Warren Buffett's Apple Stock Sale: A Strategic Move And What It Means

Table of Contents

The Scale of the Sale and its Context

Berkshire Hathaway's reduction of its Apple stock holdings represents a substantial divestment. While the exact figures may vary slightly depending on the reporting period, the sale involved a significant number of shares, translating to billions of dollars in value. This contrasts sharply with Berkshire Hathaway's previous aggressive accumulation of Apple stock, making it one of their largest holdings for years. The timeline of the sales, spread over several quarters, suggests a calculated, rather than panicked, decision.

- Specific number of shares sold: (Insert precise number of shares sold, citing source).

- Approximate dollar value of the sale: (Insert approximate dollar value of the sale, citing source).

- Dates of the sales: (Insert dates of significant sales, citing source).

- Comparison to previous Berkshire Hathaway Apple holdings: (Compare the current holdings to the peak holdings, showing the percentage reduction).

This strategic shift requires a careful examination of the market context and Buffett's overall investment philosophy. Understanding the magnitude of this decision is crucial to interpreting its implications.

Potential Reasons Behind Buffett's Decision

Several factors could explain Warren Buffett's decision to reduce Berkshire Hathaway's Apple stock holdings. Let's examine the most likely possibilities:

Profit Taking

One primary reason could be simple profit-taking. Berkshire Hathaway held Apple stock for an extended period, witnessing substantial growth. Realizing significant profits from this long-term investment is a perfectly rational strategy, especially if Buffett perceives the current valuation as potentially inflated compared to future growth projections. This doesn't necessarily imply a bearish outlook on Apple's future, but rather a strategic decision to lock in substantial gains.

- Valuation Concerns: (Discuss any potential concerns regarding Apple's valuation, citing analyst reports or market data).

- Profit Margin Analysis: (Analyze the profit margin achieved by Berkshire Hathaway on the sale.)

Portfolio Diversification

Buffett's investment philosophy emphasizes diversification. While Apple was a significant holding, reducing its concentration within the Berkshire Hathaway portfolio allows for reallocation of capital to other promising investment opportunities. This could involve sectors that Buffett believes are poised for growth, aligning with his long-term investment strategy and risk management principles.

- Alternative Investments: (Mention potential sectors or companies Buffett might be investing in).

- Risk Management Strategies: (Discuss how diversification helps mitigate risk).

Market Conditions

Macroeconomic factors, such as inflation and rising interest rates, significantly influence investment decisions. These market conditions could have prompted Buffett to adjust his portfolio, shifting towards investments perceived as more stable or better positioned to weather potential economic headwinds.

- Inflationary Pressures: (Discuss the impact of inflation on stock valuations).

- Interest Rate Hikes: (Analyze how rising interest rates can affect stock market performance).

Changes in Apple's Business Strategy or Outlook

While Apple remains a dominant player, shifts in its business strategy, competitive landscape, or future growth projections could have influenced Buffett's decision. Any perceived weakening of Apple's long-term prospects might prompt a cautious reduction in holdings.

- Competitive Threats: (Mention any emerging competitive threats to Apple).

- Slowing Growth Rates: (Discuss any potential slowing of Apple's revenue or profit growth).

Implications for Apple Stock

The sale of Apple stock by Berkshire Hathaway immediately impacted Apple's stock price, causing some short-term volatility. However, the long-term implications are less clear. While some investors may interpret the sale as a negative signal, others may view it as a simple profit-taking exercise, having no bearing on Apple's fundamental value.

- Immediate market reaction: (Describe the immediate market reaction to the news).

- Analyst predictions: (Summarize analyst predictions for Apple's future performance post-sale).

- Future stock price fluctuations: (Discuss the potential for further stock price volatility).

Lessons for Investors

Warren Buffett's actions offer valuable insights for individual investors. His decision highlights the importance of:

- Long-Term Investing: Buffett's approach emphasizes long-term value creation over short-term speculation.

- Diversification: Reducing concentration risk by diversifying across different asset classes is crucial.

- Risk Management: Thorough risk assessment is vital before making any investment decision.

- Adaptability: Market conditions change, necessitating adaptive investment strategies.

By studying Buffett's strategic moves, investors can refine their own approaches to investment and portfolio management.

Conclusion

Warren Buffett's decision to sell a portion of Berkshire Hathaway's Apple stock is a complex event with multifaceted implications. While the sale generated significant short-term market reactions, its long-term effects remain to be seen. The underlying reasons, encompassing profit-taking, portfolio diversification, market conditions, and perhaps subtle shifts in Apple's outlook, offer valuable lessons for all investors. Understanding Warren Buffett's investment decisions can provide invaluable insights. Carefully analyze your own portfolio and consider making necessary adjustments based on your risk tolerance and long-term investment goals. Stay informed about Warren Buffett's actions and market trends to make informed decisions about your Apple stock and other investments.

