Will Palantir Reach A $1 Trillion Market Capitalization By The End Of The Decade?

Table of Contents

Palantir's Current Market Position and Competitive Advantages

Palantir's current market position is a crucial factor in determining its future trajectory. Its success hinges on its competitive advantages and strategic expansion.

Dominance in Government and Defense Contracts

Palantir has established a strong presence in the government and defense sectors. Its data analytics platforms, like Gotham and Foundry, are prized for their ability to process and analyze vast amounts of complex data for national security and intelligence purposes.

- Significant Contracts: Palantir boasts contracts with numerous government agencies, including the CIA, FBI, and various branches of the military, globally. These long-term contracts provide a stable revenue stream.

- Proprietary Technology: Palantir's technology is considered proprietary and highly sophisticated, providing a significant competitive edge. Its ability to integrate disparate data sources and provide actionable insights is unmatched by many competitors.

- Competitive Landscape: While competitors exist in the government space, Palantir's established relationships and proven track record provide a significant barrier to entry for newcomers.

Expanding into the Commercial Sector

Palantir's growth strategy heavily relies on its successful expansion into the commercial market. This diversification is crucial to reduce reliance on government contracts and unlock substantial growth potential.

- Key Partnerships: Palantir has forged partnerships with leading companies across various industries, leveraging its data analytics capabilities to improve operational efficiency and decision-making.

- Successful Case Studies: Demonstrating tangible ROI for commercial clients is vital. Successful implementations across sectors like finance, healthcare, and manufacturing build credibility and attract new customers.

- Challenges in the Commercial Space: The commercial market is highly competitive, with established tech giants offering similar data analytics solutions. Palantir faces the challenge of proving its value proposition against entrenched players.

Technological Innovation and Future Product Development

Continuous innovation is paramount for Palantir's long-term success. Its R&D efforts and pipeline of new products will determine its ability to disrupt markets and maintain its competitive edge.

- New Technologies: Palantir is actively developing advanced AI and machine learning capabilities to enhance its platforms' analytical power and automate processes.

- Potential Applications: Exploring new applications across different sectors, such as supply chain optimization and fraud detection, is crucial for revenue diversification and growth.

- Impact on Future Revenue Streams: Successfully launching and adopting new technologies and applications directly translates to increased revenue and market share.

Factors that Could Drive Palantir to a $1 Trillion Valuation

Several factors could contribute to Palantir achieving a $1 trillion market cap. However, these factors are interconnected and dependent on one another.

Continued Growth in Government Spending on Data Analytics

Government investment in data analytics and intelligence is projected to increase substantially in the coming years. This trend presents a significant opportunity for Palantir.

- Global Trends: Governments worldwide are prioritizing data-driven decision-making in areas like national security, public health, and economic development.

- Specific Country Examples: Increased defense budgets in several countries, coupled with growing interest in AI and big data analytics, creates favorable conditions for Palantir's growth.

- Implications for Palantir's Revenue: Continued strong government spending translates directly into higher contract values and increased revenue streams for Palantir.

Successful Penetration of the Commercial Market

Capturing significant market share in the commercial sector is critical for Palantir's ambitious valuation goal.

- Market Size Estimations: The market for enterprise data analytics is vast and growing rapidly. Securing a substantial share of this market is crucial for achieving a $1 trillion valuation.

- Competitive Analysis: Palantir needs to differentiate itself from competitors and demonstrate a clear value proposition to win over commercial clients.

- Impact of Successful Commercial Deployments: Positive commercial deployments showcasing demonstrable ROI will build trust and attract more clients, accelerating growth.

Strategic Acquisitions and Partnerships

Strategic acquisitions and partnerships can accelerate Palantir's growth and expand its product offerings and market reach.

- Potential Acquisition Targets: Acquiring companies with complementary technologies or expertise in specific sectors can strengthen Palantir's capabilities and market position.

- Benefits of Strategic Partnerships: Collaborating with industry leaders can open up new markets and enhance product offerings, driving growth.

- Impact on Overall Valuation: Successful acquisitions and partnerships can significantly boost Palantir's overall valuation, bringing it closer to the $1 trillion mark.

Challenges and Risks to Palantir's Growth

Despite its potential, Palantir faces significant challenges and risks that could hinder its progress.

Competition from Established Tech Giants

Palantir competes with established tech giants like Microsoft, Google, and Amazon, which possess significant resources and market presence.

- Specific Competitors: These companies offer competing data analytics solutions, posing a significant challenge to Palantir's growth ambitions.

- Strengths and Weaknesses: Analyzing the strengths and weaknesses of these competitors allows Palantir to develop a targeted competitive strategy.

- Palantir's Competitive Strategy: Differentiation through specialized technology, strong customer relationships, and a focus on niche markets is crucial for Palantir to compete effectively.

