What To Expect From CoreWeave Stock In The Coming Months

Table of Contents

CoreWeave's Competitive Landscape and Market Position

CoreWeave is a rapidly growing provider of cloud computing infrastructure, specializing in high-performance computing solutions tailored for AI and machine learning workloads. Its unique selling proposition lies in its utilization of repurposed NVIDIA GPUs, offering a cost-effective alternative to traditional cloud providers. But how does CoreWeave stack up against established giants?

Analysis of Major Competitors

CoreWeave faces stiff competition from industry behemoths like Amazon Web Services (AWS), Google Cloud Platform (GCP), and Microsoft Azure. These established players boast extensive infrastructure, global reach, and massive customer bases. However, CoreWeave differentiates itself through:

- Cost-effectiveness: Its repurposed GPU strategy allows it to offer competitive pricing.

- Specialized focus: CoreWeave's niche focus on high-performance computing for AI and machine learning attracts a specific segment of the market less saturated by its larger competitors.

- Agility and Innovation: As a newer company, CoreWeave can adapt more quickly to emerging technologies and customer needs.

Market Growth Potential in Cloud Computing and AI

The cloud computing and AI infrastructure markets are experiencing explosive growth. According to Gartner, the worldwide public cloud services market is projected to reach $620 billion in 2023, with AI infrastructure a major driver of this expansion. This presents substantial opportunities for CoreWeave.

- Market share analysis: While currently a smaller player, CoreWeave's innovative approach positions it for significant market share gains.

- CoreWeave's USPs: Its specialized services and cost-effectiveness are key differentiators.

- Potential for market disruption: CoreWeave's business model could disrupt the existing market dynamics.

- Growth projections: Analysts predict strong growth for CoreWeave, though the exact figures remain speculative and dependent on various factors.

Financial Performance and Key Metrics

Analyzing CoreWeave's financial performance is critical for assessing its long-term potential. While the company is relatively new, examining available data provides valuable insights.

Recent Earnings Reports and Financial Health

CoreWeave's recent earnings reports (access them through their investor relations page) will reveal key information regarding revenue growth, profitability, and cash flow. Pay close attention to metrics like:

- Revenue growth: A strong upward trend indicates robust market demand.

- Profitability: Positive margins demonstrate efficient operations and a sustainable business model.

- Cash flow: A healthy cash flow is essential for sustained growth and investment.

Key Performance Indicators (KPIs)

Understanding CoreWeave's KPIs is crucial for gauging its operational efficiency and customer acquisition. Important metrics to monitor include:

-

Customer Acquisition Cost (CAC): Low CAC demonstrates efficient marketing and sales strategies.

-

Average Revenue Per User (ARPU): High ARPU suggests high-value customers and a strong value proposition.

-

Churn Rate: A low churn rate signifies high customer satisfaction and retention.

-

Revenue streams and growth trends: Identifying the primary revenue sources and their growth patterns is essential.

-

Profitability and margins: Analyzing profit margins helps assess the company's pricing strategy and operational efficiency.

-

Debt levels and overall financial stability: High debt levels could pose risks, whereas low debt indicates financial strength.

-

Future financial projections: Reviewing analyst forecasts can provide insights into the company's future financial performance.

Potential Catalysts for Stock Price Movement

Several factors could significantly influence CoreWeave's stock price in the coming months. Understanding these potential catalysts is key to making informed investment decisions.

New Product Launches and Partnerships

Upcoming product launches and strategic partnerships could significantly boost CoreWeave's growth and market share. Keep an eye out for announcements related to:

- New AI-focused cloud solutions: Expansion into new areas could attract new customers.

- Strategic alliances: Partnerships with major software companies could broaden CoreWeave's reach.

Regulatory Changes and Industry Trends

Regulatory changes and industry trends can also impact CoreWeave's stock price. Factors to consider include:

- Increased demand for AI infrastructure: This presents a significant growth opportunity.

