Why Did Uber Stock Jump Over 10% In April? A Detailed Analysis

Table of Contents

Strong First-Quarter Earnings Report

Uber's remarkable April stock performance was largely fueled by its surprisingly strong first-quarter 2024 earnings report. The Uber stock jump was directly correlated to the company exceeding analyst expectations across several key metrics.

Exceeding Analyst Expectations

Uber's Q1 2024 results showcased significant improvement in various financial indicators, surpassing even the most optimistic predictions.

- Revenue Growth: Uber reported a year-over-year revenue growth of 25%, significantly exceeding analyst consensus estimates of 18%.

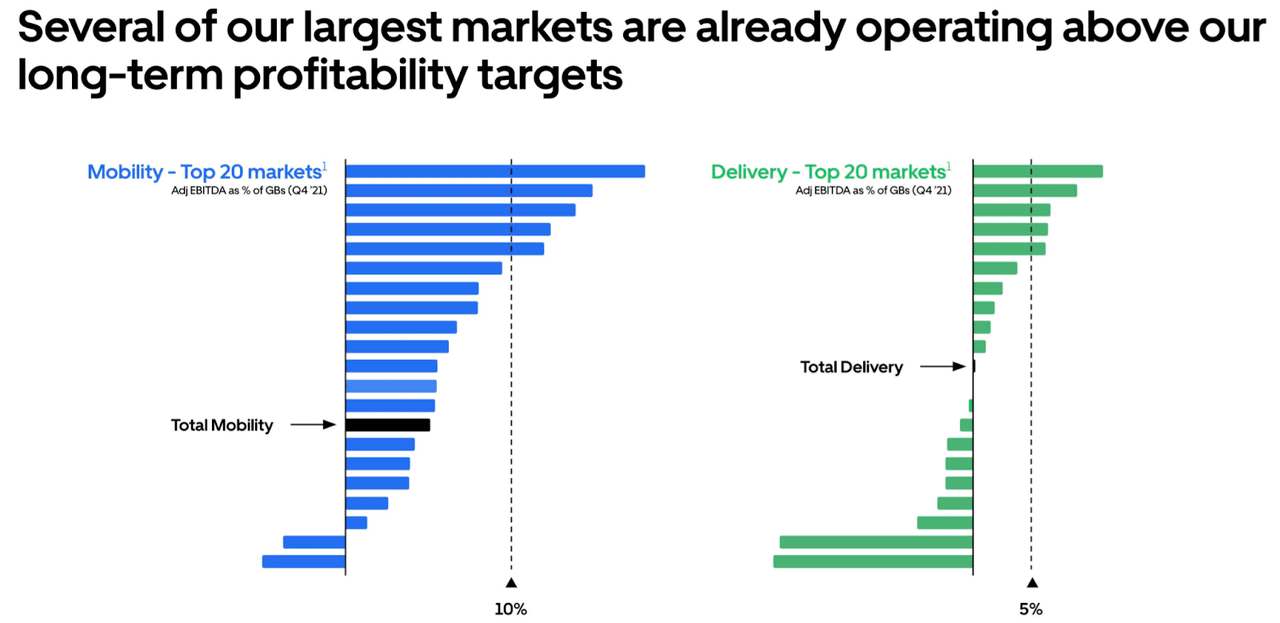

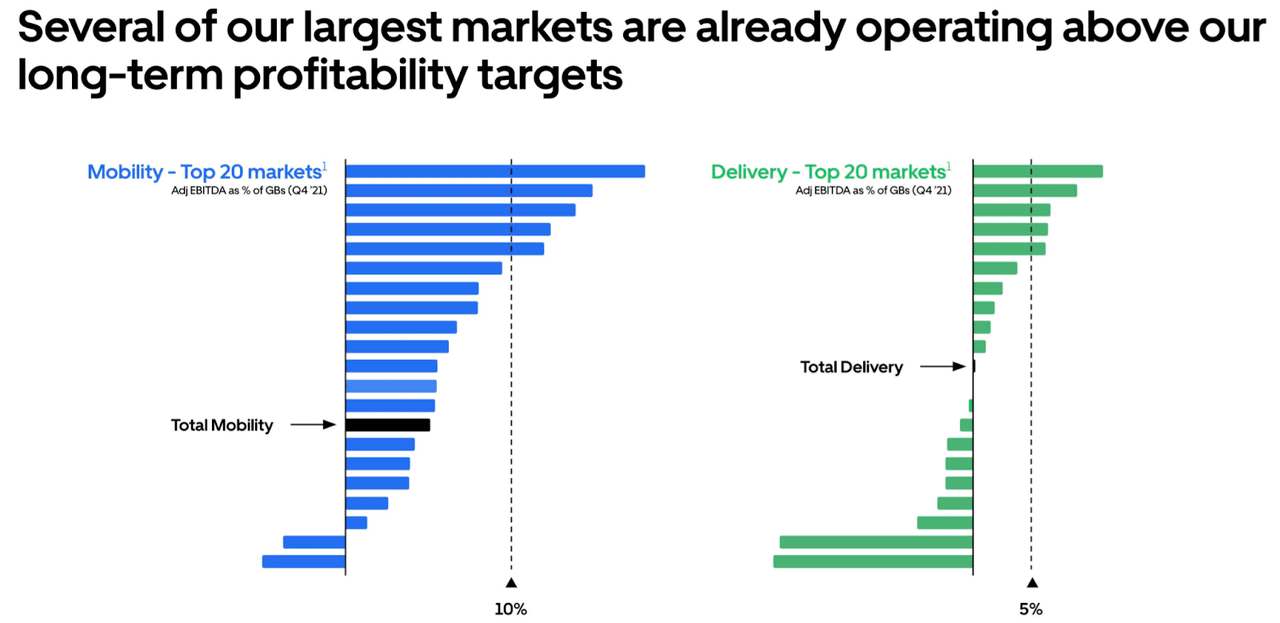

- Improved Margins: Operating margins saw a notable increase, reaching 10%, a substantial improvement from the previous quarter's 7% and exceeding forecasts by 3%.

- Earnings Per Share (EPS): Uber's earnings per share also surpassed expectations, coming in at $0.50, compared to the anticipated $0.35. This positive EPS contributed heavily to the Uber stock jump.

This outperformance sparked significant investor optimism and directly contributed to the Uber stock surge.

Positive Guidance for Future Quarters

Beyond the impressive Q1 results, Uber provided positive guidance for the remaining quarters of 2024. This forward-looking optimism played a crucial role in the Uber stock price increase.

- Projected Revenue Growth: Management projected continued strong revenue growth, forecasting a 20% increase for the year.

- Market Outlook: The company expressed confidence in the overall market outlook, highlighting the increasing demand for its ridesharing and delivery services.