Featured Posts

-

Why Pope Franciss Signet Ring Will Be Destroyed After His Death

Apr 23, 2025

Why Pope Franciss Signet Ring Will Be Destroyed After His Death

Apr 23, 2025 -

Brewers Defeat Rockies Chourios Impressive Performance

Apr 23, 2025

Brewers Defeat Rockies Chourios Impressive Performance

Apr 23, 2025 -

Boosting Ontarios Economy New Initiatives For Alcohol And Labour Mobility

Apr 23, 2025

Boosting Ontarios Economy New Initiatives For Alcohol And Labour Mobility

Apr 23, 2025 -

Artfae Aw Ankhfad Ser Aldhhb Balsaght Alywm

Apr 23, 2025

Artfae Aw Ankhfad Ser Aldhhb Balsaght Alywm

Apr 23, 2025 -

Walk Off Bunt Sinks Royals In 11 Inning Loss To Brewers

Apr 23, 2025

Walk Off Bunt Sinks Royals In 11 Inning Loss To Brewers

Apr 23, 2025

Latest Posts

-

Nyt Strands Hints And Answers Thursday February 20 Game 354

May 10, 2025

Nyt Strands Hints And Answers Thursday February 20 Game 354

May 10, 2025 -

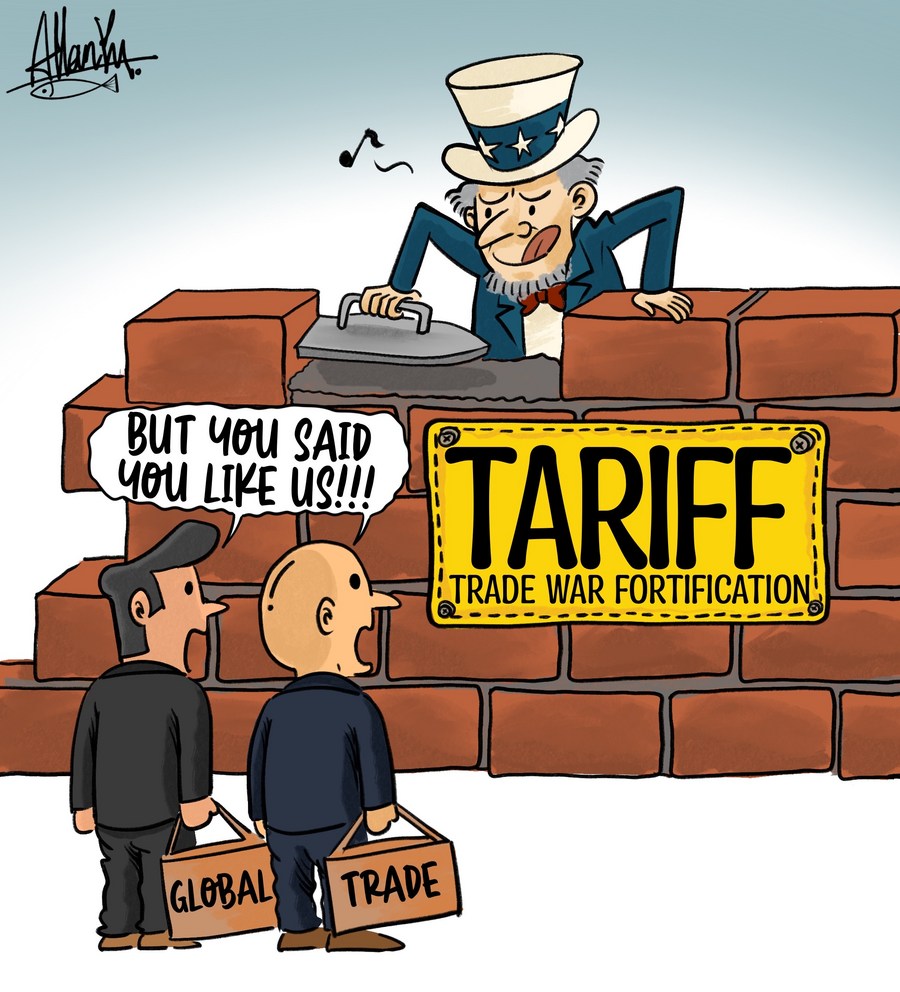

Trump Tariffs Heated Debate Erupts Between Fox News Hosts

May 10, 2025

Trump Tariffs Heated Debate Erupts Between Fox News Hosts

May 10, 2025 -

Fox News Hosts Clash Over Trumps Tariffs A Heated Exchange

May 10, 2025

Fox News Hosts Clash Over Trumps Tariffs A Heated Exchange

May 10, 2025 -

Trump Weighs Jeanine Pirro For Dc Prosecutor A Fox News Connection

May 10, 2025

Trump Weighs Jeanine Pirro For Dc Prosecutor A Fox News Connection

May 10, 2025 -

Public Condemns Jesse Watters For Ironic Infidelity Joke

May 10, 2025

Public Condemns Jesse Watters For Ironic Infidelity Joke

May 10, 2025