US Credit Downgrade: Live Updates On Dow Futures And Dollar

Table of Contents

Understanding the US Credit Downgrade

Credit rating agencies like Fitch, Moody's, and S&P play a crucial role in assessing the creditworthiness of governments and corporations. Their ratings influence borrowing costs and investor confidence. The recent downgrade of the US credit rating, for example from AAA to AA+, by Fitch Ratings, is a significant event. This downgrade, primarily attributed to the debt ceiling crisis and recurring political gridlock, reflects concerns about the US government's fiscal management and long-term debt sustainability.

- Impact of Downgrade on Borrowing Costs: A lower credit rating increases borrowing costs for the US government, meaning higher interest payments on its debt, potentially leading to increased budget deficits.

- Impact on Investor Confidence and Foreign Investment: A downgrade erodes investor confidence, potentially leading to capital flight and reduced foreign investment in US assets. This can negatively impact economic growth.

- Historical Precedents: Historical precedents show that credit rating downgrades, while not always immediately catastrophic, often lead to increased market volatility and can trigger long-term economic consequences depending on the context and the government's response.

Impact on Dow Futures

The announcement of the US credit downgrade triggered an immediate and significant reaction in Dow futures. We witnessed increased volatility, with Dow futures experiencing a sharp decline initially. While the market has shown some signs of recovery, the potential for further declines or rebounds remains substantial. The situation requires continuous monitoring.

- Dow Futures Movement: [Insert chart illustrating Dow futures movement before and after the downgrade announcement]. The chart clearly shows the immediate impact of the news.

- Expert Opinions: Many financial experts predict continued volatility in Dow futures, with opinions varying on the extent and duration of the market's response. Some foresee a deeper correction while others anticipate a relatively quick rebound.

- Correlation Analysis: The correlation between Dow futures and the US credit rating is strong, with downgrades typically leading to negative pressure on stock markets.

Impact on the US Dollar

The US dollar's initial response to the downgrade was mixed. While some anticipated a weakening of the dollar, the actual impact has been more nuanced, influenced by various global economic factors. The potential for further strengthening or weakening depends heavily on how investors perceive the long-term implications of the downgrade.

- Dollar Index Movement: [Insert chart showing the dollar index movement in relation to the downgrade news]. This illustrates the initial market reaction and subsequent fluctuations.

- Dollar's Value and US Creditworthiness: The US dollar's value is intrinsically linked to the perceived creditworthiness of the US economy. A downgrade diminishes this perception, potentially impacting its international standing as a reserve currency.

- Impact on Forex Trading Strategies: The uncertainty created by the downgrade necessitates a cautious approach to forex trading. Traders need to adapt their strategies based on real-time market developments and expert analysis.

Strategies for Investors and Traders

Navigating the market volatility triggered by the US credit downgrade requires a strategic approach. Investors and traders need to adapt their portfolios and employ risk mitigation techniques.

- Diversification Strategies: Diversifying investments across different asset classes (stocks, bonds, real estate, etc.) can help reduce overall portfolio risk.

- Hedging Strategies: Employing hedging strategies like options trading can help protect against potential market downturns.

- Investment Opportunities: Some sectors, considered less sensitive to credit rating changes, might present investment opportunities during this period. Thorough research is critical.

Conclusion

The US credit downgrade presents a considerable challenge to the US economy and global financial markets. The impact is clearly reflected in the volatility of Dow futures and fluctuations in the US dollar. Investors and traders must carefully analyze the evolving situation and adapt their strategies accordingly. This requires constant monitoring of market trends and a proactive approach to risk management.

Call to Action: Stay informed about the ongoing developments surrounding the US credit downgrade. Monitor live updates on Dow futures and the dollar to make informed investment decisions. Regularly check this site for the latest information on the US credit downgrade and its market consequences. Understanding the implications of this US credit downgrade is crucial for navigating the current market volatility.

Featured Posts

-

Unbelievable Long Standing Peppa Pig Question Finally Answered

May 21, 2025

Unbelievable Long Standing Peppa Pig Question Finally Answered

May 21, 2025 -

Juergen Klopp Un Doenuesue Duenya Devi Nin Yeni Teknik Direktoerue

May 21, 2025

Juergen Klopp Un Doenuesue Duenya Devi Nin Yeni Teknik Direktoerue

May 21, 2025 -

Market Reaction To D Wave Quantum Qbts News Thursdays Stock Drop

May 21, 2025

Market Reaction To D Wave Quantum Qbts News Thursdays Stock Drop

May 21, 2025 -

Wtt Chennai Arunas Tournament Ends Prematurely

May 21, 2025

Wtt Chennai Arunas Tournament Ends Prematurely

May 21, 2025 -

Migrant Hotel Fire Comments Tory Councillors Wife Pleads Not Guilty To Incitement

May 21, 2025

Migrant Hotel Fire Comments Tory Councillors Wife Pleads Not Guilty To Incitement

May 21, 2025

Latest Posts

-

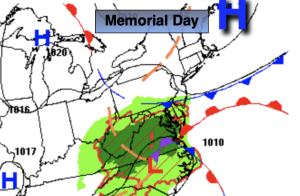

Mild Temperatures And Little Rain Chance A Perfect Week Ahead

May 21, 2025

Mild Temperatures And Little Rain Chance A Perfect Week Ahead

May 21, 2025 -

Scott Savilles Dedication Years Of Cycling Ragbrai And Daily Rides

May 21, 2025

Scott Savilles Dedication Years Of Cycling Ragbrai And Daily Rides

May 21, 2025 -

Understanding Breezy And Mild Weather Patterns A Practical Overview

May 21, 2025

Understanding Breezy And Mild Weather Patterns A Practical Overview

May 21, 2025 -

Planning Your Week Expect Mild Temperatures And Little Rain Chance

May 21, 2025

Planning Your Week Expect Mild Temperatures And Little Rain Chance

May 21, 2025 -

Breezy And Mild Destinations Where To Find The Perfect Climate

May 21, 2025

Breezy And Mild Destinations Where To Find The Perfect Climate

May 21, 2025