US Treasury Yields Hit 5%: Impact On Bond Sales And The Market

Table of Contents

Factors Contributing to the 5% US Treasury Yield

Several interconnected factors have contributed to the rise of US Treasury yields to 5%, a level not seen in many years. Understanding these drivers is crucial for navigating the current market environment.

Increased Federal Reserve Interest Rates

The Federal Reserve's aggressive campaign to combat inflation is a primary driver of higher US Treasury yields. The Fed's tightening of monetary policy, including multiple interest rate hikes and quantitative tightening (QT), directly impacts Treasury yields.

- The Fed's fight against inflation: Persistent inflation above the target rate necessitates higher interest rates to cool down the economy and curb price increases. This makes US Treasuries, which are seen as a safe haven asset, relatively more attractive, thereby increasing demand.

- Impact of quantitative tightening (QT): The Federal Reserve's QT program involves reducing its balance sheet by allowing Treasury bonds and mortgage-backed securities to mature without reinvestment. This reduces the supply of bonds in the market, pushing yields higher.

- Expectation of future rate increases: Market participants anticipate further interest rate increases from the Fed, which further contributes to the upward pressure on Treasury yields. These expectations are reflected in the yield curve, impacting both short-term and long-term yields. Related keywords: Federal Reserve policy, monetary policy, inflation rate, quantitative easing, yield curve.

Stronger US Dollar

The strength of the US dollar plays a significant role in influencing US Treasury yields.

- US dollar strength attracts foreign investment: A strong dollar makes US Treasuries more attractive to foreign investors, as the returns are enhanced when converted back to their home currencies. This increased foreign demand for US Treasuries pushes yields higher.

- Currency exchange rates: Fluctuations in currency exchange rates directly influence the attractiveness of US Treasuries to international investors. A stronger dollar generally leads to increased demand and higher yields. Related keywords: US dollar strength, foreign investment, currency exchange rates, international investors.

Increased Government Borrowing

The US government's substantial borrowing needs also contribute to the increase in Treasury yields.

- Government debt and budget deficit: The government needs to finance its budget deficit through the issuance of new Treasury bonds. This increased supply of bonds in the market can put downward pressure on bond prices and upward pressure on yields, especially if demand doesn't keep pace.

- Bond supply and demand: The relationship between the supply and demand for Treasury bonds is fundamental to yield determination. Increased supply without a corresponding rise in demand will lead to higher yields. Related keywords: government debt, budget deficit, bond supply and demand, treasury bond auctions.

Impact on Bond Sales and Investor Behavior

The rise in US Treasury yields has significant consequences for bond sales and how investors approach the market.

Decreased Demand for Existing Bonds

Higher yields generally lead to decreased demand for existing bonds.

- Inverse relationship between bond prices and yields: Bond prices and yields move inversely. As yields rise, bond prices fall, potentially leading to capital losses for investors holding existing bonds.

- Bond market volatility: The increase in US Treasury yields has introduced greater volatility into the bond market, making it more challenging for investors to predict price movements. Related keywords: bond prices, yield curve, capital loss, bond market volatility, interest rate risk.

Attractiveness of New Bond Issues

Conversely, the higher yields make new bond issues more attractive to investors seeking higher returns.

- Attractive yields for new bond issuers: Corporations and municipalities might find it more appealing to issue new bonds at higher yields to finance their projects.

- Implications for corporate bonds and municipal bonds: The rise in Treasury yields generally influences the yields offered on corporate bonds and municipal bonds, impacting the cost of borrowing for these entities. Related keywords: new bond issuance, corporate bonds, municipal bonds, bond underwriting, credit spreads.

Shift in Investment Strategies

Investors are likely to adjust their portfolios in response to the higher yields.

- Portfolio diversification: Investors may seek to diversify their portfolios by allocating more funds to higher-yielding bonds or alternative investments to maintain their desired risk-adjusted returns.

- Risk management: The rise in yields necessitates a re-evaluation of risk tolerance and investment strategies to manage potential capital losses. Related keywords: portfolio diversification, risk management, alternative investments, fixed income investments, asset allocation.

Broader Market Implications of 5% US Treasury Yields

The impact of 5% US Treasury yields extends far beyond the bond market, affecting various sectors of the economy.

Impact on Mortgage Rates

The rise in Treasury yields typically leads to higher mortgage rates.

