US Tariffs And The Copper Industry: Tongling's Perspective

Table of Contents

The Impact of US Tariffs on Copper Prices and Demand

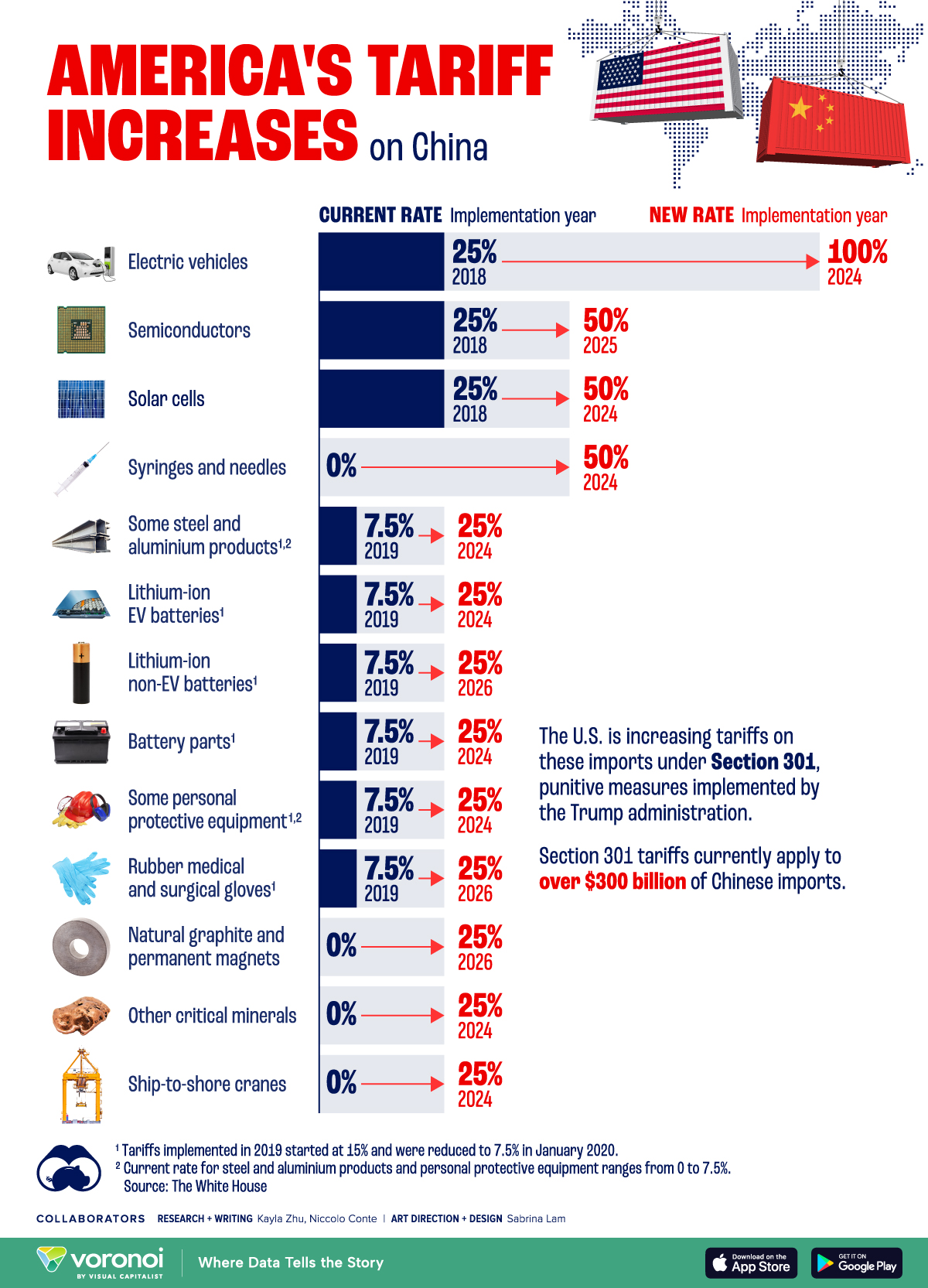

US tariffs on copper have created considerable instability in the global copper market, directly impacting Tongling's operations. This section analyzes the resulting price volatility and reduced demand from the US market.

Price Volatility and Market Fluctuations

US tariffs have introduced increased uncertainty, leading to significant price fluctuations in the copper market. This volatility makes it challenging for companies like Tongling to accurately predict future prices and manage their financial risks effectively.

- Increased uncertainty for investors: Fluctuating copper prices make investment decisions more risky, potentially deterring investment in the industry.

- Impact on hedging strategies: Traditional hedging techniques become less effective in the face of unpredictable price swings caused by tariff-related market disruptions.

- Price speculation: The uncertainty generates opportunities for speculation, further exacerbating price volatility.

(Insert chart or graph here illustrating copper price fluctuations before and after tariff implementation. Source should be clearly cited.) For example, data from the London Metal Exchange (LME) could be used to illustrate these fluctuations. The impact of these price swings on Tongling’s profitability should be discussed, if data is available.

Reduced Demand from the US Market

The tariffs have led to a decrease in US demand for imported copper, directly impacting Tongling’s export strategies and overall sales.

- Loss of market share: Tongling, like other global copper producers, has experienced a reduction in its market share in the US due to the increased cost of imported copper.

- Diversification efforts: In response, Tongling has actively sought to diversify its customer base, focusing on expanding into markets less affected by US tariffs.

- Exploring new markets in Asia and Europe: The company has invested in strengthening its presence in rapidly growing Asian and European markets to compensate for reduced US demand.

