Understanding The Real Safe Bet: Risk Vs. Reward

Table of Contents

Understanding Risk Tolerance: Your Personal Equation of Risk vs. Reward

Your individual risk tolerance is the cornerstone of successful risk vs. reward analysis. It's your personal comfort level with the possibility of losing money or facing other negative consequences in pursuit of a potential gain. Risk tolerance isn't a fixed trait; it's influenced by several factors:

- Age: Younger individuals often have a higher risk tolerance due to a longer time horizon to recover from potential losses.

- Financial Situation: Someone with a substantial financial safety net can usually tolerate more risk than someone living paycheck to paycheck.

- Personality Traits: Are you risk-averse, preferring stability and security, or are you risk-seeking, drawn to opportunities with higher potential returns, even if they carry greater risk?

- Investment Experience: Experience shapes your understanding of market fluctuations and can influence your risk tolerance.

Assessing your own risk tolerance is crucial. You can use simple online questionnaires or consider your past financial decisions. Understanding your comfort level with risk is the first step in making informed investment decisions.

Analyzing Potential Rewards: Quantifying the Upside

What's in it for you? Identifying and quantifying potential rewards is just as crucial as assessing risks. Rewards aren't always purely financial; they can include:

- Financial Gains: This is the most common type of reward, encompassing profit from investments, increased income, etc. Quantifying this often involves calculating potential returns and return on investment (ROI).

- Personal Satisfaction: Achieving a personal goal, learning a new skill, or contributing to a cause can offer significant non-monetary rewards.

- Career Advancement: Taking on a challenging project with a high degree of risk might lead to a promotion or other career opportunities.

