Will Palantir Be A Trillion-Dollar Company By 2030? An In-Depth Analysis

Table of Contents

Palantir's Current Market Position and Financial Performance

Palantir's current market capitalization and revenue growth are crucial indicators of its potential for future success. While it has experienced significant growth since its IPO, reaching a trillion-dollar valuation requires sustained, exceptional performance. Analyzing Palantir's profitability and its journey toward sustainable profitability is also key. Currently, while revenue is growing, consistent profitability remains a target. The competitive landscape, populated by giants like Microsoft and smaller, agile startups, presents another layer of complexity. Understanding Palantir's market share and its ability to defend and expand it is paramount.

- Current market cap: (Insert current market cap as of the publication date)

- Revenue growth rate (YoY): (Insert the year-over-year revenue growth rate)

- Profit margin analysis: (Analyze gross and net profit margins, highlighting trends and comparing to competitors)

- Key competitors and their market positions: (List key competitors such as Microsoft, AWS, Google Cloud, and analyze their relative strengths and weaknesses)

- Recent financial reports and analyst ratings: (Summarize key findings from recent quarterly reports and analyst ratings, emphasizing positive and negative assessments)

Growth Drivers and Opportunities for Palantir

Several key factors could drive Palantir's future growth. Government contracts, a historical cornerstone of the business, remain a significant revenue stream. However, expansion into the commercial sector, particularly through its Foundry platform, is crucial for achieving a trillion-dollar valuation. Foundry's ability to attract new customers and streamline data analytics for diverse industries—from healthcare and finance to manufacturing and energy—will be pivotal. Furthermore, advancements in artificial intelligence (AI) and machine learning (ML) could significantly enhance Palantir's offerings and open new avenues for growth.

- Government spending trends and their impact on Palantir: (Analyze government spending on defense and intelligence, projecting its effect on Palantir's government contracts)

- Success rate of new commercial partnerships: (Discuss the success of Palantir's partnerships with commercial clients and their potential for future growth)

- Market penetration in key sectors (healthcare, finance, etc.): (Assess Palantir’s current penetration in various sectors and its potential for growth within these industries)

- Technological innovation pipeline and potential disruptive technologies: (Analyze Palantir's investment in R&D and the potential of AI and ML to disrupt the data analytics landscape)

Challenges and Risks Facing Palantir

Despite its potential, Palantir faces several significant challenges and risks. Intense competition from established tech giants and emerging startups poses a constant threat. Regulatory hurdles and data privacy concerns, especially within the government and healthcare sectors, are also potential roadblocks. The company's reliance on large contracts presents a risk, as loss of a major client could significantly impact revenue. Geopolitical instability could also influence government contracts and overall market stability.

- Competitive threats from established players and new entrants: (Discuss the competitive pressures from Microsoft, Google, Amazon, and other emerging data analytics companies)

- Regulatory compliance and potential legal challenges: (Analyze potential regulatory risks and compliance challenges related to data privacy and security)

- Client concentration risk and dependency on large contracts: (Discuss the risk associated with relying on a limited number of large clients for a significant portion of revenue)

- Data security and privacy concerns: (Analyze the risks associated with data breaches and the impact on Palantir's reputation and business)

- Economic sensitivity of Palantir's business model: (Assess how economic downturns might impact Palantir's growth and profitability)

Valuation and Market Projections for Palantir

Assessing Palantir's potential future value requires sophisticated valuation models. A discounted cash flow (DCF) analysis, factoring in projected revenue growth, profitability, and discount rates, is essential. Comparing Palantir's valuation multiples to those of comparable companies provides another perspective. Analyzing various market projections and analyst forecasts for Palantir's stock price helps create a range of potential outcomes. Based on this comprehensive analysis, the likelihood of reaching a trillion-dollar valuation by 2030 can be estimated across different scenarios.

- Discounted cash flow (DCF) analysis and assumptions: (Provide a summary of a DCF analysis, outlining key assumptions and the resulting valuation)

- Comparable company analysis and peer valuations: (Compare Palantir's valuation multiples to those of similar publicly traded companies)

- Analyst price targets and consensus estimates: (Summarize analyst price targets and consensus estimates for Palantir's stock price)

- Probability of reaching a trillion-dollar market cap based on various scenarios: (Estimate the probability of reaching a trillion-dollar valuation based on different growth scenarios and market conditions)

Conclusion: The Trillion-Dollar Palantir Question – A Verdict

Our analysis reveals a complex picture. Palantir possesses significant growth potential fueled by its innovative technology, expanding commercial reach, and continued government contracts. However, intense competition, regulatory challenges, and economic sensitivity present considerable headwinds. Based on our analysis, achieving a trillion-dollar valuation by 2030 presents a significant challenge, requiring exceptional performance and favorable market conditions. While the potential is there, the likelihood remains uncertain. Palantir's long-term success hinges on its ability to navigate these challenges and capitalize on emerging opportunities in the rapidly evolving data analytics market.

