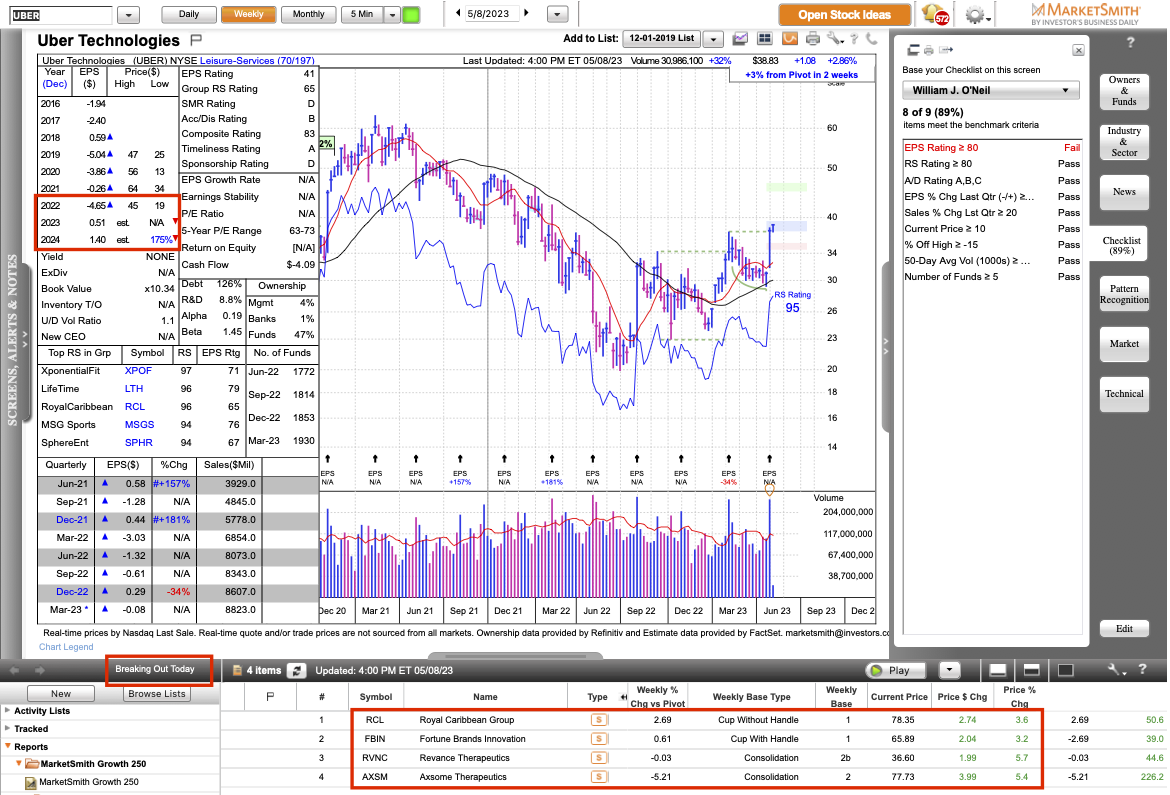

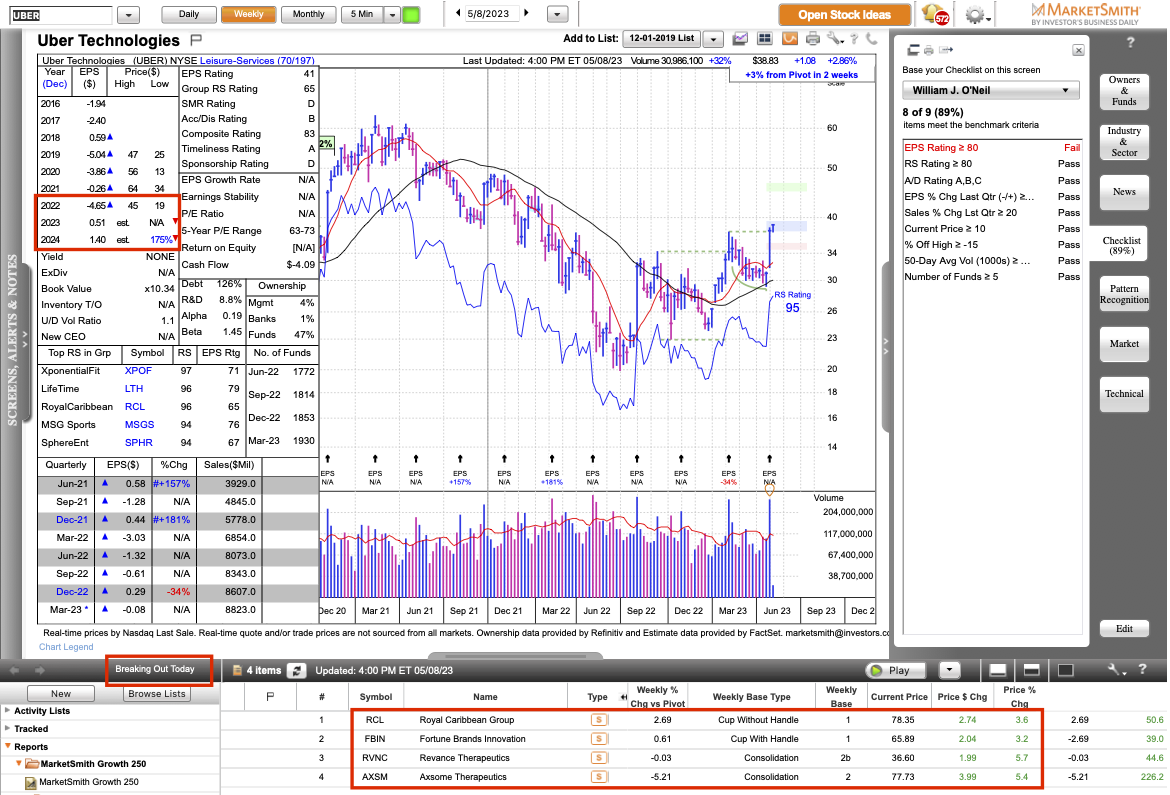

Why Uber Stock Might Weather An Economic Downturn

Table of Contents

Uber's Diversified Revenue Streams

Uber's success isn't solely reliant on its ride-sharing services. Its diversified revenue streams act as a crucial buffer against economic headwinds.

Ride-Sharing Remains a Core Strength

Uber's dominance in the ride-sharing market is undeniable, with a global reach and a flexible pricing model. Even during economic downturns, essential travel persists. People still need transportation for work, appointments, and emergencies.

- Price Sensitivity of Riders: Uber's dynamic pricing allows it to adapt to fluctuating demand. During economic hardship, price-sensitive riders might opt for Uber's services over more expensive alternatives.

- Increased Demand During Public Transit Strikes: Unexpected events like public transit strikes can actually increase demand for ride-sharing services, providing a temporary boost to revenue.

- Cost-Cutting Measures: Uber continuously seeks ways to improve efficiency and maintain competitiveness, including optimizing driver payouts and operational costs.

Uber Eats as a Recession-Resistant Sector

The food delivery sector has shown remarkable resilience during economic downturns. People still need to eat, and the convenience of food delivery often outweighs cost concerns, especially during times of uncertainty. Uber Eats is ideally positioned to benefit from this inelastic demand.

- Growth Potential in Grocery Delivery: Expanding into grocery delivery broadens Uber Eats' appeal and caters to a wider customer base.

- Partnerships with Restaurants: Strong partnerships with restaurants provide Uber Eats with a steady supply of options and help restaurants reach a larger customer base.

- Subscription Services and Targeted Marketing: Subscription services offer value and attract budget-conscious consumers, while targeted marketing campaigns can highlight affordable meal options.

Freight and Other Emerging Businesses

Uber isn't resting on its laurels. Uber Freight and other diversification efforts further reduce its dependence on a single sector, providing additional resilience during economic uncertainty.

- Growth Potential in Logistics: The logistics sector offers substantial growth opportunities, and Uber's technology gives it a competitive advantage.

- Strategic Partnerships: Collaborations with businesses streamline operations and expand market reach.

