Why Did BCE Inc. Cut Its Dividend? Understanding The Impact On Investors

Table of Contents

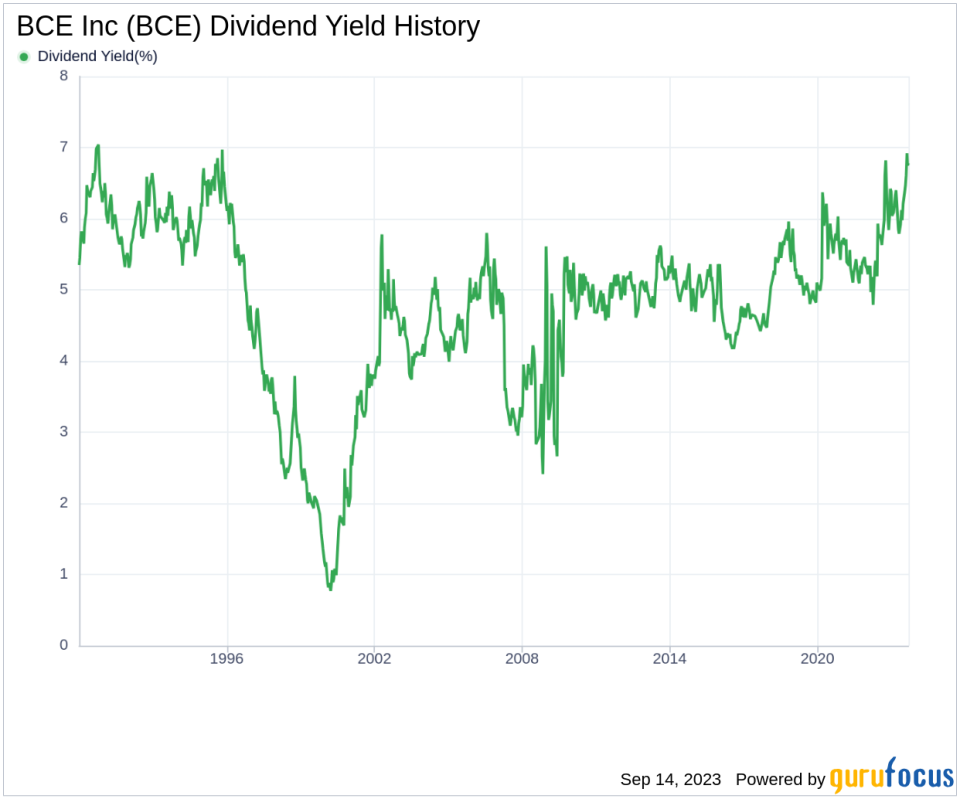

BCE Inc.'s Financial Performance and the Rationale Behind the Dividend Cut

BCE Inc.'s decision to cut its dividend wasn't arbitrary. It's a reflection of a confluence of factors impacting the company's financial performance. While BCE Inc. remains a dominant player in the Canadian telecommunications sector, recent financial reports reveal challenges that necessitate a reassessment of its dividend payout policy.

-

Analysis of declining revenue streams in specific sectors: Competition in the wireless market and slowing growth in traditional landline services have contributed to a decrease in revenue in certain segments. This pressure on revenue streams directly impacts the company's ability to sustain its previous dividend payout.

-

Increased debt levels and interest rate impact: Rising interest rates have increased BCE Inc.'s debt servicing costs, putting a strain on its cash flow. Higher debt levels also limit the company's financial flexibility and ability to maintain a generous dividend. [Link to relevant financial report, e.g., BCE Inc. quarterly earnings report]

-

Lower-than-expected profit margins: Increased competition and rising operational costs have squeezed profit margins, reducing the available funds for dividend distributions. This erosion of profitability is a key factor contributing to the BCE Inc. dividend cut.

-

Capital expenditure requirements (e.g., network upgrades, acquisitions): Significant investments in upgrading its network infrastructure (5G rollout, fiber optic expansion) and potential acquisitions require substantial capital expenditure. These investments, while crucial for long-term growth, necessitate a temporary reduction in dividend payouts to ensure financial stability.

The combination of these factors led BCE Inc.'s management to conclude that a dividend reduction was necessary to maintain the company's financial strength and pursue its strategic objectives.

Impact of the BCE Inc. Dividend Cut on Investors

The BCE Inc. dividend cut has immediate and potentially long-term consequences for investors. The impact varies depending on individual investment strategies and risk tolerance.

-

Reduced income for dividend-reliant investors: For investors who rely heavily on dividend income, the reduction represents a significant decrease in their cash flow. This necessitates a review of their portfolio's income generation strategy.

-

Potential impact on share price (both short-term volatility and long-term implications): The announcement of the dividend cut typically leads to short-term volatility in the stock price. However, the long-term impact depends on whether the company can successfully address the underlying financial challenges and deliver on its future growth plans.

-

Investor sentiment and its influence on the stock's performance: Negative investor sentiment following the dividend cut can further depress the stock price. Rebuilding investor confidence will require BCE Inc. to demonstrate a clear path to improved financial performance.

-

Comparison to dividend policies of competitors in the telecom sector: Analyzing the dividend policies of competitors like Telus and Rogers Communications can provide context and help investors assess whether BCE Inc.'s decision is in line with industry trends or represents a unique situation.