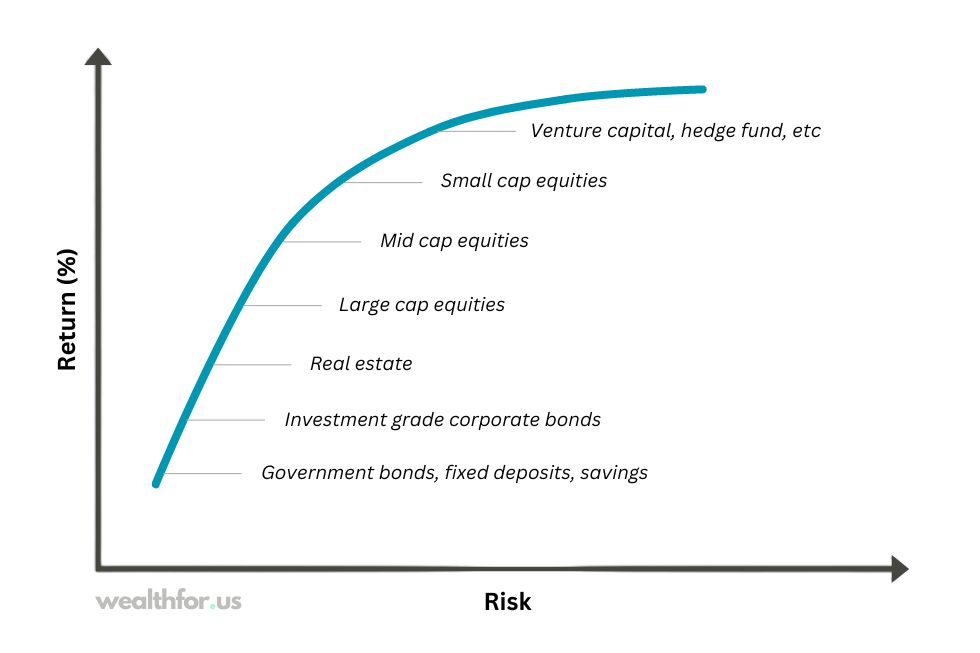

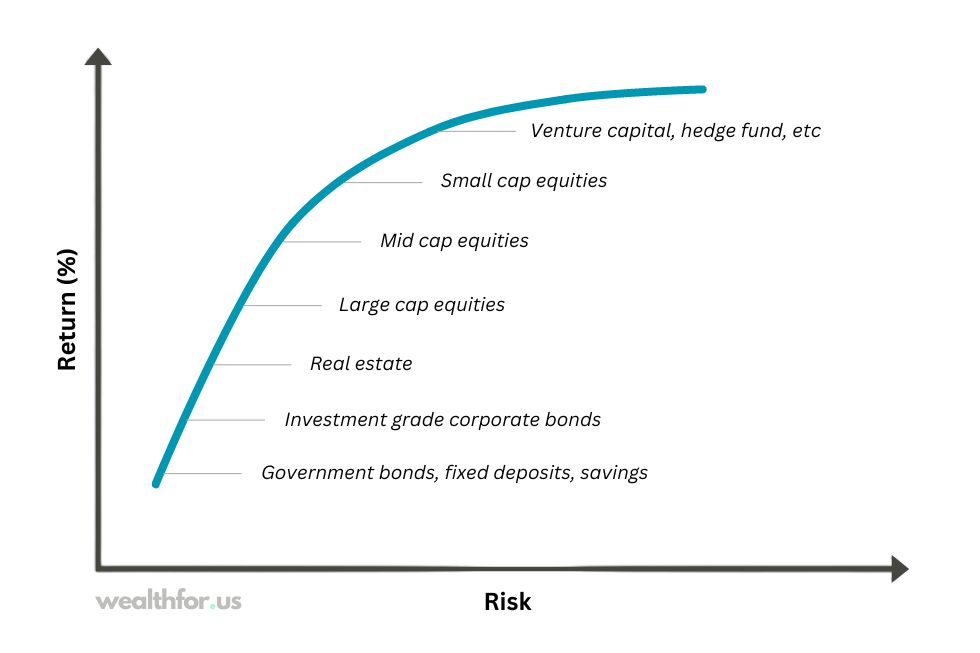

To effectively analyze rewards, you need to develop realistic reward analysis projections. Compare high-reward, high-risk scenarios (e.g., starting a business) with low-reward, low-risk scenarios (e.g., saving in a high-yield savings account). This comparison will help you understand the trade-offs involved in your risk vs. reward assessment.

Evaluating Potential Risks: Identifying and Mitigating Downside

While focusing on potential rewards is essential, a comprehensive risk vs. reward assessment requires a thorough evaluation of potential downsides. These risks can be:

- Financial Losses: This is the most obvious risk, especially in investments. Consider the potential for loss of principal or reduced returns.

- Time Commitment: Some ventures require significant time investment, which could impact other areas of your life.

- Reputational Damage: Taking on a risky project could impact your professional reputation if it fails.

Effective risk management involves implementing risk mitigation strategies:

- Diversification: Spreading investments across different assets to reduce the impact of losses in any single asset.

- Insurance: Protecting yourself against potential losses through appropriate insurance coverage.

- Thorough Research: Investing time and effort in researching any venture thoroughly can significantly reduce potential risks.

- Contingency Planning: Developing backup plans in case things don't go as expected.

Tools like SWOT analysis and scenario planning can help in systematic risk assessment.

The Illusion of the "Safe Bet": Understanding Inherent Uncertainty

The term "safe bet" is often misleading. Few, if any, investments or decisions are entirely risk-free. Even seemingly conservative options like savings accounts carry risks, such as inflation eroding the value of your savings.

Consider these examples of seemingly "safe" bets that failed:

- Investing heavily in a single industry that later experienced a major downturn.

- Reliance on a single source of income that suddenly disappears.

Accepting a degree of uncertainty is crucial for realistic risk vs. reward assessment. Understanding that financial uncertainty is inherent in most decisions allows you to focus on mitigating risks and maximizing potential gains within your risk tolerance.

Strategic Decision-Making: Balancing Risk and Reward

Balancing risk and reward requires a strategic approach. Develop a clear understanding of your goals and objectives before making any decision. Use a framework like cost-benefit analysis to weigh the potential gains against the potential losses. Remember that while analytical tools are important, intuition and experience also play a vital role in informed decision-making. A well-defined decision-making process incorporating both quantitative and qualitative factors will guide you toward the best choices for your circumstances. Using a risk assessment matrix can also aid in this process.

Conclusion: Making Informed Choices with Risk vs. Reward

Successfully navigating the risk vs. reward landscape involves understanding your risk tolerance, conducting thorough risk vs. reward analysis, and employing effective risk management strategies. There is no such thing as a completely "safe bet"; informed risk-taking is the key to achieving your financial and personal goals. Assess your personal risk tolerance, analyze potential rewards and risks, and make informed decisions based on your individual circumstances. Continue researching effective risk vs. reward strategies to improve your decision-making capabilities and achieve better outcomes.

Featured Posts

-

Oilers Draisaitl Misses Game Against Jets Due To Injury

May 09, 2025

Oilers Draisaitl Misses Game Against Jets Due To Injury

May 09, 2025 -

West Hams 25m Financial Gap How The Hammers Can Plug The Hole

May 09, 2025

West Hams 25m Financial Gap How The Hammers Can Plug The Hole

May 09, 2025 -

Sensex Recovers 100 Points Higher Nifty Above 17 950 Live Updates

May 09, 2025

Sensex Recovers 100 Points Higher Nifty Above 17 950 Live Updates

May 09, 2025 -

Trump Ag Pam Bondis Laughter At Comers Epstein Files Tirade

May 09, 2025

Trump Ag Pam Bondis Laughter At Comers Epstein Files Tirade

May 09, 2025 -

Edmonton Oilers Leon Draisaitl A Hart Trophy Finalist And Banner Season

May 09, 2025

Edmonton Oilers Leon Draisaitl A Hart Trophy Finalist And Banner Season

May 09, 2025