Weihong Liu And The Acquisition Of 28 Hudson's Bay Leases: A Closer Look

Table of Contents

Weihong Liu: The Investor Behind the Deal

Background and Investment History

Weihong Liu is a prominent figure in the Canadian investment world, although details regarding his personal life are generally kept private. His investment history reveals a focus on large-scale real estate projects and a keen eye for strategically advantageous properties. While specific details of past transactions aren't always publicly available, sources suggest a track record of successful ventures in both residential and commercial real estate development.

- Significant Past Investments: While precise details remain undisclosed due to privacy concerns, reports suggest involvement in significant residential developments in major Canadian cities and successful commercial property acquisitions.

- Institutional Affiliations: Liu's investment strategies are believed to involve collaboration with established financial institutions and investment firms, allowing access to significant capital and expert advice.

- Investment Philosophy: Although not explicitly stated, his acquisitions suggest a long-term, value-driven investment approach, focused on prime locations with strong redevelopment potential and enduring rental income streams.

Strategic Rationale Behind the Hudson's Bay Acquisition

Liu's decision to acquire 28 Hudson's Bay leases likely stems from several strategic advantages:

- Prime Locations: The acquired leases undoubtedly include properties in high-traffic, desirable areas across Canada, offering substantial rental income potential and appreciation prospects.

- Redevelopment Opportunities: Many of these locations could be ripe for redevelopment, creating the potential for significant capital appreciation through innovative mixed-use projects incorporating residential, commercial, or hospitality components.

- Rental Income Streams: The existing lease agreements provide immediate and substantial cash flow, mitigating the financial risks associated with large-scale development projects.

- Market Trends: Liu likely recognized the shifting landscape of Canadian retail, identifying opportunities presented by the restructuring of established retailers like Hudson's Bay.

The acquisition, however, also presents inherent risks, including potential construction delays, fluctuating market conditions, and unforeseen expenses during redevelopment.

The Hudson's Bay Leases: Assets and Implications

Location and Property Characteristics

The 28 acquired leases are strategically dispersed across Canada, encompassing a diverse range of properties. (A map illustrating the geographic distribution would be highly beneficial here, unfortunately, this cannot be included in a text-based response.) These properties likely include a mix of retail spaces, office spaces, and potentially even some warehouse facilities, depending on the specific lease agreements.

- Property Types: The portfolio likely encompasses a range of property types, reflecting the diverse portfolio held by Hudson's Bay.

- Demographics: The locations are strategically chosen and likely reflect strong demographics, ensuring long-term rental demand and potential property value appreciation.

- Market Conditions: The selection likely considered factors like local economic conditions and future growth prospects in these specific markets.

Impact on Hudson's Bay Company

The sale of these leases represents a significant strategic move for Hudson's Bay, likely driven by financial restructuring and streamlining operations.

- Financial Health: The sale generates a substantial cash inflow, improving the company's overall financial position and providing capital for other business initiatives.

- Retail Footprint: The sale significantly reduces Hudson's Bay's physical retail footprint, allowing the company to focus on optimizing its remaining locations and bolstering its online presence.

- Brand Image: The sale doesn't inherently impact the brand's image, but the company may need to manage consumer expectations during the transition.

Market Analysis and Future Predictions

Canadian Commercial Real Estate Market Trends

The Canadian commercial real estate market is currently experiencing dynamic shifts influenced by several factors:

- Interest Rates: Fluctuating interest rates directly impact borrowing costs and consequently affect property values and development activity.

- Economic Growth: Overall economic growth significantly impacts rental demand and the attractiveness of real estate investments.

- Supply and Demand: The balance between available commercial space and tenant demand influences property values and rental rates.

Long-Term Outlook for the Acquired Properties

Under Weihong Liu's ownership, the acquired properties hold significant potential for future growth:

- Redevelopment Scenarios: Liu may pursue various redevelopment strategies, possibly converting some properties into mixed-use complexes combining residential, commercial, and retail spaces.

- Financial Implications: Successful redevelopment could substantially increase the properties' value and generate higher rental income.

- ESG Considerations: Environmental, social, and governance (ESG) factors will likely play a role in Liu's decision-making, shaping his approach to redevelopment and influencing the long-term sustainability of these assets.

