Vodacom (VOD) Q[Quarter Number] Earnings Surpass Expectations

![Vodacom (VOD) Q[Quarter Number] Earnings Surpass Expectations Vodacom (VOD) Q[Quarter Number] Earnings Surpass Expectations](https://wjuc2010.de/image/vodacom-vod-q-quarter-number-earnings-surpass-expectations.jpeg)

Table of Contents

Revenue Growth and Key Performance Indicators

Vodacom's Q3 results showcased significant growth across various key performance indicators (KPIs), exceeding expectations and solidifying its position as a leading telecom player in South Africa and beyond.

-

Significant Revenue Increase: Total revenue experienced a substantial increase compared to both Q2 and Q3 of the previous year. This demonstrates a consistent upward trend in the company's financial performance. Precise figures will be detailed in the official earnings report but early indications suggest a double-digit percentage growth.

-

Booming Data Revenue: A key driver of this growth was the strong performance in data revenue. This reflects the increasing smartphone penetration in Vodacom's markets and the rising demand for higher data packages, driven by increased data consumption for streaming, social media, and online gaming.

-

Robust Service Revenue Growth: Service revenue also saw positive growth, indicating the success of Vodacom's diverse service offerings. This includes mobile voice, fixed-line services, and other value-added services. The company's ability to retain customers and attract new ones contributes to this sustained growth.

-

Increased Average Revenue Per User (ARPU): The increase in ARPU signifies that existing customers are spending more on Vodacom's services, indicating improved customer loyalty and the effectiveness of upselling strategies. This demonstrates the success of Vodacom's ability to offer attractive and valuable services to its customer base.

-

Customer Acquisition and Growth: Vodacom's Q3 results included details on strong customer acquisition and overall customer base growth. This shows the company's effective marketing and customer retention strategies. Specific figures on net additions will be released in the full earnings report.

-

Market Share Gains: While the official report will detail specifics, early indications suggest Vodacom may have gained market share within its competitive landscape, further highlighting its superior performance.

-

EBITDA Margin Improvement: Vodacom’s EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) margin is also expected to show positive movement, reflecting efficient cost management and strong revenue growth.

Factors Contributing to Vodacom's Success

Vodacom's exceptional Q3 performance can be attributed to a combination of strategic initiatives and favorable market conditions.

-

Strategic Network Investments: Significant investments in network infrastructure, including the ongoing rollout of 5G technology, have significantly improved network capacity and quality. This improved network provides a superior customer experience, attracting and retaining customers.

-

Thriving Digital Services: Vodacom's digital services portfolio, encompassing mobile money and other digital platforms, continues to drive substantial revenue growth. These services cater to the growing demand for convenient and accessible digital solutions.

-

M-Pesa's Continued Success: M-Pesa, Vodacom's mobile money platform, remains a key contributor to the company's financial success, demonstrating strong growth in transaction volume and value. This highlights the importance of fintech within Vodacom’s overall strategy.

-

Successful Strategic Partnerships: Strategic partnerships and collaborations have broadened Vodacom's reach and enhanced its service offerings. These partnerships leverage external expertise and market access, leading to increased revenue streams.

-

Effective Marketing and Customer Engagement: Vodacom's focused marketing strategies and customer engagement initiatives have played a crucial role in driving customer acquisition, retention, and increased ARPU.

International Operations Performance

Vodacom's international operations also contributed positively to the overall Q3 results. While specific details regarding each region will be presented in the full earnings report, the international segment demonstrated solid performance and positive growth in key markets. This shows the company's ability to expand its footprint and generate revenue from multiple regions. The company highlighted future growth opportunities and expansion plans in international markets, indicating further potential for future earnings increases.

Outlook and Implications for Investors

The strong Q3 earnings have positively impacted Vodacom's stock price, signaling strong investor confidence.

-

Positive Stock Price Impact: The strong results are expected to boost Vodacom's stock price, making it an attractive investment for those seeking exposure to the telecom sector.

-

Positive Investor Sentiment: The positive Q3 earnings are expected to further enhance investor sentiment and confidence in Vodacom's future growth prospects.

-

Future Growth Prospects: Vodacom's management team has expressed confidence in the company's ability to maintain its growth trajectory in the coming quarters. This positive outlook supports the narrative of continued success for the company.

-

Dividend Updates: The strong financial performance is likely to lead to updates regarding dividend payments, further rewarding investors.

-

Management Guidance: Management's guidance will offer further insights into the company's expectations for the remaining quarters of the financial year and beyond, providing valuable information for investors to assess future performance.

