Why Florida Condo Owners Are Desperate To Sell: Market Crash Insights

Table of Contents

Rising Interest Rates and Mortgage Costs

The dramatic increase in interest rates is a primary driver of the Florida condo market crash. Higher rates directly impact affordability, significantly reducing buyer demand. This translates to longer time on market for sellers and a decreased willingness among potential buyers to make offers.

-

Increased monthly mortgage payments deter potential buyers. Even a small percentage point increase in interest rates can dramatically increase monthly payments, pricing many prospective buyers out of the market. This is particularly true for first-time homebuyers and those with less financial flexibility.

-

Reduced buying power limits the pool of prospective purchasers. With higher interest rates, buyers can afford less expensive condos, increasing competition for those properties and leaving more expensive units stagnant on the market.

-

Higher interest rates make refinancing more expensive for existing owners. Many condo owners were relying on refinancing to manage costs or access equity. The current rate environment makes this strategy far less appealing, contributing to their desire to sell.

-

Impact on both primary residences and investment properties. Both those seeking primary residences and those aiming for investment properties are affected by the rising interest rates, shrinking the overall pool of potential buyers for Florida condos.

Data from the National Association of Realtors shows a strong correlation between rising interest rates and decreased condo sales in Florida. The impact is felt across various price points and locations, affecting both high-end luxury condos and more affordable units.

Increased Insurance Premiums and Assessments

The cost of insuring Florida condos has skyrocketed, especially in the wake of hurricane damage and increased frequency of severe weather events. This escalating expense is a major factor pushing owners towards selling.

-

Increased premiums make condo ownership less attractive and more expensive. Premiums are rising significantly, making it challenging for many owners to afford the ongoing costs of condo ownership.

-

Special assessments for repairs and renovations add financial burden on owners. Many condo buildings require substantial repairs and renovations, leading to significant special assessments that are passed on to unit owners. These unexpected costs further strain finances and encourage owners to sell.

-

Difficulties securing affordable insurance policies are pushing owners to sell. In some areas, finding insurance at any price is becoming increasingly difficult, forcing owners to make the difficult decision to sell their properties rather than face potential financial ruin.

-

The impact of building codes and safety regulations on insurance costs. Stricter building codes and safety regulations, while necessary for protection, also contribute to increased insurance costs as buildings are assessed and upgraded to meet new standards.

Examples abound of insurance premium hikes exceeding 50% or even doubling in some areas, drastically reducing the value of Florida condos and prompting owners to seek a quick sale to avoid accumulating debt.

Over-Saturation of the Florida Condo Market

The Florida condo market is currently experiencing an oversupply, adding to the pressure on sellers. Increased competition and decreased demand lead to a buyer's market, forcing owners to accept lower offers.

-

New construction projects adding to existing inventory. A significant number of new condo developments have recently been completed or are nearing completion, adding to the already substantial existing inventory.

-

Reduced demand leading to longer time on market. With fewer buyers, condos are spending considerably more time on the market than in previous years, leading to financial strain for owners and increasing their motivation to sell.

-

Increased pressure on owners to lower asking prices to secure a sale. Facing prolonged periods without offers, many sellers are forced to significantly reduce their asking prices to attract potential buyers.

-

The effect of seasonal fluctuations in demand on the market. While seasonal variations always exist in the Florida real estate market, the current oversupply amplifies the impact of these fluctuations, further depressing prices during the traditionally slower seasons.

Data indicates a significant increase in condo inventory levels in many Florida markets, with average days on market far exceeding pre-market crash levels. This underscores the fierce competition among sellers and the reduced negotiating power they currently hold.

Concerns Regarding Building Safety and Repairs

Growing concerns about building safety and the costs of necessary repairs are significantly impacting the marketability of Florida condos. The increased scrutiny and potential for large-scale repair bills are major deterrents for potential buyers.

-

Increased scrutiny on building maintenance and structural integrity. Following publicized incidents of building failures, there’s heightened scrutiny on condo building maintenance and structural integrity. This leads to more rigorous inspections and potentially costly repairs.

-

Concerns about potential repair costs and special assessments. Potential buyers are increasingly apprehensive about inheriting unforeseen repair costs or substantial special assessments, making them hesitant to purchase.

-

Negative impact of publicized building failures on buyer confidence. High-profile building collapses and safety concerns have shaken buyer confidence, impacting the desirability of Florida condos even in desirable locations.

-

The role of stricter regulations in affecting property values. New and stricter regulations aimed at improving building safety are increasing the cost of compliance for condo associations and potentially affecting property values.

The implications of repairs needed after hurricanes or other natural disasters are especially impactful, as many condos face significant damage and subsequent repair costs that deter potential buyers.

