Wall Street's Stunning Rebound: How Bear Market Strategies Are Failing

Table of Contents

The Unexpected Market Rally: A Deep Dive into the Numbers

The recent surge in market performance has surprised many experts. Wall Street's stunning rebound is evident in key market indicators, defying earlier pessimistic forecasts.

Analyzing Key Market Indicators:

- S&P 500: The S&P 500 has shown a significant percentage increase (insert actual percentage here) since the predicted bear market low, far exceeding expectations.

- Dow Jones Industrial Average: Similarly, the Dow Jones Industrial Average has experienced remarkable growth (insert actual percentage here), indicating a broad-based market recovery.

- Nasdaq Composite: The tech-heavy Nasdaq Composite has led the rebound, demonstrating substantial gains (insert actual percentage here), fueled by strong performance in the technology sector.

- Sector-Specific Growth: Specific sectors, such as technology and energy, have been key drivers of this market rebound, indicating shifts in investor sentiment and economic conditions.

Inflation's Unexpected Retreat:

The unexpected decline in inflation rates has played a pivotal role in fueling the market recovery.

- Inflation Rate Changes: (Insert data on inflation rate changes, e.g., "Inflation fell from X% to Y% in the last quarter"). This decrease in inflation has eased concerns about aggressive interest rate hikes by the Federal Reserve.

- Federal Reserve's Influence: The Federal Reserve's actions, including potential pauses or adjustments to interest rate increases, have significantly influenced investor sentiment and contributed to the market's positive trajectory. The market's response to these actions highlights the sensitivity of investor confidence to monetary policy.

Bear Market Strategies Falling Short: Why Traditional Approaches Failed

Many investors relied on traditional bear market strategies, which have proven surprisingly ineffective in this unique market environment. Wall Street's stunning rebound has exposed the limitations of these approaches.

Defensive Portfolio Strategies Underperforming:

- Cash Holdings: Increasing cash holdings, a common bear market strategy, has resulted in missed gains as the market rallied.

- Bond Investments: While bonds are traditionally considered safe havens, their performance has been relatively muted compared to the equity market's surge.

- Defensive Sectors: Investments in defensive sectors like utilities and consumer staples haven't outperformed the overall market's impressive growth.

The limitations of relying solely on historical market data are evident in this situation. Past performance is not necessarily indicative of future results, and the current market environment presents unique challenges.

The Failure of Timing the Market:

Attempting to time the market perfectly—exiting during a downturn and re-entering at the bottom—is notoriously difficult and often unsuccessful. Many investors who exited the market prematurely based on bear market predictions missed out on significant gains during Wall Street's stunning rebound.

- Emotional Factors: Fear and uncertainty often drive emotional decisions, leading investors to sell assets at the wrong time.

- Missed Opportunities: Numerous examples exist of investors who sold their holdings near the bottom, only to see prices rebound sharply, costing them potential profits.

Emerging Trends and Opportunities in the Rebounding Market

Wall Street's stunning rebound has created new opportunities for investors willing to adapt their strategies.

Sector-Specific Growth Opportunities:

- Technology: The technology sector continues to offer significant growth potential, driven by innovation and strong demand.

- Artificial Intelligence (AI): Investments in AI-related companies are seen as particularly promising.

- Renewable Energy: The renewable energy sector benefits from increasing government support and growing consumer demand for sustainable solutions.

These sectors represent significant opportunities but carry inherent risk. Investors must conduct thorough due diligence before making any investment decisions.

Adapting Investment Strategies for a Changing Market:

Navigating the current market requires a flexible approach. Investors must consider adjusting their strategies to account for the unexpectedly strong market performance and evolving economic conditions.

- Diversification: A well-diversified portfolio remains crucial to mitigate risk.

- Risk Management: Understanding and managing risk is essential, especially in a volatile market.

- Long-Term Perspective: Maintaining a long-term investment horizon can help investors weather short-term market fluctuations.

Conclusion

Wall Street's stunning rebound has surprised many, demonstrating the unpredictable nature of financial markets and the limitations of traditional bear market strategies. The unexpected decline in inflation and the Federal Reserve's actions have played significant roles in driving this market rally. Investors who relied on defensive strategies and attempted to time the market have often missed out on significant gains. The current environment presents new opportunities in specific growth sectors, but successful navigation requires adaptability, diversification, and a nuanced understanding of market dynamics.

Key Takeaways:

- Traditional bear market strategies haven't consistently performed well in the face of Wall Street's stunning rebound.

- Adaptability and a nuanced understanding of market dynamics are crucial for success.