- Technological Advantages in Route Optimization: Uber's advanced algorithms optimize delivery routes, increasing efficiency and reducing costs.

Cost-Cutting Measures and Operational Efficiency

Uber's technological prowess and ability to manage costs are critical to navigating economic downturns.

Technological Advantages

Uber's technology is a key differentiator. Its sophisticated systems facilitate efficient operations, driver management, and cost optimization. Data-driven decision-making allows for proactive adjustments to changing market conditions.

- Dynamic Pricing: This optimizes pricing based on demand, ensuring profitability even during fluctuating demand periods.

- Route Optimization Algorithms: Efficient route planning minimizes fuel consumption and driver downtime, reducing operational costs.

- Driver Incentive Programs: Strategic incentives motivate drivers to remain active, maintaining service levels.

- Automation Potential in Logistics: Investing in automation can further enhance efficiency and reduce labor costs.

Strategic Spending and Investment

Uber demonstrates an ability to control spending and prioritize investments. This disciplined approach is essential for preserving profitability during periods of economic contraction.

- Targeted Layoffs (if necessary): While difficult, strategic workforce adjustments can help reduce overhead during economic downturns.

- Reduction in Marketing Expenditures: Focusing marketing efforts on high-yield channels enhances efficiency.

- Focus on Profitability over Growth: Prioritizing profitability over aggressive expansion ensures financial stability during uncertain times.

Long-Term Growth Potential and Market Share

Uber's global expansion plans and commitment to innovation position it for continued success, regardless of short-term economic fluctuations.

Global Expansion Opportunities

Untapped markets in emerging economies present significant growth opportunities for Uber.

- Expanding into Untapped Markets: Uber's global expansion strategy targets countries with high growth potential and limited ride-sharing options.

- Adapting to Local Regulations: Successfully navigating local regulations is vital for successful expansion into new markets.

- Partnerships with Local Businesses: Collaborations with local businesses enhance market penetration and build brand recognition.

Technological Innovation and Future-Proofing

Uber's ongoing investment in technological advancements ensures its ability to maintain a competitive edge and adapt to future market conditions.

- Autonomous Vehicle Technology: Investing in autonomous vehicle technology positions Uber for long-term cost savings and efficiency gains.

- AI-Powered Route Optimization: Advanced AI algorithms constantly refine route optimization, maximizing efficiency and minimizing costs.

- Expansion into New Transportation Modalities: Exploring new transportation options, such as micromobility services, diversifies revenue streams and enhances market reach.

Conclusion

Uber stock's potential resilience during an economic downturn stems from its diversified revenue streams, cost-cutting measures, and substantial long-term growth prospects. While economic downturns present challenges for all businesses, Uber's adaptability and innovative business model suggest its potential to navigate these challenges effectively. While no investment is completely recession-proof, Uber's diversified approach offers a compelling argument for its relative strength in uncertain times. Investigate Uber stock today and learn more about the resilience of this innovative company. Explore the potential of Uber stock as a relatively resilient investment option by researching further at reputable financial news sites and Uber's investor relations page.

Featured Posts

-

Ledra Pal Carsamba Dijital Veri Tabani Ve Isguecue Piyasasi Rehberi

May 19, 2025

Ledra Pal Carsamba Dijital Veri Tabani Ve Isguecue Piyasasi Rehberi

May 19, 2025 -

Sanse Za Popravak Marko Bosnjak Na Dnu Kladionica

May 19, 2025

Sanse Za Popravak Marko Bosnjak Na Dnu Kladionica

May 19, 2025 -

Nyt Mini Crossword Answers And Hints April 18 2025

May 19, 2025

Nyt Mini Crossword Answers And Hints April 18 2025

May 19, 2025 -

Philadelphia Union Defeats Orlando City In Season Opener

May 19, 2025

Philadelphia Union Defeats Orlando City In Season Opener

May 19, 2025 -

Dijital Veri Tabani Isguecue Piyasasi Ledra Pal Carsamba Rehberi

May 19, 2025

Dijital Veri Tabani Isguecue Piyasasi Ledra Pal Carsamba Rehberi

May 19, 2025