Who Is Warren Buffett's Canadian Successor? A Billionaire's Unique Approach

Table of Contents

Potential Candidates: Examining Leading Canadian Investors

Finding a successor to Warren Buffett requires analyzing leading Canadian investors and their distinct approaches. This involves understanding not just their financial performance but also their philosophies and how they navigate the intricacies of the Canadian market.

Analyzing the Investment Philosophies of Top Canadian Billionaires

Several prominent Canadian investors stand out for their astute financial acumen and impactful investment strategies. Their approaches often differ from Buffett's, highlighting the diverse strategies successful investors employ.

- Mark Wiseman: CEO of the Canada Pension Plan Investment Board (CPPIB), known for its globally diversified portfolio and long-term investment horizon.

- Edward Clark: Former CEO of the Canada Pension Plan Investment Board (CPPIB), known for his focus on global diversification and responsible investing.

- Prem Watsa: CEO of Fairfax Financial Holdings, known for his value investing approach and contrarian bets. His style shares some similarities with Buffett’s but also incorporates unique risk management strategies within the Canadian and global markets.

These Canadian portfolio managers and top Canadian investors represent diverse approaches to investment. While Prem Watsa's value investing resonates with Buffett's approach, others incorporate global diversification and ESG factors which are increasingly prominent in the Canadian stock market.

Key Characteristics of a Buffett-esque Investor

To identify a potential successor, we must consider the qualities that define Buffett's success. These include:

- Long-term vision: A focus on long-term value creation rather than short-term gains.

- Patience: The ability to wait for the right investment opportunities, avoiding impulsive decisions.

- Value-oriented approach: Identifying undervalued assets with strong fundamentals.

- Risk management: Careful assessment and mitigation of potential risks.

While no single Canadian investor perfectly mirrors all of Buffett's traits, Prem Watsa's focus on value investing strategies and long-term investment coupled with sophisticated risk mitigation techniques come closest to embodying these long-term investment principles.

The Unique Canadian Approach to Investing

Investing in Canada presents unique opportunities and challenges compared to the US market. Understanding this context is crucial in identifying a potential "Canadian Buffett."

Geopolitical Considerations and Canadian Market Opportunities

The Canadian market differs significantly from the US market. Its stronger ties to resource extraction and its more cautious approach to regulation influence investment strategies. Analyzing the Canadian market analysis and Canadian economic outlook helps in assessing the geopolitical risk affecting investment choices and finding undervalued opportunities for savvy investors.

ESG and Sustainable Investing in Canada

Environmental, Social, and Governance (ESG) factors are increasingly integral to Canadian investment decisions. This focus on ESG investing and sustainable investments, particularly regarding socially responsible investing, contrasts with Buffett's more traditional approach, although it is also gaining traction in the US market. This shift reflects changing investor priorities and growing awareness of environmental and social impact.

The Future of Canadian Investing and its Global Impact

The next generation of Canadian investors will likely further shape the global financial landscape.

The Next Generation of Canadian Investors

Younger investors are emerging with innovative strategies, blending traditional wisdom with technological advancements. Their impact on emerging markets and the future of finance will be significant. Their approaches to the next generation investors will blend ESG considerations with technological disruption.

Predicting the Successor's Investment Style

Predicting the investment style of Buffett's eventual "Canadian successor" is challenging. However, considering current investment trends and market predictions, a blend of value investing, ESG consciousness, and a nuanced understanding of the Canadian and global markets seems likely. This would represent a unique evolution of value investing adapted to a changing world.

Conclusion: Finding Warren Buffett's Canadian Successor – A Call to Action

Identifying a direct successor to Warren Buffett is an ambitious endeavor. However, exploring prominent Canadian investors and their diverse strategies reveals a unique approach to investing, shaped by the Canadian market's characteristics and global trends. The future of investing likely lies in a synthesis of traditional value investing principles and an awareness of ESG factors and emerging markets. To fully understand the evolving landscape, we encourage you to research the investors mentioned above and discover more about potential successors to Warren Buffett's investment legacy. Explore the exciting world of Canadian investing and find your own unique approach. Learn more about Warren Buffett's Canadian Successor by subscribing to our newsletter for updates on Canadian investment strategies!

Featured Posts

-

Chainalysis Acquisition Of Alterya A Strategic Move In Ai And Blockchain

May 10, 2025

Chainalysis Acquisition Of Alterya A Strategic Move In Ai And Blockchain

May 10, 2025 -

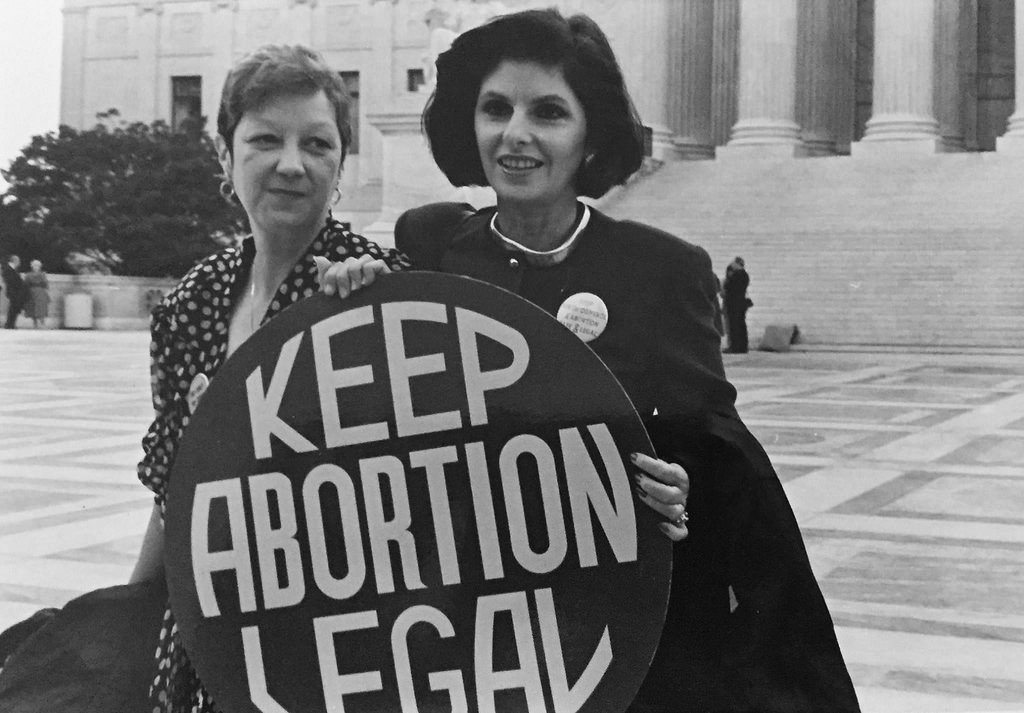

Over The Counter Birth Control Implications For Reproductive Healthcare After Roe V Wade

May 10, 2025

Over The Counter Birth Control Implications For Reproductive Healthcare After Roe V Wade

May 10, 2025 -

From Gang Violence To Political Flashpoint The Story Of Kilmar Abrego Garcia

May 10, 2025

From Gang Violence To Political Flashpoint The Story Of Kilmar Abrego Garcia

May 10, 2025 -

Go Compare Advert Change Wynne Evanss Post Strictly Situation

May 10, 2025

Go Compare Advert Change Wynne Evanss Post Strictly Situation

May 10, 2025 -

Donner Ses Cheveux A Dijon Guide Complet Pour Faire Un Don

May 10, 2025

Donner Ses Cheveux A Dijon Guide Complet Pour Faire Un Don

May 10, 2025