- Emerging sectors present new investment opportunities, but risk management remains paramount.

Don't let outdated bear market strategies leave you behind. Re-evaluate your investment plan and explore new opportunities in this dynamic environment. Understand Wall Street's stunning rebound and adjust your approach accordingly. Embrace adaptable strategies to effectively navigate the evolving market landscape and capitalize on the emerging trends shaping Wall Street's future.

Featured Posts

-

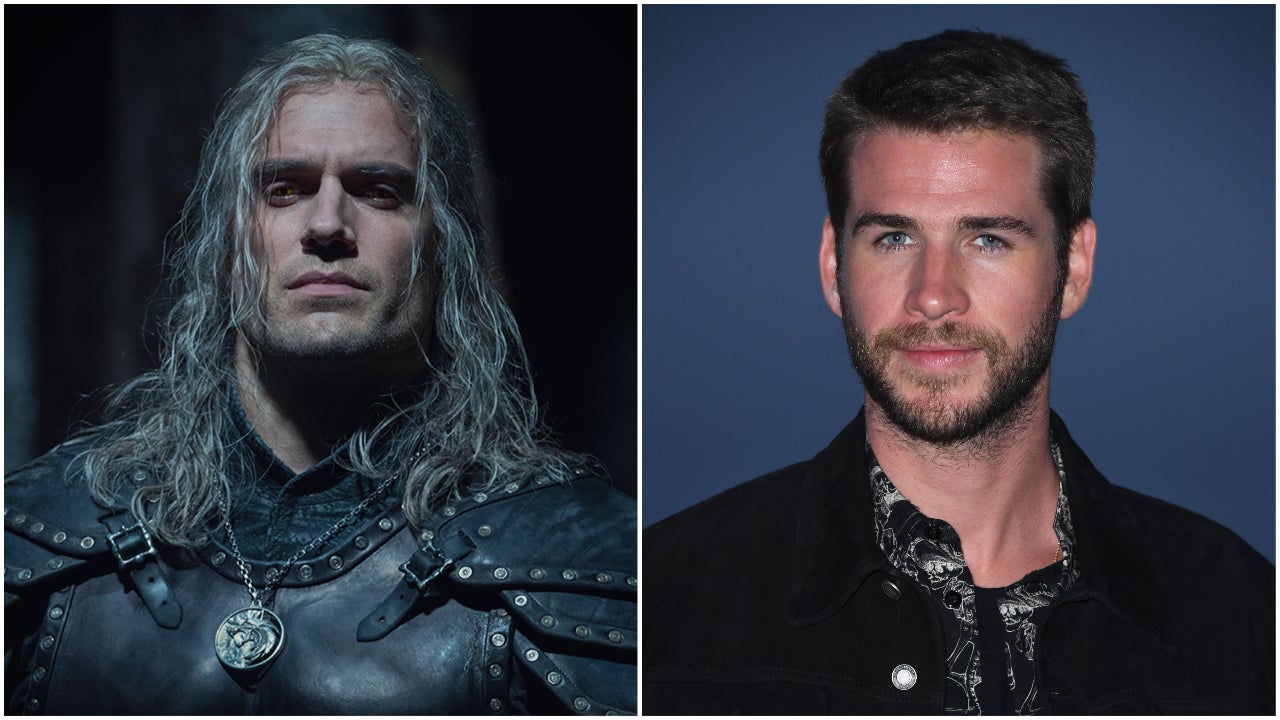

The Witcher Why Henry Cavill Left The Role Of Geralt In Season 4

May 11, 2025

The Witcher Why Henry Cavill Left The Role Of Geralt In Season 4

May 11, 2025 -

The Unexpected Hit A Fake Marvel Trailer Featuring Henry Cavill Goes Viral

May 11, 2025

The Unexpected Hit A Fake Marvel Trailer Featuring Henry Cavill Goes Viral

May 11, 2025 -

Semana Santa O Semana De Turismo El Caso De Uruguay Y Su Identidad Laica

May 11, 2025

Semana Santa O Semana De Turismo El Caso De Uruguay Y Su Identidad Laica

May 11, 2025 -

Understanding The Context Of Jessica Simpsons Snake Sperm Claim

May 11, 2025

Understanding The Context Of Jessica Simpsons Snake Sperm Claim

May 11, 2025 -

Apres 25 Ans Au Bayern Thomas Mueller Annonce Son Depart

May 11, 2025

Apres 25 Ans Au Bayern Thomas Mueller Annonce Son Depart

May 11, 2025