White House Minimizes Auto Industry Concerns Over UK Trade Deal

Table of Contents

Key Auto Industry Concerns Regarding the UK Trade Deal

The US automotive sector has voiced several key concerns about the potential impact of a new UK trade deal. These concerns stem from the complexities of post-Brexit trade and the potential for increased barriers to market access.

Tariff Barriers

A major concern centers around the potential for increased tariffs on US-made vehicles exported to the UK and vice versa. These tariffs could significantly impact the profitability and competitiveness of US auto manufacturers.

- Specific Tariff Rates: While specific rates remain subject to negotiation, discussions have hinted at the possibility of reverting to World Trade Organization (WTO) most-favored-nation (MFN) rates, which could be considerably higher than those under previous agreements. This could add thousands of dollars to the cost of each vehicle.

- Impact on Specific Models: High-end luxury vehicles and larger SUVs, often manufactured in the US, might be disproportionately affected by increased tariffs, impacting their competitiveness against European and Asian rivals in the UK market. Conversely, UK-manufactured vehicles could face similar challenges entering the US market.

- Existing Trade Agreements: The potential deal would supersede existing trade agreements and preferential access previously enjoyed under the EU framework. This shift could lead to a considerable loss of competitiveness for both US and UK automakers.

- Economic Consequences: The imposition of higher tariffs could lead to reduced sales, job losses in both countries, and a general decrease in overall economic activity within the automotive sector.

Supply Chain Disruptions

Post-Brexit complexities have introduced significant uncertainty and potential disruption to the intricate supply chains supporting the US auto industry. Many crucial components and materials are sourced from the UK and the EU.

- Component Sourcing: Numerous US auto manufacturers rely on UK and EU suppliers for parts ranging from electronics and specialized tooling to specific materials crucial for vehicle production. Disruptions to these supply chains could significantly impact manufacturing schedules and production output.

- Manufacturing Schedules: Delays in component delivery due to customs checks, new bureaucratic procedures, and potential logistical bottlenecks could lead to production shutdowns and lost revenue.

- Alternative Sourcing: While some manufacturers are exploring alternative sourcing strategies to mitigate the risk, finding reliable suppliers with comparable quality and cost-effectiveness outside the UK and EU may prove challenging and time-consuming.

- Transportation Costs: The added logistical complexities and increased transportation costs associated with navigating post-Brexit trade could significantly inflate the overall cost of producing and importing vehicles.

Regulatory Divergence

Differences in regulatory standards between the US and the UK pose another substantial challenge for the auto industry. Meeting differing standards in both markets adds significant costs and complexity.

- Emissions Standards: Discrepancies in emissions standards between the two countries could require manufacturers to make costly modifications to vehicles destined for each market, reducing profitability.

- Safety Regulations: Differing safety regulations could necessitate similar costly adaptations, adding to the overall manufacturing expense.

- Compliance Costs: The overall cost of ensuring compliance with multiple sets of regulations in both the US and UK could render exporting less economically viable for some manufacturers.

- Regulatory Harmonization: While efforts towards regulatory harmonization are underway, the timeframe for achieving substantial alignment remains uncertain, leaving significant short-term challenges for automakers.

