WestJet: 25% Stake Sold To Foreign Carriers, Marking Onex Investment Success

Table of Contents

The Onex Corporation's Successful Exit Strategy

Onex Corporation's investment in WestJet represents a classic example of a successful private equity exit strategy. Onex initially acquired a significant stake in WestJet several years ago, aiming to leverage its expertise to enhance the airline's operational efficiency and market position. The rationale behind selling the 25% stake now likely stems from a combination of factors, including maximizing return on investment (ROI) and capitalizing on favorable market conditions. The timing suggests a carefully orchestrated exit, allowing Onex to realize substantial profits from its initial investment.

- Onex's Initial Investment: While the exact figures remain confidential, it's widely understood that Onex's initial investment was substantial, securing a controlling interest in WestJet.

- Profit Realization: The sale of the 25% stake has undoubtedly yielded a significant return for Onex, representing a considerable percentage profit on their original investment. The specific figures are likely to be revealed in subsequent financial reports.

- Timeline of Onex's Ownership: Onex's ownership period spanned several years, during which they actively guided WestJet's strategic direction, contributing to its growth and profitability. This long-term perspective is typical of Onex's investment approach.

Impact on WestJet's Operations and Future Growth

The influx of foreign investment will undoubtedly shape WestJet's operational strategies and future growth trajectory. While specifics remain undisclosed, the new ownership structure presents both opportunities and challenges.

- Expansion into New Markets: The involvement of foreign carriers could open doors to new international routes and partnerships, potentially expanding WestJet's reach beyond its current network.

- Fleet and Route Changes: We might expect adjustments to WestJet's fleet strategy, potentially incorporating aircraft types favored by the new investors, and realignment of flight routes to optimize profitability within the expanded global network.

- Impact on Employment: While the immediate impact on employment is unclear, the potential for growth through expansion could lead to increased job opportunities. However, strategic restructuring might also lead to some adjustments in personnel.

The Role of Foreign Carriers and International Partnerships

The identity of the foreign carriers involved remains partially obscured, pending full regulatory approvals. However, the acquisition indicates a significant interest in the Canadian airline market and WestJet's potential. This signifies not only a financial investment but also the opportunity for strategic alliances and collaborations.

- Strategic Goals of Foreign Carriers: These investors likely see WestJet as a strategic asset, providing access to the North American market and potential synergies with their existing operations.

- Increased International Routes and Collaborations: The partnership promises access to new international routes, codeshare agreements, and potentially, improved customer loyalty programs through integration with the partners' existing networks.

- Impact on Competition: The increased international presence through this partnership will inevitably intensify competition within the North American airline industry, potentially affecting pricing and service offerings.

Regulatory Approvals and Market Reactions

The successful completion of this transaction hinges on obtaining the necessary regulatory approvals from various bodies, including Canadian and potentially international aviation authorities. The process is likely to involve a thorough review to ensure compliance with competition laws and ensure the transaction doesn't negatively impact the Canadian aviation landscape.

- Regulatory Bodies Involved: Agencies such as the Canadian Transportation Agency (CTA) and potentially others will scrutinize the deal for compliance with industry regulations.

- Stock Market Reaction: The announcement has already influenced WestJet's stock price, with market fluctuations reflecting investor sentiment regarding the potential impact of the new ownership structure.

- Expert Commentary: Industry analysts and commentators have offered diverse opinions on the deal, ranging from optimistic predictions about enhanced global connectivity to concerns about potential competitive disadvantages.

WestJet's New Chapter: Navigating a Changing Landscape

The sale of a 25% stake in WestJet marks a significant turning point for the airline. Onex Corporation's successful exit strategy demonstrates the potential for private equity investments within the airline industry, while the entry of foreign carriers signals a new era of international partnerships for WestJet. The future holds both exciting prospects for growth and the challenges inherent in navigating a complex and increasingly competitive global aviation market. The deal's ultimate success will depend on how effectively WestJet and its new partners manage the integration of their operations, leverage their combined strengths, and respond to evolving market demands. Stay updated on further developments related to WestJet's ownership changes and Onex Corporation's future investments to fully understand the long-term ramifications of this transformative event.