Conclusion

Weihong Liu's acquisition of 28 Hudson's Bay leases marks a pivotal moment in Canadian commercial real estate. This strategic move demonstrates Liu's investment acumen and his confidence in the long-term potential of Canadian properties. The deal also underscores significant shifts within the retail sector and the ongoing evolution of the Canadian commercial real estate market. For Hudson's Bay, the sale provides financial flexibility and allows the company to focus its efforts on adapting to the changing retail landscape. The long-term implications of this acquisition will undoubtedly be significant. To stay updated on this and other key developments in Weihong Liu's investments, follow [Link to Relevant Website/Blog] for more insights on Weihong Liu's investments and the Canadian commercial real estate sector.

Featured Posts

-

January 6th Conspiracy Theories Ray Epps Sues Fox News For Defamation

May 30, 2025

January 6th Conspiracy Theories Ray Epps Sues Fox News For Defamation

May 30, 2025 -

New Music Jacob Alon Shares August Moon

May 30, 2025

New Music Jacob Alon Shares August Moon

May 30, 2025 -

How To See Gorillaz Play Albums In Full In London A Guide To Getting Tickets

May 30, 2025

How To See Gorillaz Play Albums In Full In London A Guide To Getting Tickets

May 30, 2025 -

Glastonbury Tickets Official Resale Sells Out In 30 Minutes

May 30, 2025

Glastonbury Tickets Official Resale Sells Out In 30 Minutes

May 30, 2025 -

Cnns Pete Muntean What Happens When Air Traffic Control Fails

May 30, 2025

Cnns Pete Muntean What Happens When Air Traffic Control Fails

May 30, 2025

Latest Posts

-

Iga Swiatek Reaches Indian Wells Quarterfinals In Wet Conditions

May 31, 2025

Iga Swiatek Reaches Indian Wells Quarterfinals In Wet Conditions

May 31, 2025 -

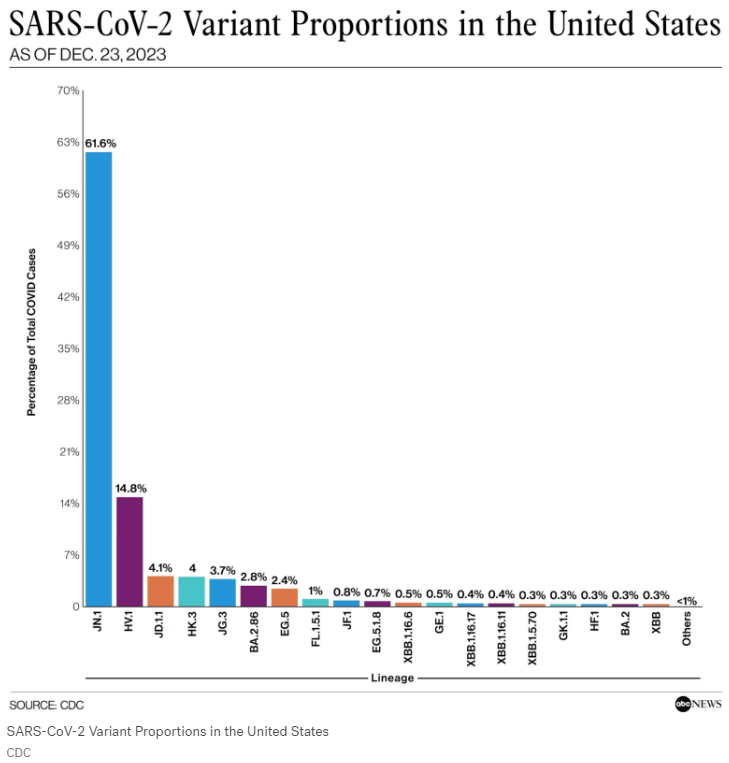

Covid 19s Jn 1 Variant What Are The Symptoms And How To Protect Yourself

May 31, 2025

Covid 19s Jn 1 Variant What Are The Symptoms And How To Protect Yourself

May 31, 2025 -

Jn 1 Variant A Deep Dive Into The Latest Covid 19 Strain

May 31, 2025

Jn 1 Variant A Deep Dive Into The Latest Covid 19 Strain

May 31, 2025 -

New Covid 19 Variant Global Case Surge Who Confirms

May 31, 2025

New Covid 19 Variant Global Case Surge Who Confirms

May 31, 2025 -

New Covid 19 Variant What You Need To Know

May 31, 2025

New Covid 19 Variant What You Need To Know

May 31, 2025