Conclusion

The desperation among Florida condo owners to sell is a result of a confluence of factors: rising interest rates, increased insurance costs, market over-saturation, and concerns regarding building safety and repairs. These factors have created a challenging environment for sellers, leading to decreased property values and increased competition in the Florida condo market crash. Understanding the current state of the Florida condo market is crucial for both buyers and sellers. If you're considering buying or selling a Florida condo, thorough research and professional advice are essential to navigate this complex market. Learn more about the current state of the Florida condo market crash and make informed decisions about your real estate investments.

Featured Posts

-

16 Million Fine For T Mobile Details On Three Years Of Data Breaches

Apr 23, 2025

16 Million Fine For T Mobile Details On Three Years Of Data Breaches

Apr 23, 2025 -

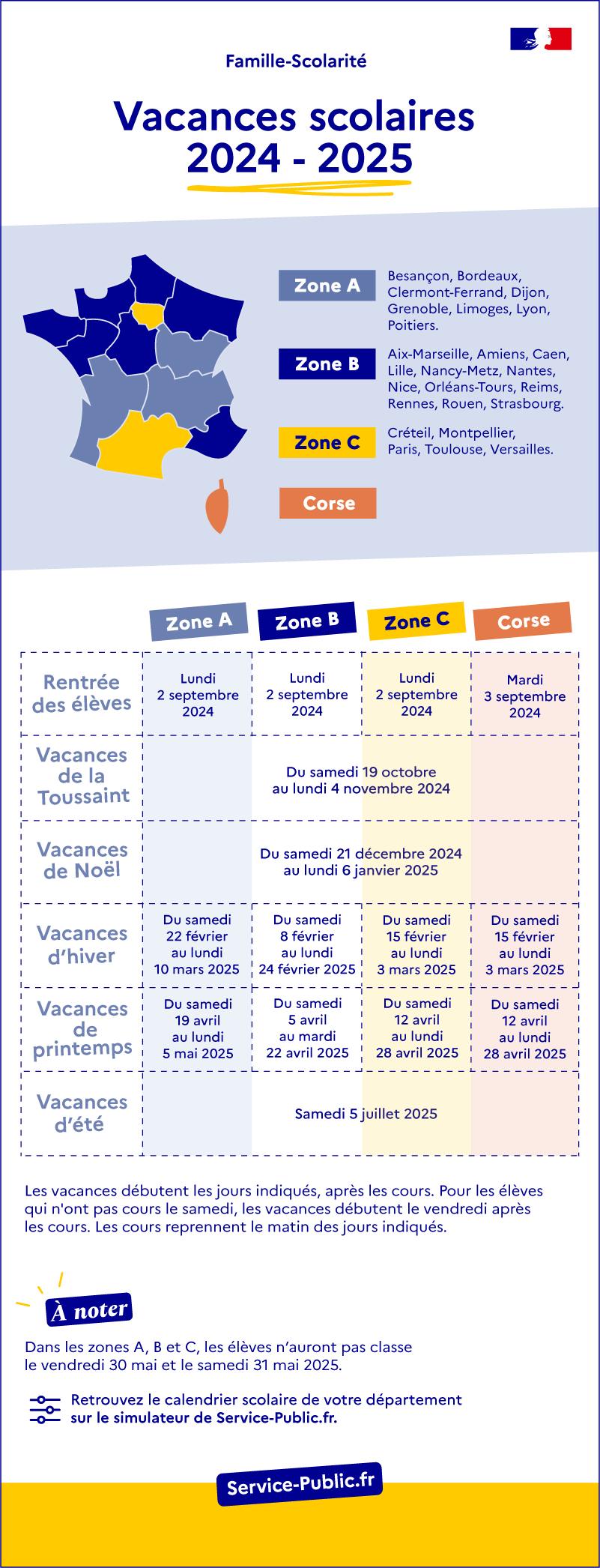

Vacances De Detente 2025 Dates Des Conges Scolaires En Federation Wallonie Bruxelles

Apr 23, 2025

Vacances De Detente 2025 Dates Des Conges Scolaires En Federation Wallonie Bruxelles