Data Privacy and Security Concerns

Handling sensitive data carries inherent risks related to data privacy and security. Meeting stringent regulatory requirements and maintaining robust security measures are paramount.

- Regulatory Hurdles: Navigating complex data privacy regulations like GDPR and CCPA is essential for Palantir to operate legally and maintain customer trust.

- Potential Legal Challenges: Data breaches or security lapses could lead to significant legal liabilities and reputational damage.

- Palantir's Data Security Measures: Palantir must continuously invest in and improve its data security infrastructure to mitigate these risks.

Dependence on Government Contracts

Reliance on government contracts presents inherent risks associated with budgetary constraints and political shifts.

- Budgetary Constraints: Changes in government budgets could impact Palantir's revenue stream, especially if its commercial expansion lags.

- Political Shifts: Changes in government priorities or policy could affect the demand for Palantir's services.

- Diversification Strategies: Palantir needs to prioritize diversification into the commercial market to mitigate the risk of over-reliance on government contracts.

Conclusion

Determining whether Palantir will reach a $1 trillion market capitalization by 2030 is a complex question. While its strong government presence and expanding commercial footprint offer immense potential, challenges related to competition, data security, and reliance on government contracts remain. Continued innovation, strategic acquisitions, successful penetration of the commercial market, and proactive risk management will be critical for Palantir's journey towards this ambitious goal. Further due diligence and comprehensive research into Palantir's financial performance, competitive landscape, and regulatory environment are recommended before making any investment decisions related to the company's potential for reaching a $1 trillion market cap. Therefore, carefully consider all factors before investing in Palantir and assessing its potential to achieve a $1 trillion market capitalization.

Featured Posts

-

Oboronnoe Partnerstvo Frantsii I Polshi Signal O Splochennosti Pered Litsom Ugroz

May 10, 2025

Oboronnoe Partnerstvo Frantsii I Polshi Signal O Splochennosti Pered Litsom Ugroz

May 10, 2025 -

Jesse Watters Joke About Wifes Infidelity Hypocrite Label Stirs Controversy

May 10, 2025

Jesse Watters Joke About Wifes Infidelity Hypocrite Label Stirs Controversy

May 10, 2025 -

Brutal Racist Stabbing Woman Faces Murder Charges

May 10, 2025

Brutal Racist Stabbing Woman Faces Murder Charges

May 10, 2025 -

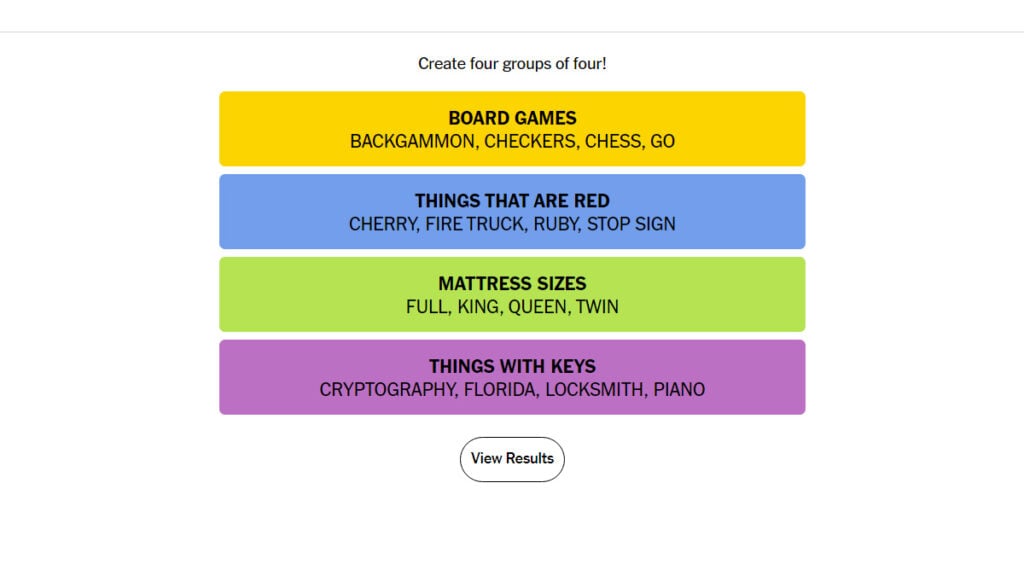

Solve The Nyt Strands Puzzle April 9 2025 Hints And Answers

May 10, 2025

Solve The Nyt Strands Puzzle April 9 2025 Hints And Answers

May 10, 2025 -

Us Immigration Debate The Case Of Kilmar Abrego Garcia And El Salvadors Gang Problem

May 10, 2025

Us Immigration Debate The Case Of Kilmar Abrego Garcia And El Salvadors Gang Problem

May 10, 2025