand

May 24, 2025 -

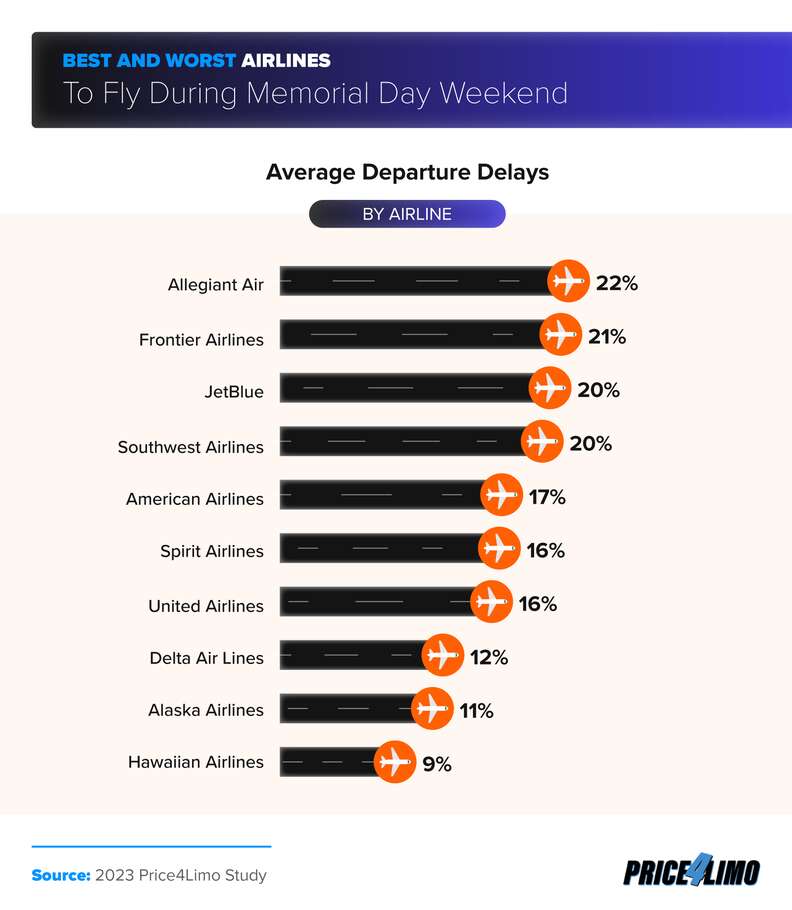

Best And Worst Days To Fly For Memorial Day Weekend 2025

May 24, 2025

Best And Worst Days To Fly For Memorial Day Weekend 2025

May 24, 2025 -

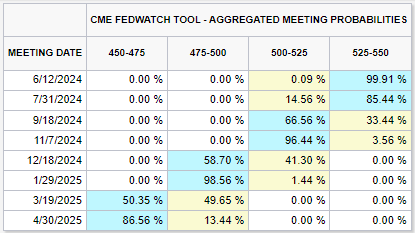

Dow Jones Rallies On Positive Pmi Maintaining Cautious Upward Trend

May 24, 2025

Dow Jones Rallies On Positive Pmi Maintaining Cautious Upward Trend

May 24, 2025

Latest Posts

-

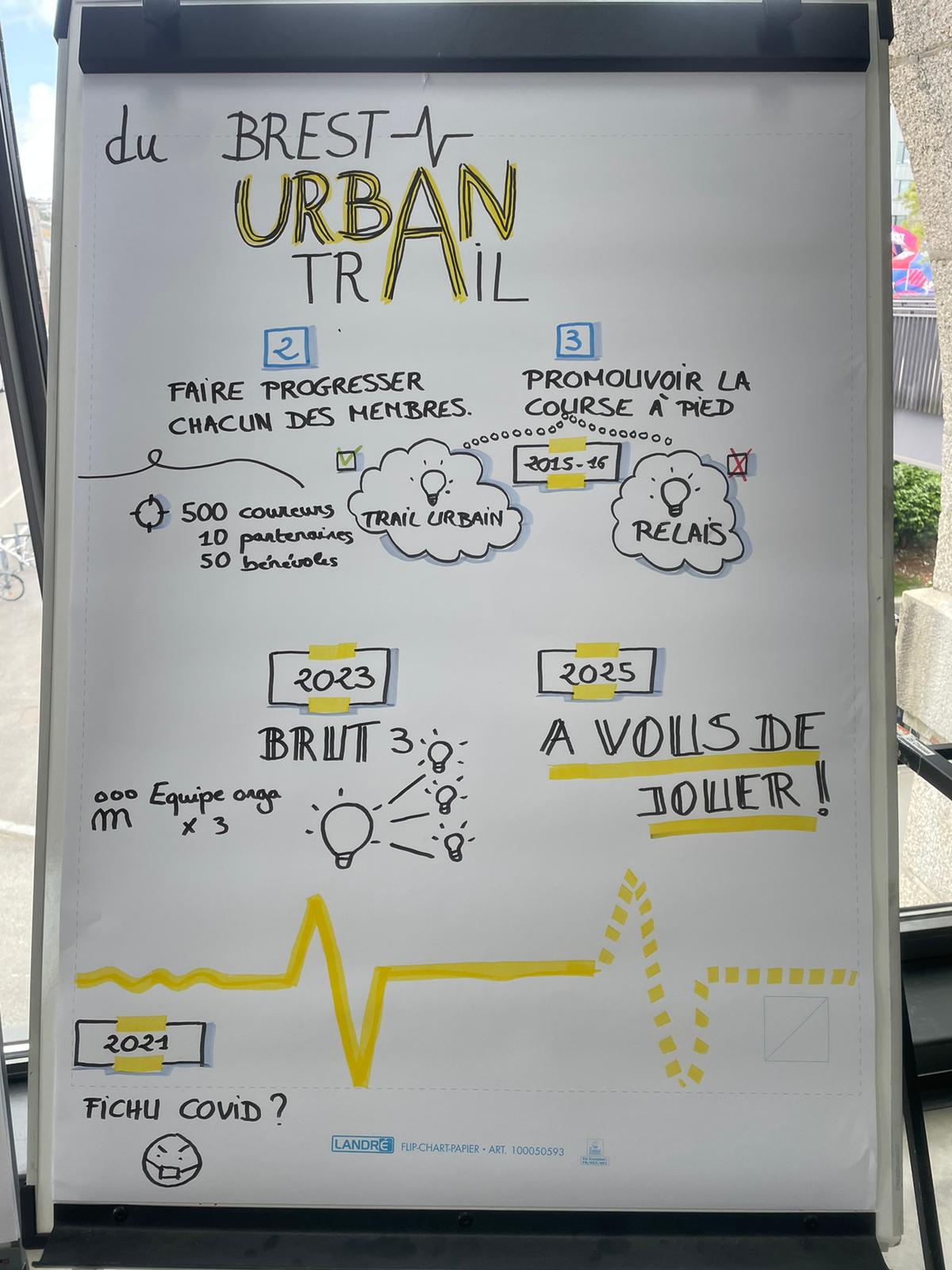

Brest Urban Trail L Importance Des Benevoles Artistes Et Partenaires

May 24, 2025

Brest Urban Trail L Importance Des Benevoles Artistes Et Partenaires

May 24, 2025 -

Best Of Bangladesh Event In Netherlands Over 1 500 Expected

May 24, 2025

Best Of Bangladesh Event In Netherlands Over 1 500 Expected

May 24, 2025 -

Les Personnes Cles Du Brest Urban Trail Benevoles Artistes And Partenaires

May 24, 2025

Les Personnes Cles Du Brest Urban Trail Benevoles Artistes And Partenaires

May 24, 2025 -

Brest Urban Trail Benevoles Artistes Et Partenaires Au Coeur De L Evenement

May 24, 2025

Brest Urban Trail Benevoles Artistes Et Partenaires Au Coeur De L Evenement

May 24, 2025 -

Brest Urban Trail Les Visages De La Course Benevoles Artistes Et Partenaires

May 24, 2025

Brest Urban Trail Les Visages De La Course Benevoles Artistes Et Partenaires

May 24, 2025