Warren Buffett's Apple Sale: Perfect Timing And Future Implications

Table of Contents

The Timing of the Apple Sale: Was it Perfect?

The timing of Berkshire Hathaway's Apple stock sale is a subject of intense debate. Several macroeconomic factors were at play during this period, significantly influencing investment decisions across the board. High inflation, rising interest rates, and slowing economic growth created a climate of uncertainty in the market. These conditions likely played a role in Buffett's decision.

Several reasons might explain the sale:

- Profit-Taking: Berkshire Hathaway had accumulated substantial gains from its Apple investment over the years. Realizing these profits, even partially, could be a prudent strategy in a volatile market.

- Portfolio Diversification: Buffett is known for his focus on diversification. Reducing reliance on a single stock, even a highly successful one like Apple, aligns with this principle. This reallocation of assets could be a move towards a more balanced portfolio.

- Shifting Investment Priorities: Changes in the economic landscape and emerging opportunities in other sectors might have prompted a shift in investment priorities.

Specific market events that may have influenced Buffett's decision include:

- Rising interest rates impacting tech valuations: Higher interest rates generally lead to lower valuations for growth stocks, including technology companies like Apple.

- Geopolitical uncertainty affecting global markets: Global instability often increases market volatility, making profit-taking a more attractive option.

Analyzing Apple's stock performance leading up to and immediately following the sale provides further insights. While the immediate market reaction was mixed, a closer examination of longer-term trends will reveal the true impact of this strategic move.

Implications for Apple's Stock Price and Future Growth

The immediate market reaction to the news of the sale was a noticeable dip in Apple's stock price. However, the long-term implications are far less clear. While some investors might perceive Buffett's sale as a negative signal, others might view it as a natural part of portfolio management.

- Investor Sentiment Shifts: Buffett's actions often influence investor sentiment. While some might follow his lead and sell, others may see it as a buying opportunity, depending on their own investment strategies and risk tolerance.

- Analyst Ratings and Price Targets: The sale likely prompted a reassessment by financial analysts, resulting in revisions to price targets and ratings for Apple stock. The overall impact will depend on the prevailing market conditions and Apple’s performance.

The long-term impact will depend on various factors, including Apple's ability to innovate, maintain market share, and navigate ongoing economic headwinds.

Warren Buffett's Investment Strategy and Future Portfolio Moves

Buffett's investment philosophy centers around value investing, identifying undervalued companies with strong fundamentals. While Apple has historically fit this description, the recent sale suggests a possible shift in his assessment of its valuation or a change in his overall strategic priorities.

Potential future investments by Berkshire Hathaway, based on this sale, could include:

- Energy sector investments: The energy sector is experiencing significant growth, presenting attractive investment opportunities for value investors.

- Increased focus on value stocks: Buffett might increase investments in undervalued companies across various sectors, seeking opportunities for long-term growth.

Any statements made by Buffett regarding the sale and its rationale will provide valuable insights into his future investment plans.

The Broader Market Implications of Buffett's Actions

Buffett's actions rarely go unnoticed. The Apple stock sale had ripple effects across the tech sector and broader market sentiment.

- Sell-off in other tech stocks: The sale could trigger a sell-off in other technology stocks, reflecting a broader concern about the sector's valuation.

- Investor Confidence: The impact on investor confidence is difficult to predict and could depend on many factors, including the overall macroeconomic environment.

The market’s response provides valuable insight into broader investor sentiment towards the tech sector and the broader economy.

Conclusion: Understanding the Legacy of Warren Buffett's Apple Sale

Warren Buffett's Apple sale represents a significant event in the financial world. The timing, while arguably influenced by multiple factors, could potentially mark a turning point in Berkshire Hathaway's investment strategy and broader market sentiment towards the tech sector. While the immediate impact on Apple's stock price was noticeable, the long-term implications remain to be seen. Whether the timing was "perfect" is debatable, depending on one's perspective and investment horizon. However, the sale underscores the dynamic nature of investing and the importance of adapting to changing market conditions. To stay informed about market trends and Berkshire Hathaway’s future investment decisions, keep following updates on Warren Buffett’s Apple sale and related news. Understanding these shifts is key to navigating the ever-evolving world of finance.