Will Palantir reach a trillion-dollar valuation? Share your insights in the comments below!

Featured Posts

-

Trumps Greenland Gambit Increased Danish Influence And Greenlands Future

May 09, 2025

Trumps Greenland Gambit Increased Danish Influence And Greenlands Future

May 09, 2025 -

The Future Of Apple The Crucial Role Of Artificial Intelligence

May 09, 2025

The Future Of Apple The Crucial Role Of Artificial Intelligence

May 09, 2025 -

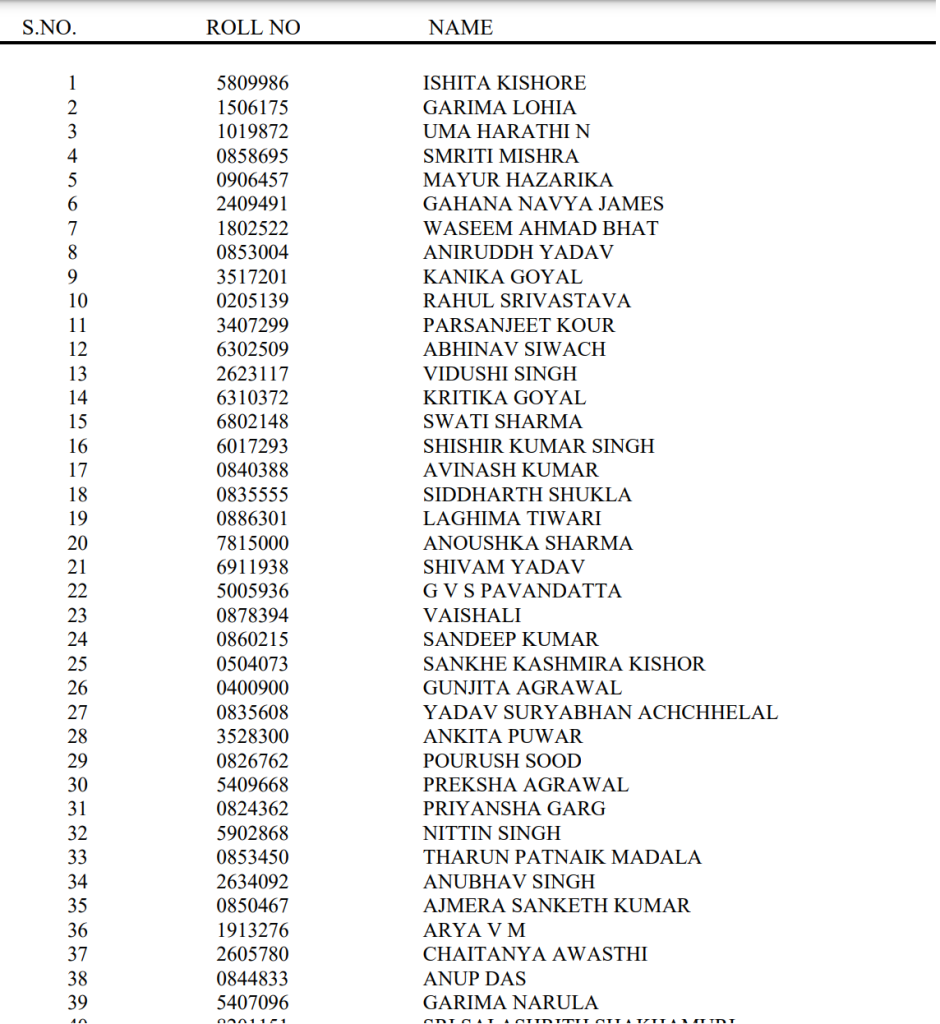

West Bengal Madhyamik Exam 2025 Merit List And Result Date

May 09, 2025

West Bengal Madhyamik Exam 2025 Merit List And Result Date

May 09, 2025 -

Young Thugs Upcoming Album Uy Scuti Potential Release Date Revealed

May 09, 2025

Young Thugs Upcoming Album Uy Scuti Potential Release Date Revealed

May 09, 2025 -

Boston Celtics Head Coach On Jayson Tatums Wrist Latest Update

May 09, 2025

Boston Celtics Head Coach On Jayson Tatums Wrist Latest Update

May 09, 2025