- Mortgage rates and housing market: Higher mortgage rates make borrowing more expensive for homebuyers, which can cool down the housing market. The sensitivity of mortgage rates to Treasury yields can have a significant impact on housing affordability and activity. Related keywords: mortgage rates, housing market, interest rate sensitivity, housing affordability.

Effect on the Equity Market

Higher Treasury yields can negatively impact the equity market.

- Impact on corporate earnings: Increased borrowing costs for corporations can reduce profitability and affect future earnings, potentially impacting stock valuations.

- Investor sentiment: Higher yields may also lead to a shift in investor sentiment, as investors might favor the higher returns offered by bonds over equities, leading to lower stock prices. Related keywords: stock market, equity valuations, corporate earnings, investor sentiment, risk-free rate.

Global Economic Implications

The rise in US Treasury yields has global implications.

- Global capital flows: Changes in US Treasury yields can influence capital flows across borders, as investors seek higher returns or safer havens.

- Exchange rate volatility: The shift in capital flows can create exchange rate volatility, impacting global trade and economic stability. Related keywords: global capital flows, exchange rate volatility, international finance, global economic growth.

Conclusion

The rise of US Treasury yields to 5% signifies a pivotal moment in the financial landscape. This increase, driven by factors such as Federal Reserve policy, a strong dollar, and increased government borrowing, has significant implications for bond sales, investor behavior, and the broader economy. Understanding the interplay between these factors and their consequences is crucial for navigating the evolving market conditions. Staying informed about fluctuations in US Treasury yields is essential for making sound investment decisions in the current environment. Continuously monitor the US Treasury yields and their impact on your portfolio.

Featured Posts

-

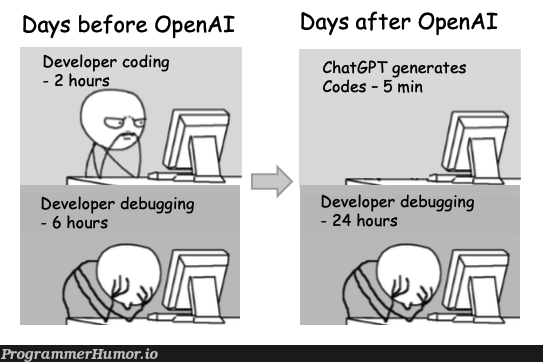

Ai Coding Agent Integrated Into Chat Gpt Streamlined Software Development

May 20, 2025

Ai Coding Agent Integrated Into Chat Gpt Streamlined Software Development

May 20, 2025 -

Inside Michael Strahans Interview Strategy Navigating The Ratings War

May 20, 2025

Inside Michael Strahans Interview Strategy Navigating The Ratings War

May 20, 2025 -

Milica Milsa Na Sahrani Andelke Milivojevic Tadic Suze I Secanje

May 20, 2025

Milica Milsa Na Sahrani Andelke Milivojevic Tadic Suze I Secanje

May 20, 2025 -

Manchester Uniteds Pursuit Of Top Striker Heats Up Agent In Talks

May 20, 2025

Manchester Uniteds Pursuit Of Top Striker Heats Up Agent In Talks

May 20, 2025 -

Asheville Rising Helene Special Gmas Ginger Zee Visits Wlos

May 20, 2025

Asheville Rising Helene Special Gmas Ginger Zee Visits Wlos

May 20, 2025

Latest Posts

-

Paulina Gretzkys Rare Public Outing With Husband Dustin Johnson

May 20, 2025

Paulina Gretzkys Rare Public Outing With Husband Dustin Johnson

May 20, 2025 -

Wayne Gretzkys Daughter Paulina Play Date Outfit In A Mini Dress

May 20, 2025

Wayne Gretzkys Daughter Paulina Play Date Outfit In A Mini Dress

May 20, 2025 -

Sofrep Evening Brief Key Developments Yemen Missile Russia Amnesty Conflict

May 20, 2025

Sofrep Evening Brief Key Developments Yemen Missile Russia Amnesty Conflict

May 20, 2025 -

Russia Bans Amnesty International Yemen Missile Intercept Todays Sofrep Evening Brief

May 20, 2025

Russia Bans Amnesty International Yemen Missile Intercept Todays Sofrep Evening Brief

May 20, 2025 -

Sofrep Evening Brief Israel Yemen Missile Intercept Russia Bans Amnesty International

May 20, 2025

Sofrep Evening Brief Israel Yemen Missile Intercept Russia Bans Amnesty International

May 20, 2025