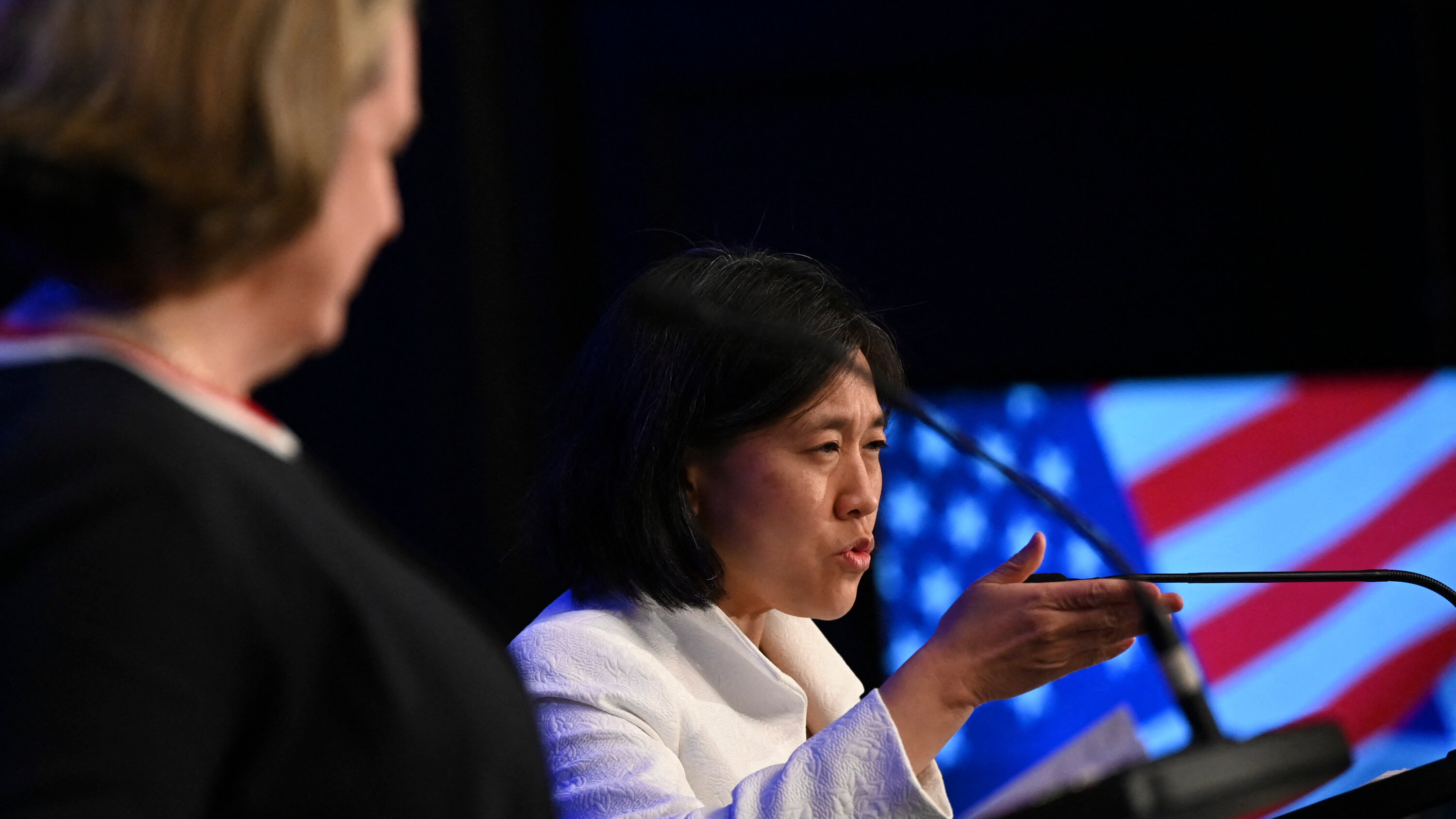

The White House's Response and Minimization of Concerns

The White House has responded to the auto industry’s anxieties with a mix of official statements, behind-the-scenes negotiations, and an emphasis on the long-term economic benefits of the trade deal.

Official Statements and Public Relations

The White House has issued several statements aiming to reassure the auto industry and downplay the severity of potential disruptions.

- Reassuring Statements: Officials have emphasized the potential economic benefits of the deal, focusing on increased trade in other sectors and opportunities for future growth.

- Industry Dialogue: The administration has pointed to ongoing dialogue with the auto industry to address concerns and explore solutions.

- Specific Commitments: While specific commitments to alleviate tariff concerns haven’t been explicitly detailed, the White House has generally portrayed the deal as mutually beneficial.

Behind-the-Scenes Negotiations and Assurances

Beyond public pronouncements, behind-the-scenes negotiations and assurances are likely playing a role in addressing the industry's concerns.

- Bilateral Meetings: The administration has likely held numerous bilateral meetings with automotive executives and representatives to discuss specific concerns and potential solutions.

- Working Groups: Dedicated working groups may be in place to address specific challenges, such as supply chain issues and regulatory differences.

- Concessions and Compromises: The extent of any concessions or compromises made by either side remains largely undisclosed, although some compromises on regulatory issues are possible.

Long-Term Economic Outlook

The White House emphasizes the long-term economic gains anticipated from the deal, even if some short-term challenges remain.

- Projected Economic Gains: The administration likely projects significant economic benefits from increased trade in various sectors, potentially offsetting any negative impact on the auto industry.

- Offsetting Benefits: The White House may be focusing on potential indirect benefits for the auto industry, such as access to new markets or opportunities for innovation.

- Investment Incentives: Potential investment incentives or other support measures for the US auto industry might be considered to mitigate the potential negative impacts of the trade deal.

Conclusion

The US auto industry has voiced significant concerns regarding the potential impact of a new UK trade deal, focusing on tariff barriers, supply chain disruptions, and regulatory divergence. The White House, in response, has sought to minimize these concerns by highlighting potential long-term economic benefits and engaging in behind-the-scenes negotiations. However, the ultimate success of these efforts remains to be seen. The White House's optimistic outlook on the UK trade deal needs further scrutiny. Closely monitoring the impact of this agreement on the US auto industry, including the resolution of outstanding concerns regarding tariffs and supply chain disruptions, is crucial. Stay informed on developments related to the White House's stance on the UK trade deal to understand its potential implications for the US automotive sector.

Featured Posts

-

Tasman Council Road Closure A Truckies Plea For Realism

May 12, 2025

Tasman Council Road Closure A Truckies Plea For Realism

May 12, 2025 -

The Significance Of Sylvester Stallones Part In Jason Stathams Upcoming Film

May 12, 2025

The Significance Of Sylvester Stallones Part In Jason Stathams Upcoming Film

May 12, 2025 -

Thomas Muellers Bayern Legacy His Most Frequent Teammates

May 12, 2025

Thomas Muellers Bayern Legacy His Most Frequent Teammates

May 12, 2025 -

Salariul Lui Sylvester Stallone Pentru Rocky O Analiza Detaliata

May 12, 2025

Salariul Lui Sylvester Stallone Pentru Rocky O Analiza Detaliata

May 12, 2025 -

Mackenzie Mc Kee And Khesanio Hall Expecting Pregnancy Confirmed

May 12, 2025

Mackenzie Mc Kee And Khesanio Hall Expecting Pregnancy Confirmed

May 12, 2025

Latest Posts

-

Which Rocky Movie Touches Sylvester Stallone The Most

May 12, 2025

Which Rocky Movie Touches Sylvester Stallone The Most

May 12, 2025 -

Stallone Reveals His Top Rocky Movie A Touching Choice

May 12, 2025

Stallone Reveals His Top Rocky Movie A Touching Choice

May 12, 2025 -

Sylvester Stallone Picks His Most Emotional Rocky Film

May 12, 2025

Sylvester Stallone Picks His Most Emotional Rocky Film

May 12, 2025 -

Sylvester Stallones Favorite Rocky Movie The Franchises Most Emotional Entry

May 12, 2025

Sylvester Stallones Favorite Rocky Movie The Franchises Most Emotional Entry

May 12, 2025 -

The Box Office Failure Sylvester Stallones Only Non Starring Directing Venture

May 12, 2025

The Box Office Failure Sylvester Stallones Only Non Starring Directing Venture

May 12, 2025