Why Investors Shouldn't Fear High Stock Market Valuations: BofA's Perspective

Table of Contents

BofA's Rationale: Understanding the Context of High Valuations

BofA's perspective on current high stock market valuations emphasizes the critical importance of context. Simply looking at high price-to-earnings (P/E) ratios without considering the broader economic picture can be misleading. Their analysis suggests that several factors contribute to the current valuation levels and shouldn't automatically signal impending market collapse.

-

Low interest rates: Historically low interest rates have a significant impact on stock valuations. When borrowing costs are low, companies can access capital more easily, fueling investment and growth, which in turn supports higher stock prices. This directly influences stock market valuation models. Lower discount rates used in valuation models lead to higher present values of future earnings.

-

Strong corporate earnings growth: BofA highlights that strong corporate earnings growth, in many sectors, is outweighing concerns about high valuations. Companies are delivering robust results, justifying, to some extent, the higher price tags. This positive earnings momentum is a key factor mitigating the risks associated with high stock market valuations.

-

Focus on long-term growth potential: BofA stresses the importance of focusing on long-term growth potential rather than reacting to short-term market fluctuations. High valuations, in their view, don't necessarily negate the potential for continued long-term growth in specific sectors. This long-term perspective is crucial for successful equity investing.

-

Sector-specific analysis: BofA's research indicates that certain sectors are less susceptible to valuation risks than others. They suggest focusing on companies with strong fundamentals, sustainable competitive advantages, and demonstrable future growth prospects, even within a high-valuation market. This targeted approach allows for more effective risk management within an overall equity portfolio.

The Importance of Long-Term Investing in the Face of Volatility

The key takeaway from BofA's analysis is the critical role of long-term investing. Reacting emotionally to short-term market volatility, particularly concerning high stock market valuations, can be detrimental to long-term investment goals.

-

Historical data: Historical data consistently shows the resilience of the stock market, despite periods of high valuations. While corrections and bear markets are inevitable, long-term investors who stay the course generally reap the rewards of market growth. This is fundamental to understanding long-term investment success.

-

Avoiding the risk of missing out: Panicking and selling during periods of high valuations carries the significant risk of missing out on substantial long-term gains. Investors who prematurely exit the market may miss out on future growth and find it challenging to time the market's re-entry point.

-

Risk management strategies: BofA recommends employing strategies to manage risk within a long-term investment plan. This includes diversification across various asset classes (stocks, bonds, real estate) and dollar-cost averaging to mitigate the impact of short-term market fluctuations. These strategies are crucial elements of a successful, long-term investment approach.

-

Portfolio allocation: BofA generally recommends a well-diversified portfolio tailored to an investor's risk tolerance and long-term financial goals. The specific allocation might vary depending on individual circumstances, but the emphasis remains on long-term growth.

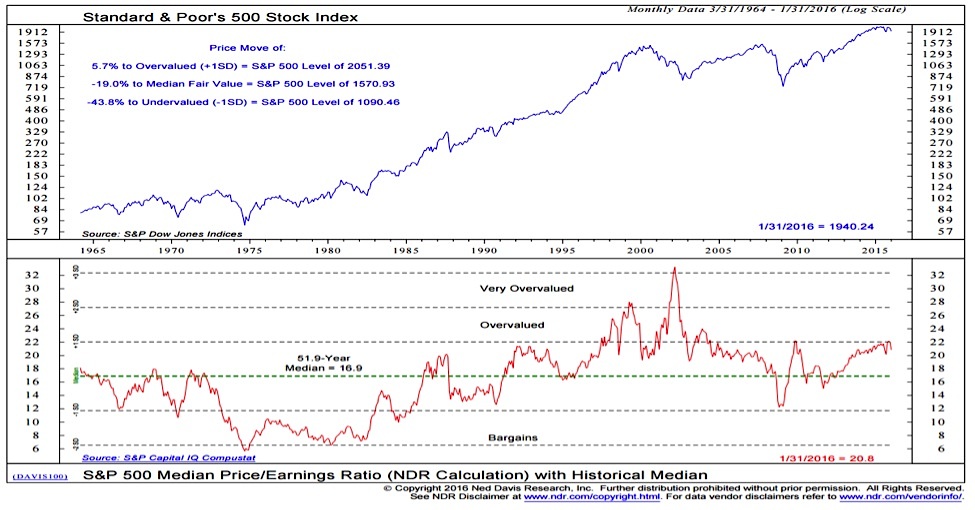

Analyzing the Metrics Beyond P/E Ratios: A Broader View of Valuation

While P/E ratios are a common valuation metric, relying solely on them can be misleading. BofA advocates for a broader, more holistic view, encompassing various other financial metrics and economic indicators.

