Why Uber Might Weather An Economic Downturn

Table of Contents

Uber's Diversified Revenue Streams: A Safety Net Against Economic Shocks

Uber isn't just about rides anymore. Its diversified business model acts as a crucial buffer against economic shocks, reducing its reliance on any single revenue source. This strategic diversification is a key factor in its potential resilience during an economic downturn.

Uber Eats and Delivery Services: A Stable Revenue Stream

The explosive growth of Uber Eats and its food delivery services provides a crucial alternative revenue stream. During economic downturns, consumers may cut back on discretionary spending like ride-hailing, but the demand for food delivery often remains relatively stable. This is driven by several factors:

- Increased demand for convenience during economic uncertainty: Busy individuals and families may opt for convenience even when cutting back on other expenses.

- Lower average order value (AOV) can be offset by increased order volume: While individual orders might be smaller, a higher frequency of orders can maintain or even increase overall revenue.

- Potential for partnerships with restaurants to offer discounts and promotions: Strategic partnerships can incentivize consumers and maintain demand even during periods of reduced consumer spending. These types of promotions can be particularly effective during times of economic stress.

Uber Freight and Logistics: A Less Volatile Market

Uber Freight offers another layer of diversification, tapping into a less volatile market segment compared to ride-sharing. The transportation of goods is a crucial part of the supply chain, less susceptible to discretionary spending cuts.

- Less susceptible to discretionary spending cuts: Unlike ride-hailing, freight transportation is often essential for business operations regardless of the economic climate.

- Essential for supply chain logistics, even during economic downturns: The need for efficient and reliable freight transportation remains high during times of economic instability.

- Potential for increased demand due to supply chain disruptions: Economic downturns can sometimes lead to supply chain disruptions, potentially increasing the demand for freight services.

International Expansion and Market Penetration: Minimizing Regional Impacts

Uber's global footprint minimizes the impact of regional economic slowdowns. If one market weakens, others may remain strong, providing a geographically diversified revenue base.

- Geographic diversification mitigates risk: A global presence spreads the risk, preventing any single regional downturn from crippling the entire business.

- Emerging markets may be less affected by developed-world recessions: Growth in developing economies can offset slowdowns in mature markets.

- Opportunities to capture market share in new regions: Expansion into new markets provides additional growth opportunities, even during periods of economic uncertainty.

Cost-Cutting and Operational Efficiency: Adaptability in Challenging Times

Uber has demonstrated a capacity for rapid cost adjustments in challenging times, a crucial element in its potential resilience during an economic downturn.

The Gig Economy Model: Flexibility and Scalability

The flexible nature of the gig economy allows Uber to easily adjust its workforce size based on demand fluctuations, reducing labor costs during downturns.

- Lower fixed costs compared to traditional employment: Uber's reliance on independent contractors significantly reduces fixed labor costs.

- Ability to scale operations up or down quickly: The company can quickly adapt its workforce to meet changing demand, minimizing unnecessary expenses.

- Reduced reliance on full-time employees: This reduces the financial burden associated with salaries, benefits, and other employee-related expenses.

Technological Advancements and Automation: Optimizing Operations

Investments in technology and automation can optimize operations and improve efficiency, reducing overall expenses.

- AI-powered route optimization: This improves efficiency and reduces fuel costs.

- Dynamic pricing algorithms: These maximize revenue generation by adjusting prices based on real-time demand.

- Improved driver matching systems: This ensures efficient allocation of drivers, reducing wait times and maximizing driver utilization.

Price Sensitivity and Essential Services: Meeting Ongoing Needs

Even during economic hardship, people still need transportation and delivery services. Uber's pricing model allows for adaptation to changing consumer behavior.

Dynamic Pricing: Maximizing Revenue During Fluctuations

Uber's dynamic pricing system allows it to adjust prices based on demand, maximizing revenue even during periods of reduced overall ridership.

- Optimized pricing strategies during peak and off-peak hours: Dynamic pricing helps to balance supply and demand and optimize profitability.

- Ability to respond to fluctuations in demand: The system adjusts prices based on real-time conditions, mitigating the impact of reduced demand.

- Potential for lower prices to attract price-sensitive customers: Lowering prices during periods of low demand can attract more riders, maintaining revenue.

Essential Service Status: Continued Demand Even During Downturns

Ride-sharing services, particularly for essential workers, and food delivery remain essential services even in difficult economic times.

- Continued demand for transportation for healthcare workers, first responders, and other essential employees: The need for transportation for essential workers remains constant, regardless of the economic climate.

- Resilience of food delivery despite reduced discretionary spending: People still need to eat, making food delivery a relatively recession-resistant service.

Conclusion: Uber's Resilience in a Changing Economy

Uber's diversified revenue streams, agile cost structure, and adaptability to fluctuating demand positions it uniquely to withstand economic downturns. While no business is entirely recession-proof, Uber's strategic moves towards diversification and operational efficiency suggest a higher likelihood of navigating economic challenges successfully. To learn more about how Uber's strategies contribute to its resilience, explore their investor relations materials and industry analyses focusing on the gig economy and its response to economic fluctuations. Understanding how Uber might weather an economic downturn offers valuable insight into the future of the ride-sharing and delivery services industries. Investing in companies with strong economic resilience like Uber is a smart move in uncertain times.