Featured Posts

-

The Blue Origin Debacle A Deeper Dive Than Katy Perrys Controversies

Apr 23, 2025

The Blue Origin Debacle A Deeper Dive Than Katy Perrys Controversies

Apr 23, 2025 -

M3 As Forgalomkorlatozas Heti Jelentes Es Elorejelzes

Apr 23, 2025

M3 As Forgalomkorlatozas Heti Jelentes Es Elorejelzes

Apr 23, 2025 -

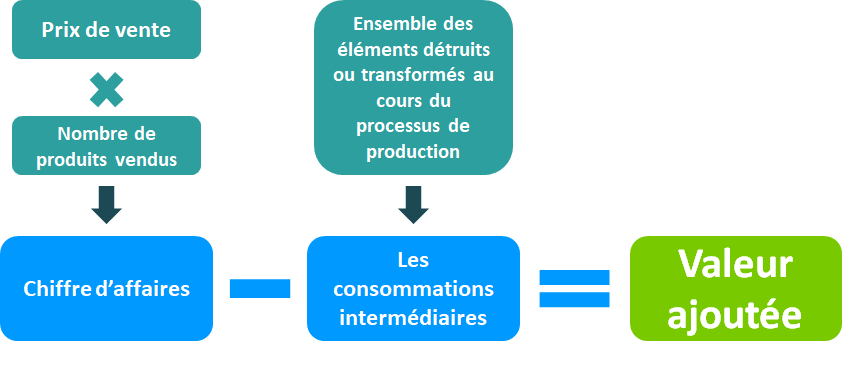

Infotel La Valeur Ajoutee Qui Fait La Difference

Apr 23, 2025

Infotel La Valeur Ajoutee Qui Fait La Difference

Apr 23, 2025 -

Guardians Lane Thomas Shows Promise In Early Spring Games

Apr 23, 2025

Guardians Lane Thomas Shows Promise In Early Spring Games

Apr 23, 2025 -

Covid 19 Test Fraud Lab Owner Admits To Falsifying Results

Apr 23, 2025

Covid 19 Test Fraud Lab Owner Admits To Falsifying Results

Apr 23, 2025

Latest Posts

-

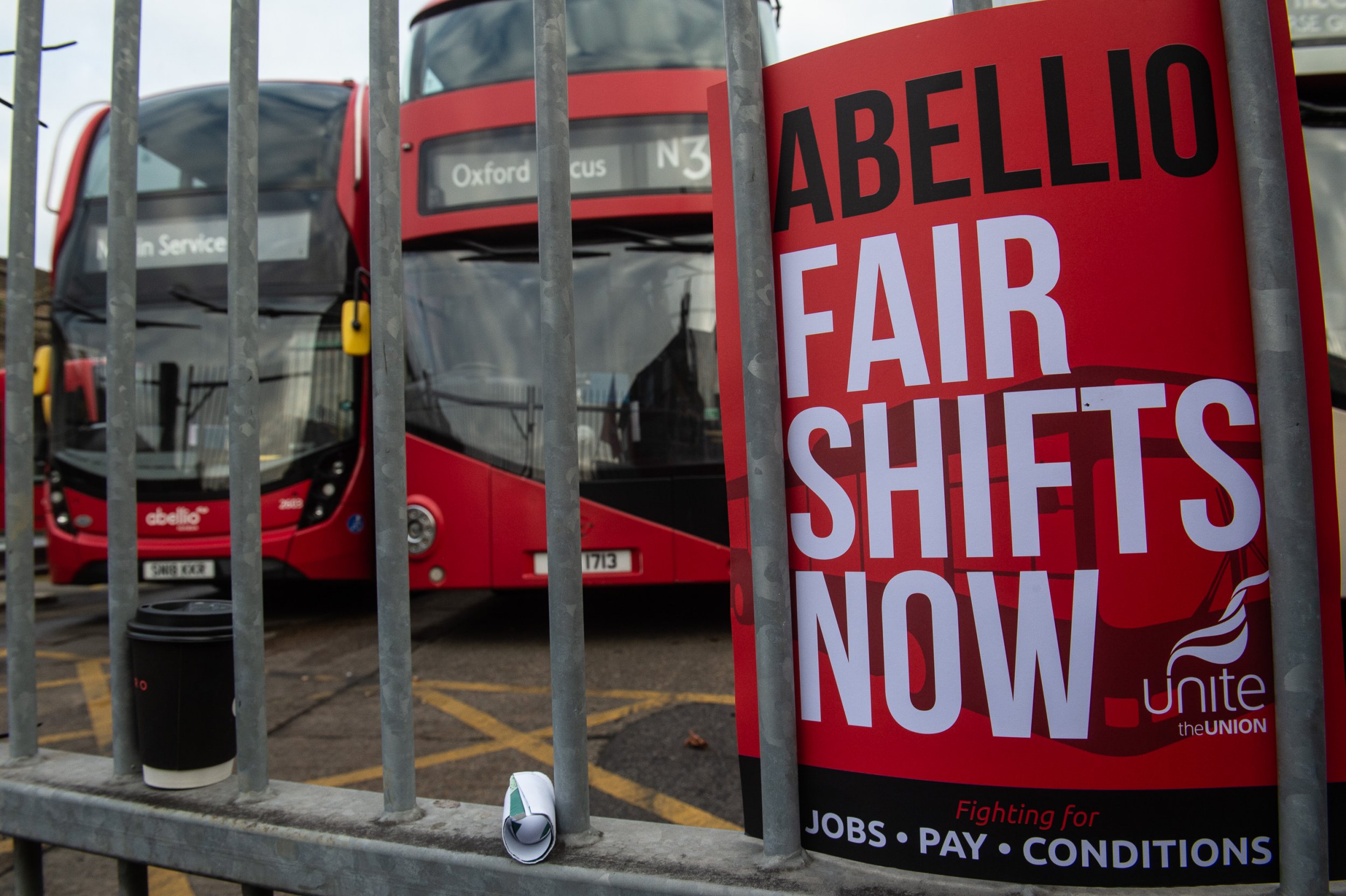

Elizabeth Line Strike Action Dates And Affected Routes February March 2024

May 10, 2025

Elizabeth Line Strike Action Dates And Affected Routes February March 2024

May 10, 2025 -

Elizabeth City Shooting Police Make Arrest

May 10, 2025

Elizabeth City Shooting Police Make Arrest

May 10, 2025 -

600

May 10, 2025

600

May 10, 2025 -

Breaking News Arrest In Elizabeth City Weekend Shooting Investigation

May 10, 2025

Breaking News Arrest In Elizabeth City Weekend Shooting Investigation

May 10, 2025 -

February And March Elizabeth Line Strikes Affected Routes And Travel Advice

May 10, 2025

February And March Elizabeth Line Strikes Affected Routes And Travel Advice

May 10, 2025