Understanding Today's Personal Loan Interest Rates

Table of Contents

Factors Affecting Personal Loan Interest Rates

Several factors significantly impact the interest rate you'll receive on a personal loan. Understanding these factors empowers you to improve your chances of securing a lower rate and a more favorable loan agreement.

-

Credit Score: Your credit score is arguably the most significant factor. Lenders use your FICO score (and other credit scoring models) to assess your creditworthiness. A high credit score (generally 700 or above) signifies a lower risk to the lender, resulting in a lower interest rate. Conversely, a low credit score (below 670) indicates higher risk, leading to significantly higher interest rates. Improving your credit report and credit history is key to obtaining better loan terms.

-

Loan Amount: The size of your loan, also known as the loan principal, influences the interest rate. While not always a direct correlation, larger loan amounts sometimes come with slightly lower interest rates, potentially due to economies of scale for the lender. Carefully consider your repayment plan and loan term to manage your monthly payments.

-

Loan Term: The length of your loan term directly impacts your monthly payments and overall interest paid. A longer loan term (e.g., 60 months) results in lower monthly payments but significantly higher total interest accumulation over the life of the loan. Shorter terms (e.g., 36 months) mean higher monthly payments but less interest paid overall. Understanding your amortization schedule is crucial for making informed decisions.

-

Interest Rate Type: Personal loans offer two main interest rate types: fixed and variable. A fixed-rate loan maintains a consistent interest rate throughout the loan term, providing predictability. A variable-rate loan’s interest rate fluctuates based on market conditions, potentially leading to unpredictable monthly payments. Carefully consider the APR (Annual Percentage Rate), which includes all fees and charges, when comparing offers.

-

Lender Type: Different lenders – banks, credit unions, and online lenders – offer varying interest rates. Banks often have stricter requirements but may offer competitive rates. Credit unions frequently provide lower rates to their members, while online lenders offer convenience but may have higher rates or hidden fees. Research peer-to-peer lending options as well.

-

Income and Debt-to-Income Ratio (DTI): Your income and debt-to-income ratio (DTI) – the percentage of your monthly income dedicated to debt payments – play a crucial role in loan approval and interest rates. A higher DTI indicates less financial stability, potentially leading to higher interest rates or loan rejection. Debt consolidation could potentially improve your DTI and increase your chances for a better rate.

