US Money Management Under Scrutiny Following $65 Billion Dutch Investment

Table of Contents

The Scale and Significance of the Dutch Investment

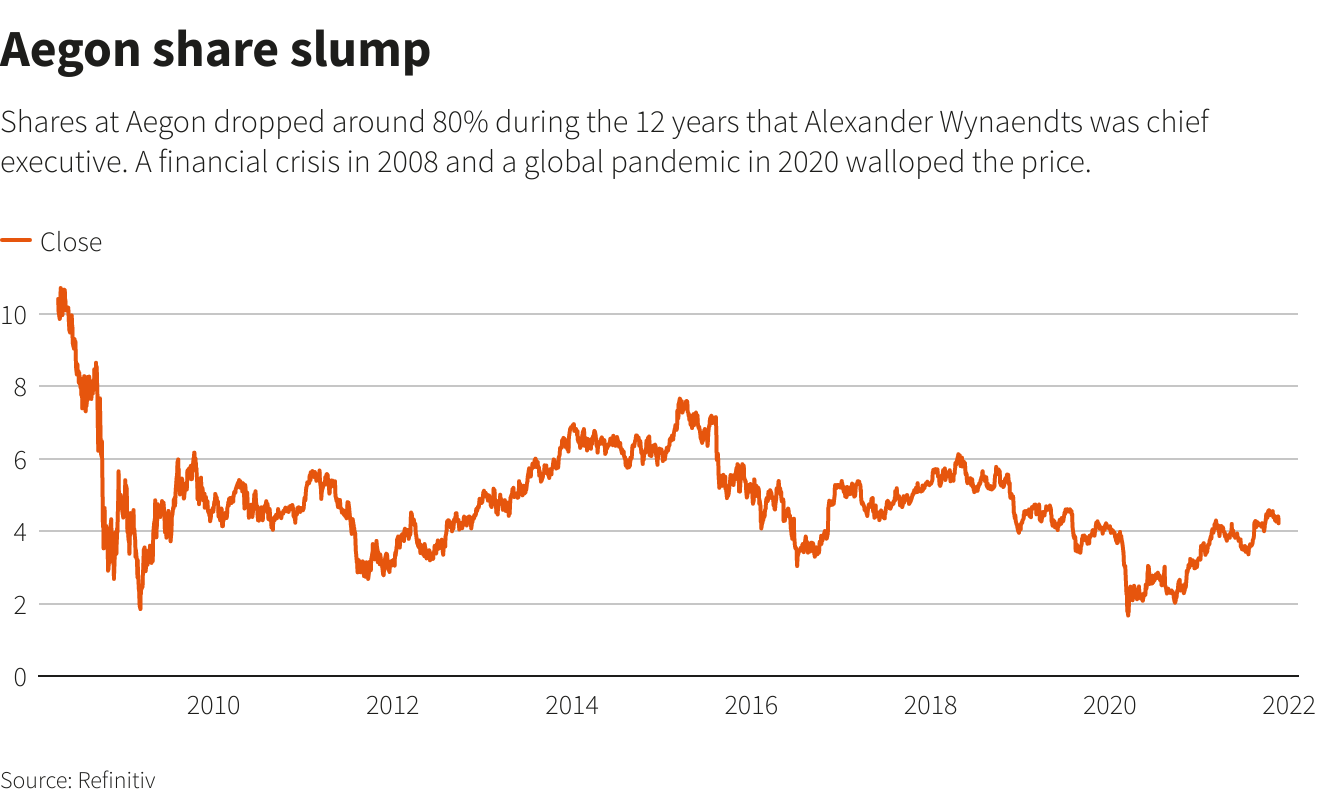

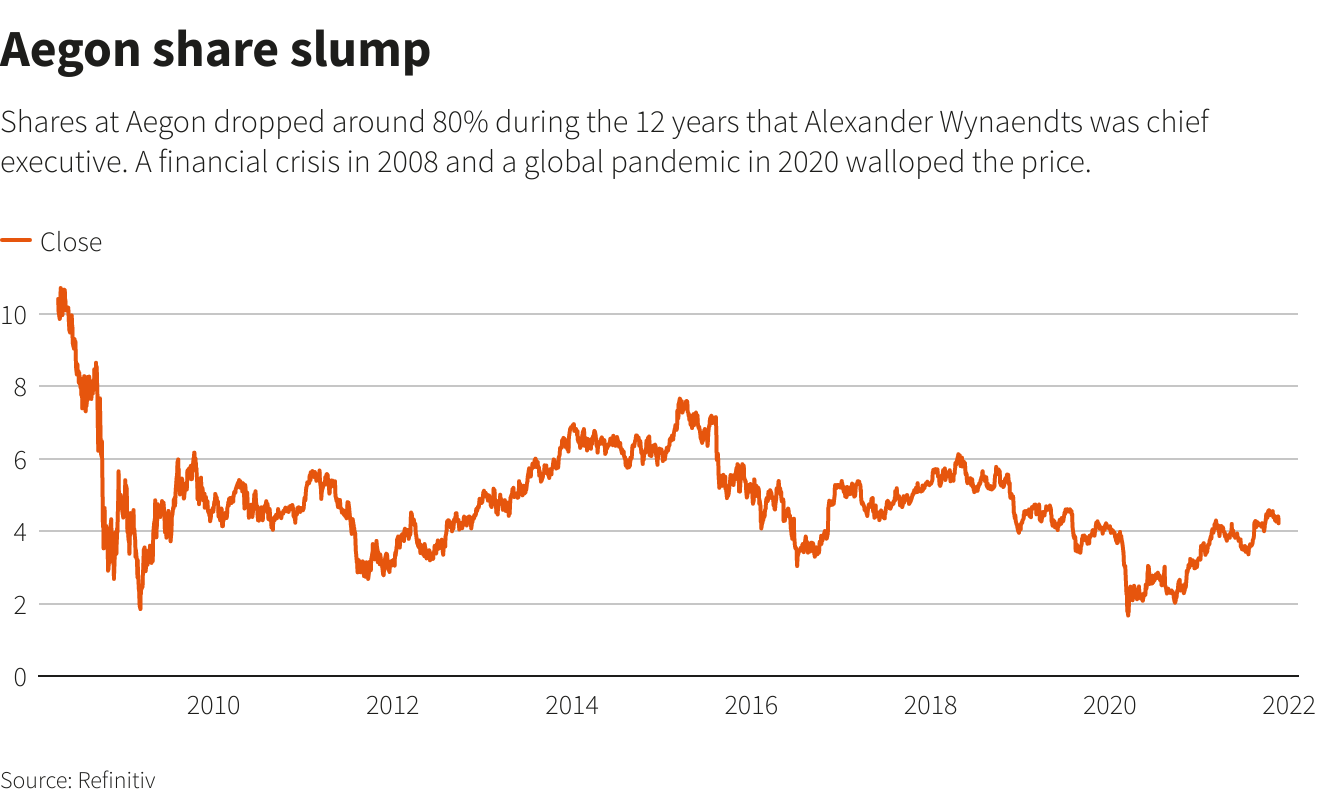

The sheer scale of the $65 billion Dutch investment is undeniably significant. This represents a substantial portion of the US financial markets, potentially impacting various sectors and influencing economic indicators. The precise details of the investors and their specific strategies remain somewhat opaque, with information trickling out gradually through official channels and financial news outlets. However, initial reports suggest a diversified approach.

- Specific sectors targeted: While specific target sectors haven't been fully disclosed, analysts speculate that significant portions of the investment are directed towards technology, renewable energy, and infrastructure development. This targeted approach points towards a long-term growth strategy.

- Motives behind the investment: The motives are likely multifaceted, encompassing long-term growth prospects in the US economy, diversification of the investor's portfolio, and perhaps strategic acquisitions to gain a foothold in key American markets. Further analysis is needed to fully understand the strategic motivations behind this significant financial maneuver.

- Comparison to previous large-scale foreign investments: This investment dwarfs many previous large-scale foreign investments in the US, highlighting the growing interest from international players in the American market and potentially signaling a shift in global financial power dynamics.

