Wall Street Analyst's $254 Apple Stock Prediction: Buy Or Sell At $200?

Table of Contents

The Analyst's Rationale Behind the $254 Apple Stock Prediction

The ambitious $254 Apple stock prediction stems from a confluence of factors, as outlined by [Analyst's Name/Firm]. Their reputation for insightful tech market analysis adds weight to this bold forecast.

Strong Fundamentals Driving the Prediction

Several key elements underpin this optimistic Apple stock prediction:

- Robust iPhone Sales: Despite economic headwinds, iPhone sales remain remarkably strong, demonstrating the enduring appeal of Apple's flagship product. Recent quarterly reports show [Insert data on iPhone sales growth percentage].

- Explosive Services Revenue Growth: Apple's services segment, including Apple Music, iCloud, and the App Store, continues to demonstrate impressive growth, offering a diversified revenue stream less susceptible to hardware cycle fluctuations. [Insert data on services revenue growth percentage].

- Wearables Market Expansion: The Apple Watch and AirPods have carved out significant market share in the wearables sector, contributing substantially to overall revenue and demonstrating Apple's ability to innovate and capture new markets. [Insert data on wearables market share or growth].

- Anticipation of New Product Launches: Rumored upcoming product launches, such as new iPhones, Apple Glasses, and potential advancements in other product lines, fuel expectations for future growth and further boost the $254 Apple stock target.

- Positive Market Sentiment: Overall positive investor sentiment towards Apple contributes to the bullish outlook, reflecting confidence in the company's long-term prospects.

Market Conditions and Economic Factors Considered

While the analyst's Apple stock prediction is positive, they acknowledge broader macroeconomic factors:

- Inflation and Interest Rates: The impact of rising inflation and interest rates on consumer spending is a potential risk, affecting demand for Apple products.

- Global Economic Growth: Slower global economic growth could dampen demand, particularly in international markets crucial to Apple's success.

- Geopolitical Uncertainty: Global political instability and trade tensions pose potential risks to Apple's supply chain and overall business operations.

Comparison to Other Analyst Predictions

The $254 Apple stock target is not universally shared. While some analysts share a similarly optimistic view, others offer more conservative predictions, ranging from [Low Prediction] to [High Prediction]. This divergence reflects the inherent uncertainty in predicting future stock performance.

Analyzing the Risks and Potential Downsides

Despite the bullish $254 Apple stock prediction, potential downsides must be considered:

Competition and Market Saturation

- Intense Competition: Apple faces fierce competition in various markets, notably smartphones (Android), wearables (Fitbit, Samsung), and streaming services (Netflix, Spotify). Maintaining its competitive edge is crucial.

- Market Saturation: The smartphone market is approaching saturation in some regions, limiting potential for significant growth through new unit sales. Apple needs to focus on service revenue growth and expansion into new markets.

Supply Chain Issues and Global Uncertainty

- Supply Chain Disruptions: Global supply chain disruptions, exacerbated by geopolitical events, can impact Apple's production capacity and timely delivery of products.

- Geopolitical Risks: Trade disputes, political instability, and other geopolitical risks can significantly affect Apple's operations and profitability.

Valuation Concerns

The $254 Apple stock target implies a substantial increase from the current price. Whether this valuation is justified based on traditional metrics like the P/E ratio and price-to-sales ratio requires careful scrutiny. [Optional: Include relevant valuation data and analysis].

Buy, Sell, or Hold? A Recommendation Based on the $254 Apple Stock Prediction

Considering the analyst's rationale and the potential risks, the recommendation depends on your risk tolerance:

- Conservative Investors: A "hold" strategy might be prudent, given the uncertainties surrounding macroeconomic conditions and potential competition.

- Moderate Investors: A "buy" might be considered, with a portion of your portfolio allocated to Apple stock, balancing potential gains with the inherent risks.

- Aggressive Investors: A "buy" strategy could be considered, acknowledging the higher risk involved in pursuing a potentially high-reward investment.

Diversification is key regardless of your risk profile. Don't put all your eggs in one basket.

Conclusion: Should You Invest in Apple Stock Based on the $254 Prediction?

The $254 Apple stock prediction is ambitious but not without foundation. Strong fundamentals support the optimistic outlook, but significant risks exist concerning global economic conditions, competition, and valuation. The recommendation – buy, sell, or hold – depends heavily on your individual risk tolerance and investment strategy. Remember to conduct thorough due diligence, analyze financial reports, and consult with a financial advisor before making any investment decisions. What are your thoughts on this Apple stock prediction? Continue your research on Apple stock predictions to inform your investment strategy.