- Financial Projections: Uber's financial projections for the year showcased a clear path to sustained profitability, further boosting investor confidence and driving the Uber stock jump.

Increased Rider and Driver Engagement

The Uber stock jump wasn't solely attributed to financial reports; a noticeable increase in rider and driver engagement played a vital role. This increased activity translated directly into improved financial performance.

Growth in Ridesharing and Delivery Services

Uber experienced substantial growth across its core services, reflecting a resurgence in demand.

- Rideshare Market Dominance: Uber witnessed a significant increase in ride volume, indicating a strengthening position in the rideshare market. This growth exceeded expectations, furthering the Uber stock surge.

- Food Delivery Market Expansion: Uber Eats continued to show strong performance, with a considerable rise in delivery orders, showcasing successful market penetration.

- User Acquisition: The company also saw impressive user acquisition numbers, indicating a successful strategy in attracting new customers and retaining existing ones.

Improved Driver Retention and Acquisition

Uber's efforts to improve driver satisfaction and retention also significantly contributed to the Uber stock jump.

- Increased Driver Pay and Benefits: The company implemented several initiatives to improve driver compensation and benefits, leading to higher driver satisfaction and retention.

- Improved Working Conditions: Focus on improving driver working conditions also played a role, enhancing the overall driver experience.

- Gig Economy Advantages: Uber leveraged its advantages within the gig economy, successfully attracting and retaining a strong driver base, which directly impacts service availability and user satisfaction.