-

Multiple valuation metrics: BofA suggests considering other valuation metrics such as the Price-to-Earnings-to-Growth (PEG) ratio, which accounts for growth rate, and the Price-to-Sales (P/S) ratio, which is less sensitive to accounting manipulations. A more comprehensive evaluation helps to gain a more realistic view of the stock market valuation.

-

Economic factors: BofA considers economic factors beyond simple valuation metrics, such as interest rate trends, inflation rates, and overall economic growth. These factors significantly impact market performance and should be considered when assessing stock market valuations.

-

Informed investment decisions: A holistic approach, combining multiple valuation metrics and broader economic analysis, leads to more informed and less emotionally driven investment decisions. This is essential for successful long-term investing.

Case Studies: Examples of Companies with High Valuations but Strong Growth Potential

While specific company examples from BofA's research might require confidentiality, the principle remains: companies with high valuations but demonstrating strong future growth prospects can still be attractive to long-term investors. Sectors like technology, healthcare, and renewable energy often show this dynamic. Companies with innovative products, strong market positions, and high growth potential may warrant a higher valuation despite seemingly high P/E ratios. Careful due diligence and consideration of the company’s long-term vision is critical.

Conclusion

High stock market valuations, while seemingly concerning, shouldn't lead to immediate panic selling, particularly for long-term investors. BofA's perspective emphasizes a holistic view, considering long-term growth potential, broader economic factors, and diversified investment strategies. Investors should focus on a well-diversified portfolio and maintain a long-term perspective to mitigate the risks associated with high stock market valuations. Don't let fear of high stock market valuations paralyze your investment strategy. Learn more about BofA's perspective and develop a robust, long-term investment plan. Consult a financial advisor to discuss your individual investment strategy in relation to current high stock market valuations.

Featured Posts

-

Over The Counter Birth Control A Post Roe Game Changer

Apr 22, 2025

Over The Counter Birth Control A Post Roe Game Changer

Apr 22, 2025 -

Wga And Sag Aftra Strike A Complete Hollywood Production Shutdown

Apr 22, 2025

Wga And Sag Aftra Strike A Complete Hollywood Production Shutdown

Apr 22, 2025 -

Ai Transforms Repetitive Scatological Documents Into A Profound Poop Podcast

Apr 22, 2025

Ai Transforms Repetitive Scatological Documents Into A Profound Poop Podcast

Apr 22, 2025 -

Google Doj Return To Court The Fight Over Search Monopoly Continues

Apr 22, 2025

Google Doj Return To Court The Fight Over Search Monopoly Continues

Apr 22, 2025 -

Did Trumps Trade War Jeopardize Americas Economic Dominance

Apr 22, 2025

Did Trumps Trade War Jeopardize Americas Economic Dominance

Apr 22, 2025

Latest Posts

-

Uk Immigration New Visa Policies Target Nigerians And Other High Risk Groups

May 10, 2025

Uk Immigration New Visa Policies Target Nigerians And Other High Risk Groups

May 10, 2025 -

Nyt Strands Answers For Saturday March 15th Game 377

May 10, 2025

Nyt Strands Answers For Saturday March 15th Game 377

May 10, 2025 -

Nigeria And Others Face Uk Visa Restrictions Amidst Overstay Concerns

May 10, 2025

Nigeria And Others Face Uk Visa Restrictions Amidst Overstay Concerns

May 10, 2025 -

Tougher Uk Immigration Rules English Language Proficiency Key To Residency

May 10, 2025

Tougher Uk Immigration Rules English Language Proficiency Key To Residency

May 10, 2025 -

Solve Nyt Strands Game 377 March 15 Hints And Answers

May 10, 2025

Solve Nyt Strands Game 377 March 15 Hints And Answers

May 10, 2025