Understanding The Treasury Market After April 8th

Table of Contents

Impact of the April 8th Announcement/Event on Treasury Yields

The April 8th [Insert Specific Event] led to immediate and substantial changes in Treasury yields. Before the announcement, [describe the pre-announcement yield curve and market conditions]. The announcement resulted in [describe the direction of the change - e.g., a sharp increase or decrease] in yields across the curve.

- Short-term yields (2-year Treasury notes): Experienced a [percentage]% change, moving from [previous yield]% to [new yield]%.

- Long-term yields (10-year Treasury notes): Showed a [percentage]% shift, going from [previous yield]% to [new yield]%.

- 30-year Treasury bonds: Saw a [percentage]% change, moving from [previous yield]% to [new yield]%.

[Include a relevant graph or chart visually representing the yield curve shift. Ensure the graph is properly labeled and sourced]. The volatility observed in the immediate aftermath of the announcement was [describe the volatility - e.g., unusually high, moderate, or contained], reflecting the market's reaction to the unforeseen development. This highlights the sensitivity of Treasury bond yields to unexpected macroeconomic events. Understanding these shifts in bond yields is crucial for investors navigating the current Treasury market landscape.

Shifts in Investor Sentiment and Market Behavior Post-April 8th

Following the April 8th announcement, investor sentiment shifted significantly. [Describe the shift - e.g., from risk-on to risk-off, or vice versa]. Trading volumes [increased/decreased] reflecting the heightened uncertainty and increased market activity as investors reassessed their portfolios.

- Increased demand for safe-haven assets: Investors sought refuge in the perceived safety of Treasury bonds, driving up demand and potentially pushing yields lower, depending on the overall market reaction.

- Significant institutional investor actions: [Mention any observable actions by large institutional investors, e.g., pension funds, hedge funds, or central banks].

- Market sentiment indicators: [Cite relevant market sentiment indicators such as the VIX (Volatility Index) or similar indices, and explain their relevance to the Treasury market].

This shift in market behavior underscores the importance of monitoring investor sentiment when making investment decisions in the Treasury market. The interplay between investor confidence and Treasury yields is a key factor to consider.

Economic Implications and Outlook for the Treasury Market

The April 8th event has significant implications for the broader economy. [Explain the potential economic consequences, such as impacts on inflation, consumer spending, and business investment]. This will likely influence monetary policy decisions by central banks, potentially leading to further adjustments in interest rates.

- Potential scenarios for future interest rate changes: [Discuss potential scenarios and their implications for Treasury yields, e.g., further rate hikes or pauses].

- Potential risks and uncertainties: [Highlight any potential risks or uncertainties in the economic outlook, such as geopolitical instability or unexpected economic shocks].

- Economic indicators to watch: [Mention key economic indicators that investors should monitor, such as inflation rates, GDP growth, and unemployment figures].

The outlook for the Treasury market hinges on how these economic factors unfold. The interplay between economic data, monetary policy, and investor sentiment will continue to shape the direction of Treasury yields and overall market performance.

Strategies for Navigating the Post-April 8th Treasury Market

Navigating the post-April 8th Treasury market requires a cautious and adaptable approach. Investors should consider diversifying their portfolios to mitigate risk.

- Risk management techniques: [Discuss strategies like hedging, diversification, and understanding individual risk tolerance levels].

- Recommendations for Treasury securities: [Offer advice on specific Treasury securities based on risk tolerance and investment goals, e.g., short-term versus long-term bonds].

- Importance of portfolio diversification: [Emphasize the benefits of spreading investments across various asset classes to reduce overall portfolio risk].

Careful consideration of these strategies is critical to managing risk and achieving desired investment outcomes in this dynamic market environment.

Conclusion: Understanding the Treasury Market's Future After April 8th

The April 8th announcement significantly impacted the Treasury market, affecting yields, investor sentiment, and the overall economic outlook. Understanding these shifts is crucial for making informed investment decisions. Investors should carefully monitor economic indicators, investor sentiment, and adapt their strategies accordingly. Stay informed about the evolving dynamics of the Treasury market and continue to monitor developments after April 8th to make well-informed investment choices. Learn more about navigating the Treasury market post-April 8th with our comprehensive resources. [Link to relevant resources if available].

