Upcoming MNTN IPO: Details On Ryan Reynolds' Beverage Company's Stock Offering

Table of Contents

MNTN: A Look at the Company and its Portfolio

MNTN's business model centers on building and acquiring premium spirits brands with a focus on strong brand identities and unique marketing strategies. While Aviation Gin remains a flagship brand, MNTN boasts a diversified portfolio extending beyond this popular gin. This diversification offers a level of resilience not always found in single-product companies.

-

Key Brands: Aviation Gin (premium gin), [Insert other brands in MNTN's portfolio here if available. Otherwise, replace with placeholder: Brand X (premium [type of alcohol]), Brand Y (premium [type of alcohol])]. The portfolio is strategically crafted to cater to different consumer preferences within the premium spirits market.

-

Marketing Strategies: MNTN leverages the power of celebrity endorsements, primarily through Ryan Reynolds' involvement, and employs creative, often humorous, social media campaigns to engage its target audience. This savvy marketing significantly contributes to brand awareness and consumer loyalty.

-

Growth Trajectory and Market Share: MNTN has demonstrated impressive growth in recent years [Insert data on revenue growth percentage if available]. While precise market share figures may not be publicly available until the IPO prospectus, the company’s strong brand recognition and rapid expansion suggest a significant presence within the competitive premium spirits market. The MNTN portfolio's growth potential is a key factor attracting investors to the MNTN IPO.

Financial Performance and IPO Details

While complete financial details are typically released closer to the IPO date, we can anticipate certain key aspects based on available information and industry trends. MNTN's financial performance, specifically revenue growth and profitability, will be scrutinized by investors. Successful IPOs generally demonstrate a strong track record of increasing revenue and profitability, indicating a stable and scalable business model.

-

Expected IPO Valuation: The expected valuation for the MNTN IPO is [Insert expected valuation or range if available, otherwise use a placeholder like "expected to be in the range of $X to $Y billion"]. This valuation reflects investor sentiment towards the company’s growth potential and brand strength.

-

Number of Shares Offered: The number of shares offered to the public during the MNTN IPO will be disclosed in the IPO prospectus. This information is crucial for investors to assess the potential dilution of existing shareholders' equity.

-

IPO Pricing Range: The IPO pricing range will be determined closer to the offering date and will depend on market conditions and investor demand. It is essential for potential investors to monitor these updates.

-

Use of Proceeds: The proceeds from the MNTN IPO are likely to be used for further brand acquisitions, marketing and expansion initiatives, and general corporate purposes. The exact allocation will be outlined in the IPO filing.

-

Lead Underwriters: [Insert the names of lead underwriters if available. Otherwise, use a placeholder like "Leading investment banks are expected to underwrite the offering."]

Risks and Considerations for Potential Investors

Investing in an IPO, particularly a smaller company like MNTN, carries inherent risks. Potential investors must carefully evaluate these risks before committing capital.

-

Market Competition: The premium spirits market is highly competitive, with established players and emerging brands vying for market share. MNTN's ability to maintain its competitive edge will be a crucial factor in its long-term success.

-

Dependence on Celebrity Endorsements: While Ryan Reynolds’ involvement has been instrumental to MNTN's success, a change in this strategy, or even a negative event associated with the celebrity endorser, could significantly impact the brand and its valuation. This dependence represents a key risk factor for the MNTN IPO.

-

Regulatory Risks: The alcoholic beverage industry is subject to various regulations, including those related to alcohol production, distribution, and marketing. Changes in these regulations could affect MNTN's operations and profitability.

-

Other Risks: Additional risks, including economic downturns, supply chain disruptions, and changes in consumer preferences, must also be carefully considered. A thorough review of the IPO prospectus is critical for understanding the full range of risks.

Analyzing the Investment Opportunity

The MNTN IPO presents a potentially lucrative investment opportunity given the company's strong brand portfolio, unique marketing approach, and demonstrated growth. However, the risks outlined above must be carefully weighed against the potential returns. A comparative analysis of MNTN against similar publicly traded companies in the alcoholic beverage sector can provide valuable insights into its valuation and growth prospects. Investors should perform a thorough due diligence process, including carefully reviewing the prospectus, before making any investment decision related to the MNTN IPO.

Conclusion

The upcoming MNTN IPO presents a compelling investment opportunity, but potential investors should carefully consider the associated risks and conduct thorough due diligence. Understanding MNTN's financial performance, competitive landscape, and growth strategy is crucial before making any investment decisions. This overview provides a starting point for your research into the MNTN IPO. Stay informed about the latest developments and consult with a financial advisor before investing in this, or any, MNTN IPO. Remember to always conduct thorough research before investing in any IPO, especially one as high-profile as the MNTN IPO.