The immediate reaction to the news has been a decline in the BCE Inc. share price, reflecting the market's assessment of the situation. [Link to relevant financial news articles or analyst reports].

Alternative Investment Strategies After the BCE Inc. Dividend Cut

The BCE Inc. dividend cut necessitates a reassessment of investment strategies for affected investors. Several options exist to mitigate the impact of the reduced income stream.

-

Rebalancing portfolios to offset reduced income: Investors may need to rebalance their portfolios to compensate for the loss of dividend income, potentially by shifting towards other dividend-paying stocks or higher-yielding bonds.

-

Exploring other dividend-paying stocks in the telecom or similar sectors: The telecom sector still offers other dividend-paying stocks. Researching alternative options within the sector can help investors maintain a similar level of dividend income.

-

Considering growth stocks or other investment vehicles: Investors may choose to reallocate funds towards growth stocks or other investment vehicles with higher potential returns, albeit with potentially higher risk.

-

Analyzing the potential for future dividend increases by BCE Inc.: Investors should closely monitor BCE Inc.'s financial performance and management guidance to assess the likelihood of future dividend increases.

Seeking professional financial advice is crucial to developing a suitable strategy based on individual circumstances and risk tolerance.

Analyzing BCE Inc.'s Future Outlook and Dividend Prospects

BCE Inc.'s future outlook and the potential for dividend increases hinge on several factors.

-

Management's guidance on future financial performance: Closely examining management’s projections for revenue growth, cost control, and debt reduction is crucial for assessing the timeline for potential dividend restoration.

-

Potential for future dividend increases (timeline and conditions): Understanding the conditions under which BCE Inc. might reinstate or increase its dividend is critical for long-term investment planning.

-

Company's strategic initiatives and their impact on profitability: The success of BCE Inc.'s strategic initiatives, such as 5G deployment and network upgrades, will significantly impact its future profitability and ability to reinstate a higher dividend.

-

Risk assessment for future investments in BCE Inc.: Conduct a comprehensive risk assessment before making further investments in BCE Inc., considering factors such as industry competition, regulatory changes, and economic conditions.

Careful monitoring of BCE Inc.'s financial performance and strategic execution is essential for evaluating the long-term investment prospects.

Conclusion

The BCE Inc. dividend cut highlights the challenges facing the company and underscores the importance of understanding the underlying financial factors that influence dividend policy. The reduction in dividend payouts has immediate consequences for investors relying on this income stream, prompting the need for portfolio adjustments and a thorough reassessment of the investment's risk-reward profile. Understanding the reasons behind the BCE Inc. dividend cut is crucial for informed investment decisions. While the short-term impact may be negative, the long-term outlook depends on BCE Inc.'s ability to execute its strategic initiatives and improve its financial performance. We encourage you to conduct your own thorough research, considering the factors discussed above, before making any investment decisions related to BCE Inc. and to stay informed about the company’s future dividend policy and financial performance. The impact of the BCE Inc. dividend cut underscores the importance of diligent portfolio management and a proactive approach to adapting investment strategies in response to changing market conditions.

Featured Posts

-

Netherlands Extends Border Checks Despite Fewer Arrests And Asylum Claims

May 12, 2025

Netherlands Extends Border Checks Despite Fewer Arrests And Asylum Claims

May 12, 2025 -

Tom Cruises 1 Debt To Tom Hanks An Unpaid Acting Favor

May 12, 2025

Tom Cruises 1 Debt To Tom Hanks An Unpaid Acting Favor

May 12, 2025 -

Uruguay Envia Tres Toros A China Como Obsequio A Xi Jinping

May 12, 2025

Uruguay Envia Tres Toros A China Como Obsequio A Xi Jinping

May 12, 2025 -

Uruguays Film Industry Growth Incentives And Location Scouting

May 12, 2025

Uruguays Film Industry Growth Incentives And Location Scouting

May 12, 2025 -

Exclusif Un Animateur De M6 Donne Son Avis Sur L Arrivee De Cyril Hanouna

May 12, 2025

Exclusif Un Animateur De M6 Donne Son Avis Sur L Arrivee De Cyril Hanouna

May 12, 2025

Latest Posts

-

Lids I Barnli Nov Sezon Vo Premier Ligata

May 13, 2025

Lids I Barnli Nov Sezon Vo Premier Ligata

May 13, 2025 -

Triumf Lids Una Ted I Barnli Vo Premier Ligata

May 13, 2025

Triumf Lids Una Ted I Barnli Vo Premier Ligata

May 13, 2025 -

Povratok Vo Premier Ligata Za Lids I Barnli

May 13, 2025

Povratok Vo Premier Ligata Za Lids I Barnli

May 13, 2025 -

Vozvratok Vo Premier Ligata Barnli Slavi Pobeda Vo Derbito Lids Isto Taka Se Vrakja

May 13, 2025

Vozvratok Vo Premier Ligata Barnli Slavi Pobeda Vo Derbito Lids Isto Taka Se Vrakja

May 13, 2025 -

Lids I Barnli Obezbedile Mesto Vo Premier Ligata

May 13, 2025

Lids I Barnli Obezbedile Mesto Vo Premier Ligata

May 13, 2025