Featured Posts

-

New Uber Kenya Program Customer Cashback And Increased Earnings For Drivers Couriers

May 18, 2025

New Uber Kenya Program Customer Cashback And Increased Earnings For Drivers Couriers

May 18, 2025 -

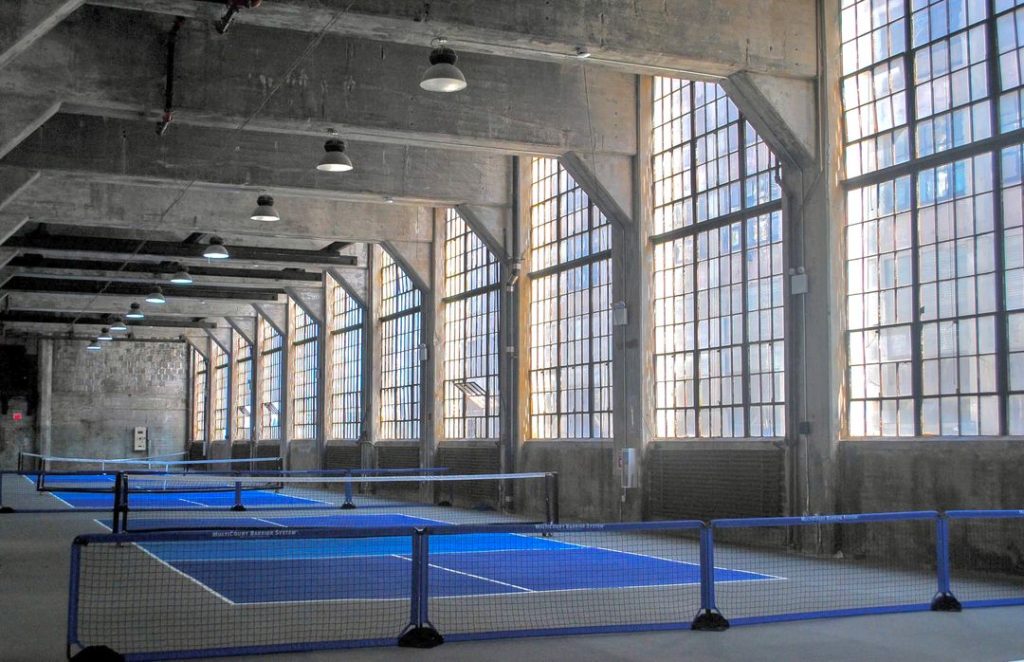

Massive New Pickleball Venue Coming To Brooklyn City Pickles 60 K Square Foot Complex

May 18, 2025

Massive New Pickleball Venue Coming To Brooklyn City Pickles 60 K Square Foot Complex

May 18, 2025 -

Jenna Bush Hager Fans Call For Permanent Today Show Change

May 18, 2025

Jenna Bush Hager Fans Call For Permanent Today Show Change

May 18, 2025 -

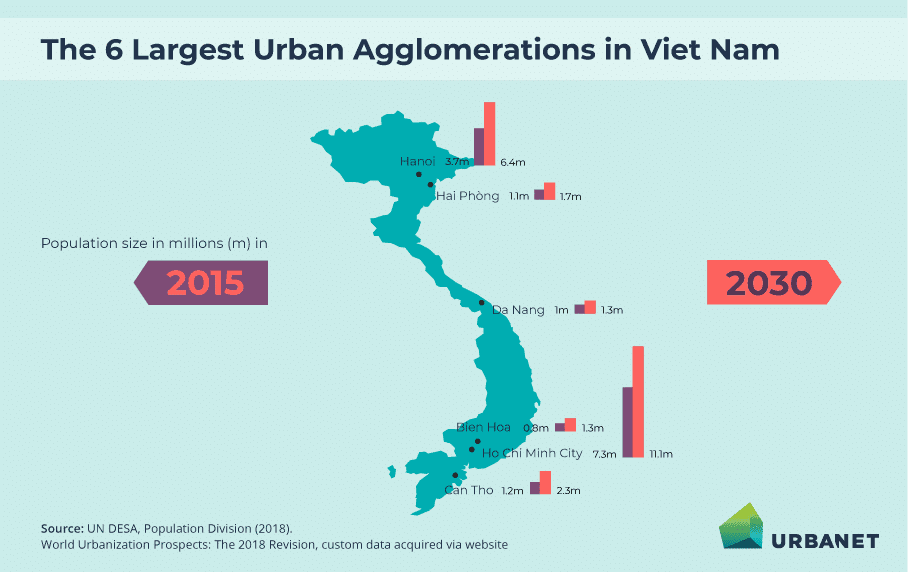

Japans Metropolis A Comprehensive Overview Of Its Urban Landscape

May 18, 2025

Japans Metropolis A Comprehensive Overview Of Its Urban Landscape

May 18, 2025 -

Spring Breakout 2025 Roster Composition And Strategy

May 18, 2025

Spring Breakout 2025 Roster Composition And Strategy

May 18, 2025