Increased Scrutiny of US Money Management Practices

The massive Dutch investment has intensified public and regulatory scrutiny of US money management. The sheer size of the transaction has raised questions about the effectiveness and transparency of existing regulatory frameworks and the potential vulnerabilities within the US financial system. Concerns are now being voiced about potential conflicts of interest and the need for more robust oversight.

- Concerns about transparency and accountability: The investment has highlighted concerns about transparency and accountability within some US financial institutions. Critics argue that a lack of complete disclosure regarding investment strategies raises questions about potential conflicts of interest and the need for greater regulatory oversight.

- Potential regulatory responses: Regulatory bodies are likely to respond with increased scrutiny and potential changes to existing financial regulations. This could involve more stringent reporting requirements for large foreign investments, stricter oversight of financial institutions, and potentially even new legislation aimed at improving transparency and accountability in the US financial system.

- Increased public debate: The investment has ignited a heated public debate about the effectiveness of current US money management strategies. Questions are being raised about whether existing strategies adequately protect against significant risks and whether reforms are needed to adapt to the changing global financial landscape.

Potential Economic and Political Ramifications

The economic consequences of this $65 billion investment are complex and far-reaching. While it could stimulate economic growth in targeted sectors, it also poses potential risks. The political implications are equally significant, impacting relations between the US and the Netherlands and sparking debates about national security and foreign investment policy.

- Impact on inflation and interest rates: Such a large investment could potentially fuel inflation, increasing pressure on the Federal Reserve to adjust interest rates.

- Influence on US employment and job creation: Depending on the sectors targeted, the investment could significantly impact US employment. However, this effect may not be uniformly positive across all sectors of the economy.

- Potential for increased political tension: Although unlikely to cause major diplomatic friction, the investment could raise political discussions about the influence of foreign capital in the US economy and the need for policies to safeguard national interests.

Responses from US Financial Institutions and Regulators

The response from US financial institutions and regulators to the Dutch investment has been varied. Some institutions have welcomed the investment as a sign of confidence in the US economy, while others have expressed concerns about its potential impact. Regulators have initiated reviews and investigations to ensure compliance with existing regulations and identify any potential vulnerabilities in the system.

- Statements from major financial institutions: Major financial institutions have issued public statements expressing cautious optimism, highlighting the potential economic benefits of the investment while acknowledging the need for careful monitoring and risk management.

- Regulatory reviews and investigations: Several regulatory bodies have initiated reviews and investigations to assess the implications of the investment and ensure compliance with existing financial regulations.

- Potential changes to existing financial regulations: The investment may lead to a reassessment of existing financial regulations, with potential changes aimed at improving transparency, accountability, and oversight of large foreign investments.

Conclusion: The Future of US Money Management in Light of the Dutch Investment

The $65 billion Dutch investment has undeniably placed US money management practices under a microscope. The scale of this investment necessitates a thorough review of current strategies and regulatory frameworks. The potential long-term consequences for the US economy and financial system are significant and far-reaching, requiring careful monitoring and proactive responses from both financial institutions and regulatory bodies. Stay informed about the evolving landscape of US money management and the ramifications of this landmark investment. Understanding these complex financial issues is crucial for navigating the future. The ongoing debate surrounding this massive influx of capital will undoubtedly shape the future of US money management for years to come, requiring careful consideration of both its opportunities and risks.