Featured Posts

-

Bayern Munich Legend Thomas Mueller A Look At His Most Frequent On Field Companions

May 11, 2025

Bayern Munich Legend Thomas Mueller A Look At His Most Frequent On Field Companions

May 11, 2025 -

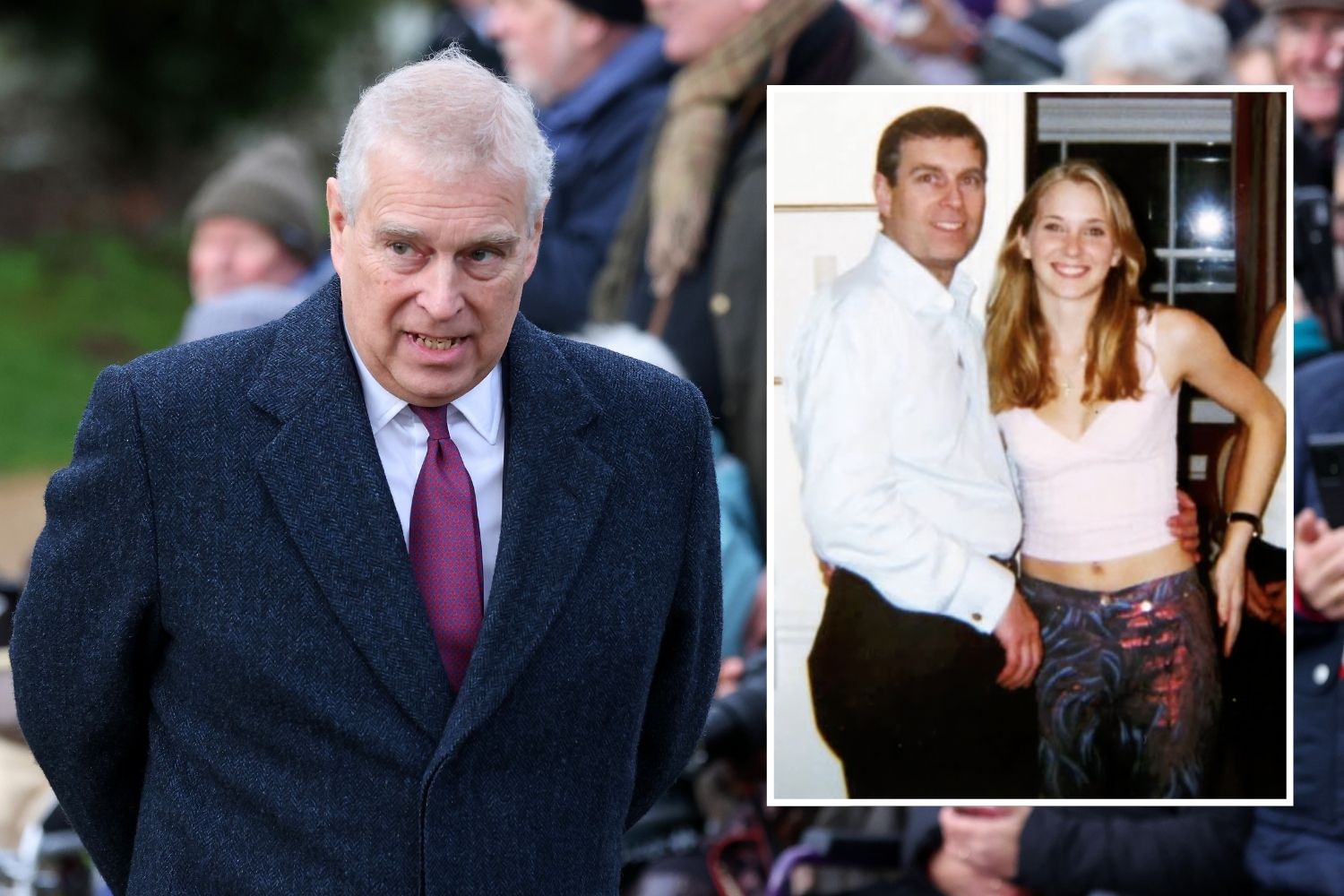

Prince Andrew Accusers Dire Health Claim 4 Days To Live

May 11, 2025

Prince Andrew Accusers Dire Health Claim 4 Days To Live

May 11, 2025 -

Zarabotok Borisa Dzhonsona Na Fotografiyakh Novye Podrobnosti

May 11, 2025

Zarabotok Borisa Dzhonsona Na Fotografiyakh Novye Podrobnosti

May 11, 2025 -

Debate Rages Parliament Tackles Illegal Immigration Crisis

May 11, 2025

Debate Rages Parliament Tackles Illegal Immigration Crisis

May 11, 2025 -

Prins Andrew In Opspraak Nieuwe Details Over Controversiele Contacten

May 11, 2025

Prins Andrew In Opspraak Nieuwe Details Over Controversiele Contacten

May 11, 2025