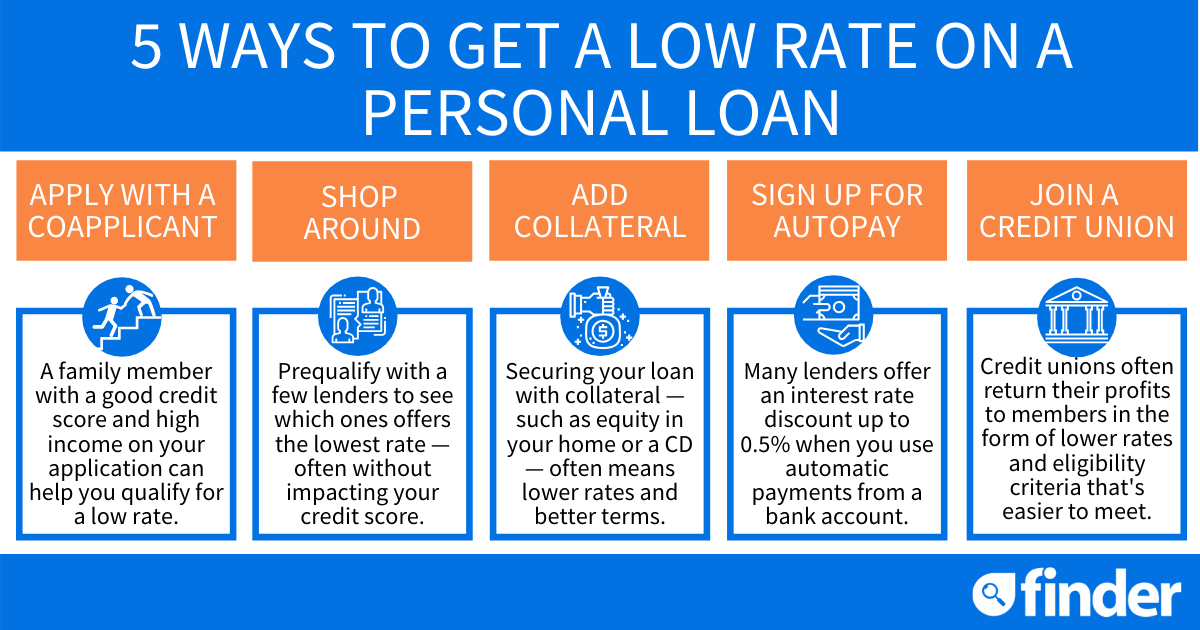

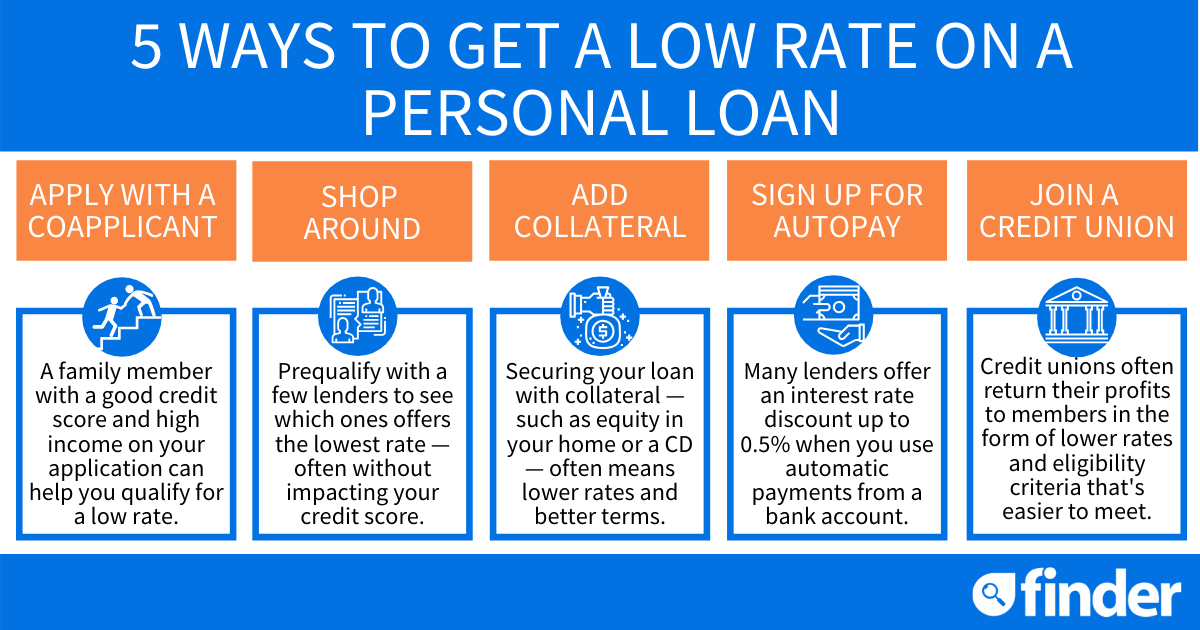

How to Find the Best Personal Loan Interest Rates

Securing the best personal loan interest rates requires proactive steps and careful planning.

-

Shop Around: Comparing offers from multiple lenders is paramount. Use online tools for rate comparison to quickly survey the market and identify the best loan offers. This diligent approach ensures you're not settling for a suboptimal rate.

-

Improve Your Credit Score: Before applying for a loan, work on improving your credit score. This involves paying bills on time, reducing debt, and monitoring your credit report for errors. Credit repair services can assist, but proceed cautiously and compare options. Building credit responsibly is a long-term investment that pays off.

-

Negotiate: Don't be afraid to negotiate interest rates with lenders. Highlight your positive financial attributes and explore the possibility of interest rate reduction. Your bargaining power increases with a strong credit score and multiple loan offers.

-

Consider Your Needs: Match the loan term and amount to your specific financial situation. Responsible borrowing involves careful financial planning and budgeting to ensure you can comfortably manage monthly payments.

-

Read the Fine Print: Always carefully review loan documents to understand all fees and charges, including origination fees and prepayment penalties. Hidden costs can significantly increase the total cost of the loan.

Current Average Personal Loan Interest Rates

(Note: This section requires regularly updated data. Include a disclaimer stating that these are estimates and can vary based on the factors mentioned above. Provide a range of current average rates from reputable sources.) For example: "As of October 26, 2023, average personal loan interest rates range from X% to Y%, depending on creditworthiness and loan terms. However, individual rates may vary significantly."

Conclusion

Understanding today's personal loan interest rates is essential for making informed financial decisions. By considering the factors outlined above and actively comparing offers, you can secure the best possible terms for your personal loan. Remember to shop around, improve your credit, and negotiate to achieve the lowest possible personal loan interest rate. Don't hesitate to start comparing personal loan interest rates today and find the perfect loan for your needs!