Conclusion

Vodacom's Q3 earnings have significantly exceeded expectations, driven by strong revenue growth, successful digital initiatives, and strategic investments. The company's positive outlook, fueled by growth in data revenue, expansion of digital services, and continued success in its international markets, suggests continued growth and makes Vodacom an attractive prospect for investors. The increased ARPU and positive EBITDA also speak to the long-term health and success of the company.

Call to Action: Stay informed on the latest developments and future performance of Vodacom (VOD) by regularly checking our website for updates on Vodacom's financial results and market analysis. Learn more about investing in Vodacom and other leading telecom companies.

![Vodacom (VOD) Q[Quarter Number] Earnings Surpass Expectations Vodacom (VOD) Q[Quarter Number] Earnings Surpass Expectations](https://wjuc2010.de/image/vodacom-vod-q-quarter-number-earnings-surpass-expectations.jpeg)

Featured Posts

-

Vybz Kartel Self Esteem Issues And Skin Bleaching

May 21, 2025

Vybz Kartel Self Esteem Issues And Skin Bleaching

May 21, 2025 -

Post Brexit Challenges For Uk Luxury Exporters To The Eu

May 21, 2025

Post Brexit Challenges For Uk Luxury Exporters To The Eu

May 21, 2025 -

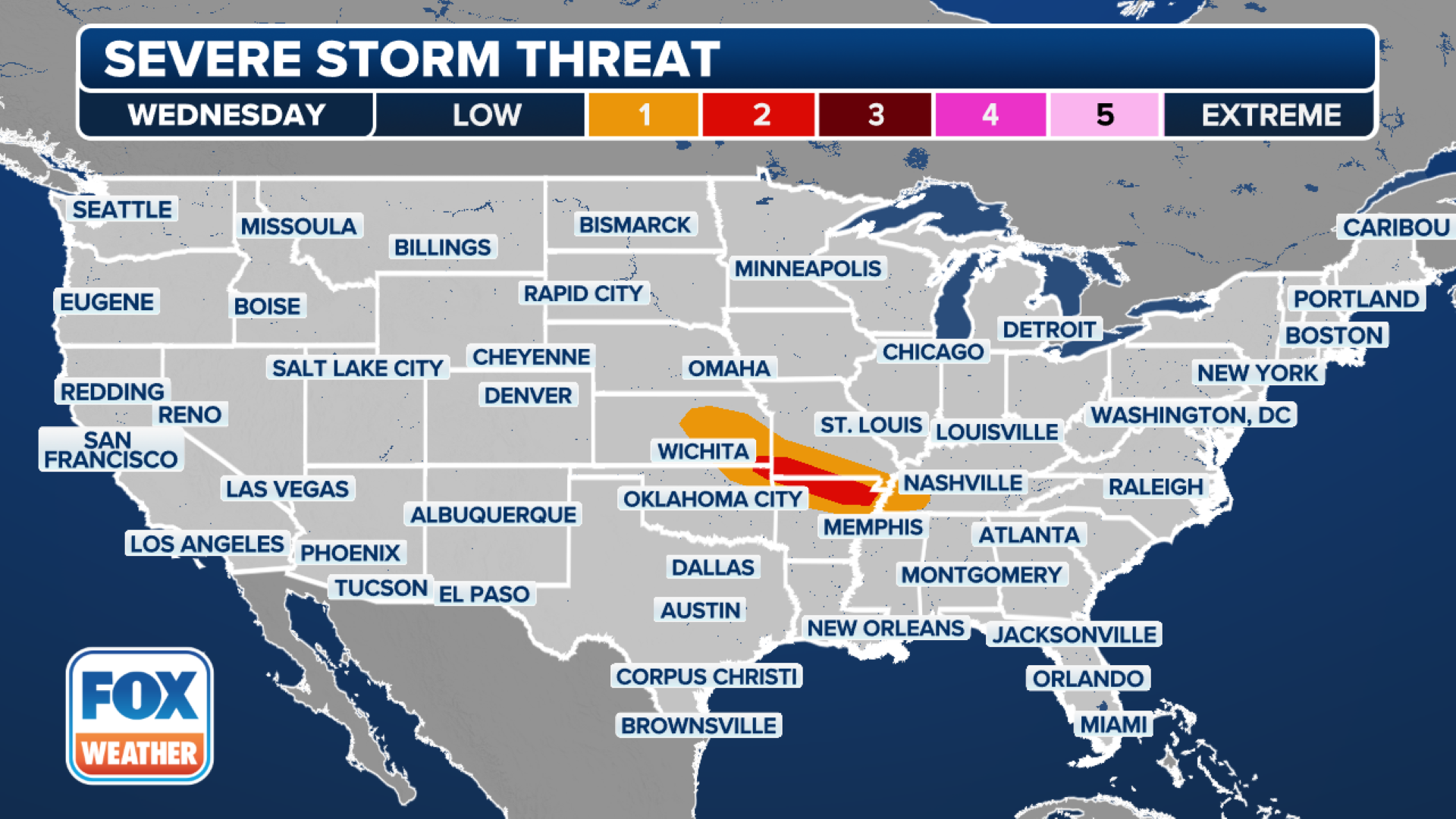

Overnight Storm Potential Severe Weather Risk Monday

May 21, 2025

Overnight Storm Potential Severe Weather Risk Monday

May 21, 2025 -

Appeal Pending Ex Tory Councillors Wife Faces Decision On Racial Hatred Tweet

May 21, 2025

Appeal Pending Ex Tory Councillors Wife Faces Decision On Racial Hatred Tweet

May 21, 2025 -

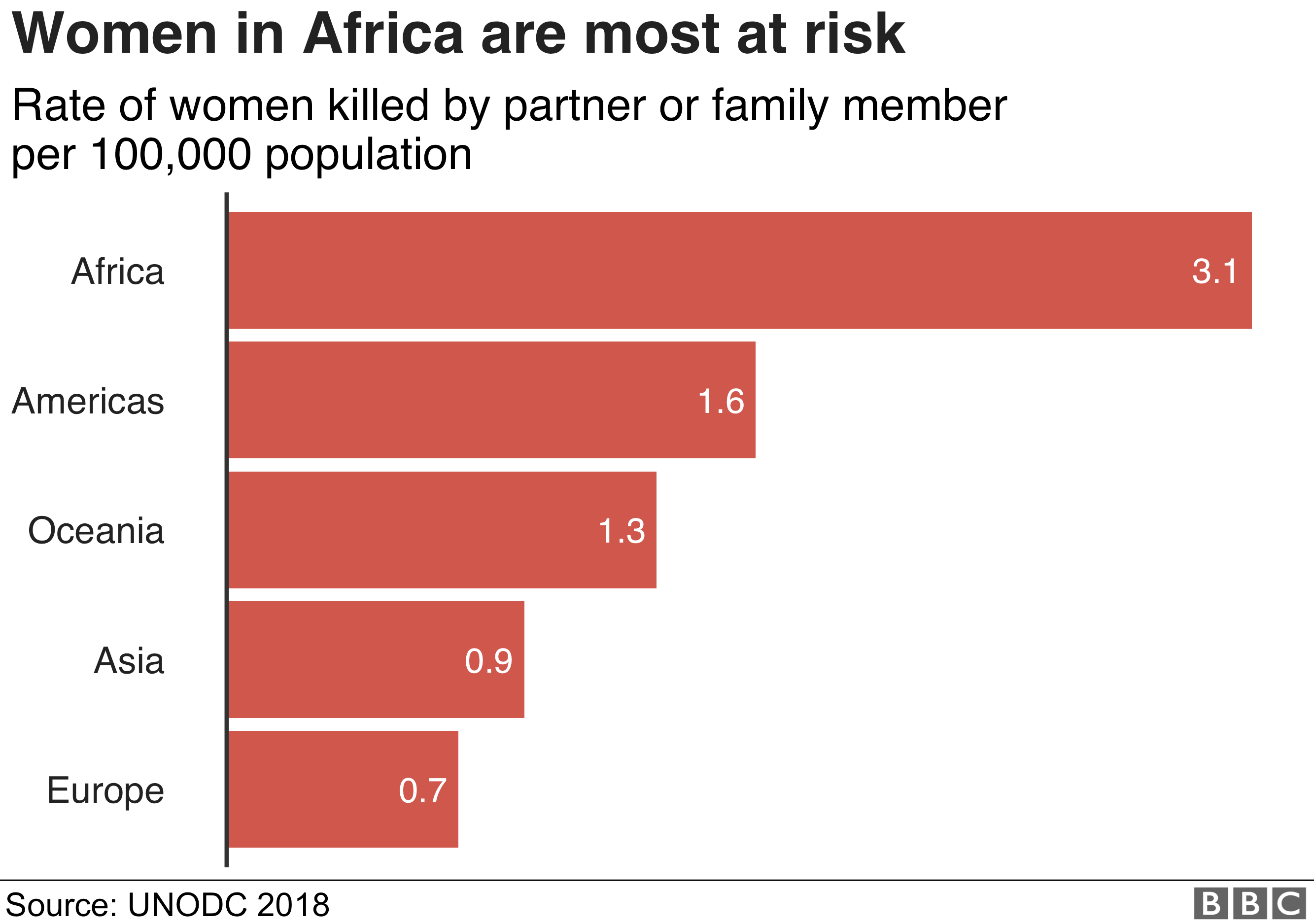