Featured Posts

-

L Affaire Ardisson Baffie Sexisme Mea Culpa Et Controverse

May 25, 2025

L Affaire Ardisson Baffie Sexisme Mea Culpa Et Controverse

May 25, 2025 -

Camunda Con 2025 Amsterdam Orchestration For Maximizing Ai And Automation Roi

May 25, 2025

Camunda Con 2025 Amsterdam Orchestration For Maximizing Ai And Automation Roi

May 25, 2025 -

When To Fly Around Memorial Day 2025 Avoid Crowds

May 25, 2025

When To Fly Around Memorial Day 2025 Avoid Crowds

May 25, 2025 -

F1 Testing Video Shows Lewis Hamiltons Kind Gesture Towards Past Teammate

May 25, 2025

F1 Testing Video Shows Lewis Hamiltons Kind Gesture Towards Past Teammate

May 25, 2025 -

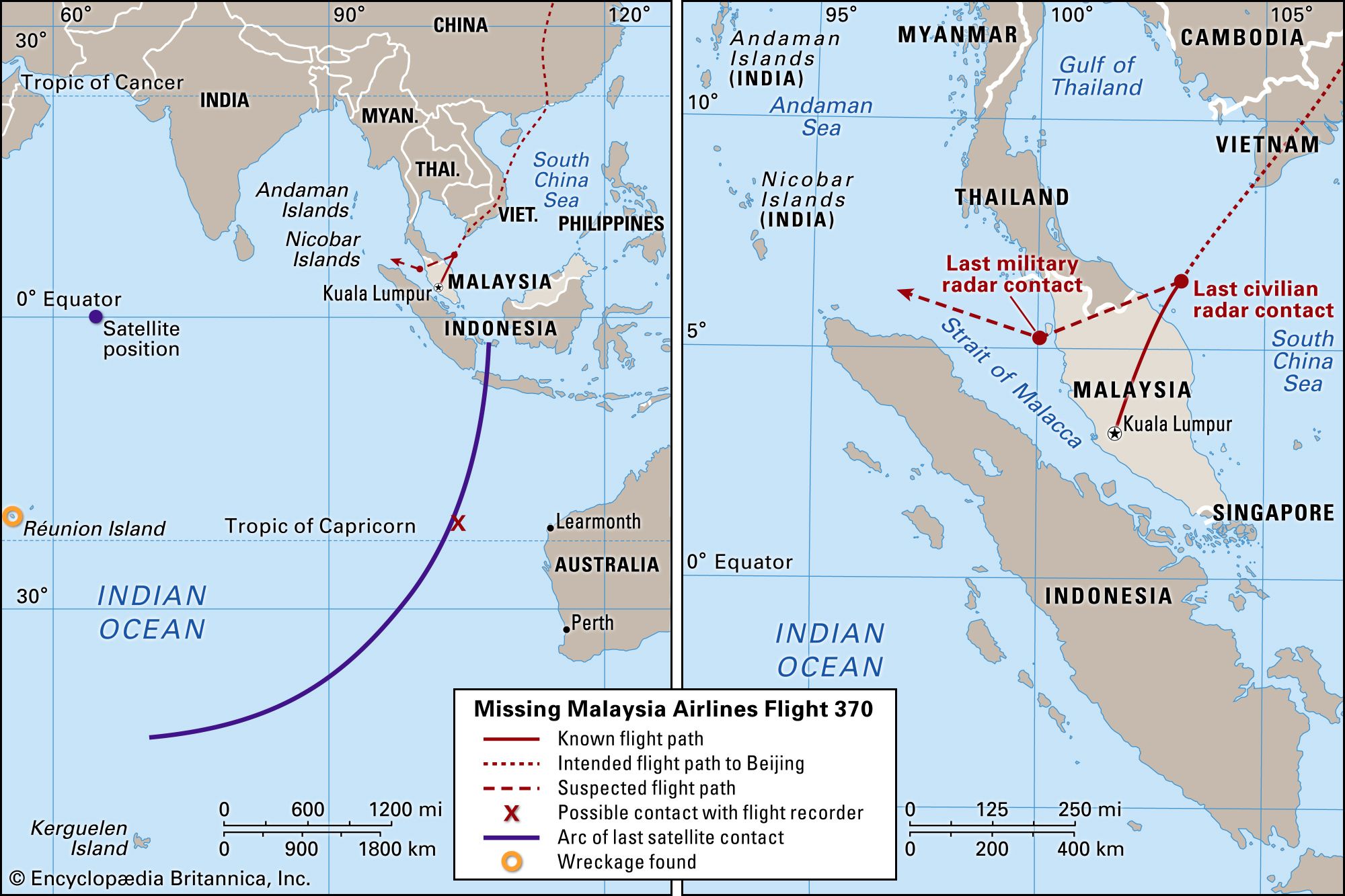

The Disappearance Finding Answers And Closure

May 25, 2025

The Disappearance Finding Answers And Closure

May 25, 2025