- Government regulations on data privacy and security: Compliance is crucial for continued growth.

Macroeconomic Factors

Broader macroeconomic factors can significantly influence investor sentiment and market valuations. Key considerations include:

-

Interest rates: Rising interest rates can reduce investment appetite.

-

Inflation: High inflation can impact both costs and consumer spending.

-

Recessionary fears: Economic uncertainty can lead to decreased investment in growth stocks.

-

Specific details about upcoming product releases: Analyze the potential market impact of each new offering.

-

Impact of partnerships: Assess the strategic value and potential synergies of collaborations.

-

Regulatory risks and opportunities: Identify potential regulatory hurdles and explore opportunities stemming from changes in regulations.

-

Impact of macroeconomic factors: Gauge the potential effects of interest rates, inflation, and economic uncertainty on investor sentiment toward CoreWeave stock.

Conclusion: Making Informed Decisions About CoreWeave Stock

Investing in CoreWeave stock presents both significant opportunities and considerable risks. While the company operates in a rapidly growing market and possesses innovative technology, it also faces competition from established giants and the inherent volatility of a relatively new player. This analysis highlights the key factors influencing CoreWeave stock outlook. Remember, a thorough understanding of CoreWeave's competitive landscape, financial performance, and the potential catalysts affecting its stock price is vital for making informed investment decisions. Before investing in CoreWeave stock, conduct thorough research, consider the risks, and consult with a qualified financial advisor. Learn more about CoreWeave stock and analyze CoreWeave investment opportunities carefully before making any decisions. Investing wisely in CoreWeave requires diligent analysis and a balanced approach to risk assessment. Consider your own risk tolerance and investment goals before proceeding. A careful assessment of the CoreWeave stock prediction, based on your own research, is crucial.

