Walleye Cuts Credit: Commodities Teams Prioritize Core Client Groups

Table of Contents

The Rise of Risk Aversion in Commodities Trading

The commodities market is inherently volatile, subject to the whims of global events, economic cycles, and geopolitical instability. Recent years have amplified these uncertainties. The war in Ukraine, supply chain disruptions, and fluctuating energy prices have all contributed to increased market volatility and heightened credit risk. Furthermore, rising interest rates are making it more expensive to finance commodity trades, squeezing margins and forcing businesses to reassess their risk profiles.

- Increased regulatory scrutiny: Stringent regulations demand more robust risk management frameworks and increased transparency.

- Higher default rates: Certain client segments have experienced higher default rates, prompting commodities firms to re-evaluate their credit exposure.

- Need for stronger risk assessment models: Sophisticated data analytics and predictive modeling are crucial for accurately assessing and mitigating credit risks.

This increased risk aversion is driving a fundamental shift in how commodities firms manage their client portfolios.

Prioritizing Core Client Groups for Enhanced Profitability and Stability

In response to the heightened risk environment, many commodities teams are adopting a strategy of focusing their resources on high-value, low-risk clients. This "Walleye effect" approach involves selectively tightening credit, concentrating efforts on core client groups that offer greater stability and profitability. This targeted approach leads to several key benefits:

- Improved credit quality: Focusing on clients with a proven track record of timely payments significantly reduces the risk of defaults.

- Reduced operational costs: Streamlining operations by focusing on a smaller, more manageable group of clients reduces administrative overhead.

- Enhanced customer loyalty: Prioritizing core clients fosters stronger, more enduring relationships, leading to increased loyalty and long-term partnerships.

- Increased profitability per client: Concentrating resources on high-value clients improves profitability and return on investment.

Identifying and Cultivating Core Client Relationships

Identifying core clients involves evaluating several key factors, including:

- Long-term relationships: Established clients with a history of consistent trading activity represent a lower risk.

- Consistent trading volume: High-volume clients contribute significantly to revenue and offer greater predictability.

- Low default risk: A strong credit history and stable financial position are crucial indicators of low risk.

Nurturing these relationships requires a proactive and personalized approach:

- Personalized service and support: Providing dedicated account management and tailored solutions enhances client satisfaction.

- Proactive risk management collaboration: Working closely with clients to identify and mitigate potential risks builds trust and strengthens partnerships.

- Tailored financial solutions: Offering flexible financing options and competitive pricing strengthens client relationships.

- Exclusive access to market insights: Providing privileged access to market analysis and strategic guidance enhances client value.

Strategic Implications of Walleye Cuts on the Commodities Market

The "Walleye effect" has significant implications for the broader commodities market. Smaller or less established players may find it increasingly difficult to secure financing and compete effectively. This could lead to market consolidation, with larger firms gaining market share.

- Consolidation within the commodities sector: Smaller players may be forced to merge or exit the market.

- Increased reliance on technology and data analytics: Firms are increasingly utilizing advanced technologies to manage risk and optimize client relationships.

- Emergence of new business models: Innovative business models focusing on niche markets and specialized services may emerge.

- Shifting market dynamics: The market will likely experience a shift towards a smaller number of larger, more established players.

Conclusion: Navigating the Changing Landscape with Strategic Client Focus

The increased risk aversion in commodities trading is driving a significant shift towards the "Walleye effect"—a strategic focus on core client relationships. This involves prioritizing low-risk, high-value clients and tightening credit lines to mitigate exposure. By understanding and adapting to this changing landscape, commodities firms can navigate the challenges and capitalize on the opportunities. Implementing strategies to identify and nurture core client relationships is crucial for mitigating risk, enhancing profitability, and ensuring long-term success. Embrace the "Walleye effect" and secure your position in this evolving market through effective credit management and a strategic focus on your most valuable clients.

Featured Posts

-

The R2 Crore Disaster How One Salman Khan Film Ended Careers In Bollywood

May 13, 2025

The R2 Crore Disaster How One Salman Khan Film Ended Careers In Bollywood

May 13, 2025 -

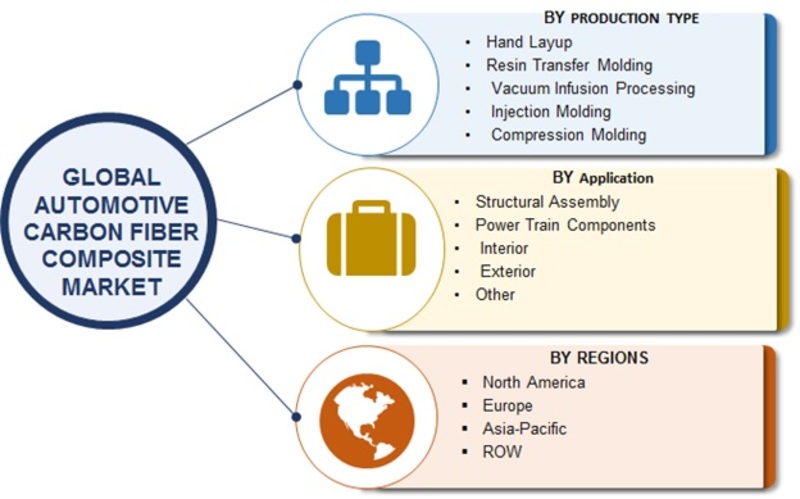

2029 Natural Fiber Composites Market Outlook Trends And Opportunities

May 13, 2025

2029 Natural Fiber Composites Market Outlook Trends And Opportunities

May 13, 2025 -

Nightmare For Families The Ongoing Gaza Hostage Crisis

May 13, 2025

Nightmare For Families The Ongoing Gaza Hostage Crisis

May 13, 2025 -

Dodgers Fall Short In 11 10 Slugfest

May 13, 2025

Dodgers Fall Short In 11 10 Slugfest

May 13, 2025 -

Everything You Need To Know About Doom The Dark Ages

May 13, 2025

Everything You Need To Know About Doom The Dark Ages

May 13, 2025

Latest Posts

-

Aldi Recalls Shredded Cheese Due To Steel Contamination Risk

May 14, 2025

Aldi Recalls Shredded Cheese Due To Steel Contamination Risk

May 14, 2025 -

Aldi Cheese Recall Possible Steel Fragments Found In Shredded Cheese Packets

May 14, 2025

Aldi Cheese Recall Possible Steel Fragments Found In Shredded Cheese Packets

May 14, 2025 -

Recall Alert Walmarts Tortilla Chips And Jewelry Kits Recalled

May 14, 2025

Recall Alert Walmarts Tortilla Chips And Jewelry Kits Recalled

May 14, 2025 -

Nationwide Recall Walmarts Action On Unsafe Baby Products

May 14, 2025

Nationwide Recall Walmarts Action On Unsafe Baby Products

May 14, 2025 -

Consumer Alert Walmart Recalls Tortilla Chips And Jewelry Kits

May 14, 2025

Consumer Alert Walmart Recalls Tortilla Chips And Jewelry Kits

May 14, 2025