Featured Posts

-

Hanif Faisol Strategi Pengelolaan Sampah Di Bali Untuk Indonesia

May 28, 2025

Hanif Faisol Strategi Pengelolaan Sampah Di Bali Untuk Indonesia

May 28, 2025 -

Gaza Conflict Us Envoys Ceasefire Proposal To Hamas

May 28, 2025

Gaza Conflict Us Envoys Ceasefire Proposal To Hamas

May 28, 2025 -

Todays Mlb Game Brewers Vs Diamondbacks Predictions Best Picks And Odds

May 28, 2025

Todays Mlb Game Brewers Vs Diamondbacks Predictions Best Picks And Odds

May 28, 2025 -

Galaxy S25 Ultra 256 Go 5 Etoiles Vente Flash A 1196 50 E

May 28, 2025

Galaxy S25 Ultra 256 Go 5 Etoiles Vente Flash A 1196 50 E

May 28, 2025 -

Pepper Premiere On Pepper 96 6 Fm Listen Live And On Demand

May 28, 2025

Pepper Premiere On Pepper 96 6 Fm Listen Live And On Demand

May 28, 2025

Latest Posts

-

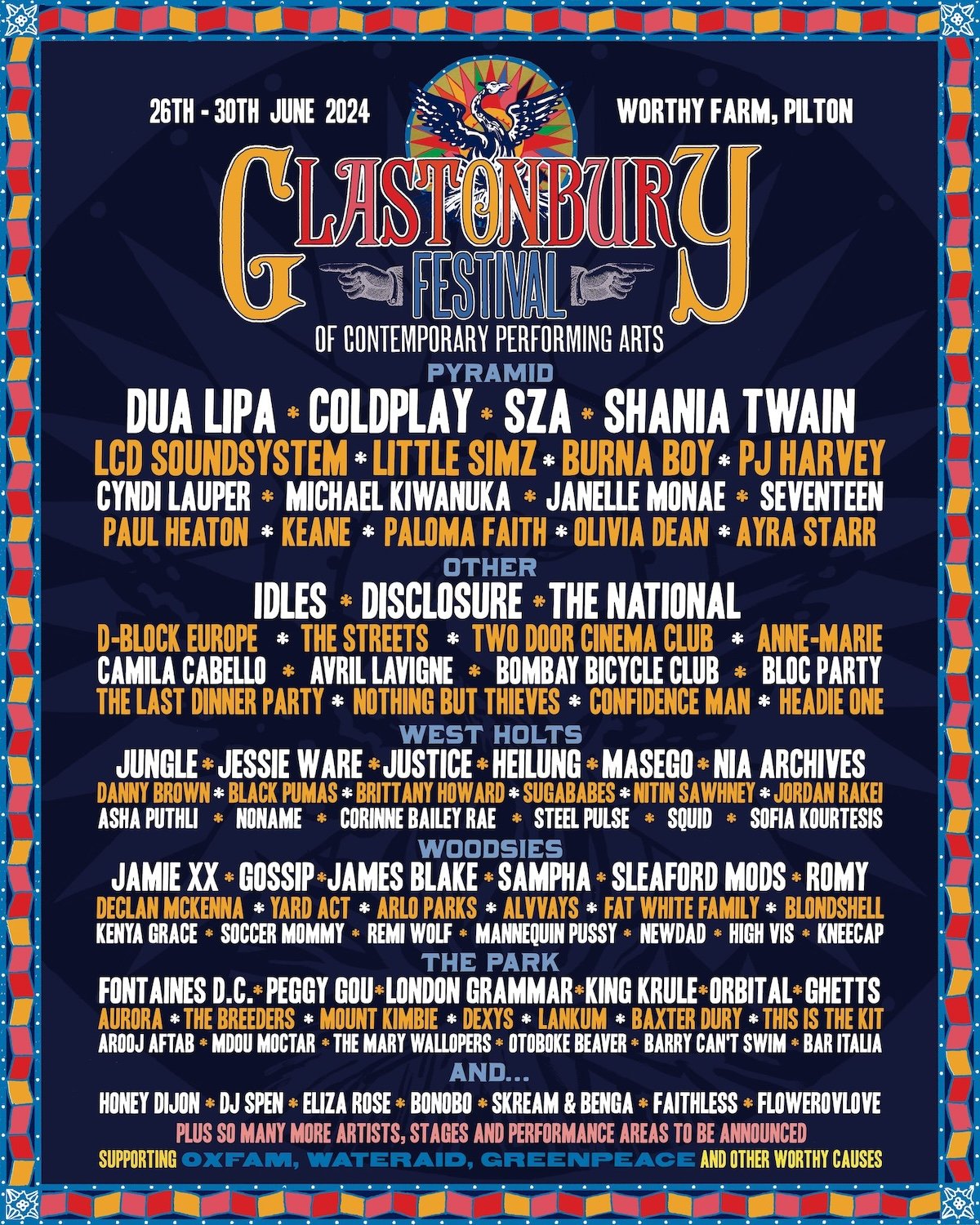

