Unexpected Drop In PBOC's Daily Yuan Support

Table of Contents

Analyzing the Reasons Behind the Reduced Yuan Support

The diminished PBOC intervention in the Yuan's value begs the question: why the change? Several factors may be at play.

Decreased Intervention – A Shift in Policy?

One possibility is a deliberate policy shift by the PBOC. This could reflect a strategic move towards allowing market forces to play a more significant role in determining the Yuan's value. Several reasons might drive such a shift:

- Strengthening the domestic economy: Reduced intervention could encourage greater reliance on internal economic strength rather than artificial currency manipulation.

- Managing inflation: A more market-driven exchange rate might help manage inflationary pressures by influencing import costs.

- Increasing the Yuan's international standing: A freely fluctuating Yuan could enhance its credibility and appeal as a global reserve currency.

Evidence of reduced intervention can be seen in:

- A noticeable decrease in the PBOC's daily forex trading activities, as indicated by publicly available data.

- Subtle shifts in official statements and pronouncements from the PBOC regarding currency policy.

Impact of External Factors on Yuan Stability

Global economic conditions significantly influence the Yuan's stability. The strength of the US dollar, a major global currency, exerts considerable pressure. Global trade tensions and uncertainty also play a role.

- A strong US dollar makes the Yuan appear relatively weaker, increasing downward pressure on its value.

- Geopolitical uncertainties and trade disputes can lead to capital flight, reducing demand for the Yuan and increasing volatility.

- Changes in global capital flows and shifts in foreign exchange reserves impact the supply and demand dynamics for the Yuan.

Specific examples include:

- The recent increase in US interest rates, making dollar-denominated assets more attractive and drawing capital away from Yuan-denominated assets.

- Escalating trade tensions between China and other major economies, creating uncertainty and discouraging investment.

Speculation and Market Sentiment

Market speculation and investor sentiment heavily influence the Yuan's value. Negative sentiment, driven by news and economic forecasts, can lead to increased volatility and downward pressure on the currency.

- Negative news headlines about the Chinese economy or global trade can trigger sell-offs, weakening the Yuan.

- Speculative trading can amplify short-term fluctuations, creating further uncertainty.

Examples of market reactions include:

- Sharp drops in the Yuan's value following negative economic data releases.

- Increased volatility in the forex market following announcements of new trade tariffs or sanctions.

Potential Consequences of the Reduced PBOC Support

The reduced PBOC support for the Yuan carries significant potential consequences for both the Chinese economy and the global market.

Impact on the Chinese Economy

A weaker Yuan can impact various sectors of the Chinese economy:

- Exports: A weaker Yuan can boost exports by making Chinese goods more competitive internationally. However, it could also lead to increased import costs.

- Imports: A weaker Yuan increases the cost of imports, potentially fueling inflation.

- Domestic Investment: Uncertainty in the currency market can discourage domestic investment and hinder economic growth.

Specific potential consequences include:

- Increased inflationary pressure due to higher import costs.

- Potential for slower economic growth if investment slows down.

- A shift in the global competitiveness of Chinese exports.

Global Market Implications

The reduced PBOC support has global implications:

- Currency Markets: Fluctuations in the Yuan can trigger volatility in other currency markets, particularly those of other emerging economies.

- International Trade: Changes in the Yuan's value can impact global trade flows and the competitiveness of different countries' goods and services.

Potential effects on different regions and global economic indicators:

- Increased volatility in Asian currency markets.

- Potential impacts on global inflation and trade balances.

Opportunities and Risks for Investors

The situation presents both opportunities and risks for investors:

- Opportunities: A weaker Yuan may offer opportunities for investors seeking exposure to undervalued Chinese assets.

- Risks: Increased currency volatility and economic uncertainty pose significant risks for investors in Chinese markets.

Potential hedging strategies and advice for investors:

- Diversification of investment portfolios to mitigate risks.

- Careful consideration of currency hedging strategies.

Conclusion: Understanding the Future of PBOC's Daily Yuan Support

The recent decrease in PBOC's daily Yuan support is a complex event with various contributing factors, including policy shifts, external economic pressures, and market sentiment. The potential consequences are far-reaching, affecting the Chinese economy and global markets. It's crucial to monitor the situation closely. The future direction of the PBOC's policy on Yuan support remains uncertain. It's vital to understand fluctuations in PBOC's daily Yuan support for effective investment decisions. Stay informed about developments by subscribing to reputable financial news sources and following key economic indicators. Understanding the nuances of PBOC's daily Yuan support is essential for navigating the complexities of the global economy.