Mexican And Colombian Femicides Influencer And Model Murders Reignite Debate On Violence Against Women

May 21, 2025

Mexican And Colombian Femicides Influencer And Model Murders Reignite Debate On Violence Against Women

May 21, 2025

Latest Posts

-

The Future Of Aj Styles In Wwe Contract Details Revealed

May 21, 2025

The Future Of Aj Styles In Wwe Contract Details Revealed

May 21, 2025 -

Aj Styles Contract Situation A Wwe Update

May 21, 2025

Aj Styles Contract Situation A Wwe Update

May 21, 2025 -

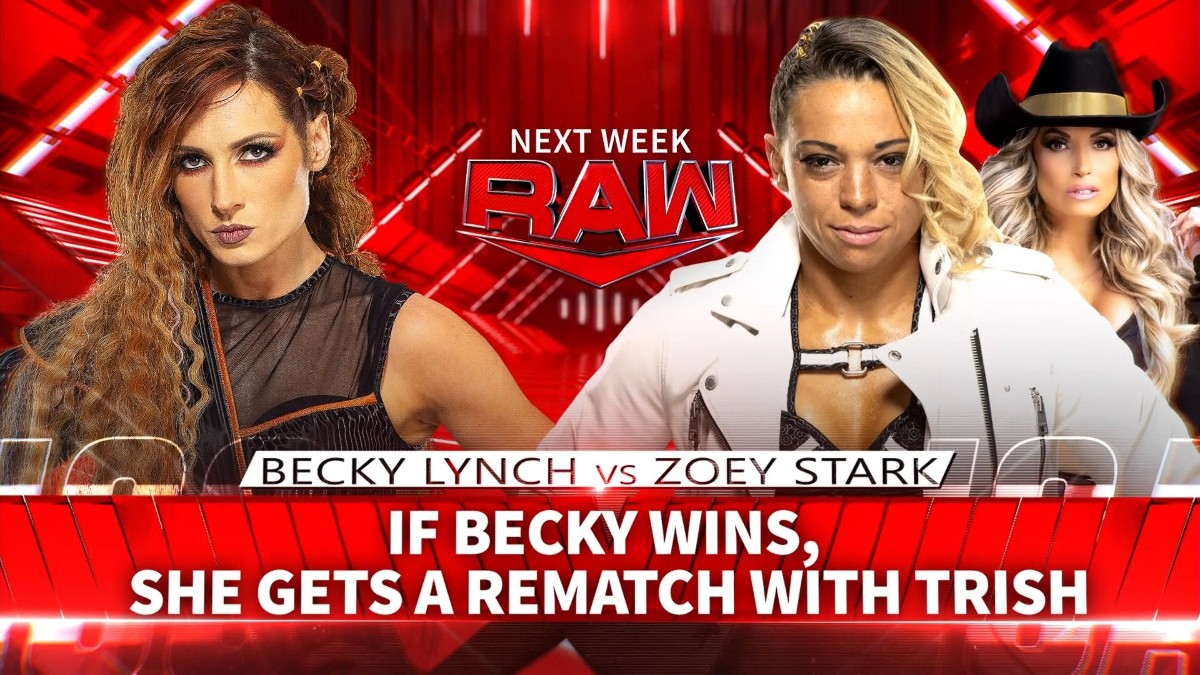

Injury Update Zoey Stark Sidelined After Wwe Raw Match

May 21, 2025

Injury Update Zoey Stark Sidelined After Wwe Raw Match

May 21, 2025 -

Zoey Starks Injury What Happened On Wwe Raw

May 21, 2025

Zoey Starks Injury What Happened On Wwe Raw

May 21, 2025 -

Wwe Raw Zoey Starks Injury Update

May 21, 2025

Wwe Raw Zoey Starks Injury Update

May 21, 2025