Will The Bank Of Canada Cut Rates Again? Tariff Job Losses Fuel Speculation

Table of Contents

The Impact of Tariff-Related Job Losses on the Canadian Economy

The escalating trade war and resultant tariffs have dealt a significant blow to the Canadian economy, particularly impacting manufacturing and related sectors.

Decline in Manufacturing and Related Sectors

Tariffs have directly affected numerous industries, leading to substantial job losses.

- Manufacturing: The automotive sector has been especially hard hit, with reports indicating thousands of job losses in Ontario and other provinces.

- Agriculture: Increased tariffs on Canadian agricultural exports have negatively impacted farmers and related industries.

- Forest Products: Demand for Canadian lumber has declined, resulting in layoffs in the forestry sector.

These job losses have a ripple effect, impacting consumer spending and overall economic growth. Reduced consumer confidence translates into decreased demand for goods and services, further slowing down economic activity. [Link to Statistics Canada report on job losses]. [Link to Bank of Canada report on economic outlook].

Weakening Consumer Confidence

The uncertainty surrounding the trade war and the resulting job losses are eroding consumer confidence. [Cite relevant economic indicators, e.g., consumer confidence index]. This decline in confidence leads to decreased consumer spending and investment, creating a vicious cycle that can further depress economic growth. Surveys show a noticeable dip in consumer sentiment, reflecting concerns about job security and future economic prospects. [Link to survey data].

The Bank of Canada's Current Monetary Policy Stance

The Bank of Canada's recent monetary policy decisions provide valuable insights into its current thinking.

