Why Did D-Wave Quantum (QBTS) Shares Increase Today? A Detailed Analysis

Table of Contents

Positive Financial News and Earnings Reports

Positive financial news often significantly impacts a company's stock price. Any recent earnings reports or announcements from D-Wave Quantum likely played a role in today's surge. Investors closely scrutinize key performance indicators (KPIs) to gauge a company's financial health and future prospects. Strong performance in these areas can boost investor confidence and drive up share prices. Let's explore some potential contributing factors:

- Increased revenue from quantum computing cloud services: Growth in this area demonstrates market adoption and the potential for future revenue streams. A substantial increase here would likely be a major positive for investors.

- Securing a major contract with a prominent technology company: Landing a large contract with a well-known company validates D-Wave's technology and strengthens its market position, signaling future growth potential. The sheer size and prestige of the client would influence investor perception.

- Improved profitability margins indicating operational efficiency: Demonstrating improved efficiency in operations signals a path towards sustainable growth and profitability, a key factor for long-term investor confidence. This suggests better cost management and a more robust business model.

These positive financial data points, if released recently, could easily explain a portion of the QBTS share price increase.

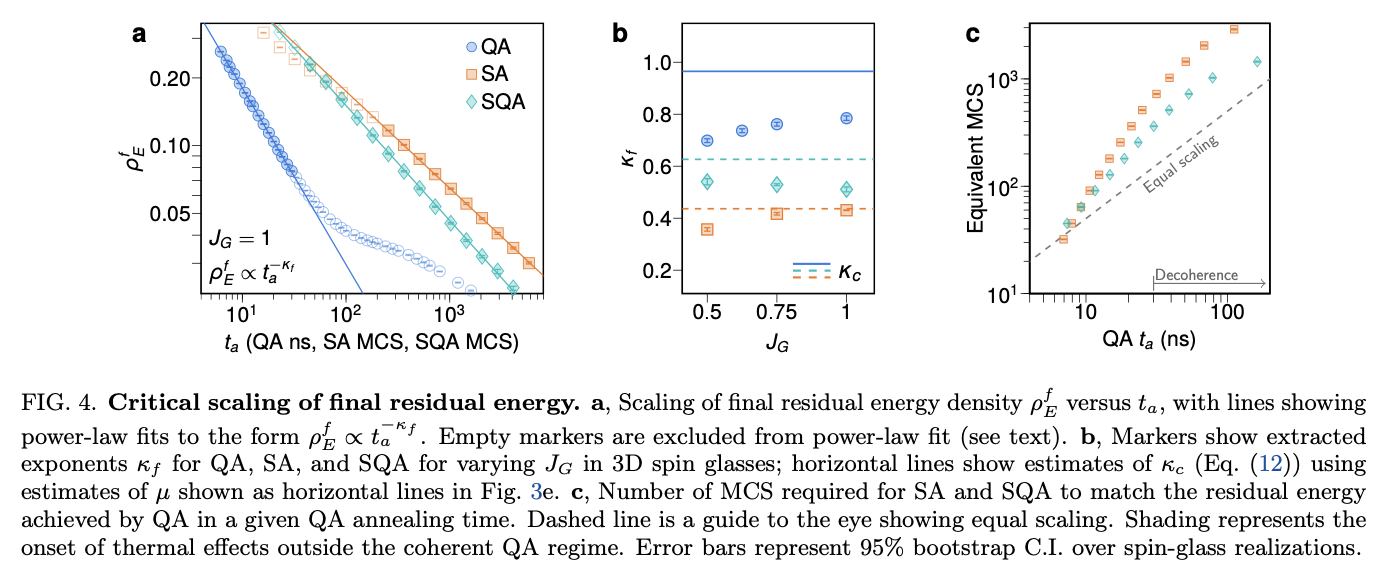

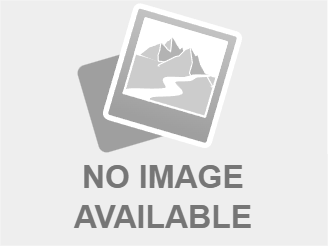

Technological Advancements and Breakthroughs

In the rapidly evolving field of quantum computing, technological advancements are crucial for attracting investors. Any breakthroughs announced by D-Wave Quantum could be a significant driver of the increased share price. Progress in algorithms, hardware, or software directly translates to improved capabilities and market competitiveness. Let's consider some possibilities:

- Successful implementation of a new quantum annealing algorithm: Improved algorithms directly enhance the performance and capabilities of D-Wave's quantum computers, making them more attractive to potential clients and fueling investor optimism.

