Vodacom's (VOD) Improved Earnings Drive Higher-Than-Expected Payout

Table of Contents

Increased Revenue Streams Fuel Vodacom's (VOD) Financial Success

Vodacom's improved financial performance is primarily attributed to several key factors driving substantial revenue growth. This growth in Vodacom's earnings is directly linked to the company's strategic initiatives and market performance.

- Growth in Mobile Data Subscriptions: The increasing demand for mobile data services across Vodacom's operational regions has fueled significant revenue growth. This is reflected in a substantial increase in data subscribers and higher average revenue per user (ARPU). (Source needed - e.g., Vodacom's financial report).

- Expansion into New Markets/Services: Diversification into high-growth sectors like fintech and IoT (Internet of Things) has broadened Vodacom's revenue streams. These new ventures are contributing significantly to the company's overall financial performance. Examples of successful fintech initiatives should be included here, with supporting data.

- Strong Performance in Specific Geographic Regions: Specific regions within Vodacom's operational footprint demonstrated exceptional performance, contributing disproportionately to the overall revenue increase. (Source needed – highlighting specific regions and their growth rates).

- Successful Marketing Campaigns and Customer Acquisition Strategies: Targeted marketing campaigns and effective customer acquisition strategies have resulted in increased subscriber numbers and improved customer retention rates, further boosting revenue.

Cost Optimization Strategies Contribute to Profitability

Beyond revenue growth, Vodacom's commitment to cost optimization significantly contributed to its enhanced profitability. The company implemented several strategic initiatives to streamline operations and improve efficiency.

- Network Optimization Initiatives: Investments in network infrastructure upgrades and optimization have led to improved operational efficiency and reduced operational costs. Specific examples (like 5G rollouts and efficiency gains) should be mentioned.

- Streamlining Operational Processes: Vodacom implemented process improvements across various departments, leading to cost savings and improved productivity. Detail specific examples of process improvements here.

- Investing in Automation and Digital Transformation: The adoption of automation technologies and digital transformation initiatives resulted in significant cost reductions and enhanced operational efficiency. Examples of automation tools or processes should be listed here, if available.

- Employee Efficiency Improvements: Initiatives aimed at improving employee productivity and training have further enhanced operational efficiency, minimizing labor costs. Quantifiable results, such as productivity increases or reduction in employee turnover, would be beneficial here.

The impact of these cost-cutting measures on profit margins should be quantified using data from Vodacom's financial reports.

Higher-Than-Expected Dividend Payout: A Boon for Investors

The improved financial performance has resulted in a significantly higher-than-expected dividend payout, a welcome development for Vodacom shareholders.

- Percentage Increase in Dividend Compared to Previous Periods: State the percentage increase in the dividend compared to previous periods, showing the significant improvement. (Source needed: Vodacom's dividend announcement).

- Analysis of the Dividend Yield Relative to Competitors: Compare Vodacom's dividend yield to its competitors within the telecommunications sector to demonstrate its competitiveness. Use a table to clearly illustrate this comparison.

- Investor Reaction to the Increased Payout (Stock Price Movement): Discuss the market's reaction to the increased dividend, including the stock price movement following the announcement. (Source needed – e.g., financial news sources).

- Future Dividend Expectations Based on the Current Financial Performance: Based on the current financial performance, project potential future dividend payouts, providing a forward-looking perspective for investors.

Vodacom's (VOD) Future Outlook and Investment Implications

Vodacom's future prospects appear promising, despite potential challenges.

- Potential Challenges Facing Vodacom (e.g., Competition, Regulatory Changes): Identify and discuss potential headwinds like increased competition from other telecommunication companies or upcoming regulatory changes that could affect Vodacom's performance.

- Growth Opportunities for Vodacom in the Coming Years: Identify opportunities for growth, such as expanding into new markets, introducing innovative services, or leveraging technological advancements.

- Analyst Predictions and Ratings for Vodacom's Stock: Include relevant information about analyst predictions and ratings for Vodacom's stock, offering insights into the market sentiment. (Sources needed – reputable financial analysis firms).