Featured Posts

-

Kentucky Governor Issues State Of Emergency Due To Imminent Heavy Rain And Flooding

Apr 29, 2025

Kentucky Governor Issues State Of Emergency Due To Imminent Heavy Rain And Flooding

Apr 29, 2025 -

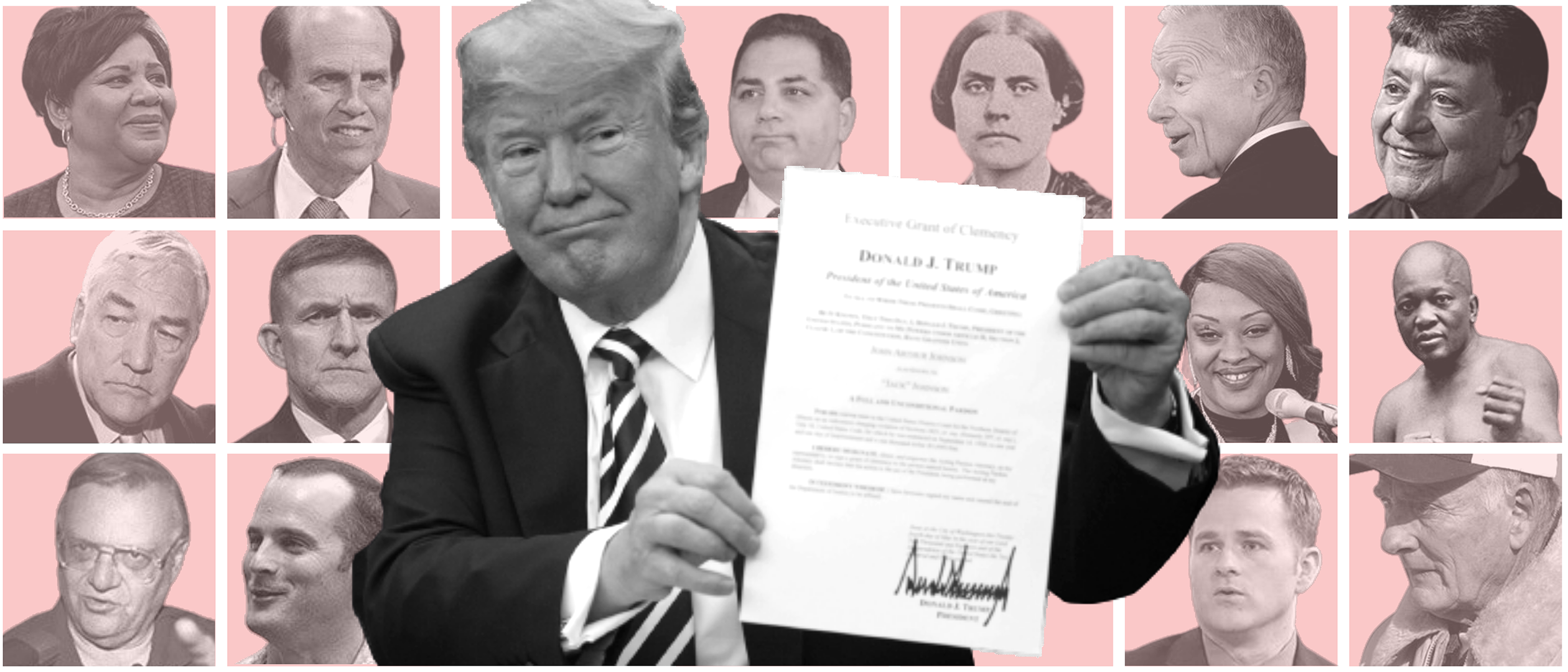

Donald Trumps Pardon Of Pete Rose A Long Awaited Decision

Apr 29, 2025

Donald Trumps Pardon Of Pete Rose A Long Awaited Decision

Apr 29, 2025 -

The Los Angeles Wildfires A Case Study In Disaster Speculation

Apr 29, 2025

The Los Angeles Wildfires A Case Study In Disaster Speculation

Apr 29, 2025 -

Israel Faces Pressure To Lift Gaza Aid Ban Amidst Shortages

Apr 29, 2025

Israel Faces Pressure To Lift Gaza Aid Ban Amidst Shortages

Apr 29, 2025 -

Hollywood Production Halts As Sag Aftra Joins Writers Strike

Apr 29, 2025

Hollywood Production Halts As Sag Aftra Joins Writers Strike

Apr 29, 2025

Latest Posts

-

Preload Doom The Dark Ages Now Early Access And Launch Dates Announced

May 13, 2025

Preload Doom The Dark Ages Now Early Access And Launch Dates Announced

May 13, 2025 -

Doom The Dark Ages File Size And Review Embargo Date Announced

May 13, 2025

Doom The Dark Ages File Size And Review Embargo Date Announced

May 13, 2025 -

Doom The Dark Ages Review And File Size Details Revealed

May 13, 2025

Doom The Dark Ages Review And File Size Details Revealed

May 13, 2025 -

When Does Doom The Dark Ages Early Access Start Preload Info Included

May 13, 2025

When Does Doom The Dark Ages Early Access Start Preload Info Included

May 13, 2025 -

Doom The Dark Ages Review Embargo Lifted File Size Confirmed

May 13, 2025

Doom The Dark Ages Review Embargo Lifted File Size Confirmed

May 13, 2025