(Include statistics illustrating the decrease in US copper imports and its effect on Tongling’s sales figures. Source should be clearly cited.) Data from sources like the US Census Bureau or industry reports could be utilized.

Adapting Supply Chains and Sourcing Strategies

To mitigate the negative impact of US tariffs, Tongling has undertaken significant changes to its supply chain and sourcing strategies.

Diversification of Raw Material Sources

Tongling has actively diversified its sources of raw materials to reduce its reliance on US-sourced copper and minimize the impact of tariffs.

- Sourcing from Chile, Peru, Zambia, and other countries: The company has expanded its sourcing network to include various geographically diverse locations, ensuring a more stable supply.

- Strengthening relationships with global suppliers: Developing strong relationships with suppliers worldwide ensures access to raw materials even during periods of market instability.

- Securing long-term contracts: Negotiating long-term contracts with suppliers helps to mitigate price fluctuations and secure a reliable supply of raw materials.

Restructuring Global Operations

Tongling has also adjusted its global production and distribution network to better respond to the challenges posed by the US tariffs.

- Investment in new facilities in other regions: The company has invested in building new facilities in strategic locations outside the US to better serve its global customer base.

- Optimizing logistics: Improving logistics and transportation networks has helped to minimize delays and reduce costs associated with the changing trade landscape.

- Improving supply chain efficiency: Implementing advanced technologies and streamlining processes has improved overall supply chain efficiency and resilience.

Tongling's Strategic Responses and Future Outlook

Tongling’s response to the US tariffs demonstrates a proactive approach to navigating the complexities of global trade. This section highlights Tongling's investment in research and development, exploration of new markets, and the role of government support.

Investment in Research and Development

To reduce reliance on imported materials and enhance competitiveness, Tongling is investing heavily in research and development.

- Development of high-performance copper materials: R&D efforts focus on creating innovative copper alloys with superior properties, potentially reducing dependence on specific sources.

- Exploration of substitute materials: Research is being conducted into alternative materials that could replace copper in certain applications, further diversifying the company's offerings.

- Technological advancements: Investing in advanced technologies can help improve efficiency and reduce costs, enhancing competitiveness in the global market.

Exploring New Market Opportunities

Tongling is actively pursuing new market opportunities to compensate for reduced US demand.

- Focus on emerging economies: The company is concentrating on emerging economies with strong growth potential in the copper industry.

- Partnerships with local companies: Collaborating with local companies in these markets facilitates market entry and strengthens local presence.

- Adaptation to regional market demands: Tongling is tailoring its products and services to meet the specific needs and preferences of various regional markets.

Government Support and Policy Influence

The Chinese government's policies have played a significant role in supporting Tongling's adaptation to the changing trade environment.

- Subsidies: Government subsidies may have helped offset some of the costs associated with diversifying operations and exploring new markets.

- Export incentives: Export incentives may have been crucial in supporting Tongling's efforts to expand its presence in international markets.

- Trade negotiations: The Chinese government's involvement in trade negotiations has helped to create a more favorable trade environment for companies like Tongling.

Conclusion

The US tariffs on copper have presented significant challenges to Tongling, impacting pricing, supply chains, and overall market dynamics. However, Tongling has responded effectively by diversifying its sources, optimizing its operations, and exploring new market opportunities. These strategic adaptations highlight the company's resilience and its ability to navigate complex geopolitical landscapes. Understanding the intricacies of US tariffs and their impact on the copper industry, as illustrated through Tongling’s experience, is crucial for all stakeholders. Further research into the evolving impact of US Tariffs Copper Industry Tongling is vital for navigating the future of global copper trade.

Featured Posts

-

A Look Into The Lives Of Chalet Girls In Europes Exclusive Ski Destinations

Apr 23, 2025

A Look Into The Lives Of Chalet Girls In Europes Exclusive Ski Destinations

Apr 23, 2025 -

Retail Giants Walmart And Target Confront Trump Over Tariffs

Apr 23, 2025

Retail Giants Walmart And Target Confront Trump Over Tariffs

Apr 23, 2025 -

Ontarios Internal Trade Reform Removing Barriers To Alcohol And Labour Mobility

Apr 23, 2025

Ontarios Internal Trade Reform Removing Barriers To Alcohol And Labour Mobility

Apr 23, 2025 -

Ftcs Case Against Meta Instagram Whats App And The Ongoing Legal Battle

Apr 23, 2025

Ftcs Case Against Meta Instagram Whats App And The Ongoing Legal Battle

Apr 23, 2025 -

Actualites Economiques Du 14 Avril Le Journal Du 18h Eco

Apr 23, 2025

Actualites Economiques Du 14 Avril Le Journal Du 18h Eco

Apr 23, 2025

Latest Posts

-

Dijon Concarneau 0 1 Resume Du Match National 2 28e Journee

May 10, 2025

Dijon Concarneau 0 1 Resume Du Match National 2 28e Journee

May 10, 2025 -

Uk Government Restricts Visa Access For Selected Nationalities

May 10, 2025

Uk Government Restricts Visa Access For Selected Nationalities

May 10, 2025 -

Resultat Dijon Concarneau 0 1 National 2 2024 2025 Journee 28

May 10, 2025

Resultat Dijon Concarneau 0 1 National 2 2024 2025 Journee 28

May 10, 2025 -

Updated Uk Visa Policy Impact Assessment For International Applicants

May 10, 2025

Updated Uk Visa Policy Impact Assessment For International Applicants

May 10, 2025 -

Uk Government Considers Stricter Visa Rules For Pakistani Students

May 10, 2025

Uk Government Considers Stricter Visa Rules For Pakistani Students

May 10, 2025