Featured Posts

-

Ufc 313 Mauricio Ruffys Ko Clinching Spinning Kick Revealed

May 12, 2025

Ufc 313 Mauricio Ruffys Ko Clinching Spinning Kick Revealed

May 12, 2025 -

Asylum Shelter Efficiency Advisory Councils Recommend E1 Billion Improvement Plan

May 12, 2025

Asylum Shelter Efficiency Advisory Councils Recommend E1 Billion Improvement Plan

May 12, 2025 -

Chantal Ladesou Le Fil D Ariane Revient Sur Tf 1

May 12, 2025

Chantal Ladesou Le Fil D Ariane Revient Sur Tf 1

May 12, 2025 -

Campeonato Uruguayo Segunda Division 2025 Fechas Formato Y Equipos

May 12, 2025

Campeonato Uruguayo Segunda Division 2025 Fechas Formato Y Equipos

May 12, 2025 -

Gerard Hernandez Et Chantal Ladesou Une Collaboration Sans Filtre

May 12, 2025

Gerard Hernandez Et Chantal Ladesou Une Collaboration Sans Filtre

May 12, 2025

Latest Posts

-

Universal Remote Control One Controller For All Your Devices

May 12, 2025

Universal Remote Control One Controller For All Your Devices

May 12, 2025 -

Sonos Interim Ceo Tom Conrad An Exclusive Interview

May 12, 2025

Sonos Interim Ceo Tom Conrad An Exclusive Interview

May 12, 2025 -

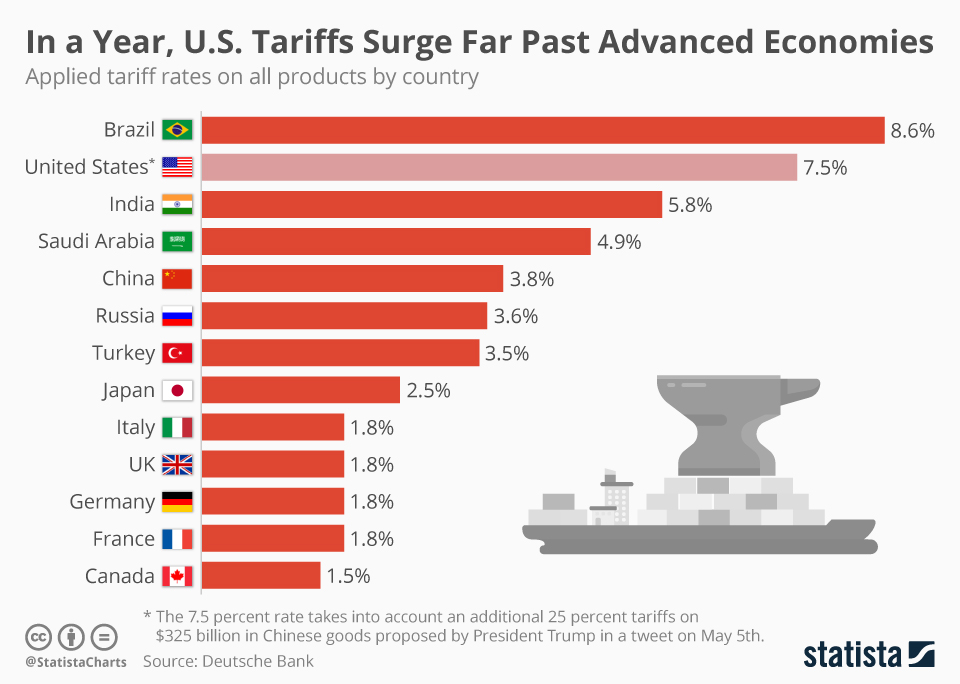

Trumps Tariffs And The Struggle Of Small Businesses A Case Study

May 12, 2025

Trumps Tariffs And The Struggle Of Small Businesses A Case Study

May 12, 2025 -

Ice Arrest And Public Response Analysis Of The Intervention Attempt

May 12, 2025

Ice Arrest And Public Response Analysis Of The Intervention Attempt

May 12, 2025 -

Filming Alligators In Florida Springs A Guide For Filmmakers

May 12, 2025

Filming Alligators In Florida Springs A Guide For Filmmakers

May 12, 2025