- Announcement of a more powerful quantum computer architecture: A leap in computing power signifies a major step forward in the technology, highlighting D-Wave's leading position in the quantum computing landscape and drawing investor attention.

- Collaboration with a leading research institution to advance quantum computing research: Partnerships with reputable research institutions strengthen D-Wave's credibility and access to cutting-edge research, further improving its long-term prospects.

Market Sentiment and Industry Trends

The overall market sentiment towards the quantum computing sector can significantly influence individual company valuations. Positive industry trends and news often result in increased investor interest, benefiting all players in the field, including D-Wave Quantum. Let's examine some potential external factors:

- Increased investor interest in the quantum computing sector: A general rise in investor enthusiasm for quantum computing technologies can lift all boats, pushing up share prices across the board.

- Positive media coverage highlighting the potential of quantum computing: Positive media attention generates public awareness and interest, attracting both individual and institutional investors to the sector.

- Competitor's announcements that could boost overall sector confidence: Even positive news from competitors can indirectly benefit D-Wave by increasing the overall attractiveness of the quantum computing market.

These broad market forces can have a considerable impact on QBTS's stock performance.

Speculative Trading and Investor Behavior

Finally, it is important to acknowledge the role of speculative trading and investor behavior in driving short-term stock price fluctuations. While the factors discussed above likely contribute to the long-term value of D-Wave Quantum, speculative trading can create significant short-term volatility.

- Increased trading volume indicating high investor activity: High trading volume often suggests increased interest and activity from both buyers and sellers.

- Short squeeze potential as a contributing factor: A short squeeze, where investors buying shares force short-sellers to cover their positions, can dramatically increase share prices in the short term.

- Social media sentiment analysis showing increased positive sentiment: Positive social media buzz can influence retail investor decisions, leading to increased buying pressure and price increases.

Conclusion

The increase in D-Wave Quantum (QBTS) shares today is likely a result of a combination of factors, including positive financial news, technological advancements, favorable market sentiment, and potentially speculative trading activity. Understanding these factors is crucial for informed investment decisions. While the recent surge is encouraging, investors should maintain a balanced perspective, considering potential future risks and conducting thorough due diligence. Continue your research on QBTS and the broader quantum computing market to make well-informed decisions about investing in D-Wave Quantum and similar companies in the rapidly evolving quantum computing landscape.

Featured Posts

-

The Love Monster And You A Practical Guide To Relationship Health

May 21, 2025

The Love Monster And You A Practical Guide To Relationship Health

May 21, 2025 -

Exclusive Mummy Pigs Gender Reveal Party At A Famous London Spot

May 21, 2025

Exclusive Mummy Pigs Gender Reveal Party At A Famous London Spot

May 21, 2025 -

Brasserie Hell City L Adresse Incontournable Pres Du Hellfest

May 21, 2025

Brasserie Hell City L Adresse Incontournable Pres Du Hellfest

May 21, 2025 -

Love Monster Crafts Creative Projects Inspired By The Book

May 21, 2025

Love Monster Crafts Creative Projects Inspired By The Book

May 21, 2025 -

Trumps Legacy In Aerospace Assessing The Size And Transparency Of Completed Deals

May 21, 2025

Trumps Legacy In Aerospace Assessing The Size And Transparency Of Completed Deals

May 21, 2025

Latest Posts

-

Cassis Blackcurrant Liqueur Production Taste Profile And Cocktail Applications

May 22, 2025

Cassis Blackcurrant Liqueur Production Taste Profile And Cocktail Applications

May 22, 2025 -

Swiss Foreign Minister Cassis Condemns Pahalgam Terror Attack

May 22, 2025

Swiss Foreign Minister Cassis Condemns Pahalgam Terror Attack

May 22, 2025 -

Superalimentos Por Que Este Supera Al Arandano En Beneficios Para La Salud

May 22, 2025

Superalimentos Por Que Este Supera Al Arandano En Beneficios Para La Salud

May 22, 2025 -

Adios Enfermedades Cronicas El Poder Del Superalimento Para Una Vida Larga Y Saludable

May 22, 2025

Adios Enfermedades Cronicas El Poder Del Superalimento Para Una Vida Larga Y Saludable

May 22, 2025 -

El Superalimento Que Combate Enfermedades Cronicas Y Promueve La Longevidad

May 22, 2025

El Superalimento Que Combate Enfermedades Cronicas Y Promueve La Longevidad

May 22, 2025