Featured Posts

-

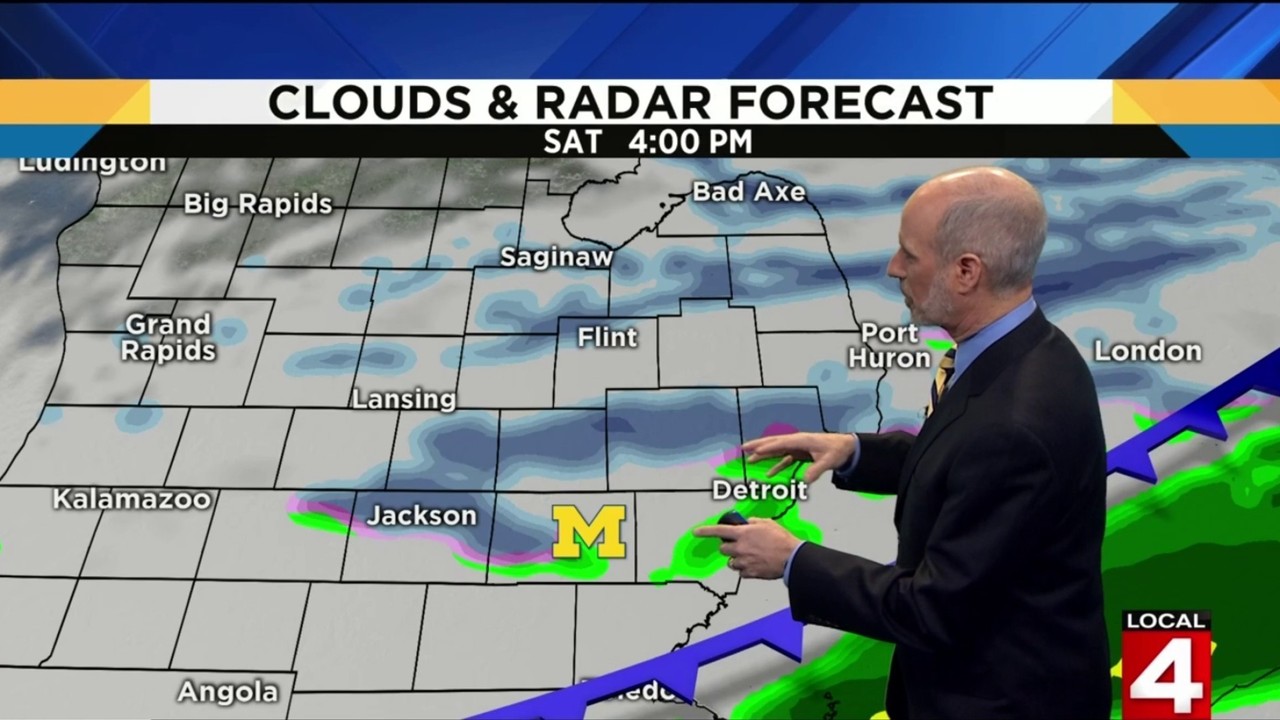

Metro Detroit Weather Update Cool Monday Morning Sunny Afternoon

May 28, 2025

Metro Detroit Weather Update Cool Monday Morning Sunny Afternoon

May 28, 2025 -

Kemenangan Dramatis Psv Kampiun Liga Belanda Setelah Bungkam Sparta Rotterdam

May 28, 2025

Kemenangan Dramatis Psv Kampiun Liga Belanda Setelah Bungkam Sparta Rotterdam

May 28, 2025 -

Changes To Rent Control How New Regulations Affect Tenants Rights

May 28, 2025

Changes To Rent Control How New Regulations Affect Tenants Rights

May 28, 2025 -

Hugh Jackman And The Avengers Doomsday A Big Question Remains

May 28, 2025

Hugh Jackman And The Avengers Doomsday A Big Question Remains

May 28, 2025 -

Roland Garros 2025 Draw Fate Decided For Raducanu Draper And Djokovic

May 28, 2025

Roland Garros 2025 Draw Fate Decided For Raducanu Draper And Djokovic

May 28, 2025

Latest Posts

-

Canelo Vs Golovkin Ppv Fight Time Full Card And Where To Watch

May 31, 2025

Canelo Vs Golovkin Ppv Fight Time Full Card And Where To Watch

May 31, 2025 -

Fatal Fury Boxing Mays Must See Riyadh Fight Night

May 31, 2025

Fatal Fury Boxing Mays Must See Riyadh Fight Night

May 31, 2025 -

Full Canelo Vs Golovkin Fight Card Start Time And Ppv Details

May 31, 2025

Full Canelo Vs Golovkin Fight Card Start Time And Ppv Details

May 31, 2025 -

Canelo Vs Golovkin When Does The Fight Start Full Ppv Card And Details

May 31, 2025

Canelo Vs Golovkin When Does The Fight Start Full Ppv Card And Details

May 31, 2025 -

Astrological Predictions For May 27 2025 By Christine Haas

May 31, 2025

Astrological Predictions For May 27 2025 By Christine Haas

May 31, 2025