US-China Trade War: 80% Tariff Impact On Stock Market Today

Table of Contents

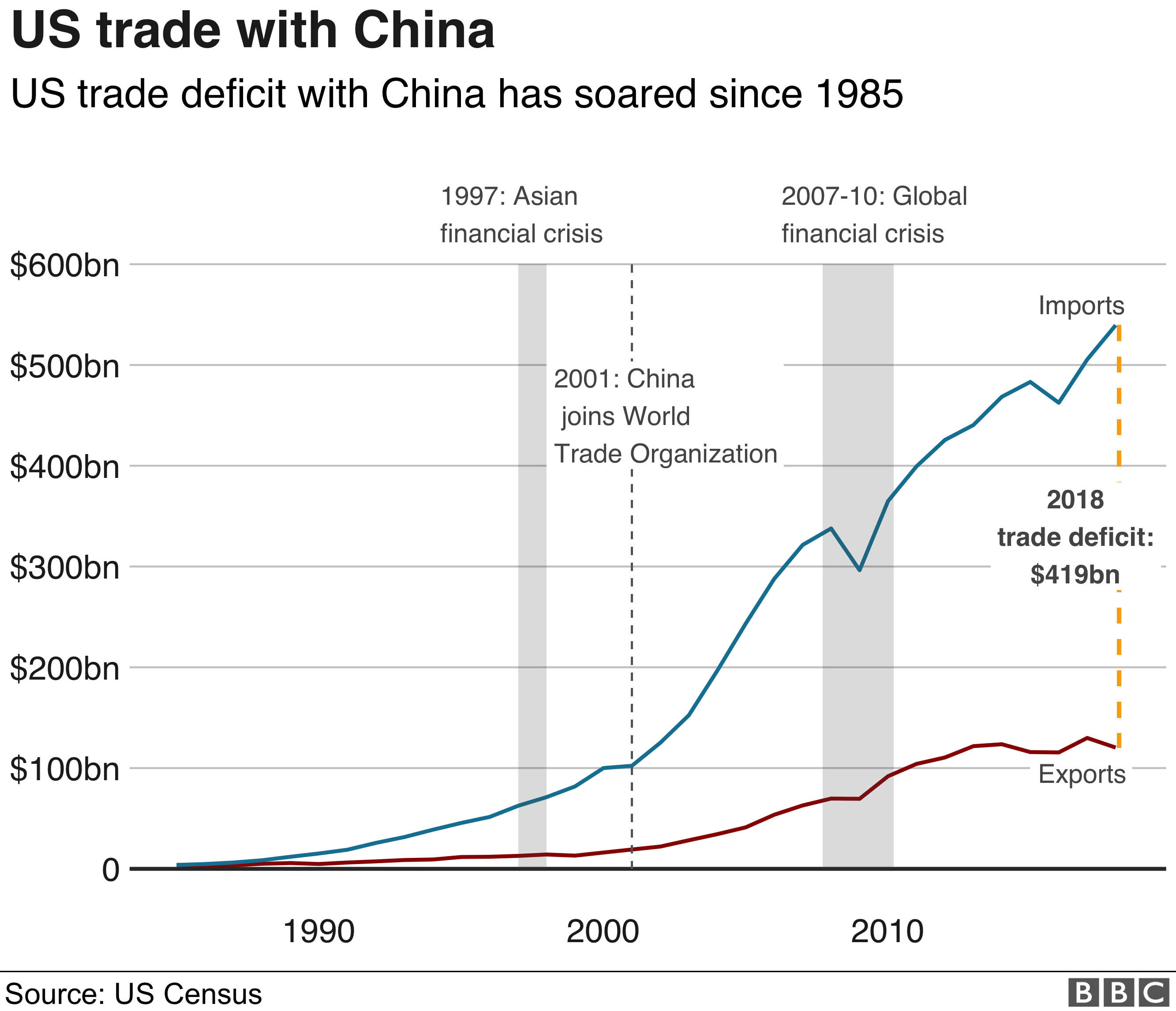

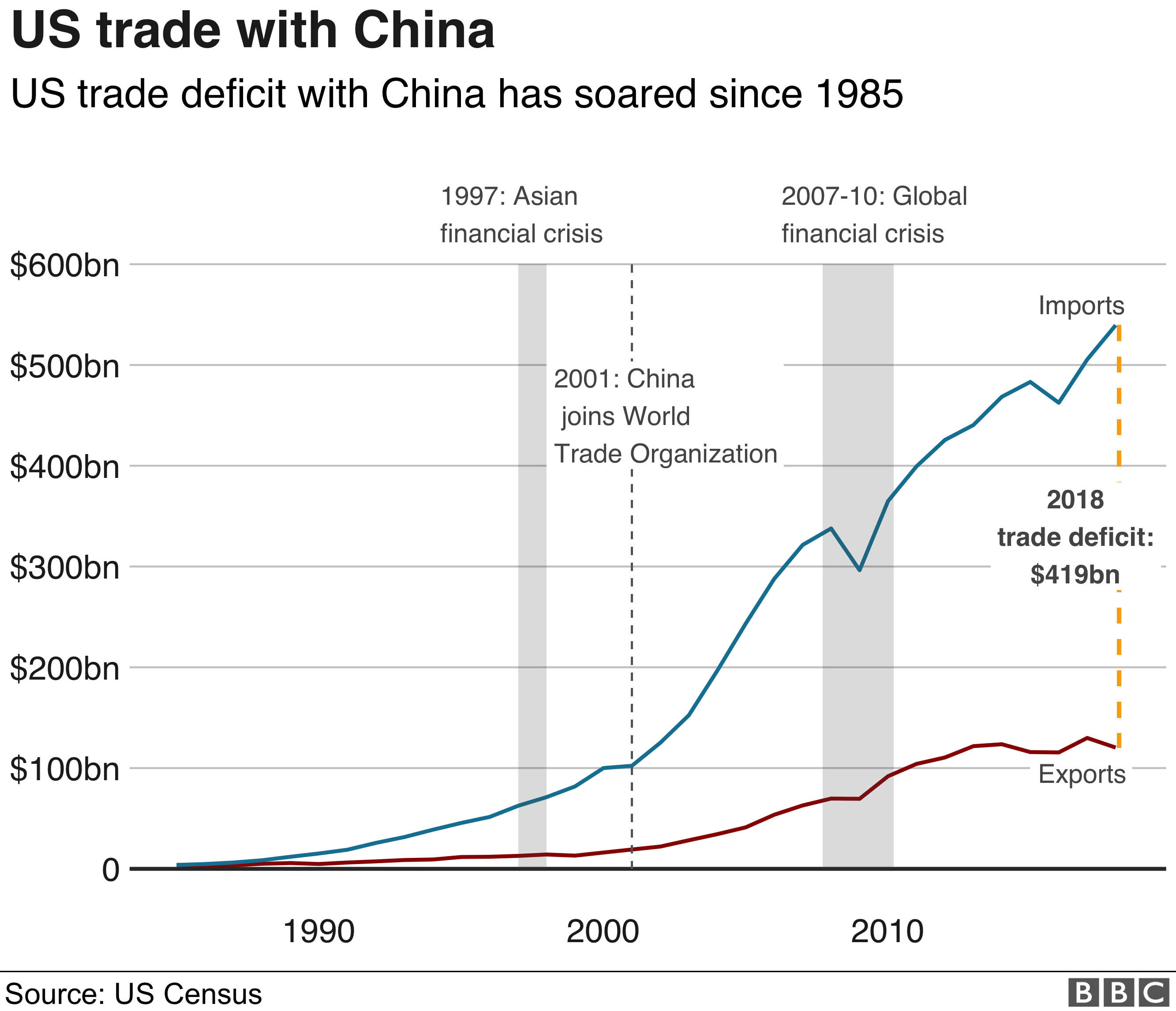

Understanding the 80% Tariff Threat

The hypothetical implementation of 80% tariffs on goods traded between the US and China represents a catastrophic escalation of the trade war. Such a dramatic increase would far surpass previous tariff levels and have devastating consequences for both economies. Imagine an 80% increase on imported electronics, impacting everything from smartphones to laptops. This isn't just a theoretical concern; economists have modeled potential scenarios.

The implications of an 80% tariff are far-reaching. Specific industries, such as technology and manufacturing, would be hit hardest. The technology sector, heavily reliant on components sourced from China, would face massive disruptions. The manufacturing sector, already struggling with global competition, would be further crippled by increased production costs. This would also significantly increase prices for consumers.

-

Retaliatory Tariffs: China is almost certain to retaliate with its own tariffs, triggering a tit-for-tat escalation that could cripple global trade. This cycle of retaliatory measures would only amplify the negative economic effects.

-

Economic Models: Numerous economic models predict a sharp contraction in global economic growth under an 80% tariff scenario. These models highlight decreased consumer spending, reduced business investment, and a significant decline in global trade.