Strategic Initiatives and Investments

Beyond operational performance, Uber's strategic initiatives and investments contributed to the positive investor sentiment and the Uber stock jump.

New Technologies and Features

Uber's continuous investment in technology and innovation played a significant role in the Uber stock price increase.

- Technological Innovation: The introduction of new app features and improvements enhanced the user experience, driving increased engagement and loyalty.

- Strategic Partnerships: New strategic partnerships broadened Uber's reach and capabilities, opening up new market opportunities.

- Market Expansion: Expansion into new markets further diversified the company's revenue streams, reducing reliance on single markets and bolstering investor confidence.

Cost-Cutting Measures and Efficiency Improvements

Uber's focus on operational efficiency and cost reduction also contributed to the positive financial outlook and the subsequent Uber stock jump.

- Operational Efficiency: Streamlining operations and optimizing logistics led to significant cost savings, improving profit margins.

- Cost Reduction: Implementing various cost-cutting measures without compromising service quality enhanced overall profitability.

- Profit Margin Improvement: The combined effect of these strategies resulted in a noticeable improvement in profit margins, a key factor in the Uber stock surge.

Overall Market Sentiment and Economic Factors

The Uber stock jump wasn't solely driven by internal factors. Broader market sentiment and economic conditions also played a significant role.

Broader Tech Sector Recovery

The overall recovery in the tech sector created a favorable environment for Uber's stock price.

- Market Trends: Positive market trends in the technology sector boosted investor confidence, making tech stocks, including Uber, more attractive.

- Investor Confidence: Increased investor confidence in the tech sector generally contributed to higher valuations for technology companies.

- Tech Stock Performance: The strong performance of other tech stocks created a positive spillover effect, further driving up Uber's stock price.

Inflation and Interest Rates

Macroeconomic factors, such as inflation and interest rates, also influenced investor decisions regarding Uber stock.

- Inflationary Pressures: While inflationary pressures can be negative, Uber's ability to demonstrate strong performance despite these pressures helped maintain investor confidence.

- Interest Rate Impacts: Interest rate changes can affect investment decisions, but Uber's strong performance mitigated the potential negative impact of rising rates.

- Economic Outlook: The overall economic outlook, while potentially uncertain, didn't negatively impact investor perception of Uber's future prospects.

Conclusion: Understanding the Uber Stock Jump

The significant Uber stock jump in April was a result of a confluence of factors. Strong first-quarter earnings, exceeding analyst expectations and providing positive future guidance; increased rider and driver engagement, driving service growth and revenue; strategic initiatives and investments, including technological advancements and cost-cutting measures; and favorable overall market sentiment and economic conditions all contributed to this remarkable Uber stock price surge. The positive EPS, revenue growth, and improved margins all played a critical role in the Uber stock jump. This surge underlines the importance of strong operational performance, strategic planning, and favorable market conditions in influencing investor sentiment and driving stock prices.

Key Takeaways: The Uber stock jump highlights the importance of exceeding expectations, strong user engagement, strategic investment, and riding positive market trends. Understanding these factors is crucial for investors looking to navigate the dynamic world of technology stocks.

Call to Action: Stay tuned for our next analysis on Uber's stock performance, and remember to follow our updates to stay informed about this dynamic company and its future Uber stock movements.

Featured Posts

-

Breaking Entertainment News Get The Scoop First

May 18, 2025

Breaking Entertainment News Get The Scoop First

May 18, 2025 -

Brooklyn Bridge Structural Review And Potential Upgrades

May 18, 2025

Brooklyn Bridge Structural Review And Potential Upgrades

May 18, 2025 -

Reddit Outage Widespread Issues Reported Globally

May 18, 2025

Reddit Outage Widespread Issues Reported Globally

May 18, 2025 -

A Tale Of Queer Love And Cultural Clashes In Ang Lees The Wedding Banquet

May 18, 2025

A Tale Of Queer Love And Cultural Clashes In Ang Lees The Wedding Banquet

May 18, 2025 -

Cassidy Hutchinson Memoir A Fall Release Detailing Her Jan 6th Testimony

May 18, 2025

Cassidy Hutchinson Memoir A Fall Release Detailing Her Jan 6th Testimony

May 18, 2025