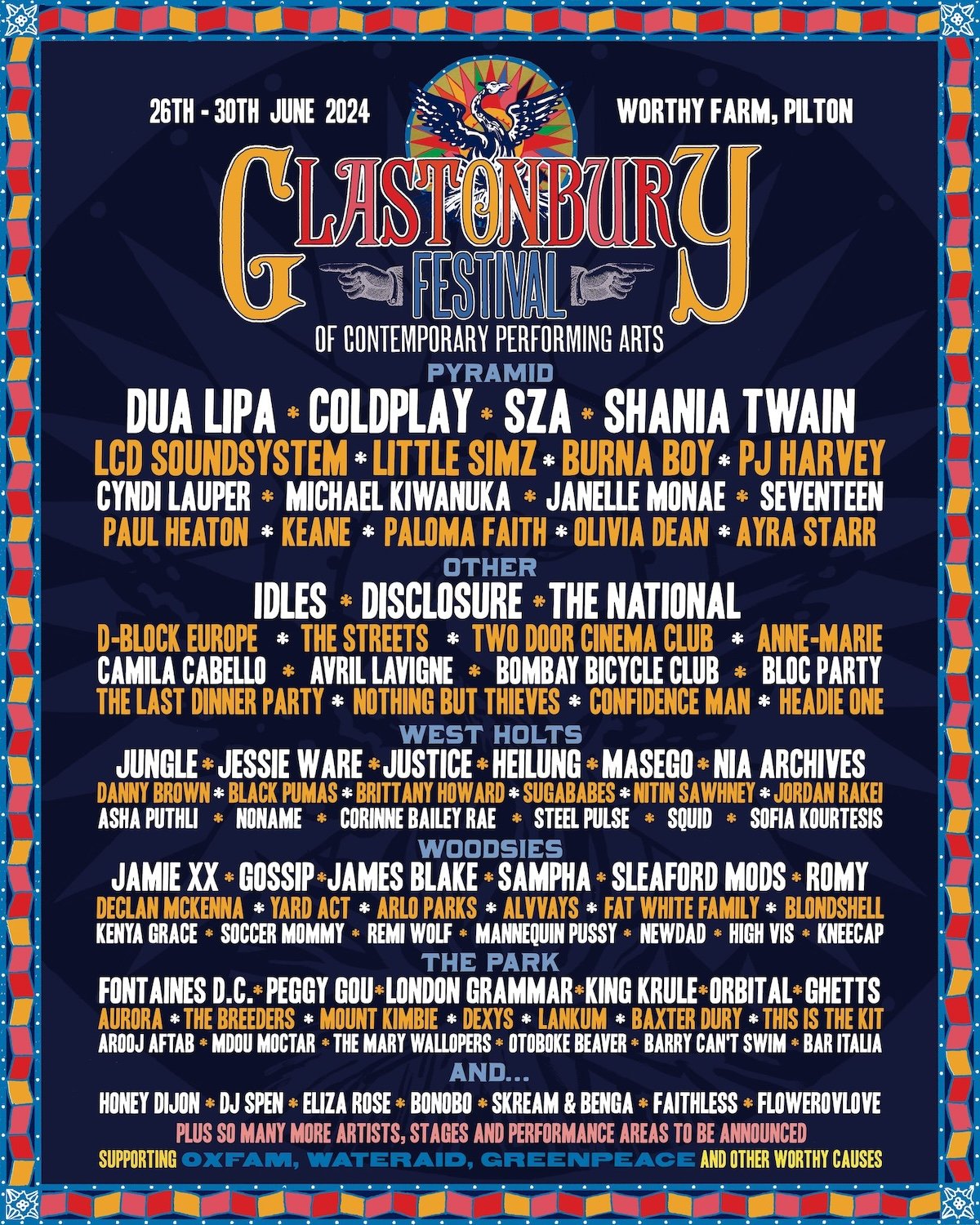

Secure Your Glastonbury 2025 Ticket Resale Information And Tips

May 31, 2025

Secure Your Glastonbury 2025 Ticket Resale Information And Tips

May 31, 2025 -

When Is The Glastonbury 2025 Resale Ticket Application Process Explained

May 31, 2025

When Is The Glastonbury 2025 Resale Ticket Application Process Explained

May 31, 2025 -

Liverpool Bands Surprise Glastonbury Set Fan Theories And Predictions

May 31, 2025

Liverpool Bands Surprise Glastonbury Set Fan Theories And Predictions

May 31, 2025 -

Glastonbury Festival Speculation Mounts Over Unannounced Liverpool Band Performance

May 31, 2025

Glastonbury Festival Speculation Mounts Over Unannounced Liverpool Band Performance

May 31, 2025 -

Glastonbury 2024 Liverpool Band Rumoured For Secret Set

May 31, 2025

Glastonbury 2024 Liverpool Band Rumoured For Secret Set

May 31, 2025