-

Consequences:

- Increased consumer prices for imported goods.

- Reduced consumer spending due to higher prices.

- Severe supply chain disruptions, leading to shortages.

- Decreased corporate profits and potential bankruptcies.

- Widespread job losses across multiple sectors.

Sectors Most Vulnerable to 80% Tariffs

Several key sectors would be disproportionately affected by 80% tariffs. Their reliance on trade with China makes them particularly vulnerable to the consequences.

-

Technology: The semiconductor industry and consumer electronics manufacturers are heavily reliant on Chinese components and manufacturing. Companies like Apple, reliant on Chinese manufacturing, would face immediate pressure. A significant increase in tariffs would drive up the cost of production, potentially impacting profitability and competitiveness.

-

Agriculture: US agricultural exports, particularly soybeans and pork, are highly dependent on the Chinese market. An 80% tariff would effectively shut down a major export channel, leading to significant losses for US farmers.

-

Retail: The retail sector, heavily dependent on imported goods from China, would see a dramatic rise in prices for clothing, electronics, and various consumer products. This would reduce consumer purchasing power and negatively impact sales.

-

Examples of Impacted Companies: Specific companies within these sectors would suffer severely. The impact would vary depending on the degree of reliance on Chinese imports and the ability to diversify supply chains.

Current Stock Market Reactions to Trade Tensions

Recent market trends clearly demonstrate the link between US-China trade negotiations and stock market volatility. Announcements of new tariffs or escalations in trade tensions have consistently led to market downturns.

-

Key Indices: The Dow Jones Industrial Average, S&P 500, and Nasdaq have all shown significant fluctuations in response to trade war developments. Sharp declines have been observed following major tariff announcements.

-

Volatility Index (VIX): The VIX, a measure of market volatility, spikes dramatically during periods of heightened trade tension, reflecting investor anxiety. Higher VIX readings indicate increased uncertainty and risk aversion.

-

Sector-Specific Declines: Industries most exposed to the trade war, such as technology and agriculture, have experienced sharper declines than other sectors.

-

Investor Sentiment: Negative investor sentiment, fueled by uncertainty surrounding the trade war, plays a crucial role in driving down stock prices. Confidence is key to a healthy stock market, and the trade war is severely eroding it. (Include charts and graphs here visually representing market fluctuations correlated to trade news)

Strategies for Navigating Market Uncertainty

While the potential impact of an 80% tariff is alarming, investors can take steps to mitigate risks during this period of heightened trade tension.

-

Diversification: Diversifying your investment portfolio across different asset classes (stocks, bonds, real estate) and geographical regions is crucial to reduce risk. Don't put all your eggs in one basket.

-

Defensive Stocks: Consider shifting some investments towards defensive stocks, companies less susceptible to economic downturns. These typically include consumer staples and utility companies.

-

Monitor Geopolitical News: Stay informed about developments in the US-China trade war. Closely following news and analyses can help you anticipate market movements.

-

Financial Advisor: Consult with a qualified financial advisor for personalized guidance on managing your investments during this period of uncertainty.

Conclusion

The US-China trade war presents significant risks to the global economy, and the potential implementation of an 80% tariff would be devastating for the stock market. Specific sectors like technology, agriculture, and retail are particularly vulnerable. Informed investment decisions are crucial during this time of uncertainty. Continuous monitoring of trade developments and their implications for market performance is essential.

Stay informed about the US-China trade war and its impact on the stock market. Learn more about mitigating risks related to the US-China trade war and 80% tariff implications by [link to relevant resource, e.g., financial news website].

Featured Posts

-

Suri Cruises Birth Tom Cruises Unconventional Response

May 11, 2025

Suri Cruises Birth Tom Cruises Unconventional Response

May 11, 2025 -

Mackenzie Mc Kees Pregnancy Announcement A New Baby With Khesanio Hall

May 11, 2025

Mackenzie Mc Kees Pregnancy Announcement A New Baby With Khesanio Hall

May 11, 2025 -

Impact Of A Thomas Mueller Departure Bayern Munichs Response And Future Plans

May 11, 2025

Impact Of A Thomas Mueller Departure Bayern Munichs Response And Future Plans

May 11, 2025 -

Senior Calendar Trips Activities And Events

May 11, 2025

Senior Calendar Trips Activities And Events

May 11, 2025 -

National Fallen Firefighters Memorial Fremont Firefighter Tribute

May 11, 2025

National Fallen Firefighters Memorial Fremont Firefighter Tribute

May 11, 2025