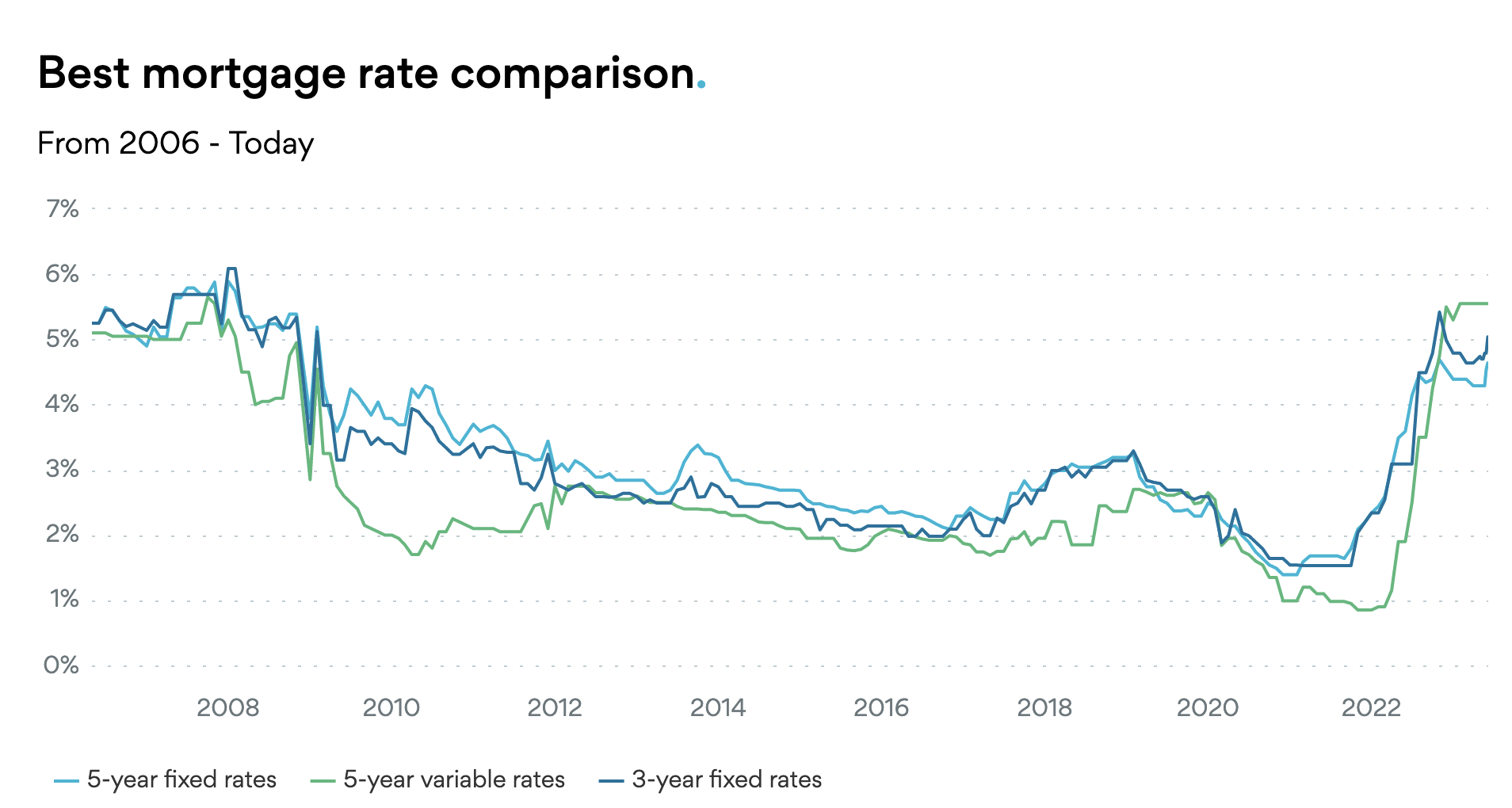

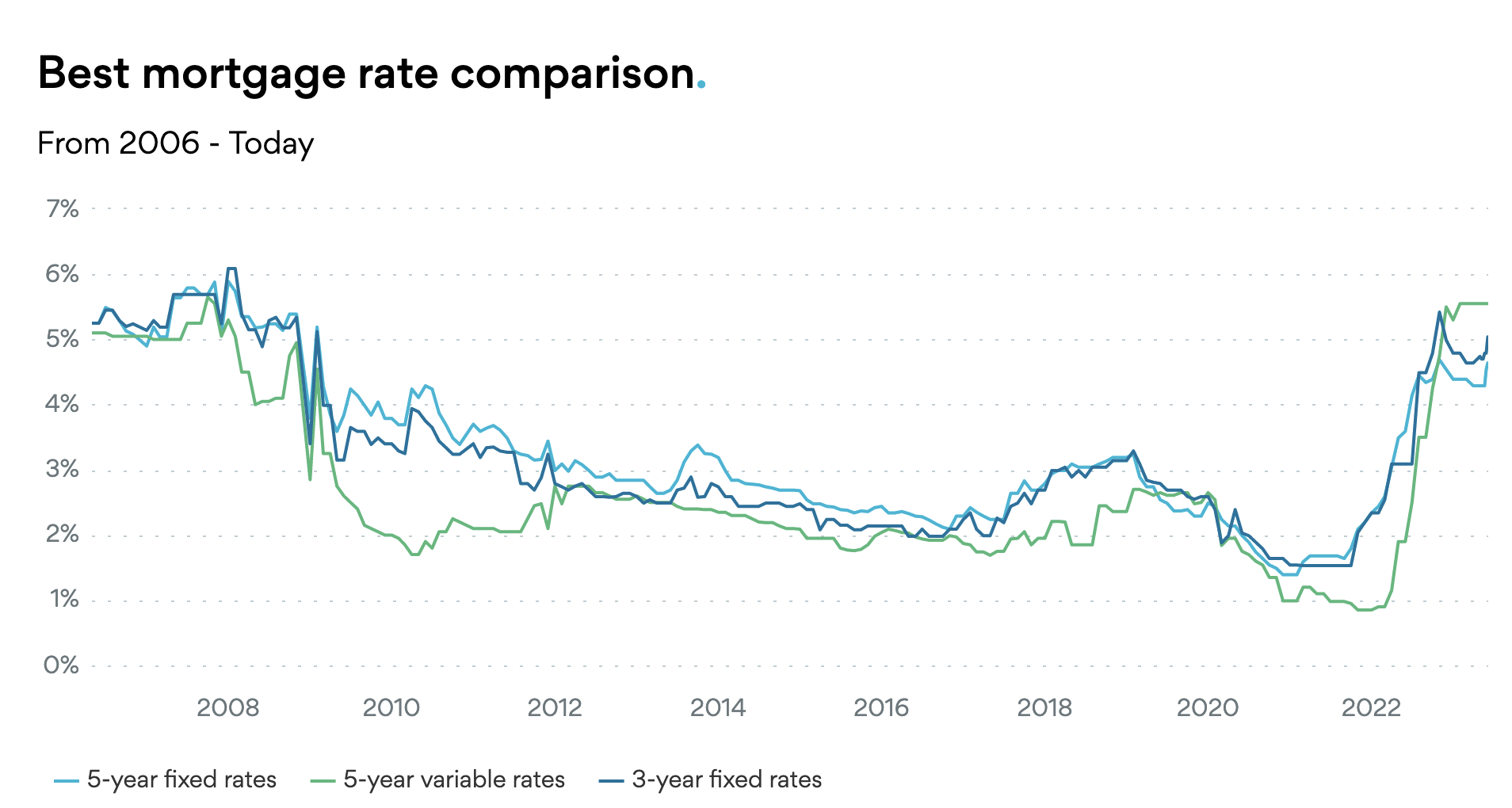

Review of Recent Interest Rate Decisions

In recent months, the Bank of Canada has [summarize recent interest rate decisions: e.g., maintained rates, cut rates, etc.]. The rationale behind these decisions usually involves a careful assessment of key economic indicators, such as inflation, unemployment, and GDP growth. [Include quotes from Bank of Canada officials explaining their rationale]. [Link to official Bank of Canada publications on monetary policy].