Apr 23, 2025 -

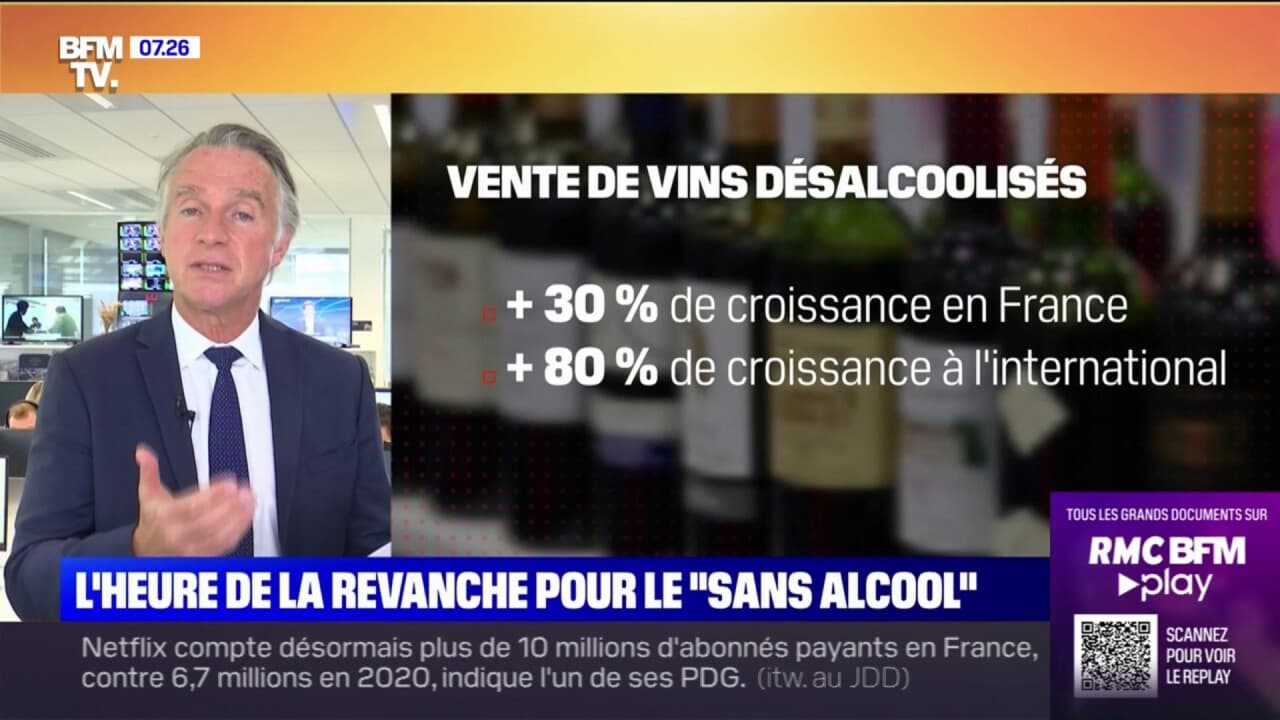

Tournee Minerale Et Dry January Un Marche Du Sans Alcool En Plein Essor

Apr 23, 2025

Tournee Minerale Et Dry January Un Marche Du Sans Alcool En Plein Essor

Apr 23, 2025 -

Solutions 30 Pourquoi Le Cours De L Action Est Il En Hausse

Apr 23, 2025

Solutions 30 Pourquoi Le Cours De L Action Est Il En Hausse

Apr 23, 2025 -

Nine Stolen Bases Brewers Rewrite The Record Books

Apr 23, 2025

Nine Stolen Bases Brewers Rewrite The Record Books

Apr 23, 2025

Latest Posts

-

Elizabeth Hurley Shows Off Her Figure In Maldives Bikinis

May 10, 2025

Elizabeth Hurley Shows Off Her Figure In Maldives Bikinis

May 10, 2025 -

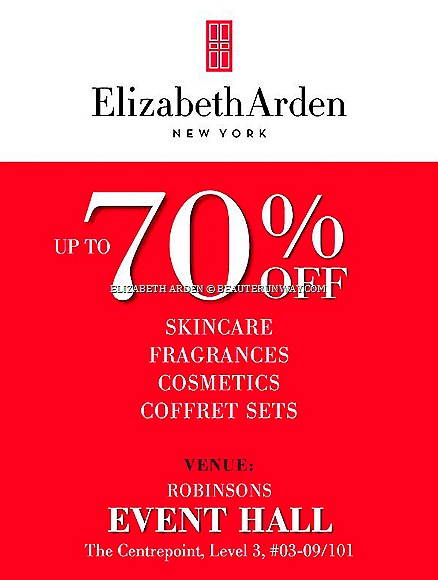

Cheaper Elizabeth Arden Skincare Smart Shopping Guide

May 10, 2025

Cheaper Elizabeth Arden Skincare Smart Shopping Guide

May 10, 2025 -

Elizabeth Line Accessibility Addressing Wheelchair User Challenges

May 10, 2025

Elizabeth Line Accessibility Addressing Wheelchair User Challenges

May 10, 2025 -

Best Elizabeth Arden Skincare Deals At Walmart

May 10, 2025

Best Elizabeth Arden Skincare Deals At Walmart

May 10, 2025 -

Britannian Kruununperimysjaerjestys Paeivitetty Lista Ja Selitys

May 10, 2025

Britannian Kruununperimysjaerjestys Paeivitetty Lista Ja Selitys

May 10, 2025