Featured Posts

-

Jimmy Butlers Game 3 Availability Warriors Remain Hopeful

May 15, 2025

Jimmy Butlers Game 3 Availability Warriors Remain Hopeful

May 15, 2025 -

Gop Mega Bill Unveiled Whats Inside And Whats Next

May 15, 2025

Gop Mega Bill Unveiled Whats Inside And Whats Next

May 15, 2025 -

Trumps Egg Price Prophecy An Analysis Of Current Market Conditions

May 15, 2025

Trumps Egg Price Prophecy An Analysis Of Current Market Conditions

May 15, 2025 -

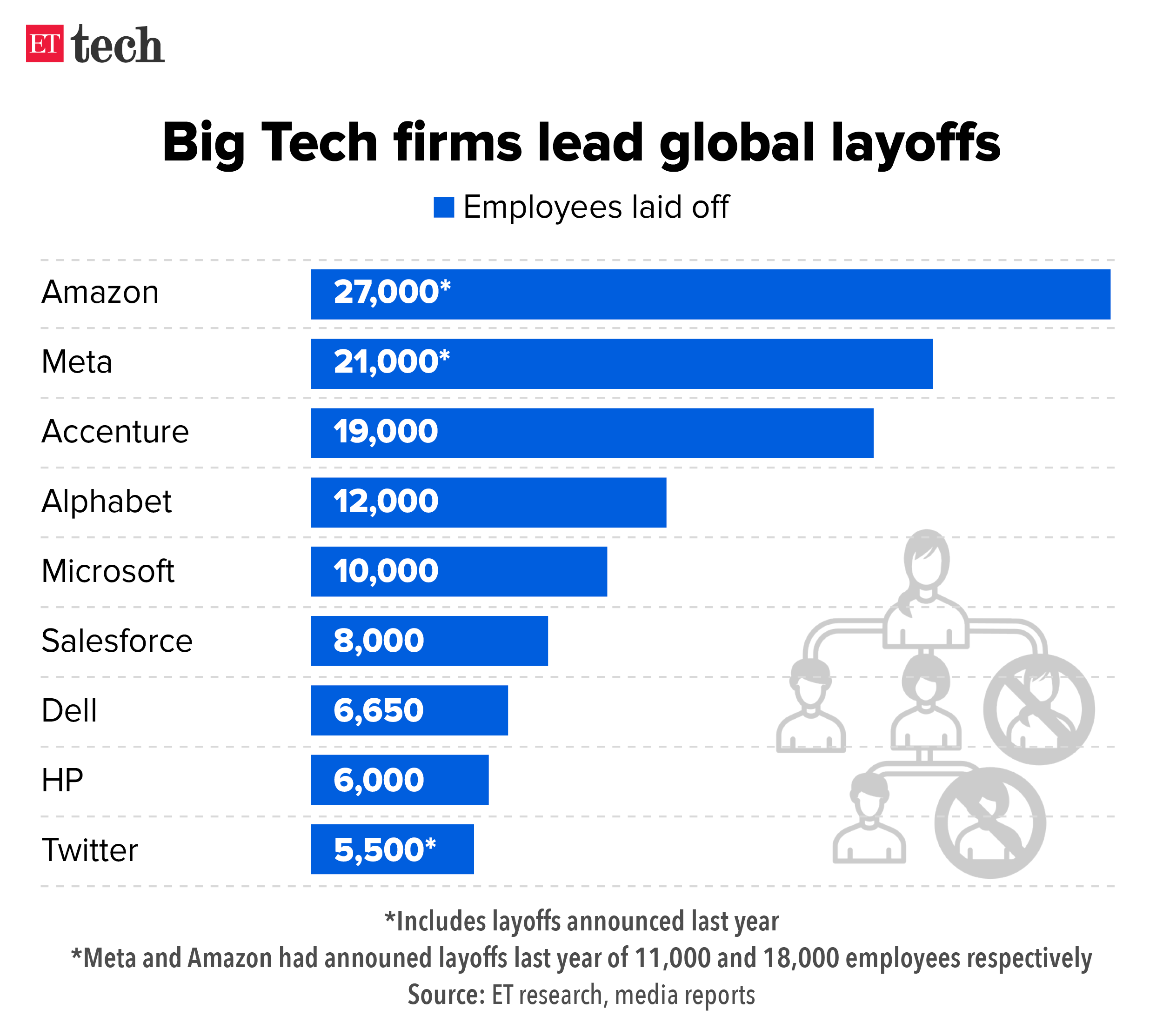

Microsofts Layoff Announcement Impact On Employees And The Tech Industry

May 15, 2025

Microsofts Layoff Announcement Impact On Employees And The Tech Industry

May 15, 2025 -

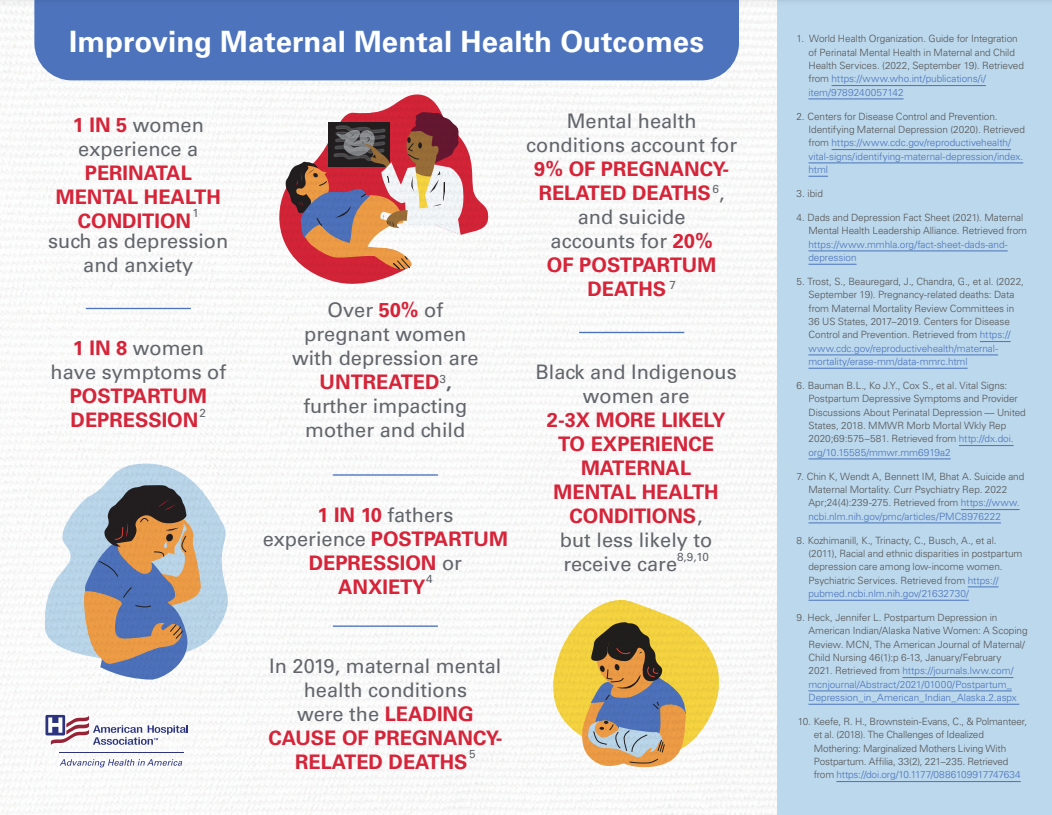

Measuring Gender Euphoria Impact On Transgender Mental Health Outcomes

May 15, 2025

Measuring Gender Euphoria Impact On Transgender Mental Health Outcomes

May 15, 2025

Latest Posts

-

Padres Comeback Triumph Over Cubs

May 15, 2025

Padres Comeback Triumph Over Cubs

May 15, 2025 -

Rookie Chandler Simpsons Three Hit Game Leads Rays To Sweep Padres

May 15, 2025

Rookie Chandler Simpsons Three Hit Game Leads Rays To Sweep Padres

May 15, 2025 -

San Diego Padres Secure Win After Comeback Against Chicago Cubs

May 15, 2025

San Diego Padres Secure Win After Comeback Against Chicago Cubs

May 15, 2025 -

10 Run Inning Doesnt Dim Padres Bullpens Positive Outlook Tom Krasovic San Diego Union Tribune

May 15, 2025

10 Run Inning Doesnt Dim Padres Bullpens Positive Outlook Tom Krasovic San Diego Union Tribune

May 15, 2025 -

Padres Battle Back To Defeat Cubs

May 15, 2025

Padres Battle Back To Defeat Cubs

May 15, 2025