- Recommendations for Investors (Buy, Hold, or Sell): Based on the analysis, provide a concise recommendation to investors (buy, hold, or sell), justifying the recommendation with supporting data and analysis.

Conclusion: Investing in Vodacom's (VOD) Improved Earnings Potential

In summary, Vodacom's (VOD) improved earnings, driven by increased revenue streams and effective cost optimization, have resulted in a higher-than-expected dividend payout. This positive financial performance presents a compelling investment opportunity. The company's strategic initiatives, coupled with its strong market position, suggest a promising future. Learn more about Vodacom's improved earnings and explore Vodacom's investment potential. Consider investing in Vodacom's future growth and capitalize on this promising opportunity. Remember to conduct thorough due diligence before making any investment decisions.

Featured Posts

-

Adressage Du District Autonome D Abidjan Etat D Avancement

May 20, 2025

Adressage Du District Autonome D Abidjan Etat D Avancement

May 20, 2025 -

Exploring The World Of Agatha Christies Poirot From Novels To Adaptations

May 20, 2025

Exploring The World Of Agatha Christies Poirot From Novels To Adaptations

May 20, 2025 -

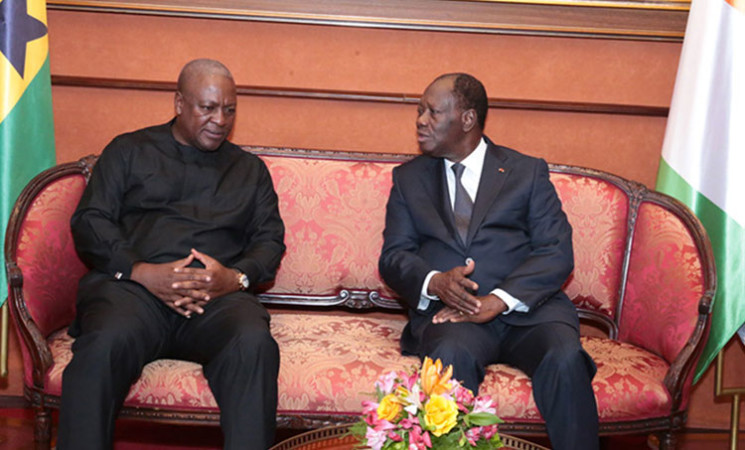

Diplomatie Ivoiro Ghaneenne Le President Mahama En Visite Officielle A Abidjan

May 20, 2025

Diplomatie Ivoiro Ghaneenne Le President Mahama En Visite Officielle A Abidjan

May 20, 2025 -

Canadian Tire And Hudsons Bay Exploring The Merits Of A Merger

May 20, 2025

Canadian Tire And Hudsons Bay Exploring The Merits Of A Merger

May 20, 2025 -

Assessing The Impact Trumps Aerospace Deals And Their Long Term Effects

May 20, 2025

Assessing The Impact Trumps Aerospace Deals And Their Long Term Effects

May 20, 2025

Latest Posts

-

Wayne Gretzkys Legacy The Controversy Surrounding His Trump Relationship

May 20, 2025

Wayne Gretzkys Legacy The Controversy Surrounding His Trump Relationship

May 20, 2025 -

The Gretzky Trump Connection Impact On The Hockey Legends Image

May 20, 2025

The Gretzky Trump Connection Impact On The Hockey Legends Image

May 20, 2025 -

Wayne Gretzky And Donald Trump A Legacy Under Scrutiny

May 20, 2025

Wayne Gretzky And Donald Trump A Legacy Under Scrutiny

May 20, 2025 -

Gretzkys Loyalty Examining The Legacy Amid Trump Ties

May 20, 2025

Gretzkys Loyalty Examining The Legacy Amid Trump Ties

May 20, 2025 -

Wayne Gretzky And The Trump Tariff Controversy A National Conversation

May 20, 2025

Wayne Gretzky And The Trump Tariff Controversy A National Conversation

May 20, 2025