US IPO Filing: Klarna Reports Significant Revenue Growth

Table of Contents

Klarna's Revenue Growth Figures and Analysis

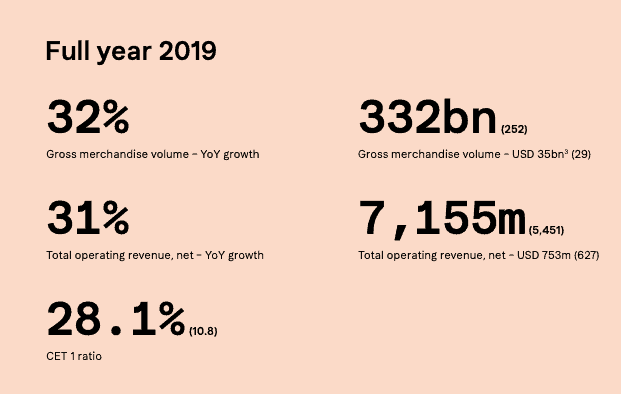

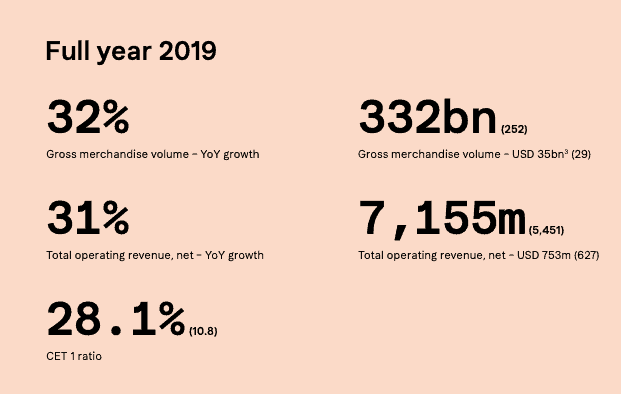

Klarna's US IPO filing showcased remarkable revenue growth. While specific figures may vary slightly depending on the final prospectus, early reports indicate substantial year-over-year increases. This explosive growth can be attributed to several key factors, including a rapidly expanding user base, successful expansion into new markets (particularly the US), and strategic partnerships with major retailers.

- Total revenue for [Year]: [Insert projected or reported revenue figure here]. This represents a [Insert percentage]% increase compared to [Previous Year]. (Replace bracketed information with actual data from the filing.)

- Growth percentage in key market segments: The US market has shown particularly strong growth, exceeding [Insert percentage]% year-over-year. European markets also contributed significantly, with growth rates of [Insert percentage]%.

- Contribution from different revenue streams: Klarna's revenue is diversified across transaction fees, merchant services, and other revenue streams. The specific breakdown will be detailed in the final IPO filing. However, the strong growth across all segments points to a robust and resilient business model.

Key Factors Contributing to Klarna's Success

Klarna's phenomenal success isn't accidental. The rise of BNPL as a preferred payment method is a key driver, offering consumers flexible payment options and retailers an attractive alternative to traditional financing. Klarna has further capitalized on this trend through:

- Strong brand recognition and marketing campaigns: Klarna has invested heavily in building a strong brand identity and reaching a broad consumer base through targeted marketing.

- Seamless user experience and mobile app: The user-friendly platform and mobile app make the BNPL process incredibly convenient, contributing to high user engagement and adoption rates.

- Strategic partnerships with major retailers: Collaborations with leading retailers have broadened Klarna's reach and solidified its position as a preferred payment option for millions of consumers.

- Expansion into new markets and product offerings: Klarna's strategic expansion into new geographical markets and the introduction of new financial products demonstrates its commitment to growth and innovation.

Challenges and Risks Mentioned in the IPO Filing

While Klarna's growth is undeniably impressive, the IPO filing also acknowledges potential challenges and risks inherent in the BNPL market:

- Increased competition in the BNPL market: The BNPL space is becoming increasingly crowded, with new entrants vying for market share.

- Regulatory scrutiny and potential changes in legislation: Government regulations regarding BNPL services are evolving, and changes in legislation could impact Klarna's operations.

- Risk of high default rates among users: The inherent risk of consumer defaults is a significant concern, particularly during periods of economic uncertainty.

- Economic uncertainty and its impact on consumer spending: Economic downturns can negatively impact consumer spending and increase default rates, posing a risk to Klarna's profitability.