Analysis of Key Economic Indicators

The Bank of Canada carefully considers several key economic indicators when making interest rate decisions:

- Inflation: The Bank aims to keep inflation within its target range of 1-3%. [Analyze current inflation data].

- Unemployment: High unemployment rates often signal a weak economy, potentially justifying rate cuts to stimulate growth. [Analyze current unemployment data].

- GDP Growth: GDP growth provides a broad measure of the economy's overall performance. [Analyze current GDP growth data].

Currently, [analyze the current state of these indicators in relation to the Bank's mandate]. These data points will heavily influence the Bank's future decision-making.

Arguments For and Against Further Interest Rate Cuts

The debate surrounding further interest rate cuts is multifaceted.

Arguments for Rate Cuts

Proponents of further rate cuts argue that the job losses stemming from tariffs and the resulting economic slowdown necessitate intervention to stimulate growth. Lower interest rates can make borrowing cheaper for businesses and consumers, potentially boosting investment and spending.

Arguments Against Rate Cuts

Conversely, opponents express concerns about the potential risks associated with further rate cuts:

- Inflation: Prolonged low interest rates could fuel inflation if demand outpaces supply.

- Weakening Canadian Dollar: Lower rates can weaken the Canadian dollar, making imports more expensive.

- Increased Debt: Lower rates might encourage excessive borrowing and increase overall debt levels.

Predictions and Market Sentiment

Predicting the Bank of Canada's next move requires analyzing expert opinions and market reactions.

Expert Opinions

Economists and financial analysts hold varying views on future interest rate movements. [Summarize the opinions of different economists and analysts, citing news articles and financial reports]. The consensus seems to be [summarize the consensus], but there are dissenting opinions, suggesting [highlight dissenting opinions].

Market Reactions

Financial markets are closely monitoring the situation. [Discuss how bond yields and currency exchange rates are reacting to the speculation around potential rate cuts]. These market reactions provide further insights into the overall sentiment and expectations regarding future interest rate decisions.

Conclusion: Will the Bank of Canada Cut Rates Again? A Look Ahead

The arguments for and against further Bank of Canada interest rate cuts are compelling. While tariff-related job losses and weakening consumer confidence suggest the need for stimulus, concerns about inflation and a weakened Canadian dollar counter this. Predicting the Bank's next move with certainty is impossible. However, considering the current economic climate and the Bank's mandate, a further interest rate cut remains a strong possibility. Stay tuned for updates on the Bank of Canada's next move and the impact of tariff job losses on interest rate decisions. The future of Canadian interest rates remains a crucial topic, requiring continued monitoring of key economic indicators and the Bank's policy pronouncements.

Featured Posts

-

Raducanus Short Lived Coaching Partnership Ends

May 14, 2025

Raducanus Short Lived Coaching Partnership Ends

May 14, 2025 -

Captain America Brave New World And The Mcus Transition From Darkness To Light

May 14, 2025

Captain America Brave New World And The Mcus Transition From Darkness To Light

May 14, 2025 -

Chelsea Outpaces Manchester United For Jobe Bellingham

May 14, 2025

Chelsea Outpaces Manchester United For Jobe Bellingham

May 14, 2025 -

Man United Transfer Targets Amorims Seven Player List Revealed

May 14, 2025

Man United Transfer Targets Amorims Seven Player List Revealed

May 14, 2025 -

Seven Players Amorim Wants Man United To Sign This Summer

May 14, 2025

Seven Players Amorim Wants Man United To Sign This Summer

May 14, 2025

Latest Posts

-

Disneys Woke Snow White Flops Did Insulting Half The Country Backfire

May 14, 2025

Disneys Woke Snow White Flops Did Insulting Half The Country Backfire

May 14, 2025 -

Snow Whites Box Office Disappointment A Turning Point For Disney Live Action Remakes

May 14, 2025

Snow Whites Box Office Disappointment A Turning Point For Disney Live Action Remakes

May 14, 2025 -

Using Disney Live Action Data To Predict Snow Whites Rotten Tomatoes Score

May 14, 2025

Using Disney Live Action Data To Predict Snow Whites Rotten Tomatoes Score

May 14, 2025 -

Box Office Report Nolte On Snow Whites Repeated Mothers Day Weekend Failure

May 14, 2025

Box Office Report Nolte On Snow Whites Repeated Mothers Day Weekend Failure

May 14, 2025 -

Revisiting Snow White Comparing Disneys New Adaptation With A Darker Predecessor

May 14, 2025

Revisiting Snow White Comparing Disneys New Adaptation With A Darker Predecessor

May 14, 2025