Featured Posts

-

Phan Tich 7 Diem Nut Giao Thong Quan Trong Tp Hcm Long An

May 22, 2025

Phan Tich 7 Diem Nut Giao Thong Quan Trong Tp Hcm Long An

May 22, 2025 -

Nato Pa Antalya Teroerizm Ve Deniz Guevenligine Dair Oenemli Degerlendirmeler

May 22, 2025

Nato Pa Antalya Teroerizm Ve Deniz Guevenligine Dair Oenemli Degerlendirmeler

May 22, 2025 -

New Business Hotspots Across The Country A Detailed Map And Analysis

May 22, 2025

New Business Hotspots Across The Country A Detailed Map And Analysis

May 22, 2025 -

Danh Gia Tac Dong Cua Cac Du An Ha Tang Den Giao Thong Tp Hcm Binh Duong

May 22, 2025

Danh Gia Tac Dong Cua Cac Du An Ha Tang Den Giao Thong Tp Hcm Binh Duong

May 22, 2025 -

Juergen Klopp Un Doenuesue Duenya Devi Nin Yeni Lideri Mi

May 22, 2025

Juergen Klopp Un Doenuesue Duenya Devi Nin Yeni Lideri Mi

May 22, 2025

Latest Posts

-

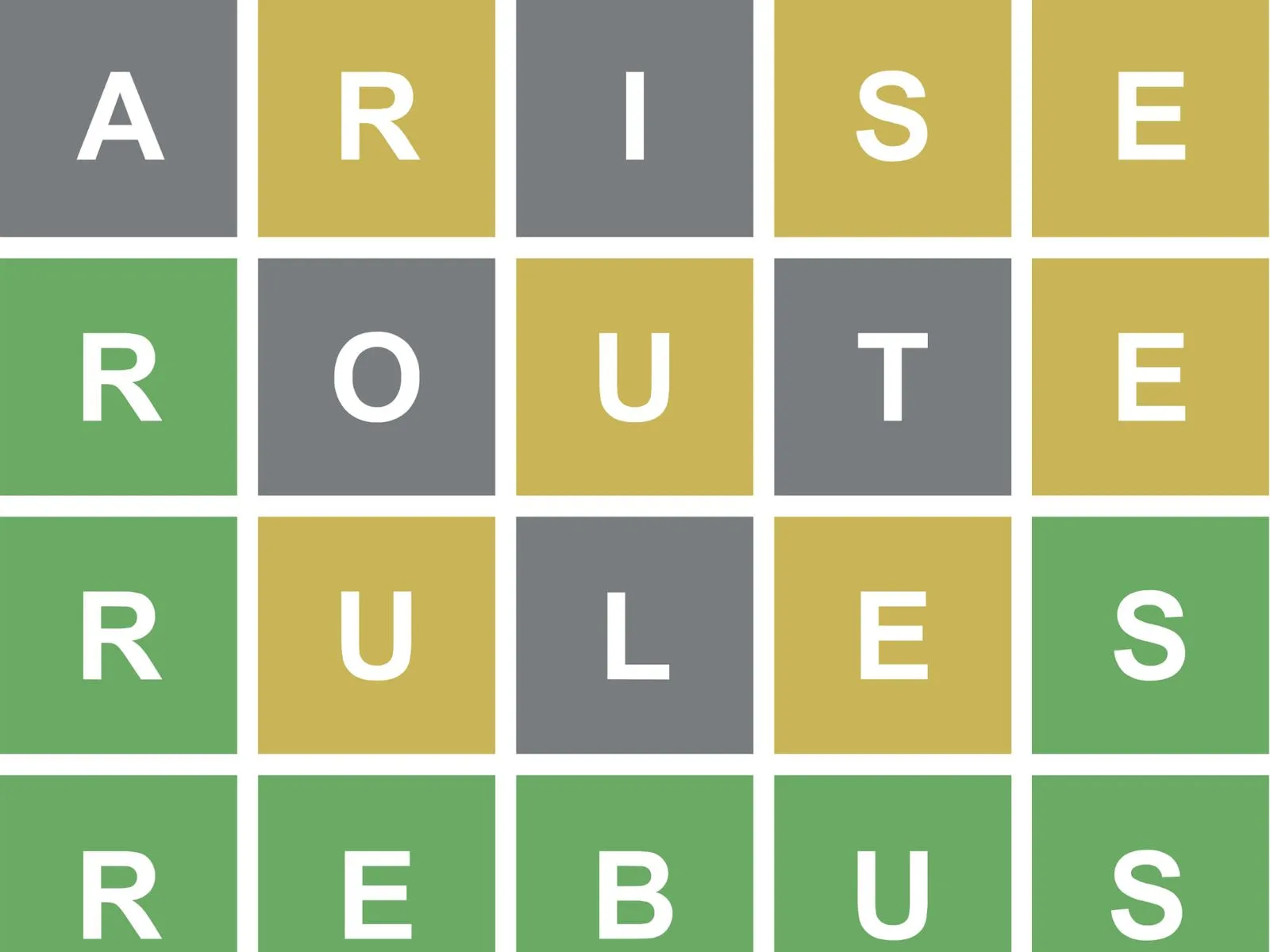

Solve Wordle 370 Clues And Solution For March 20th

May 22, 2025

Solve Wordle 370 Clues And Solution For March 20th

May 22, 2025 -

Wordle Today 370 March 20th Hints Clues And The Answer

May 22, 2025

Wordle Today 370 March 20th Hints Clues And The Answer

May 22, 2025 -

Conquering Todays Nyt Wordle March 26 A Step By Step Guide

May 22, 2025

Conquering Todays Nyt Wordle March 26 A Step By Step Guide

May 22, 2025 -

Nyt Wordle March 26 Solution And Gameplay Analysis

May 22, 2025

Nyt Wordle March 26 Solution And Gameplay Analysis

May 22, 2025 -

March 26 Nyt Wordle How To Solve Todays Difficult Puzzle

May 22, 2025

March 26 Nyt Wordle How To Solve Todays Difficult Puzzle

May 22, 2025