Implications of Klarna's IPO for the Fintech Industry

Klarna's IPO is a watershed moment for the Fintech industry. Its valuation will significantly influence the valuation of other BNPL companies and attract further investment into the sector.

- Increased investor interest in BNPL companies: Klarna's successful IPO will likely trigger a wave of investment in other BNPL firms.

- Potential for further consolidation in the Fintech industry: The IPO may lead to mergers and acquisitions within the Fintech space, shaping the landscape for years to come.

- Impact on traditional financial institutions: The growth of BNPL poses a challenge to traditional financial institutions, forcing them to adapt and innovate to remain competitive.

Conclusion: The Future of Klarna and the US IPO

Klarna's significant revenue growth, as revealed in its US IPO filing, demonstrates the company's strong position in the rapidly expanding BNPL market. The successful completion of its US IPO will undoubtedly be a pivotal moment, influencing the entire Fintech landscape. While challenges exist, Klarna's innovative approach, strategic partnerships, and strong brand recognition position it for continued growth. Stay tuned for updates on Klarna's US IPO and its continued impact on the Fintech landscape. Learn more about the implications of Klarna's impressive revenue growth and its upcoming US IPO to stay ahead in the dynamic world of financial technology.

Featured Posts

-

Mlb Power Rankings Winners And Losers At The 30 Game Mark 2025

May 14, 2025

Mlb Power Rankings Winners And Losers At The 30 Game Mark 2025

May 14, 2025 -

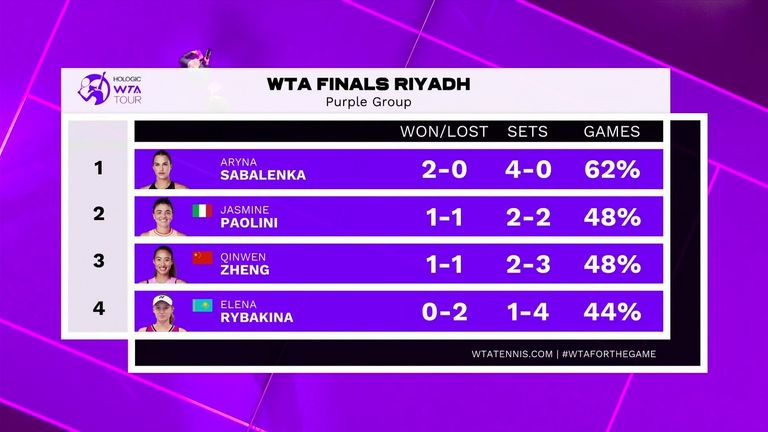

Dubai Tennis Sabalenka Defeats Paolini Ending Reign

May 14, 2025

Dubai Tennis Sabalenka Defeats Paolini Ending Reign

May 14, 2025 -

Disneys Snow White Bombs At The Box Office Worst Opening Ever

May 14, 2025

Disneys Snow White Bombs At The Box Office Worst Opening Ever

May 14, 2025 -

Two Week Trial Ends For Raducanus New Coach

May 14, 2025

Two Week Trial Ends For Raducanus New Coach

May 14, 2025 -

Six Premier League Clubs Including Man Utd Target Sunderland Ace

May 14, 2025

Six Premier League Clubs Including Man Utd Target Sunderland Ace

May 14, 2025

Latest Posts

-

Wynonna And Ashley Judd Open Up About Family In Powerful Docuseries

May 14, 2025

Wynonna And Ashley Judd Open Up About Family In Powerful Docuseries

May 14, 2025 -

Untold Judd Family Stories Wynonna And Ashleys New Docuseries

May 14, 2025

Untold Judd Family Stories Wynonna And Ashleys New Docuseries

May 14, 2025 -

The Judd Family A Docuseries Unveiling Untold Stories

May 14, 2025

The Judd Family A Docuseries Unveiling Untold Stories

May 14, 2025 -

Wynonna Judd And Ashley Judd A Family Docuseries Reveals Untold Stories

May 14, 2025

Wynonna Judd And Ashley Judd A Family Docuseries Reveals Untold Stories

May 14, 2025 -

Judd Sisters Docuseries Revealing Family History And Heartache

May 14, 2025

Judd Sisters Docuseries Revealing Family History And Heartache

May 14, 2025